The market for high performance computing can be a capricious one in any short term, but in general has been growing and, at last according to some of the experts who have spent decades tracking it, is set to grow a little bit faster than the IT sector at large in the coming years.

A lot, of course, will depend on whether or not the United States, Europe, China, and Japan come through with what are expected to be substantial investments in pre-exascale and exascale systems in the next few years, and quite possibly resulting in a bumper crop of revenues around 2021 or so.

As usual, Hyperion Research, formerly the HPC division of market researcher IDC that was spun out of that company in the wake of its own acquisition by a Chinese conglomerate, hosted its breakfast statistics blitz during the SC17 supercomputing conference in Denver.

As we previously reported, 2016 was a record year for HPC server sales, with revenues hitting $11.2 billon, but it was still less than the same people at IDC were projecting for both 2015 and 2016 back in the middle of 2016. Somewhere in the ensuing twelve months between these datasets, the 2015 data for HPC server sales was revised downwards, so that growth might have more to do with that revision – which is in essence sales that were lost for good – than with real growth in the market. The market for high-end machines was good last year, but it was soft at the low end where divisional, departmental, and workgroup clusters dominate.

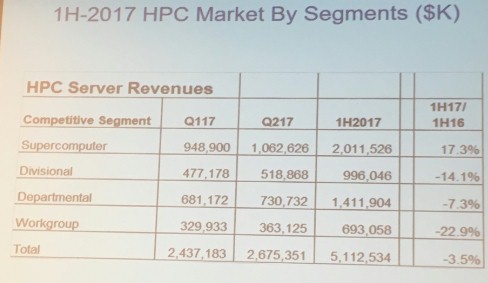

The first half of 2017 has not been particularly good, either, according to Earl Joseph, principal researcher at Hyperion, with total server sales across all HPC segments down 3.5 percent to $5.11 billion. Take a look at the raw data:

Hyperion breaks down the server sales a bit more granularly into four subsegments: workgroup clusters that cost under $100,000; departmental clusters that cost between $100,000 and $250,000; divisional machines that cost between $250,000 and $500,000; and supercomputers that cost more than $500,000. The HPC server market continues to be a little top heavy, with 39.3 percent of sales being for supercomputers alone. The good news is that supercomputer sales have risen by 17.3 percent so far in the first half of 2017, the latest data that Hyperion has available. The bad news is that the other three segments have contracted, with workgroup systems being hit the hardest, falling 22.9 percent compared to the first six months of 2016.

“This is not unusual,” said Joseph of the first half slowdown, “because this is often the softest part of the year.”

Still, we recall that there was softness at the bottom half of this business in the first half of 2016, too, and this may be a trend more than a blip. With so many public clouds getting GPUs and high speed, low latency networks integrated into their clusters for true HPC functionality, we think this could be part of a permanent trickle migration from academic, government, and corporate datacenters to the cloud. Joseph conceded this was a possibility and that the team at Hyperion was trying to get a handle on it.

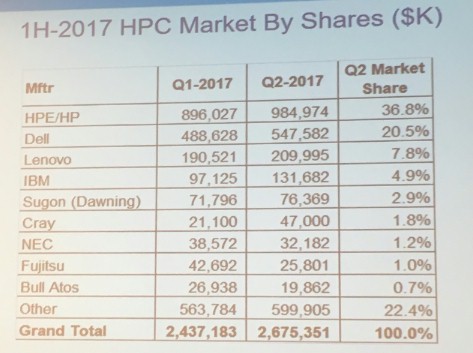

For the longest time, IBM and Hewlett Packard Enterprise jockeyed for supremacy in HPC server sales, with IBM selling a mix of Power and X86 iron across the spectrum, often focusing on big deals for big systems with HPE selling a larger number of smaller systems. Now, the tables have turned quite a bit, with IBM having sold off its System x business to Lenovo two years ago and HPE buying SGI. Dell has been growing, and so have a number of vendors that are indigenous to China. Here is the vendor breakdown for the first and second quarters of this year:

While we get excited about HPC server revenues because they are a bellwether for enthusiasm for technical computing, we wonder how much – if any – profit is in the $5.11 billion in machinery consumed so far this year. We suspect that, thanks to rising memory and flash prices as well as a pretty steep rise in pricing with Intel’s “Skylake” Xeon SP processors, profits are under even more pressure than usual. For all we know, the server part of this business is only nominally profitable. We hope not, and we hope that this is a healthier business than that for sales of systems into the hyperscalers and cloud builders, who squeeze most of the margin out of their minimalist systems and force vendors to live with it or seek profits in a declining enterprise sector. It is not a pretty situation if you sell servers for a living. But they can make it up with software, storage, and services – at least that is the theory. (More on that in a moment.)

Just for completeness of the Hyperion dataset that was unveiled at SC17, here is how the HPC server sales break down by region:

The North American market is still almost twice the size of that in Europe, the Middle East, and Africa, and almost ten times as large as that in Japan. If you add Japan to Asia/Pacific, which is how some vendors think of the market, and others do not, then for the moment that third of the globe is still generating less HPC server revenue than Europe. China is growing fast, mind you, and spending big bucks on pre-exascale projects. That is because the supercomputing centers are built for industry use in China, while in the Western economies, corporations buy their own systems and don’t share. They only use academic and government centers when they have code they want to scale beyond their own capabilities, if at all.

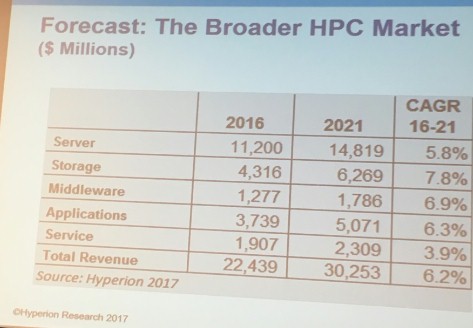

If you want to get a feel for the real traditional HPC business, you have to add the software, storage and services in. While Hyperion did not give this breakdown for its 1H 2017 figures, it did provide some insight into these other areas as part of its updated forecast, which compares 2016 levels with those expected five years later in 2021. Take a look:

Servers, as you can see, represent about half of the spending on HPC systems, and that part of the market is expected to expand at a compound annual growth rate of 5.8 percent between 2016 and 2021, rising to $14.8 billion at the end of the forecast. Obviously, a lot will depend on the exascale systems expected to be deployed that year and when they are ready for acceptance and therefore revenue recognition. The thing that the industry does not want – and that might very well happen – is that there is a big bubble in sales in 2021 and a recession in supercomputing the year after that and maybe into the next.

The other parts of the HPC ecosystem are growing more or less in concert with HPC server sales, with storage doing slight better and services doing slightly worse. Still, if all goes well, by 2021 this will be a $30.2 billion business, more than a third larger than it was in 2016.

We shall see.

How about Including a breakdown by maker for Power9, Xeon, Epyc, ARM, Etc. HPC for CPUs that may not have the FP resources can also mean that GPUs can more than offset any FP workload deficiencies such as say on AMD’s Zen/Epyc SKUs saving power for most server workloads that may not need to FP horsepower but with AMD able to supply Radeon Pro WX and Radeon Instinct MI25/variants for HPC related compute/AI workloaads. Ditto for Power9’s paired with Nvidia’s GV100 based GPU accelerator products. ARM can also be included for those SVE instructions that can also be considered HPC focused.

Intel appears to be taking notice of Nvidia’s GV100 and Power9 supercomputer contracts as Intel has gone out and Hired Raja Koduri away from AMD and Koduri is a GPU specialist. So Intel appears to be concerned enough to hire one of the most well known GPU microarchitecture engineers and former Head of AMD’s Radeon Technolohies Group. So there must be some changes ahead considering Intel’s latest Xeon Phi Knights Hill cancellation.

The GPU/Other accelerator market opens up a whole list of CPU processors that may not themselves possess that much FP FLOPS power as that FP work can now be offloaded to the accelerator processors. TPUs are a thing now also for the AI market from Google and Nvidia(Included on GV100) and others so CPU sales for HPC are going to be even more competative as any CPU weakness in the FP area can be easily made up for with GPU/Other accelerator products.

AMD’s ability to package price its Epyc CPU offerings with its Radeon Pro WX/Instinct offerings can not be ignored as AMD does possess both an x86 license and Some very nice Vega 10 base die Compute/AI focused GPU accelerator variants. And Vega 20 is coming in 2018 with a better 1/2 DP FP to SP FP ratio so the Vega 20 die variants will have a bit more DP FP performance. Intel has sure taken notice of GPUs and the HPC market that can even potentially give any ARM designs some extra DP FP performance where the ARM designs may lack as much FP abilities currently.

Intel’s CPU based HPC margins are going to be under greater pressure than ever and that pressure will even start to accelerate come 2018. These past few weeks in Nov 2017 have seen some unimaginable deals and on new packaging IP from Intel using AMD based semi-custom sourced GPU dies for the consumer market, including a career move by AMD’s RTG head. So what may be in store for 2018 will become even more interesting. Raja Koduri is going to be mostly focusing on Compute/AI focused GPU/Other AI variants with Intel sourcing semi-custom AMD dies for the lower margin consumer market that Intel really sees no reason to focus on currently. And Nvidia’s GV100 GPU variants are a big reason for Intel to really double down or risk loosing even more high margin HPC sales to Nvidia and its OpenPower partners.