There is something weird about storage companies that were started around the same time as the Great Recession.

The big ones that have gone public after being true innovators in their fields – MongoDB in NoSQL databases, Nutanix in hyperconverged storage, and Pure Storage in all-flash arrays – have grown to have tens of thousands of customers. But they can’t seem to generate the profits that we would expect at this stage in their development. And frankly, their customer bases are smaller than we would expect given the technology they are peddling and the hundreds of thousands of potential enterprise customers.

Pure Storage just passed into marginal profitability after a very long slog starting in 2011 with its first product sales, and if it can grow revenues and increase profits even more, there is hope that MongoDB and Nutanix will be able to follow suit.

The latter told Wall Street last Friday that its audit committee was working through some issues with evaluation and testing software licenses to one of its third party partners and has not released full financial results, just preliminary ones that do not include net income, so we can’t tell how profitable Nutanix is or is not. (Odds are it is not.)

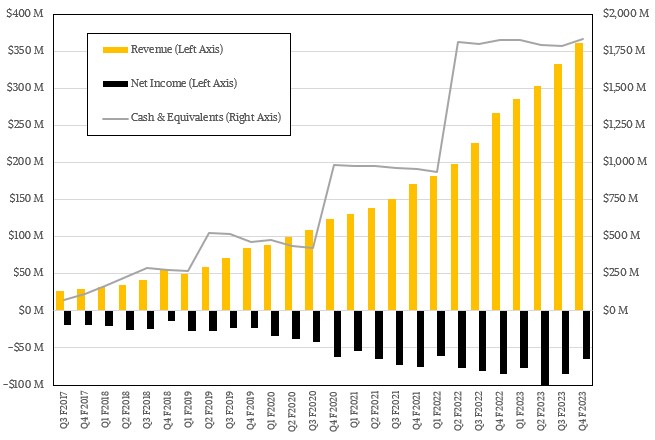

What we do know as of today is that MongoDB is still fueling its growth with substantial losses that are thankfully growing at one quarter the rate of revenue growth and one half the rate of customer growth. That should mean that MongoDB, by far the dominant commercial NoSQL database in use today with over 40,800 customers as its Q4 of fiscal 2023 ended in January, can get profitable in the next few years. If current trends persist, MongoDB could reach above $4 billion by the end of fiscal 2026, and it will be kissing 60,000 customers and perhaps a modicum of profitability.

The only way to accurately predict the future is to live it, and we will take it one quarter at a time, just like MongoDB has to, and frankly takes great pleasure in doing as far as we can tell. It ended the fiscal 2023 year with $1.8 billion in the bank and it has plenty of fuel to get there as more and more companies need to scale certain applications and NoSQL document databases are a good way to get scale and performance even if you do sacrifice some ACID compliance to get there.

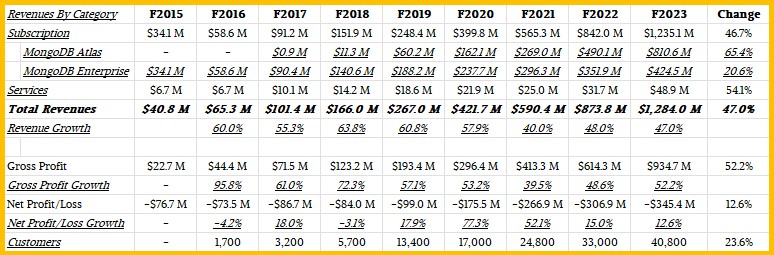

In the January quarter, MongoDB had $348.2 million in subscriptions for its MongoDB Enterprise And Enterprise Advanced editions of its licensed software combined with its Atlas cloud-based service, which is available on as a managed service run by the company itself on the cloud infrastructure from Amazon Web Services, Microsoft Azure, and Google Cloud. Atlas started out on AWS, and then Amazon launched its competing DocumentDB service in 2019 and MongoDB got real friendly with Microsoft and Google while still maintaining a partnership with frenemy AWS.

All software makers have no choice but to partner with the big clouds, and it was always inevitable that they would all have NoSQL competition. MongoDB will have to compete on the merits. Thus far, the combination of the cross-cloud Atlas database service and the ability to license MongoDB Enterprise and Enterprise Advanced for on-premises and cloud infrastructure with customers managing it for themselves is working.

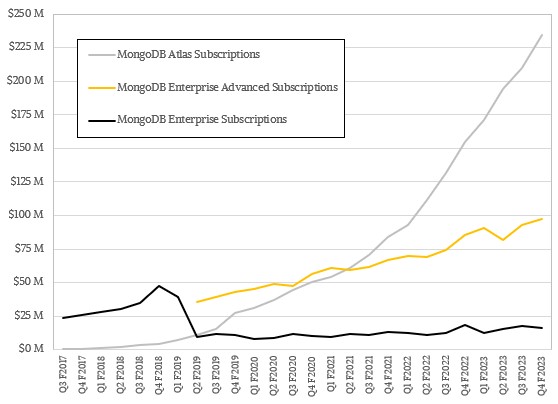

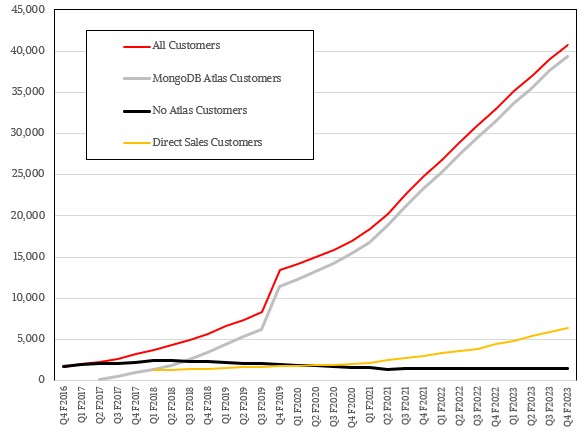

The Atlas service, launched in 2016, reached parity in terms of revenue with Enterprise Advanced subscriptions four years ago and has long-since been driving both customer count and revenues for the past three years. Here is how the customers break out:

Based on the numbers that MongoDB puts out, it has about 1,500 customers who don’t use the Atlas service, a number that has been steady for years and is no doubt some of the largest MongoDB installations in the world who like to control their own infrastructure. This number of customers has not changed in years, and is very likely among the more than 2,000 core customers who were deploying MongoDB years before the Atlas service was available. These customers accounted for $113.3 million in revenues, which is just shy of a third of all subscription sales. So it is not like the Enterprise and Enterprise Advanced subscriptions don’t matter. They do, and the average Enterprise and Enterprise Advanced customer spent $75,550 in the fourth quarter of fiscal 2023, and that average spending per quarter number has more than doubled in three years even as the customer count has essentially stayed the same. This always was and always will be the foundation of the MongoDB business.

At the end of January, there were 39,300 customers using the Atlas service, and they spend on average just under $6,000 per quarter. Four years ago, the average Atlas customer was spending half of that each quarter, so the Atlas revenue is not growing as fast as it is for the Enterprise and Enterprise Advanced customers. But there is a factor of 26.2X more Atlas customers, and the money is mounting up – just as MongoDB had hoped. We think there is a chance that at some point, customers will look at their cloud bills and think seriously about repatriating some MongoDB applications back to their own datacenters.

The other part of the MongoDB business that is growing are those handled by the company itself and its closest channel partners. In Q4, the direct sales customer base grew to over 6,400, up 45.5 percent year on year, and drove 88 percent of total subscription revenues, up 38 percent to $306.4 million.

Wall Street is probably not going to be happy with MongoDB when the market opens on Thursday because it is predicting much slower growth in fiscal 2024 than it had in the prior year. Very much smaller growth, in fact.

In the first quarter of fiscal 2024, sales are projected by the company to be between $344 million and $348 million, which is 21.2 percent growth at the midpoint. And for all of fiscal 2024, sales are estimated to be somewhere between $1.48 billion and $1.51 billion, which is only 16.4 percent growth.

MongoDB’s market capitalization, which stood at $15.5 billion after its financials were reported on Wednesday, will probably take a 10 percent or so haircut given this forecast, but even then, MongoDB will be too large for just about anyone except a big cloud to acquire. Even Oracle, with only $7.3 billion in cash and a need to build its own cloud with its capital, would have to strain itself to do such an acquisition. So Wall Street will have to play the same long game that MongoDB is playing, which is to get to 60,000 customers and profitability in the next couple of years.

Be the first to comment