There are definitely easier businesses to be in than operating a neocloud.

For one thing, the makers of AI accelerators, which are driving around half of systems sales worldwide these days, are hell bent in getting new compute engines in the field every year, which plays havoc with the street value and desirability of the fleet of existing compute engines that neoclouds have managed to wrangle to do work.

Moreover, the anchor customers set the pace of the business, and if one of them threatens to leave or to make their own accelerators and leave (this is a more permanently bad condition), this creates all kinds of heartburn and angst. And perhaps, as we might see in the coming years, delivers the killing blow.

Despite this, plenty of people believe that there is a way to shoot underneath the pricing of the very expensive big cloud builders like Amazon Web Services, Microsoft Azure, and Google Cloud and get enough XPU allocations – oh, let’s not dance around it and just say GPUs, and while we are at it say mostly Nvidia GPUs to boot – to actual run large-scale AI training and inference foundation models and make a little money.

Well, to speak more precisely, to generate some revenues. Whether the neoclouds can actually make some money – mean deliver real and consistent net profits without any qualifiers and exceptions and excuses – remains to be seen.

Given all of these pressures, it is inevitable that neocloud CoreWeave would shell out $9 billion in stock to absorb rival neocloud Core Scientific. Only the large and strong will survive, and the big will be getting bigger at a faster clip as the hyperscalers and cloud builders push the price/performance envelope harder to compete. When all is said and done, the neoclouds might evolve (devolve?) into sovereign utilities with a steady supply of customers from government and industry that do not want to pay the big cloud premium to run their AI models.

The wonder is why Core Scientific didn’t buy CoreWeave, or better still, sue it for trademark infringement given the similarity between their logos and their names and their businesses. Perhaps that is how this deal really went down, given that of the 1,300 megawatts of gross power capacity that Core Scientific had in the field, 840 megawatts in five datacenter sites of that was tied to active HPC/AI contracts where CoreWeave was renting capacity to fulfill its own contracts with its own customers. It was financially prudent for CoreWeave to spend big ol’ bales of stock funny money and eat the supplier than just be the middleman passing through the flops and not really keeping any of the bucks.

By the way, the other 500 megawatts of gross power that Core Scientific has running is for three cryptocurrency miners, and CoreWeave said on a call with Wall Street analysts that it would either divest these businesses – interesting in that CoreWeave itself was founded in the New Jersey suburbs of the New York City megalopolis as a bitcoin mining farm – or convert them to AI/HPC datacenters.

CoreWeave is trying to solve a big problem, which is why it is buying Core Scientific. Well, it is trying to solve two big problems.

The first one is that Larry Ellison, the co-founder, chairman, and chief technology officer of Oracle, is filthy stinking rich and he got that way the old-fashioned way: By charging a hell of a lot of money for the stickiest database, middleware, and application software that the enterprise has ever seen. Oracle is a key cloud supplier for OpenAI’s Stargate project, and Ellison can fund it out of the profits from this software empire while the neoclouds have to mortgage their GPU allocations to raise money to buy then next batch. (Which is also its own kind of brilliance.)

The second problem – and this is a good problem to have, we suppose – is that in March of this year, CoreWeave signed a direct deal with AI model builder OpenAI to provide datacenter compute, storage, and networking capacity for it between now and October 2030 worth an aggregate of $11.9 billion. If OpenAI needs capacity and CoreWeave can’t supply it, then OpenAI can nix the deal. So CoreWeave can’t be screwing around being the middleman between OpenAI and Core Scientific because OpenAI could just go to Core Scientific directly and be done with it. (Just like OpenAI is cutting out the Microsoft Azure middleman and commissioning its own capacity. A very big chunk of revenues for CoreWeave last year were from Microsoft, which was buying capacity to supplement its own Azure facilities as OpenAI’s needs kept growing fast.

Here’s the Core Scientific datacenter footprint:

And for reference, here is the CoreWeave global datacenter footprint as the end of March of this year:

With this acquisition of Core Scientific, CoreWeave now has more than 2 gigawatts of gross power across nine regions, and it will be eliminating some huge costs. Nitin Agrawal, CoreWeave’s chief financial officer, said on the call with Wall Street that by snapping up Core Scientific, it could in one fell swoop eliminate $10 billion in future lease costs for datacenters over the next twelve years, which is a fair trade for $9 billion worth of stock given to Core Scientific shareholders that yields them in the aggregate less than 10 percent of the total stake of CoreWeave. On top of that, through operational synergies, CoreWeave says it can cut $500 million a year in annualized costs by 2027, according to Agrawal, who did not say what the cost removal would be in 2025 and 2026.

With the merger, which should be completed by the end of this year, the combined companies have $5 billion in capital expense commitments, a lower cost of capital, and the ability to own the assets it is renting out to AI shops, which means it can pay for additional capacity through “infrastructure-oriented vehicles,” as Agrawal put it, rather than using equity or debt financing.

What this all tells us is that CoreWeave was much more of a shell than we had thought. But, now it has bought some yolk.

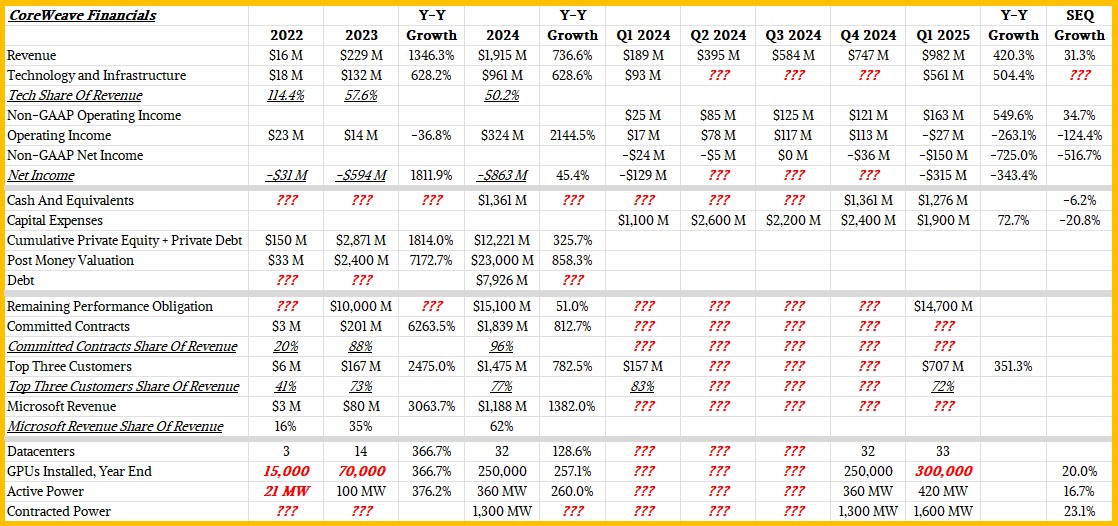

We did a financial and historical profile on CoreWeave back in early March ahead of its initial public offering, and we have updated the financial table based on its first quarter results, filling in some granularity for 2024 along the way:

Looking at the operating and net income lines above for Q1 2025 and indeed for the full 2024 year, you can see why CoreWeave is eager to reduce some costs. It’s not pretty. This is some Nutanix-class and Pure Storage-class lossage when they were under their original founding management after their IPOs. This is not sustainable, and particularly if it ramps up by an order of magnitude, with each incremental tranche of revenue creating an embiggening loss.

Core Scientific was founded in 2017 by Darin Feinstein and Michael Levitt in the shadow of Microsoft in Bellevue, Washington. The company moved to Austin, Texas a few years later and raised $115 million in three funding rounds as a supplier of blockchain and bitcoin mining datacenters. For three years from 2018 through 2021, Kevin Turner, a Wal-Mart executive for two decades who eventually was Microsoft’s chief operating officer for a decade and a half, was chief executive officer at Core Scientific. The company went public through a SPAC in January 2022. Seven months later, the bitcoin market crashed and one of its key customers, Celsius Mining, went bankrupt, and by the end of the year, Core Scientific itself was declaring bankruptcy reorganization. The company emerged from bankruptcy last year.

This acquisition of Core Scientific by CoreWeave is a step in the right direction to take on Oracle for OpenAI’s business. So is being first in line to get GB300 NVL72 systems from Nvidia, as CoreWeave is also bragging about. But success with OpenAI might not be as profitable as CoreWeave might hope, particularly with OpenAI pitting Microsoft, CoreWeave, and Oracle against each other to drive down the cost of its enormous AI processing needs. Spreadsheets are such optimistic little tools . . . . and having one big egg in your basket means that when it breaks, it really makes a mess as Core Scientific clearly knows.

Be the first to comment