One of the hardest things in the world to do at either the International Supercomputing Conference in June or the Supercomputing conference in November is getting out of bed and to the rapid-fire, data-packed breakfast hosted by Hyperion Research, formerly known as IDC’s HPC research division. The food is good, the coffee is strong, and it is what one generally needs after a long evening of socializing with the HPC crowd.

It doesn’t hurt that the HPC server market set record revenues in 2017, following fast on the heels of a record level of sales in 2016. But the market for HPC iron was a bit softer in both 2015 and 2016 than the folks at Hyperion were expecting when they did a mid-year snapshot in 2016 at the ISC16 conference. Prediction is only easy in hindsight. Now that we are well into 2018 and all of the vendors of systems gear have reported their financials, Hyperion can take the time and reckon how much of it was derived from HPC shops. As best as Hyperion can figure, the worldwide market for HPC servers came to $12.3 billion in 2017, an increase of 6.1 percent from the $11.6 billion in machinery for running simulation and modeling workloads in 2016.

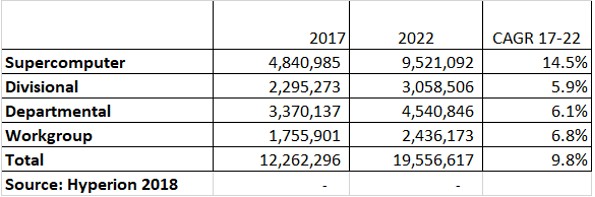

That 2017 ended on a high note is significant because last November, at SC17, according to Earl Joseph, principal researcher at Hyperion, explained that HPC server sales were off 3.5 percent to $5.11 billion through the first half of the year. Hyperion breaks down the server sales a bit more granularly into four subsegments: workgroup clusters that cost under $100,000; departmental clusters that cost between $100,000 and $250,000; divisional machines that cost between $250,000 and $500,000; and supercomputers that cost more than $500,000. Sales of divisional, departmental, and workgroup clusters were all off to varying degrees – 14.1 percent, 7.3 percent, and 22.9 percent respectively – and only the high end supercomputer segment was showing growth, rising 17.3 percent for the first half. That ratio of sales meant that supercomputers made up almost 40 percent of the total HPC server pie, which is not necessarily a healthy distribution.

So that was the first half of last year. Everything worked out a lot better. The supercomputing server segment grew by 18.3 percent to $4.84 billion, and the divisional segment even showed a one point gain to $2.3 billion. Departmental HPC server sales rose by 7.1 percent to $3.37 billion, and workgroup servers had a 4 percent bump up to $1.76 billion. The total market for HPC servers rose by 12.7 percent to $12.63 billion.

The forecast looking ahead for the next five years is much the same across the HPC server categories, but with a slightly muted compound annual growth rate. Take a gander at these Hyperion prognostications:

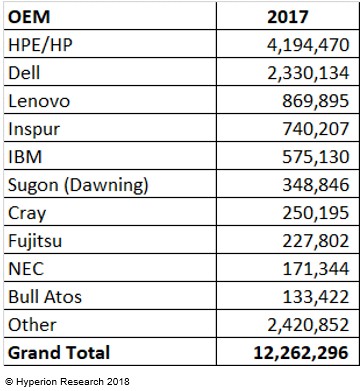

It is always interesting to see who is getting the money, and Hyperion provided a breakdown of HPC server sales by vendor:

Hewlett Packard Enterprise, which rocketed up to number one when it bought SGI and after IBM sold off its System x server division to Lenovo a few years back, had just under $4.2 billion in HPC server sales in 2017, up 8.2 percent from 2016. If you add in SGI’s sales to the 2016 numbers for HPE to make an apples-to-apples comparison, then the combined HPE/SGI only had 3.6 percent growth in 2017.

Dell posted HPC server sales of $2.33 billion, up 15.7 percent and beating the market overall. Lenovo was the number three HPC server shipper in 2016 with $909 million in sales, but fell by 4.3 percent in 2017 to just under $870 million. Chinese system maker Inspur came out of nowhere to take over the number 4 revenue ranking in HPC servers last year, with $740.2 million in revenues. We do not have the before numbers for Inspur for 2016, but it has to be under $120 million because we can see all the vendors who did more than that in this data here, and that means Inspur grew its HPC server business in 2017 by at least a factor of 6.3X. IBM grew its Power Systems HPC business by 16.9 percent, beating the market, reaching $575.1 million, but it could not hold onto the number 4 position and was knocked out by Inspur to number 5. Sugon, which sells under the Dawning brand in China, similarly jumped ahead of Cray, with 10.7 percent growth to $348.9 million in HPC server revenues, but that jump was mostly because Cray’s HPC systems sales fell by 45.7 percent to $250.2 million last year. Fujitsu’s HPC server business was essentially flat at $227.8 million, and NEC and Bull/Atos showed modest growth to hit $171.3 million and $133.4 million, respectively. The share of other HPC system makers was down a smidgen to $2.42 billion, comprising 19.7 percent of the market.

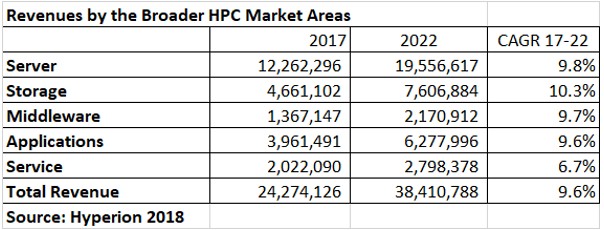

In addition to tracking the HPC server space, Hyperion also looks at storage, middleware, applications, and services that HPC shops get from various OEMs and services companies. Here is the forecast looking ahead:

As you can see, in the overall HPC spending forecast, the growth rates across these areas are expected to be fairly uniform, with the market growing at a compound annual growth rate of 9.6 percent from $24.27 billion in sales in 2017 to $38.41 billion in sales in 2022. As for a more short-term forecast, Joseph says that 2018 is looking good, with the first quarter being strong. The acceptance of the “Summit” and “Sierra” supercomputers built for the US Department of Energy by IBM are going to help the second quarter and probably helped the first quarter already, depending on when the revenue was recognized. We shall see how the rest of the year goes.

Be the first to comment