It is hard to imagine, but someday, IBM may not care much about its proprietary System z and Power Systems platforms. Or, more precisely, it may not be able to afford to care the way it has for decades

But the good news for Big Blue is that it has a third platform in the Red Hat stack, and that platform is growing as the other “real” IBM systems businesses are flat to trending downwards, and the even better news is that the landmark acquisition of Red Hat for $34 billion in October 2018 gives IBM the chance to transmute those old platforms and modernize them. And so that day of reckoning is being pushed further out than it otherwise might have been – and the collective sighs of relief among the System z and Power Systems lines are audible each quarter that Red Hat grows.

Anything that makes Red Hat stronger makes System z and Power Systems last longer. And anything that lets them last longer gives IBM the fuel to expand its Red Hat business because the System z platform is still wickedly profitable if you throw in the databases, services, and sometimes even applications that IBM sells for them.

In the quarter ended in March, IBM reported revenues up 7.7 percent to $14.2 billion, and net income up 1.8X to $733 million. Red Hat’s revenues rose by 18 percent as reported (and by 21 percent at constant currency) to what we calculate as $1.41 billion. So, Red Hat is now 1/10th of Big Blue after the spinoff of its Kyndryl managed services business early this year. IBM has rejiggered its financials in different groups and divisions and product segments in the wake of the spinoff and recast the numbers absent Kyndryl but including Red Hat back to Q1 2019. (The Red Hat numbers only go back to July 2019 when the deal closed.)

When IBM announced the Red Hat deal three and a half years ago, we said the whole point of the acquisition was to give IBM a new story to tell its large enterprise customers and a new and broader revenue stream among the many hundreds of thousands of fairly large businesses that do not already use IBM platforms – as many of them did a decade or three ago. But this deal was also about creating a new, higher-level platform business, one that could run on IBM’s proprietary machinery (in some fashion) but also was not restricted to those machines.

We know that Linux drives a lot of the MIPS consumption on mainframes and has for the past two decades, and Linux therefore represents a lot of the operating system licenses on System z mainframes. But the revenue for Linux on mainframes is piddling compared to what IBM charges for its z/OS stack, which includes all kinds of things in addition to an operating system and virtualization environment, such as transaction monitors, Java middleware, system monitoring, and security tools. It has been a long time since we have seen lost prices for the z/OS stack, but when we did, Linux was somewhere between five and ten times cheaper for the same System z motors. And IBM charged a quarter the price for a z motor running Linux as it did for one running z/OS.

Linux has some play on IBM’s Power Systems line, particularly in HPC and AI engagements or among AIX and IBM i customers who want to run modern, containerized systems of engagement on the same platforms where they run mission critical ERP applications and their databases. But Linux has never driven the Power platform’s revenue stream and aggregate compute capacity sold as it has done with the System z mainframe. There is no reason why it could not have – IBM has just never gotten the mix of products and pricing right, or people didn’t believe that the Power system running Linux could compete against an X86 platform running Linux.

The weird thing about Red Hat, from the IBM point of view, is that most of its revenues come from OPP – Other People’s Platforms. This would seem to argue strongly that IBM should have an Arm or X86 platform, but the company sold off its System x business to Lenovo and seems disinclined to start up that volume server business again. It would much rather be a software supplier at this point and ride out the Power Systems and System z lines to where they go off on the horizon. We here at The Next Platform are not foolish enough to predict when IBM will say enough with creating new Power and z chips and updating its z/OS, AIX, IBM i, and Linux operating systems for them. What we can say for sure is that whenever that day happens, IBM will mothball a ton of processors and motherboards and memory and peripherals and sell them for a long time – perhaps for a decade – and that the software support will last even longer. With very high prices relative to whatever prevails in the market at the time.

The Red Hat deal can be paid for easily enough from these legacy businesses. In the past six quarters, IBM earned more from its “real” systems business based on the Power and z platforms (again, not including databases and applications) than it paid for Red Hat. And with the Power10 and System z16 product cycles just starting in earnest here in 2022 and probably running for another three years, IBM will get all of its bait back on its Power10 and z16 investments and have plenty left over to create Power11 and z17 processors and systems that use them.

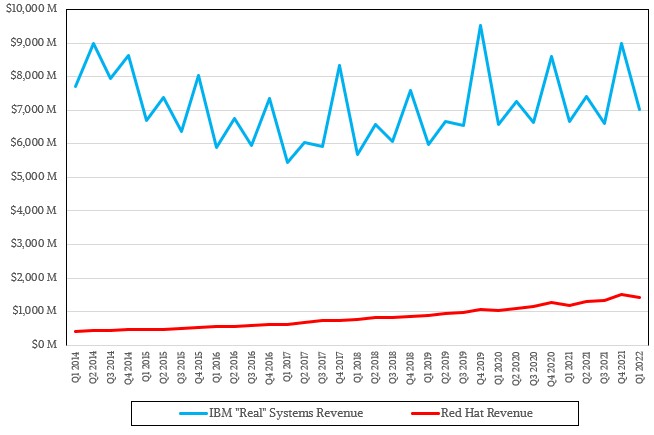

Every quarter, we try to carve out what we think is that “real” systems business, including the servers, storage, core systems software, tech support, and financing that IBM provides for its machinery. In an updated model, we have plotted out Red Hat’s revenues and estimated what we think are its contributions at the systems software level, including support licenses for Red Hat Enterprise Linux, the OpenShift container controller, the OpenStack cloud controller, and related middleware, systems management, and storage software. Our model assumes that about 75 percent of Red Hat’s revenues fall into these categories. And as you can see in the chart below, the Red Hat Effect that we have been expecting is indeed pulling IBM’s systems business up and to the right:

If you take Red Hat out of the equation using our modified old model (modified for the change in groups and segments but adding up to the same revenues historically), then this “real” IBM systems business had sales of $5.98 billion in Q1 2022, up 3.5 percent. But with the Red Hat core systems business in the mix, then this “real” systems business brought in a little more than $7 billion, up 5.4 percent year-on-year.

IBM just launched the System z mainframes in April with the “Telum” z16 processor we wrote about here, so it was no surprise that mainframe revenues were off 18 percent as companies await the new products. (IBM has a lot of latent cores in its System z iron, so companies are always firing up more cores as workloads grow, which is why revenues don’t stop dead ahead of a new system launch. Those core activations are very profitable for IBM.) Sales of distributed infrastructure – which means Power Systems plus storage in the new financial categories from IBM – rose by 8 percent in the quarter, driven primarily by sales of the “Denali” Power E1080 NUMA systems announced last September that are now fully ramped.

Sales of IBM’s legacy systems and storage, including all of those proprietary operating systems, was off by 5 percent to $1.69 billion, we estimate, and sales of support for these platforms rose by just under 1 percent to $1.53 billion. So Infrastructure group sales were off 2.3 percent to $3.22 billion.

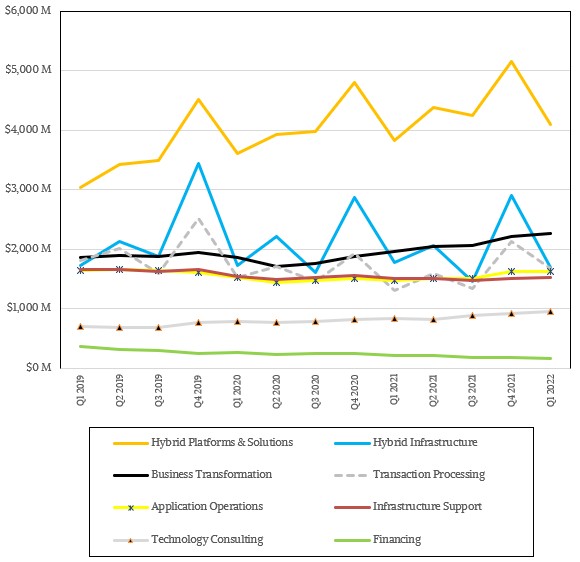

The larger Software group had sales of $5.77 billion, up 12.3 percent, with Transaction Processing software brining in $1.67 billion (up 28 percent) and Hybrid Platforms & Solutions (which includes Red Hat, databases, security, and analytics software) brining in $4.1 billion, up 7 percent. If you extract Red Hat from this segment, then the core legacy part of the Hybrid Platforms & Solutions business rose by 2.1 percent to around $2.7 billion.

IBM’s Consulting group had sales of $4.83 billion, up 13.3 percent, and Financing group posted sales of $154 million, off 25.6 percent as Big Blue shifts away from financing hardware and software from others and also awaits the System z16 bump that is coming.

IBM is belatedly trying to copy Google and is failing to succeed while leaving the IBM mainframe and IBM i platforms and the IBM customers and personnel to decay, as well as IBM itself.

The 34 billion dollars spent on Red Hat should have been spent on creating an IBM that can compete with and perhaps beat Microsoft and provide a great future path for all of IBM’s current customers and for many new ones.

The very most important chart is the annual chart of IBM revenues and profits, which shows it all and the future for IBM.

Congratulations on the accessibility of the charts.

Rather than migrating users of z/OS to RedHat after which any of the 600 or more other Linux distributions are but a small step, my recommendation would be to regenerate developer enthusiasm and expertise for the mainframe environment by introducing licensing models that allow educational use of modern versions of z/OS with the Hercules emulator. After this one also needs to supply cost effective hardware and licensing at the entry level that could be used by developers and small-scale businesses to get started.

In particular, IBM no longer has a large market share that needs to be diminished to avoid antitrust but instead a few customers at the very high end that are encountering a skills shortage. This skills shortage arose precisely because there is no entry-level hardware or software licensing for new developers or customers. Thus, the only way to protect customers at the high end is to grow the ecosystem at the entry level.