After only a little more than a year of running Intel’s Data Center and AI group – which is probably about as much fun right now as falling down the stairs – Justin Hotard has departed the chip maker to become the next chief executive officer of Nokia, which interestingly enough has a renewed interest in building cloud networks and making money at that.

Intel, of course, has mothballed its datacenter networking aspirations as it seeks to clean up the technical and financial messes that several generations of its leaders have created, which is extremely difficult given that GPU compute has come to dominate the datacenter budgets of the world and Intel doesn’t have one to sell. It doesn’t help Intel’s cause that AMD is in the driver’s seat with the X86 architecture and the hyperscalers and cloud builders are all working on their own server CPUs based on the Arm architecture to co-design their compute engines for their proprietary software stacks.

So given the shakeup at Intel, which includes trying to rebuild its foundries on a shoestring budget and without any appreciable margins coming from datacenter compute engines, it is not a mystery why Hotard would leave Intel. Hotard is being given the chance to run mostly transformed Nokia that has a plan to get a bigger slice of the booming cloud datacenter budgets to counter balance the relatively tough time it has had capitalizing on the 5G network transition at the world’s telecom service providers. Nokia was hit particularly hard in December 2023 when AT&T awarded a $14 billion 5G wireless network contract to archrival Ericsson, and had to lay off 11,500 employees (13.4 percent of its workforce) to get its books back into balance.

These service providers have been key to the rise of both Nokia, of Finland, and archrival Ericsson, of Sweden, and to a large extent have also been a backbone of Cisco Systems, which has its share of the telco networking gear racket, as does China’s Huawei Technologies.

Hotard is replacing Pekka Lundmark, who got a master’s degree in physics and information technology from the Helsinki University of Technology in 1988 and worked for a relational database maker for five years while in school and a few years after graduating before joining Nokia in 1990. Lundmark was a country manager, a business unit manager, a vice president of strategy and development and head of marketing at Nokia before leaving in 2000 to work at a startup incubator and then honing his skills as a chief executive officer at a number of Finnish companies.

Given his background in telecom networks and roles as CEO, Lundmark was brought back to Nokia as its president and CEO in August 2020, and in the two decades since Lundmark left, Nokia sold its handheld phone business to Microsoft (which flushed it) for $7.2 billion and bought Alcatel-Lucent (and inherited Bell Labs) for $16.6 billion to try to better take on Ericsson and Huawei.

Hotard has not been a CEO before, but he has been working towards that goal, and frankly, he should have been in the running for the top job at Intel. And the fact that Hotard is leaving and that Michelle Johnston-Holthaus was named interim co-CEO at Intel and was appointed CEO of the Intel Products group at the chip maker is telling. Johnston-Holthaus was made Hotard’s boss when she was previously his peer before former CEO Pat Gelsinger was shown the door in December 2024 after four years of trying to turn around both Intel’s foundry and its chip business.

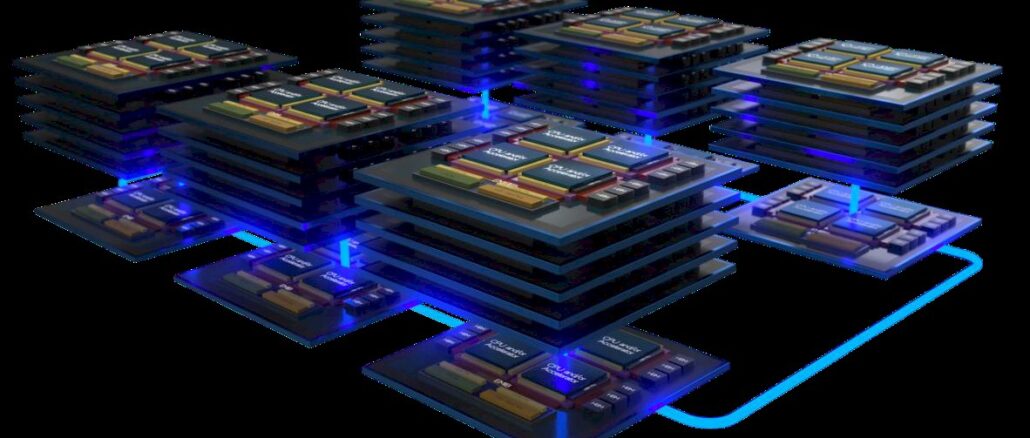

Hotard got his bachelor’s in electrical engineering from the University of Illinois in 1997 and an MBA from MIT Sloan in 2002. He worked as a sales engineering at Motorola and worked his way up the title ladder at Symbol Technologies and NCR before joining the Data Center Infrastructure group at Hewlett Packard Enterprise in August 2015. Eventually, Hotard ran the X86 server business and managed the H3C partnership with China, and did a one-year stint running HPE Japan before taking over HP Labs and its HPC and AI group in March 2021. If Nokia is going to be pushing harder into cloud datacenters with its networking – it has expanded its Ethernet fabrics and commercialized the open source SONiC network operating system in recent years – then Hotard is a good fit as the new CEO at Nokia.

As it is, without a GPU accelerator and only tepid support for its Gaudi AI accelerator, Intel does not have much of an HPC and AI story to tell, particularly with “Falcon Shores” merger of its GPU and Gaudi architecture being downgraded to a development platform in recent weeks. With AMD keeping the heat on Intel in datacenter CPUs, and the temperature going up and up, the question now is who will be brought up to take over running the DCAI group at Intel? Sandra Rivera, who ran DCAI before Hotard was brought on board Intel, is CEO of the Altera spinout and it would be too disruptive to bring her back in. That said, Intel might not have a better choice given the situation. Johnston-Holthaus could just take over the role herself until a new CEO for Intel is found, and we think this is likely given the situation.

If Intel wanted to shake things up, it could buy Arm server CPU upstart Ampere Computing and thereby bring back Renee James, who would have been a much better choice for Intel CEO back in 2013 when she was named president and Brian Krzanich was named CEO. Kirk Skaugen, who has been running Lenovo’s datacenter infrastructure business since 2016, left that server maker in June last year and might also be a candidate for Intel CEO. Intel could also merge with Marvell Technology to get more work for its foundry and widen its chip offerings and thereby get Matt Murphy as its CEO. Murphy has decades of experience at Analog Devices before talking the helm at Marvell.

There is some talk about Lip-Bu Tan, the now-former CEO at Cadence, taking over at Intel, but this seems very unlikely to us. Tan has way too much fun running his venture capital firm, Walden International.

Timothy Prickett Morgan described running Intel’s Data Center and AI group as “probably about as much fun right now as falling down the stairs”. I think there is a lot of potential for Intel’s server CPUs. The compute capability in one server processor is comparable to an entire rack of servers from not long ago. PCIe Gen5 NVMe SSDs can sustain 3.3M random reads or 14 GBytes/sec of sequential reads from a single drive. PCIe Gen6 NVMe SSDs have already been demonstrated by Micron. The engineering challenges of the network in the processor, the DRAM subsystem, support for large language models and support for insanely fast NVMe SSDs are all very interesting.

Intel’s Data Center and AI group is in a difficult spot right now but it’s not hopeless. Intel will be in a completely different position if they can get high yields on both 18A and their high-NA EUV 14A processes. Intel’s Board of Directors and Intel’s whole management team have to know that getting high yields on these new process technologies is a do-or-die situation for them.

Intel got lazy when they had a strong monopoly. They wasted their engineering resources on things like Intel On Demand that antagonized customers instead of doing things that help customers, like adding better support for large language models on their server CPUs. I expect Intel to learn from their mistakes so I have confidence that Diamond Rapids will be good. My main worry is whether Intel will be able to manufacture it. Regardless of whether AGI happens or we just get increasingly powerful assistants with a different type of intelligence, these are interesting times for server CPUs.

Good points all around, Mike. I remain hopeful. A decade ago, people were writing off AMD, which at the time I said was foolish as long as they had a desktop PC business from which to get revenue and some profits on which to build. The same applied here — except that it is complicated and compounded by the needs of the foundry business. Intel used to have a strategic advantage because of its foundry and there is a chance — a very expensive chance — that it can get there again.

You are right that the technology keeps marching on in exciting ways. However, that role in the organization is often mostly about bookkeeping, selling product to customers, selling the stock to investors, and selling the corporate strategy to the board of directors. Intel is at a crossroads where independent survival is both a near term challenge requiring constant cost cutting, and a long term challenge, requiring significant investment.

Not that Nokia is without challenges.