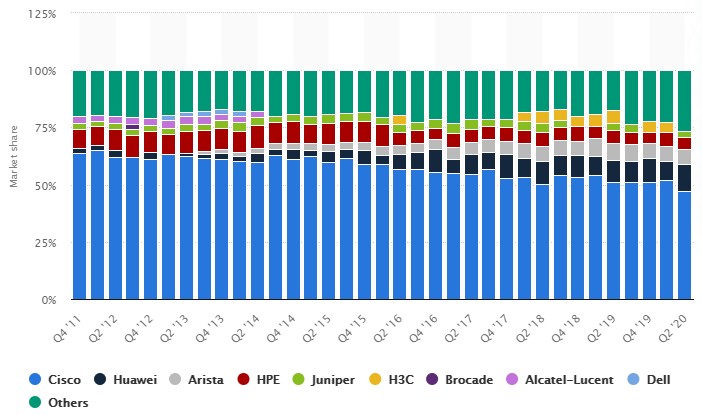

If you want to get a sense of what is happening in the high-end of the Ethernet switch and routing market, it is Arista Networks, formerly an upstart and now just one of the bigger vendors taking on the hegemony of Cisco Systems in networking in the datacenter and now on the campus and at the edge, is probably the best bellwether there is. And so, we like to keep an eye on what Arista is up to.

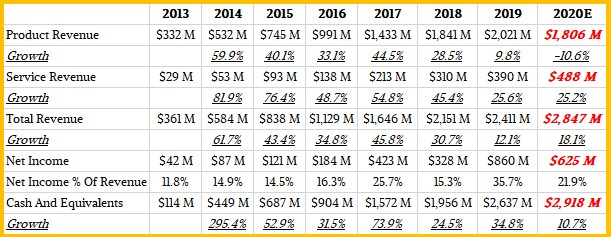

With the coronavirus pandemic both helping and hurting its business and the increasing competition that comes in a tight economic situation, it is not a surprise at all that revenues have been slipping here in the second half of the year. But the declines that Arista has had starting in the fourth quarter of 2019 predate the pandemic, so there was an undercurrent of slippage even before that really started to hit home in the second quarter of 2020. Some of that is the changing economics of 100 Gb/sec networking – eventually, all ports get cheaper, and sometimes volumes grow faster and revenues can rise nonetheless and sometimes they don’t rise fast enough and revenues decline. The same holds true of bits of capacity on disk and flash or cores of compute on CPUs. All we know is that it is the constant and inevitable decline in the cost per bit or op or flop that drives the entire IT sector, which is where insatiable appetites are met by inertial budgets.

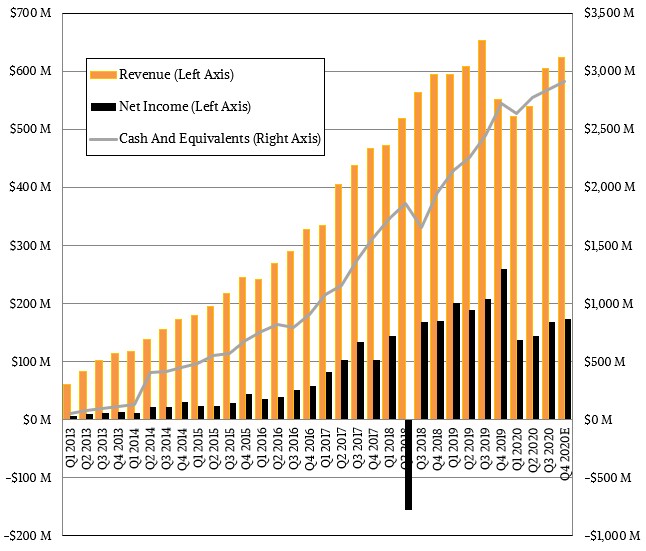

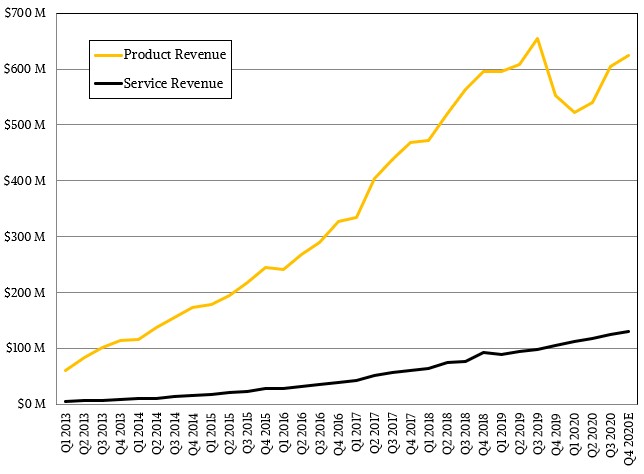

In the third quarter ended in September, Arista’s product revenues fell by 13.5 percent to $480 million, and that is after the company has spent the past year pushing hard into campus networks, opening up a new front in its war with Cisco. (Arista’s top brass, all of whom have worked at Cisco at one point or another, doesn’t like any such comparisons or characterizations because they don’t want to rile up Cisco in public, but rather just quietly beat them in the datacenter one deal at a time.)

Services revenues rose by 26 percent to $125.2 million, and that means overall revenues only fell by 7.5 percent to $605.4 million. That revenue decline put a damper on profits, and we think that expansion out to the campus has also hurt profits a bit as well as investments in 400 Gb/sec Ethernet products, and consequently net income fell by 19.5 percent to $168.4 million in the period.

That product dip that started in the fourth quarter of 2019 and the rise that started in the second quarter of 2020 mirror the ups and downs of the server market, as you would expect, because of the effect of the spending levels by the Super 8 hyperscalers and public cloud builders – Amazon, Facebook, Google, and Microsoft in the United States and Alibaba, Baidu, JD.com, and Tencent in China.

Jayshree Ullal, chief executive officer at Arista, said on a conference call with Wall Street this week that the company’s push into the broader enterprise datacenters of the world as well as into campus switching (which we don’t care about except that it is a revenue stream that has helped moat Cisco and will do the same for Arista, thereby giving it more maneuvering room in the datacenter) allows it to sign a record number of new customers this quarter, and also a record number of customers who spent more than $1 million. More precisely, Ullal said that the so-called “cloud titans” represented its largest vertical, with around 37 percent of total sales (we reckon it is around $227 million in our model), and enterprise and financial represented about another 37 percent in sales (we calculate it to be $223 million), with the remaining smaller clouds and other service providers representing the remaining quarter of its sales, around $155 million. Historically in the past several years, Microsoft and Facebook together have represented 40 percent of its revenues, so that is down a bit. If you break the enterprise customers from the financial customers, the enterprise customers represent the second largest customer group for Arista, followed by the financial industry and then followed by the remaining service providers.

It is hard to say for sure, but we think that about half Arista’s expansion has come from datacenter growth at what it calls the cloud titans and the other half is coming from growth across the rest of its sectors and, to a smaller but growing degree, from its expansion out into the edge and across the campus. At this point, Arista is chasing a total addressable market that is in excess of $30 billion, and Ullal said that business in Europe has recovered after a slump in spending in Q2 and that its business in Asia was “particularly strong.” Given all of this Ullal said that “despite this tough reset year, we believe Arista will emerge stronger, not only returning to double digit growth in 2021, but also aiming for consistent growth in the years beyond.”

The indications are that growth will resume in the fourth quarter, in fact. The company said on the Wall Street call that revenues would be somewhere between $615 million and $635 million in the final quarter of 2020, and at the midpoint, here is what we are estimating in our model:

Our model, which is based on the midpoint as we said above, shows Arista seeing 10.3 percent growth in product sales in Q4, hitting $494 million, with services revenues up 25 percent to $131 million, to hit that $625 midpoint. We think any upside or downside will come out of product sales because, as you can see from the charts above, the services revenue stream has been growing steadily and along a very smooth curve for a long, long time. To guesstimate product revenues for Arista, in fact, you project out the total revenues and then easily move the services revenues ahead by 25 percent and the subtraction will be product revenues. So, we are really saying $494 million plus or minus $10 million for product sales. Arista’s model will not always work like this, of course. But it has for six of the past seven quarters. (The fourth quarter of 2019 didn’t fit the pattern as the hyperscalers and cloud builders tapped the brakes.)

One thing we found interesting was when Anshul Sadana, chief operating officer at Arista, talked a bit about the ever-present and presumed threat of whitebox switch makers who, like Arista, create network equipment based on merchant silicon from Broadcom, Intel (Barefoot Networks), Nvidia (Mellanox), and Innovium and often use open or third party software such as SoNIC (championed by Microsoft), FBOSS (championed by Facebook), ArcOS (created by Arrcus), Cumulus Linux (owned now by Nvidia), and others.

“While there is a lot of talk about whiteboxes and 400 Gb/sec, our customers have maintained the status quo,” explained Sadana. “We have not seen a change in position from this status quo. Customers that used whiteboxes are continuing to use whiteboxes. Whereas customers who use Arista switches are continuing to use our products for today and for their future designs. If anything, some use cases currently covered by internally developed whiteboxes may transition to our feature rich products in a few years. Cloud companies upgrade at a massive scale and they are continuing to grow. This scale makes them lean more on us for technology and support. Our cloud customers see immense value in working with us, and we have high customer satisfaction here. Our portfolio is highly competitive and we are being told that we are ahead of competition. Hence it is unlikely that we will see significant share shift. Savvy cloud titans are not influenced by pretty marketing slides.”

Well, to be fair, neither are the rest of datacenter operators in the enterprise, other cloud builders, telcos, or service providers. But there are those who are committed to whiteboxes – AT&T comes to mind, which is going to only use whitebox switching and routing gear and only use open source software like the Disaggregated Network Operating System (DANOS) platform, which is based on the open source Vyatta NOS for routers. (ArcOS is similarly a routing operating system built from scratch that has been stretched down into the switching realm, meeting the merchant silicon that has had more and more routing functions built in such that much of networking in the modern datacenter is routing, not switching.)

On the campus front, Arista has booked around $100 million in revenues so far, and is looking to at least double that in 2021. And it also believes that its cloud titan business can grow next year, too.

Be the first to comment