The most interesting thing about Hewlett Packard Enterprise has nothing to do with its many products in compute, storage, and networking, or even its recent $1.3 billion deal to acquire supercomputer maker Cray. It is the relatively new GreenLake cloud-alike subscription model that HPE has implemented to try to get its hardware off the capital budget and onto the operational budget – and Cray is fixing to play a part in this going forward, as it turns out.

GreenLake was launched – or more precisely, relaunched – at HPE Discover last June, starting with a hybrid cloud offering that created on premises Azure Stack environments atop virtualized ProLiant servers that mimicked the virtualized servers run by Microsoft in its Azure public cloud. HPE has set its future on hybrid IT, and while there was a time when HPE had aspirations to build its own public cloud based on OpenStack, the company has long since given up on that and is now happy to just have its on premises slice of the hybrid IT pie – provided it gets to layer on management and software fees to make a little extra money. HPE launched plans for a similar setup in April of this year with Google, pairing the search engine giant and cloud player’s Anthos Kubernetes on-premises platform as an on-premises pairing to its own Kubernetes stack atop the Google Cloud Platform public cloud. Eventually there will be some variant of GreenLake for Amazon Web Services, perhaps based on the VMware cloudy stack on both sides of the wire. AWS support is coming, but how this will be accomplished has not been disclosed. Pricing is not something that HPE is willing to talk about publicly, either. Which is unfortunate but not surprising.

In essence, if HPE can’t beat the big six cloud players – Amazon, Microsoft, Google, Baidu, Tencent, and IBM – at the public cloud game, it can build what amounts to a distributed public cloud that is parked on premises for those organizations that do not want – or cannot – move their applications and data to the actual public clouds. This is precisely what we have said the public cloud providers would have to do in the long run, despite all of their enthusiasm that the entire world would shift to public clouds from private infrastructure.

HPE started noodling with what is called GreenLake Flex Capacity for selected systems in its portfolio with subscription pricing eight years ago, starting with selected customers and opening it up to a wider potential customer base. HPE says it has hundreds of customers using the GreenLake Flex Capacity service, and that it has delivered “over $2 billion in value,” whatever that means. HPE started shipping the broader, solution-stacked GreenLake service at the end of last year, and in its most recent quarterly results, the GreenLake offering, which is buried in HPE’s Pointnext services business, was one of the highlights. In a conference call with Wall Street analysts last week, HPE chief executive officer Antonio Neri said that Greenlake had its best quarter ever and that orders for the service grew by 39 percent year on year. This is certainly fast growth, but orders are not revenues and we also assume that it is growing from a pretty small number, too.

HPE is working with companies that do not have their own public clouds to offer subscription-based systems, including Nutanix for hyperconverged infrastructure, and is even talking up the possibilities of selling supercomputing capacity this way. To be fair, most of the supercomputers at the national labs and many academic centers are actually leased, not acquired, so even though we talk about them buying supercomputers, they actually already pay monthly lease payments on them. So they are already sort-of GreenLake. But GreenLake is more than that, with HPE actually setting up and managing the infrastructure stacks.

GreenLake is certainly growing faster than HPE’s sales of physical servers to end users, and its success could start having an impact HPE’s balance sheet as well as its sales as they shift from ProLiant hardware to PointNext GreenLake services. There has already been such an effect, by definition, but it is probably nominal at the moment. If HPE is right about subscription priced private infrastructure paired with and compatible with public clouds (to the extent possible) as well as supercomputers or other stacks that will probably not be installed on the public clouds (Nutanix is a good example, and so is Cray despite its efforts to get people to buy time on Cray iron in the Azure cloud), the impact on HPE’s hardware sales (but probably not its manufacturing, oddly enough) could be material and even someday substantial.

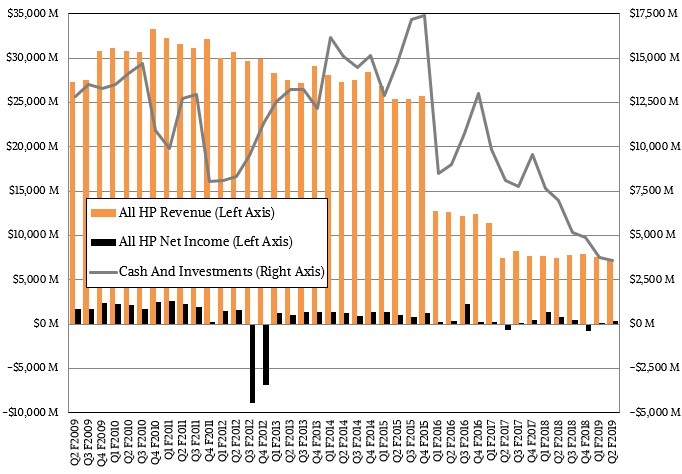

As the chart above shows, HPE is continuing to shrink and some of that shrinkage is done on purpose through divestitures of its PC, printer, enterprise services, and various software businesses over the past couple of years, and some of it is due to dialing back its sales to Tier 1 service providers – including a few hyperscalers but also a number of telcos, Internet service providers, and webscale companies. HPE has been dialing back that Tier 1 business, which has very little to no margin for the likes of HPE, for three years now, and it has shrink considerably. We estimate that HPE was doing somewhere around $1.3 billion per quarter in sales to the Tier 1 players back in 2016, and it dropped to something on the order of $1 billion per quarter in 2017, $400 million per quarter in 2018, and is more like $150 million per quarter in 2019. (Those are fiscal years for HPE, which start in November and end in October.) That Tier 1 business comprised 5 percent of sales in fiscal 2018, according to Tarek Robbiati, chief financial officer at HPE, and dropped to around 2 percent so far in fiscal 2019. It was around 10 percent back in fiscal 2016 – and that was when HPE still had a large services business propping up revenues. To give a more accurate number, that Tier 1 business has fallen from around $5 billion in fiscal 2016 to what could be as low as $500 million to $600 million by the time fiscal 2019 closes this fall. This is a 90 percent contraction, and a very tough decision that many companies have to make in many markets.

What HPE’s numbers show, more than anything, is just how difficult it is to make a profit in IT infrastructure, even if you stay out of the Tier 1s. And small and medium businesses moving to the cloud are not helping, either. This puts HPE in a pair of profit pinchers. So you can see why HPE would want to have hardware sold under subscription, with lots of room to add higher margin services on top of that iron and extend what amounts to a lease term out an extra year or two, as many companies will no doubt do. That’s essentially free money.

Having done all of those divestitures, the winding down of this Tier 1 business still has material impacts on HPE’s overall numbers. Neri said that HPE’s revenues in the Americas were down 7 percent at constant currency, but were only down 2 percent when the effect of the Tier 1 sales declines were taken out of the numbers. Within the Hybrid IT group at HPE, which includes servers, storage, networking, and services, sales were down 3 percent in the second quarter, but up 2 percent taking out the Tier 1 downdraft. And drilling down into the compute segment, which means mostly ProLiant servers but also a smattering of Superdome, Synergy, and SGI servers, sales were down 4 percent but were up 4 percent with the Tier 1 decline removed from the year-on-year comparison.

Overall, HPE’s revenues were off 4.3 percent to $7.15 billion, and earnings from continuing operations rose by 18.6 percent to $434 million. Net earnings were boosted significantly by tax indemnifications and other tax benefits that hit in Q2 of fiscal 2018, so net income this time around fell by 46.1 percent to $419 million.

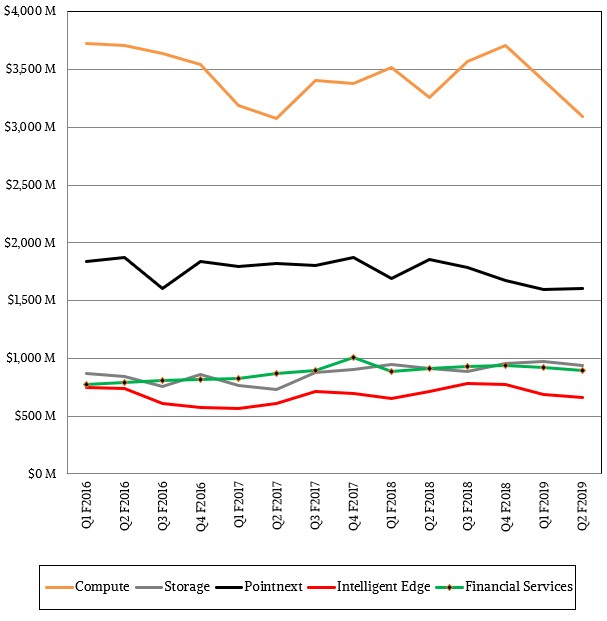

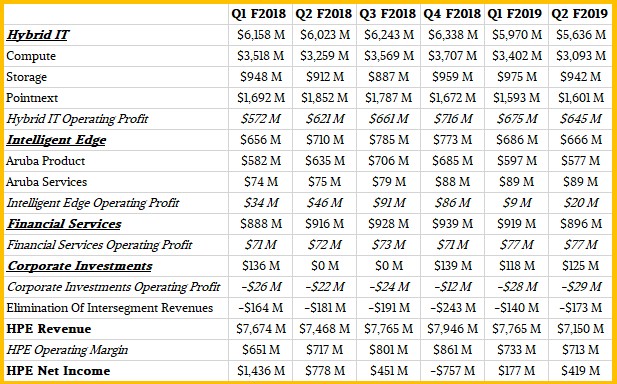

If you look at sales by category and division, the Compute segment at HPE accounted for just a little under $3.1 billion in sales, down 5.2 percent in the period, while storage managed to eke out some growth (3.3 percent) to hit $942 million. Despite the growth of GreenLake services, the overall Pointnext lineup had a 6.8 percent decline to $1.6 billion. Add it all up, and the Hybrid IT group had sales of $5.64 billion, down 4.4 percent, with operating profits of $645 million. Here’s a table that shows it all.

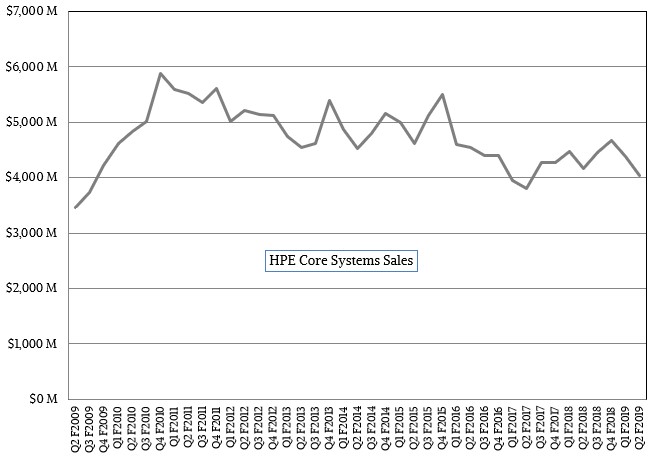

While this breakdown in the table above is interesting, what we want to know is how that core systems business at HPE is doing, particularly as we anticipate adding Cray to the mix. Every quarter, we take a stab at estimating what portion of sales that HPE does is for the core hardware and systems software, plus break fix services and financing of its gear. Here is what the curve looks like:

There is a general downward trend in the past several quarters, but it is stabilizing. We are not sure how to take into account GreenLake sales once they become material. But we will figure it out by the time they become material – this much we are sure about. At some point, HPE will have to tell Wall Street roughly how big it is if it is getting big, and if they don’t say anything, then we know that GreenLake didn’t get big after all.

Certainly Tier 1 compute and network sales, regardless of platform category, have systematically concentrated into slimmer margin business morphed back toward platform timeshare was originally a poor IT department’s solution to hardware, maintenance, operation and administration cost and is again?

“We estimate that HPE was doing somewhere around $1.3 billion per quarter in sales to the Tier 1 players back in 2016, and it dropped to something on the order of $1 billion per quarter in 2017, $400 million per quarter in 2018, and is more like $150 million per quarter in 2019.”

One of the back stories, being missed or avoided, is why this acceleration in revenue decline facing the entire industry, beyond HPE, competitively affects margin but the primary driver of concentration in “enterprise” hardware sales, Tier 1 primary product sale, is simply associated with prior sales and secondary ‘used’ equipment whose utility, application and sales value now exceeds new hardware value on use scenarios.

There’s plenty of good used compute and network equipment available in the market, produced prior five years fit for many uses. And until there are new uses, driving bandwidth and throughput, there’s a lot of secondary market hardware availability, including off primary lease, second and on third lease, perfectly acceptable in terms of price performance fit for use.

I’ll offer my foremost example used Xeon. There are 1,106,286,630 used v3/v4 processors out there in the market, Intel 1K Value at 70% discount $559,730,392,652 does not include their product wrappers are on average 80% server, 15% workstation and 5% raw component is a lot of primary production value in the hands of secondary market suppliers. No wonder First Tier design producers are feeling their back in time supply pinch.

In relation to Intel Xeon CPUs alone, 5 to 10 years of supply. Considering just v3/v4 14C and above, there are 235,763,310 processors associated with compute, network and communications equipment available and in use. XSL adds another 40 M units that is a good three year supply of technically useful equipment the majority of which existed before Intel boosted Xeon pricing meant to give the secondary market headway and runway to move used equipment reclaiming that financial investment for new purchase.

Where the objective must be to reclaim by exchanging old values for new values because that’s what funds innovation, development and new equipment purchase from primary producers.

No doubt all the first Tier providers are now engaged in used equipment sales on secondary market value exceeding primary market value.

https://seekingalpha.com/instablog/5030701-mike-bruzzone/5272437-xeon-channel-inventory-management-data

Mike Bruzzone, Camp Marketing