Data changes behavior and behavior changes data. It is a phenomenon that is akin to the Observer Effect in physics in that you can’t observe something without changing its behavior. The same is true in economics.

If we are constantly worried about a threat of a recession, we will start behaving as if one is coming and our pullback in spending, in the collective hundreds of millions of people in one set of national economies, will cause the malaise to spread elsewhere in a vicious cycle and expanding circle. Rosy forecasts run this cycle in reverse and expand outwards around the globe in the virtual Pangea we have stitched together as a global economy in the past five hundred years.

It is with these interplays in mind that we are always analyzing IT spending patterns and forecasts that come out of the major market researchers like Gartner, IDC, and others. Inasmuch as we live in the same IT market as you do, we don’t want to jinx anything, but at the same time, we want to inform you of what the current thinking is on spending for hardware, software, and services in this IT market that has become central to maintaining the links in this virtual Pangea.

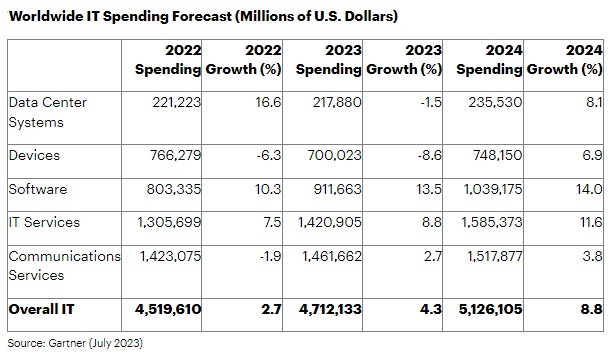

Gartner has recently updated its IT spending forecast for 2023, updated spending for 2022, and also put out its first forecast for 2024, and as usual, we are picking it apart to try to make some sense of it. The news is all good, but given the inflationary environment in IT, where vendors held off for one or more years on spending increases during the coronavirus pandemic and after it but are not holding back anymore, some of that good feeling is just due to inflationary pressure, we think. Let’s take a look at the data and do some spreadsheet work.

First of all, Gartner updated its IT spending for 2022 for all five categories where it tracks spending – datacenter systems, enterprise software, IT services, devices, and telecom services – and this should be the final revision of that dataset. Significantly for The Next Platform, where we examine all aspects of servers, storage, and networking hardware in the datacenter, datacenter system spending has been revised upwards three times now in the past two years and has come close to the projection that Gartner made for the 2022 year for datacenter hardware back in January 2022. Specifically, in the latest forecast, datacenter system spending for 2022 was boosted from $212.4 billion in the January 2023 IT spending forecast to $221.2 billion in the forecast that came out at the end of July. That represents a pretty impressive 16 percent increase in IT spending over 2021 levels, which came in at $190.7 billion.

For 2023, earlier this year Gartner had been projecting modest growth for datacenter systems spending, which was easier given that its estimates for 2022 sales were lower, but with the raise in 2022 sales, even with an incremental $4 billion now added to the datacenter systems row, Gartner is now projecting that spending on datacenter systems will decline by 1.5 percent for all of 2023. This is consistent with but a lot less rosy than the first quarter 2023 data coming out of IDC and its forecasts for consolidated server and storage sales to grow by 1.1 percent to $156.8 billion. (IDC and Gartner are obviously counting datacenter infrastructure differently, and not just that Gartner has switching in its data and IDC does not.)

Thanks in part to price hikes that vendors are passing through to customers as their people costs are rising and thanks in part to increasing demand for updated EPR, SCM, and CRM application software and underlying database and middleware software, Gartner thinks that sales of enterprise software will rise by 13.5 percent to $912.7 billion in 2023. IT services, which includes everything from consulting to system integration to cloud to technical support, will grow by 8.9 percent to $1.42 trillion according to Gartner. Add these all up, and the core datacenter part of IT spending is forecast to rise by 9.5 percent to $2.55 trillion. Add in devices and telecom services, which do not affect the datacenter arena as such, and overall global IT spending will rise by 4.3 percent to $4.71 trillion.

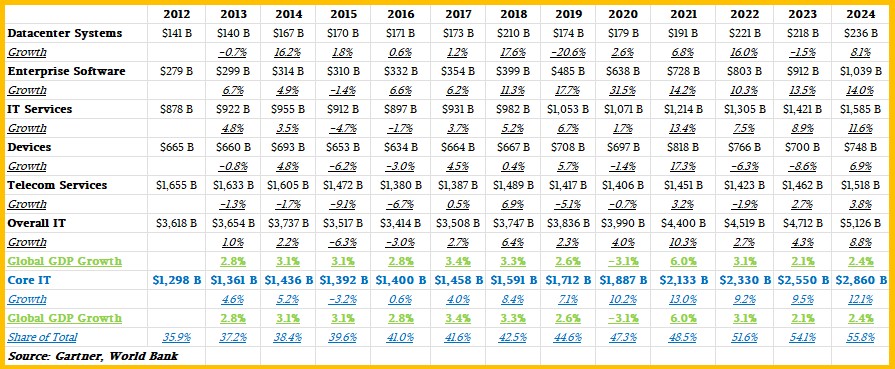

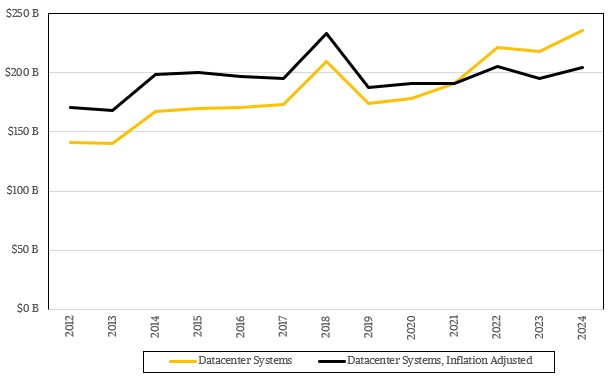

Here is a longer historical trend table we have been compiling since 2012 using the Gartner data (the first time it broke things out this way):

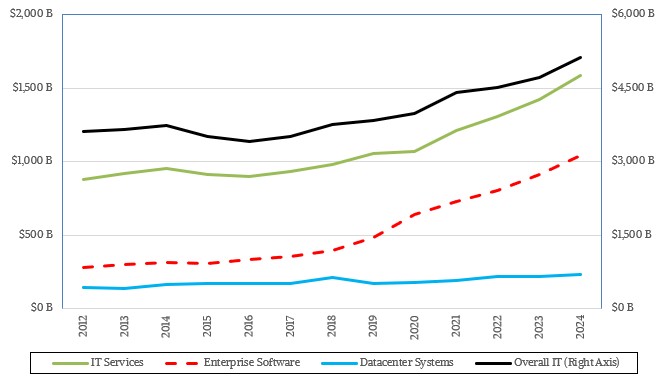

And here is a chart that shows this visually:

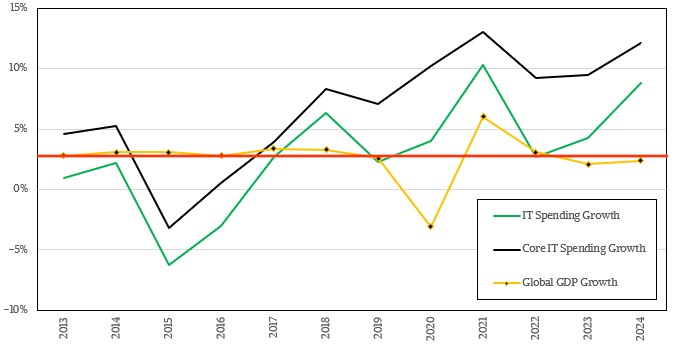

This time around, we added in annual growth data for global gross domestic product (GDP) and compared it to core IT spending and overall IT spending and then added in the forecast from Gartner for IT spending as well as the World Bank’s expectations for global GDP growth for 2023 and 2024.

Looking ahead to next year, Gartner is expecting a big rebound in datacenter systems spending, rising 8.1 percent over the newly anticipated 2023 level, to $235.5 billion. That is an incremental $17.7 billion in datacenter systems spending, which is a lot. Enterprise software sales are expected to boom – again, both from price inflation as well as updated or expanded functionality of software stacks as well as normal organic growth to support higher transaction rates – with a projection to rise 14 percent to $1.04 trillion. That’s the first time enterprise software will break the $1 trillion mark. IT services will also post very good growth, if Gartner is right, jumping 11.6 percent to $1.59 trillion. That puts core IT in the datacenter up 12.1 percent to $2.86 trillion, and overall IT spending (including devices like PCs, tablets, and smartphones and telecom services) up 8.8 percent to $5.13 trillion.

That is much higher growth rate than the expected 2.4 percent increase in global GDP that the World Bank is prognosticating for 2024.

As you can see from the chart above, overall IT spending and core IT spending have their own cycles, and do not seem to be particularly correlated with global GDP – unless something truly terrible happens. With the coronavirus pandemic, global GDP took a big hit in 2021 and recovered some of it in 2022 and 2023 and is expected to get back to normal levels in 2024. It is scary how regular GDP growth is compared to IT spending levels, which tend to trend upwards more sharply but which have their own rather dramatic up and down cycles.

There was a huge crash in IT spending growth in 2015 and a recovery that started in 2016 as well as some spending spikes in 2018 due in large part to hyperscalers and cloud builders as they expanded their capacity and an obvious big jump in 2021 as hyperscalers and clouds (as well as enterprises) bought lots of gear as the world pivoted to work from home. Enterprise software spending just keeps going and going like a freight train. The spending level for overall IT and core IT recovered a bit in 2022 and is coming on stronger and stronger as we go through 2023 and is projected to be even stronger in 2024. But look at how flat that GDP growth is by comparison.

This might tell you how much more vital IT is to driving the global economy, and it would be tempting to make a causal argument that IT is driving GDP or that GDP is driving IT. The global economy will come in at around $105 trillion in 2023, and IT spending, even at an impressive $4.71 trillion in the broadest sense, represents only 4.5 percent of the global economic output. There is no question that IT drives a lot of global GDP, mind you, through secondary and tertiary effects. There are all kinds of things you can’t do with pencil and paper.

Whenever we look at datasets over long periods of time, particularly when we are in an inflationary phase as we have been for the past two years, we are tempted to do an inflation adjustment to try to ascertain how much of the trend is due to real growth in capacity consumed for goods and services and how much is coming from price increases. And so we have taken the Gartner datacenter spending data and adjusted it based on the Consumer Price Index (CPI) to get a first-level estimate on how inflation is driving revenue growth in the IT sector. Take a gander at it:

The orange line shows the unadjusted data, which shows this nice, healthy curve up and to the right. And the black line shows the data after inflation adjustment. There was a step function growth in IT spending in 2013 and a spike in 2018, but otherwise, as measured in 2021 dollars, datacenter spending has actually been relatively flat. Just like GDP when we are not in a pandemic.

But again, correlation may not be causation.

The trick is probably to observe these systems without collapsing their wavefunctions (causing particulate bubbles from resonance of the picked eigenstates). Lest we figure some “delayed choice quantum eraser” to newly post-forecast the past, from the present and future (ouch…)!

Amazing though that, for the decade from 2012 to 2022, enterprise software shows 190% growth to datacenter hardware’s 57% (close to CPI’s).