If you think about it for a minute, it is amazing that any of the old-time IT suppliers, like IBM and Hewlett Packard, and to a certain extent now Microsoft and Dell, have persisted in the datacenter for decades or, in the case of Big Blue, for more than a century. It is difficult to be constantly adapting to new conditions, but to their great credit, they still do as they world is changing – sometimes tumultuously – both around them and underneath their feet.

So it is with HPE, which is going through its umpteenth restructuring and refocusing since we entered IT publishing more than three decades ago, this time under the helm of Antonio Neri, its relatively new president and chief executive officer. The current Hewlett Packard is a very different animal than the one that sold proprietary minicomputers and then Unix systems in the 1980s and 1990s, and it is in many ways more of a successor to the systems businesses of Compaq and Digital Equipment, which the company absorbed two decades ago.

These days, HPE has just finished acquiring the assets of commercial Hadoop and Spark distributed systems software maker MapR Technologies – which it apparently picked up for less than one year’s worth of revenue generated by MapR, although no one knows what that revenue figure is – and has just this week got regulatory approval to moved ahead with its $1.3 billion acquisition of supercomputer maker Cray. Nimble Storage hybrid flash/disk storage and SimpliVity hyperconverged infrastructure have rounded out and modernized HPE storage portfolio, which still includes its more traditional – but not growing – XP7 and 3PAR arrays. To a certain extent, companies like HPE encapsulate the rising of new technologies and falling of old ones, and that is why they always seem to be treading water, particularly when they focus strictly on enterprise customers as HPE is trying to do.

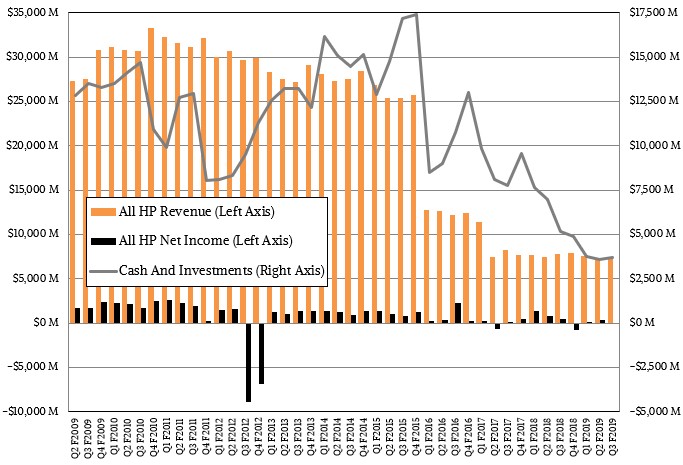

Trying to break into the hyperscalers and cloud builders did HPE no favors in terms of margins, even if it did help prop up its server revenues for a time. This is why it has been backing away from this business gradually; ditto for its direct business in China, which has been superseded by its H3C partnership with Unisplendour, part of Tsinghua Holdings which is itself a wholly owned subsidiary of Tsinghua University. On a conference call this week with Wall Street analysts, Tarek Robbiati, chief financial officer at HPE, said that fiscal year to date, through the third quarter ended in July, the Tier 1 customers that HPE has represented 2.2 percent of the company’s total revenues, and that works out to a mere $487 million across those three quarters. In fiscal 2018’s first three quarters, this business represented $1.15 billion in sales, and it was much higher than that one and two years further back in history. Part of the steady decline in HPE’s revenues over the past four years is the decision – wise or not, even history probably will not be able to decide – to back away from sales that have no profits.

What can be said is that the underlying infrastructure businesses of HPE seem to be getting a little more profitable even as it takes a sales hit as it backs away from the Tier 1 customers (which includes some telcos, service providers, hyperscalers, and cloud builders). The truth is, in the long run, due to margin pressures that Quanta Computer, Foxconn, Wistron, Inventec, and other ODMs do not have, HPE was going to be driven out of these businesses anyway. The company no doubt excepted to have to expend more energy chasing deals that it would not win, and if it did, all it would be doing would be manufacturing gear for customers to keep its factories warm and the revenues flowing. This is what the ODMs essentially do. But HPE has Wall Street owners who want more, and so HPE has to do a more complex dance of absorbing and creating new technologies and constantly reinventing itself. That’s why the Tier 1 business represented only somewhere between 1 percent and 2 percent of HPE’s total revenues in fiscal Q3, and why it will be essentially zero excepting where the H3C partnership sells gear in China.

In the third quarter, HPE’s revenues fell by 7.1 percent, to $7.22 billion, but if you take out that Tier 1 business in the compares, then it was only down 3 percent. That 3 percent decline is still a big deal, mind you, and it really hurt HPE’s bottom line, which swung from a $451 million net income in the year ago period to a $27 million loss this time around. The restructurings and divestitures and other costs add up, and like IBM, they become as much a perpetual habit as stock buybacks to distribute cash to shareholders who might not make as much on a stock price rise. But what is the alternative if you are HPE or IBM, really? It is easy to criticize, but given their hands, they play them as well as any of us could.

That said, it is tough for HPE to boost research and development by 10.6 percent to $481 million at the same time as it increases its SGA costs by 2.6 percent to $1.25 billion at the same time transformation costs come in at the tune of $170 million (more than triple what they were in the April quarter) and various acquisition and divestiture charges came in at $563 million (a factor of more than 23.5X higher than the year ago period) while at the same time taking a 7.1 percent revenue decline. If HPE had not had a $238 million tax benefit it could book, it would have been $211 million in the red. But again, HPE is doing pretty well, all things considered. This is a particularly tough transition in increasingly uncertain times with nervous customers, and for HPE to be increasing gross margins and operating profits in that environment is about as good as can happen.

“We continue to see uneven demand due in part to ongoing trade tensions, which impact market stability and customer confidence,” Neri explained on the call. “This is showing up in elongated sales cycles, particularly in larger deals, as we noted last quarter and reiterated during our Investor Relations Summit at the Discover conference in June. However, our customers continue to affirm their need to accelerate their digital transformations to improve business outcomes and customer and employee experiences while reducing cost. The exposure of data will continue to fuel underlying demand for solutions to help protect, store, manage, and analyze their vast data. And this is where we are laser focused.”

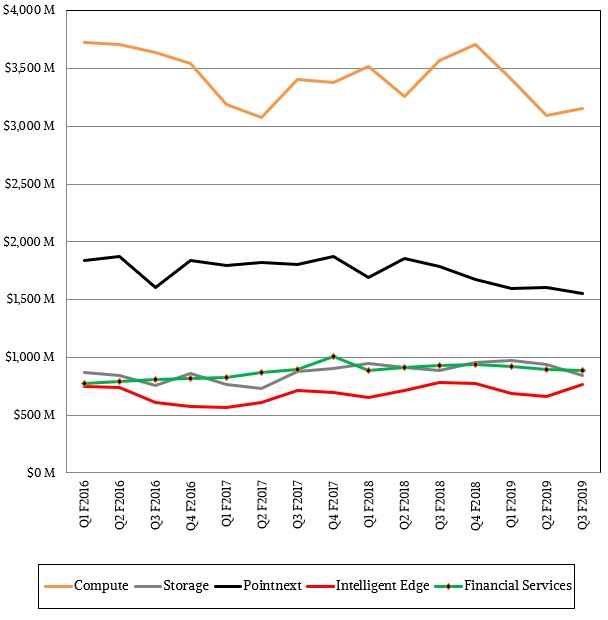

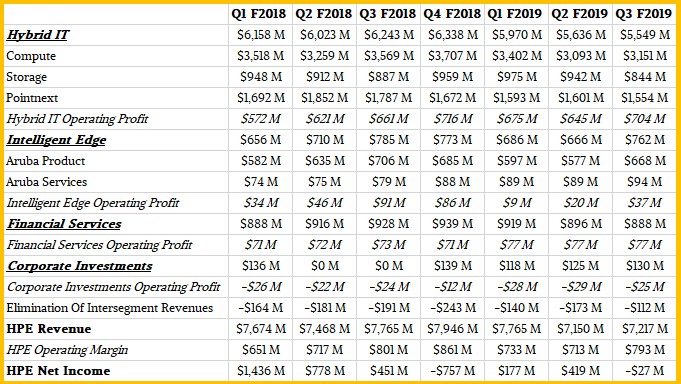

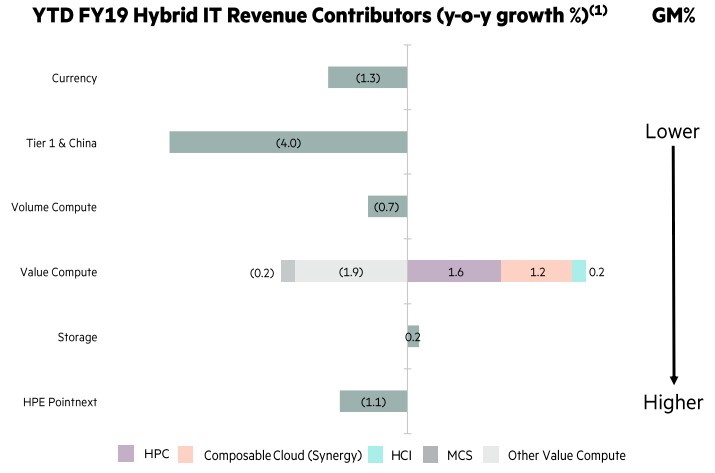

Like other server makers, HPE has seen a slowdown in the past few quarters, and revenues were off 11.7 percent as reported for the ProLiant, Superdome-X, and Synergy lines (but down 10 percent at constant currency and down only 3 percent if you take out the Tier 1s and China). Within this broad compute category in the Hybrid IT group at HPE, high performance computing (which we presume includes both traditional simulation and modeling as we know HPC as well as machine learning and data analytics on distributed systems) was up 2 percent. Composable systems, which means the Synergy line of iron, was up 28 percent at constant currency, and hyperconverged infrastructure on VMware’s vSAN and its own SimpliVity (plus a smattering of other options) was up 4 percent compared to the year-ago period. While storage revenues were down 4.8 percent as reported to $844 million, the drop was only 3 percent at constant currency, and Nimble hybrid flash/disk arrays saw revenues rise by 21 percent (again, at constant currency).

On the Pointnext services front, which is also part of Hybrid IT, revenues were off 13 percent to $1.55 billion, but the Greenlake infrastructure-for-rent service now has well over 600 customers and has racked up more than $2.5 billion in revenues cumulatively to date. HPE has been very clear that by 2022, it wants every product available for rent as a Greenlake service.

Add it all up – compute, storage, and services – and Hybrid IT had an operating profit of $844 million, down 4.8 percent.

On the more traditional financing front, HP Financial Services brought in $888 million in sales, down 4.3 percent, but operating profits were up 5.5 percent to $77 million.

Here’s the revenue and operating profit trends for the past two fiscal years thus far:

And here is an interesting chart HPE put together showing revenue contributors in the Hybrid IT by product type extracting out Tier 1 and China deals. Take a look:

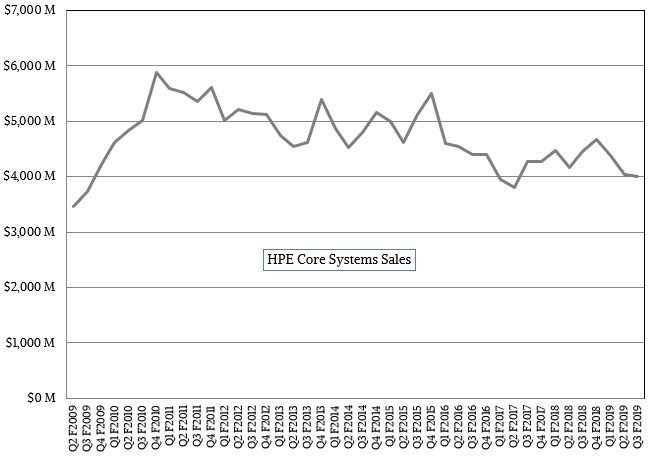

At this point, the core HPE systems business, as we reckon it, is averaging a little north of $4 billion per quarter. Some of the shrinking in recent years is due to divestitures, and some of it is organic decline, and some still is walking away from unprofitable business segments in general and deals in particular.

There is another factor in the declining revenue in this core systems business: Components are getting cheaper and HPE is passing those savings on to customers because it has no choice.

First and foremost, DRAM and flash memory prices are coming down from their local maxima highs from the past several years at the same time persistent memories like Intel’s Optane are coming to market. (There is not precisely a causal effect. Companies were not buying gobs of memory in recent years, so it is not like this is a clean replacement. You have to do things to use Optane correctly in conjunction with DRAM.) Moreover, there is competition in the X86 server market, with AMD now fielding two generations of its Epyc processors and no doubt putting pricing pressure on Intel. The prices come down on all of these components, but no one is suggesting that HPE gets to benefit from higher margins. It apparently does not in and of itself. But customers, explained both Neri and Robbiati, are adding richer mixes of networking and accelerators to their systems and that is compensating somewhat for the return to sanity in DRAM and flash memory prices.

It is all quite a balancing act, isn’t it? You can’t be weak-kneed about it, and you have to make your steps as best you can and not fall down. It will be interesting to see how Cray changes the core strength at HPE and perhaps gives it some spring in its step.

The really big Tectonic Shift is the open RISC-V ISA being joined by the MIPS, and Power ISAs going Open with no ISA licensing payments required. And the question to be asked for HPE is how much longer will the x86 ISA remain dominant in the server CPU market. And x86 is mostly no where to be found on phones and mainstream tablet market devices in any larger numbers but that infinitesimally small amount of phones that are no longer being pushed or the mainstream tablet market where the numbers are a little larger than insignificant for x86 but still tiny in comparison to ARM ISA based Tablets/Phones.

What if HPE decides to tape out their own custom Implementation of a Power ISA running monster, ditto for AMAZON, or Facebook, Google or even Apple, Nvidia.

Maybe Intel and AMD have to begin to see the longer term trends and become more than just x86 core designers and GPU core designers, FPGAs(Intel’s already there) as well. Maybe AMD needs to marry some eligible FPGA maker.

Nvidia sure needs to consider becoming more than just an embedded class CPU core maker with that auto and portable gaming console market segment. And maybe Nvidia can now do with Power and compete better with the AMD and Intel competition in the server CPU market segment as well. It costs AMD relatively peanuts to field a Xeon quashing Rome MCM based multi-die processor with that Rome line giving AMD a markup that’s matching or exceeding most of Nvidia’s GPU offerings save a few top end SKUs. And Nvidia does pay a handsome price for those larger GPU Die samples what with the die/wafer yield curve so poor as direct function as the total die area size increases.

Maybe HPE can just rely on more AMD and Intel x86 competition to drive server CPU prices down and feature sets up but some others with deeper pockets will have to look at the longer term implications of the commodity CPU market if the prices are not competitively low enough for any larger scale CPU deployments where the costs of in house development can be justified if the unit counts required are large enough to produce a better economy of scale for that to happen more affordably.

AMD and Intel maybe need to look at their qualified chip design engineers as a more needed resource to branch out to any and all available CPU ISAs that can be utilized most efficiently across specific market segments. And HPE is most certainly a user of CPUs and GPUs, FPGAs and other processors from many vendors. Arm Holdings as well as its ISA only Architectural licensing business is going to take a hit from RISC-V, OpenPower/Power ISA, and even it’s oldest rival MIPS and that Opened Up ISA.

HPE, HP-Inc, Dell and other Server/PC/Laptop OEMs are sure looking like good investments as their commodity processor pricing BOMs continue to drop in the face of severe processor supplier competition and it’s becoming an OEM buyers market for the processor parts that take the largest bite out of these OEM’s bottom lines. DRAM, Flash, and even XPoint(If Micron gets into that XPoint contest in earnest) market competition as well.

The only thing that currently spoils any market excitement is the current trade war tit for tat, that and inverted bond yields.