Transitions in the datacenter take time.

It took Unix servers a decade, from 1985 through 1995, to supplant proprietary minicomputers and a lot of mainframe capacity that would have otherwise been bought. And from 1996 through 2001 or so, Sun Microsystems servers set the pace and reaped the profits, although nothing like what IBM mainframes had commanded before them. And in 2001, IBM brought its Power architecture and aggressive pricing to bear – an aggression funded by its vast profits from proprietary systems where mission-critical COBOL and RPG applications and their underlying databases and middleware were extremely sticky – and over the next decade and a half wiped Hewlett Packard and Sun from the face of the Unix market. IBM rules Unix systems with its AIX-Power platform, but that business is maybe 25X smaller than it was in the Unix heyday.

Starting in 1993, it took about a decade for X86 servers to evolve to become a reasonable and credible alternative to RISC platforms and the Linux operating system, which was a few years behind Intel’s Pentium Pro and Xeon efforts in the datacenter, evolved alongside the X86 platform to supplant Unix. And from there, the X86/Linux platform crushed the RISC/Unix platform and became the first dominant, general purpose compute substrate in the datacenter, actually fueling the rise of the hyperscalers and cloud builders.

The Internet as we know it could never be built on mainframes, or even RISC/Unix machinery. It was just too damned expensive and the vendors providing RISC/Unix gear had no incentive to cut their prices in half and lose money on the operation. New low-cost suppliers of all of the system and software components had to come into being to lower that cost. AMD came into the X86 market in 2003, but by 2009 had run out of gas and Intel took over from there, exercising what was effectively monopoly power in datacenter compute. And its higher profits and less aggressive server CPU roadmap are the two things that inevitably fostered the competitive threat that Intel did not see until it was way too far along the wrong paths in both chip design and manufacturing – and hit the wall with Moore’s Law, no matter how much Intel’s top brass protests that Moore’s Law (where transistors become half expensive every two years) is not dead.

It’s dead, or at least dead enough that Nvidia co-founder and chief executive officer, Jensen Huang, is correct in his assessment from last September that it was indeed dead. At this point, who you gonna believe: Jensen Huang or Pat Gelsinger, Intel’s chief executive officer and a student of the Andy Grove “only the paranoid survive” school of semiconductor design and manufacturing?

With riches, Intel lost the ability to be paranoid, and became complacent. And its wrong moves in manufacturing research and development, the consequential stall in CPU architecture advancement, in GPU development, and in tangential software acquisitions all compounded.

So here is to hoping, if you are a system architect or a Wall Street investor, that Huang & Co can remain paranoid this year and into the future.

The Nvidia financial presentation that came to light this week that had a roadmap for CPUs, GPUs, and networking, and which we edited for accuracy and which we added DPUs to, had some other interesting charts in it, which got us to thinking about the IT market and Nvidia’s growing place in it. There was a companion presentation that Collette Kress, Nvidia’s chief financial officer, gave at the Citi Global Technology Conference on September 7 that also had some money and market food for thought.

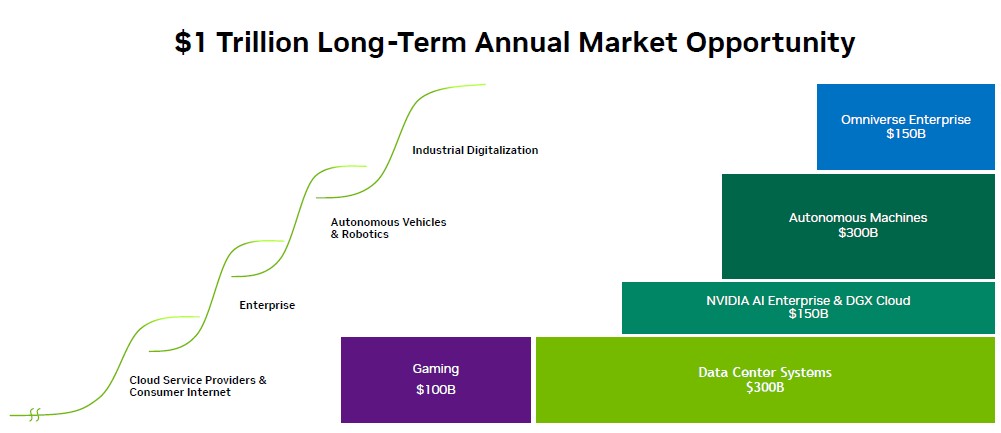

Let’s start with total addressable market and serviceable addressable market. The entire IT market, speaking very generally and including hardware, software, and services – including telecom and data services – is projected to be a $4.71 trillion market in 2023, according to the latest numbers from Gartner. The Nvidia TAM does not perfectly overlap this because it not only includes IT, but autonomous machines, which is embedded within a very large industry making cars, trucks, forklifts, robots and other machinery. The forklift market is north of $60 billion this year, the robotic market is somewhere around $40 billion to $75 billion, depending on how you characterize it, and cars and trucks will probably account for somewhere around $1,400 billion if you poke around the Internet and look for stats. So the total addressable market for Nvidia is the compute, visualization, networking, and software part of these markets, which together comprise around $5.7 billion in spending this year. Within that, and what Nvidia is really carving out in its data, is the much smaller $1 trillion opportunity it is chasing within these industries where compute and visualization are needed. One might properly call this Nvidia’s serviceable addressable market, but this is really somewhere between TAM and SAM. Call it “TAM” we guess.

Nvidia has spoken a lot of this $1 trillion opportunity, and here Kress broke it down here in 2023:

Now, if you take this “TAM” of $1 trillion and divide it into Nvidia’s projected revenues for calendar 2023 of somewhere around $50 billion, that is 5 percent of the “TAM” as we have defined it. That sure doesn’t feel like anything close to monopoly power. But if we restricted the actual TAM and SAM comparison to all accelerated computing and its necessary networking, visualization, and graphics, you would find that Nvidia has a dominant share. Our guess is more than 50 percent but less than the 85 percent threshold that law enforcement concerning monopoly regulation tends to use to determine if a company is a monopoly or not.

And once again, we are not against monopolies, which we think are economic as well as technical situations that arise naturally after a certain amount of consolidation in any industry. We are, however, against unbridled and unregulated monopolies after a certain amount of economic pain from customers and potential competitors is reached. Economic substitution is how we all get around such pain, but it is sometimes not possible to do it at any scale. Like, for instance, when it comes to GPU compute in the datacenter right now. But competitors are ramping up and getting better, and there will be substitution. Fear not.

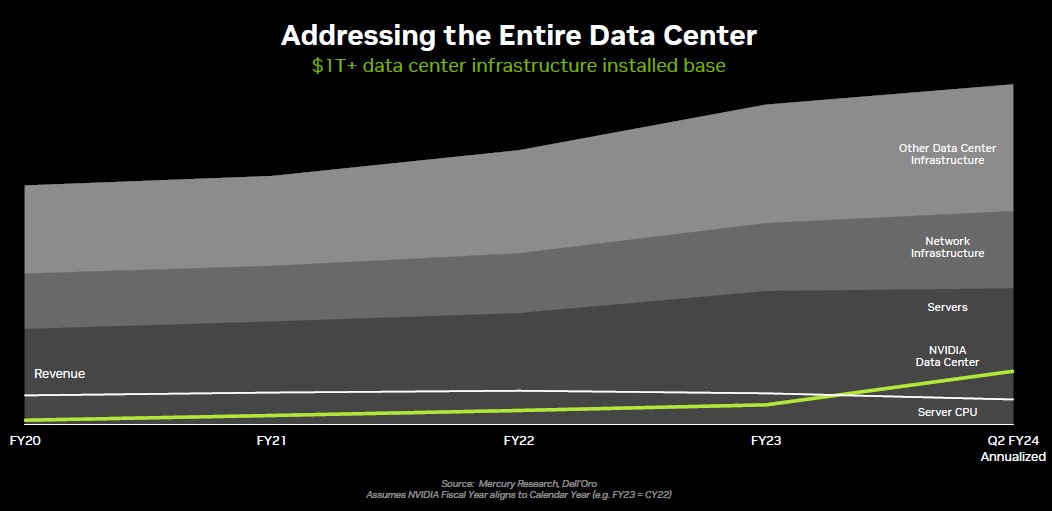

The $1 trillion referenced above is not the same $1 trillion that Huang & Co talk about when they are discussing the “datacenter infrastructure installed base.”

Now, this chart says datacenter installed base, but it appears to be plotting out datacenter revenues for all kinds of things. We doubt very much that this chart is gauging the net present value of datacenter gear and adding new gear going into the datacenter and extracting the value of the machines that are retired and then plotting then-current server CPU revenues and Nvidia datacenter revenues against that. This had better be all revenues per year for the categories shown.

Nvidia does say that the spending for server CPUs, servers, network infrastructure, and other datacenter infrastructure is on a calendar year and that the Nvidia datacenter spending is on the nearest calendar year. (Nvidia’s fiscal 2023 ends in January 2023, and is almost the same thing as calendar 2022, to say it in plain English American.)

If you do the math on that chart above (by measuring the lines with a ruler on the Y axis because there are no dollar or percent figures given), then in fiscal 2024/calendar 2023, Nvidia’s share of datacenter spending is somewhere around 15 percent.

You will also note in the chart above that server CPU revenues have taken a downward trend – send AMD thank you notes as well as the Arm collective – while server revenues are up modestly as AMD has doubled its revenues, more or less. We see here – as we have showed before – how much GPU-accelerated server spending is propping up the server market.

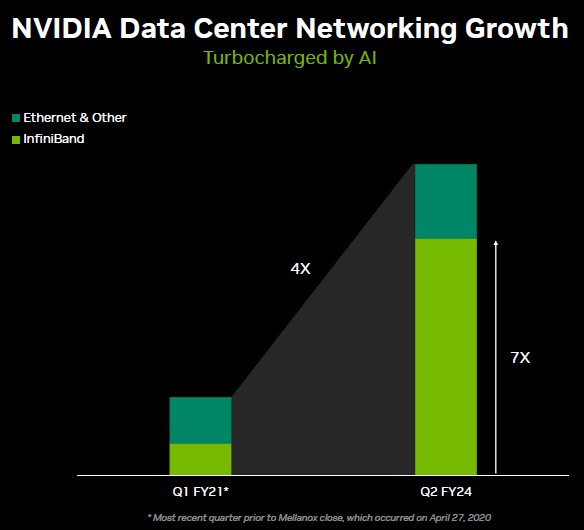

The big story after the GPU crazy is networking, of course, and AI has been very, very good to InfiniBand. Like this:

Based on our model, we think networking represented about $410 million in revenues in Q1 F2021 for Nvidia, and that it grew to $1.64 billion in Q2 F2024 ended in July of this year. If you use the 4X for overall networking growth and the 7X for InfiniBand growth, and measure the share on the bars in the chart, that means the share of Ethernet versus other on the Q1 F2021 stacked bar is not right. It has to be almost perfectly evenly split to have InfiniBand grow by 7X and overall networking grow by 4X. This implies that InfiniBand drove $1.41 billion in sales in Q2 F2024 for Nvidia, but Ethernet And Other drove only $232 million, up 1.1X from Q1 F2021. (We wonder where NVSwitch is accounted for here? Hopefully in Other.)

The only thing growing faster than the datacenter networking business at Nvidia over the same timeframe is the rest of the Nvidia datacenter business, which has grown by a factor of 11.9X since the Mellanox acquisition and which drove $8.68 billon in sales in Q2 F2024.

Nvidia is clearly the leader of accelerated computing, and it probably has another 12 to 18 months of being the undisputed revenue and mindshare leader. But, others are coming with new technologies and lower prices, and this is as unavoidable as the rain that eventually comes to spur on new growth.

Nvidia apparently joined the trillion+ dollar market cap club this past May (now the AMMANTA seven; the sAMMANTAs), and interestingly in these times of defavored hydrocarbons, the other 2 companies with such cap (both non-US) are Saudi Aramco and PetroChina (what?! who?! https://en.wikipedia.org/wiki/List_of_public_corporations_by_market_capitalization ).

They too can now buy the Netherlands (GDP of $1 trillion: https://en.wikipedia.org/wiki/List_of_countries_by_GDP_(nominal) ).

Yaddi-yadda, trillion shtrillion, our European trillionaires here, in France, are super-portly corpulent Exa-rich, each with a most plump €1e18 or more (€10^18)! The slim little US trillionaires are just measly Tera-rich by comparison, ultra-skinny at $1e12, not even a contest, a rounding error on the boardroom’s mini bar scale! Better luck next time mister sAMMANTAs (if that is even really your name!)! p^8

Excellent analysis, as usual Morgan.

Watch as software holds it all together beyond the 18 months you predict. It’s a platform. IBM360, iphone rinsed and repeated again, imho.