The days of the disk drive have been numbered for so long that it is hard to take any prediction of its demise seriously.

It is literally like predicting the demise of the IBM mainframe. In fact, the first rotating storage device with a moving head, the IBM 350 RAMAC drive, was a rotating column of 50 24-inch metal platters, with a 600 millisecond average access time, that was announced in 1956 as part of the IBM 305 vacuum tube computer, weighing in at an astonishing 5 MB capacity and literally 1 ton. Big Blue sold over 1,000 of these IBM 305 systems and their RAMAC drives, replacing its venerable punch card storage. (IBM could have shipped the disk drive even sooner, but the company’s board put the kibosh on that idea because of the margins on punch cards.)

Over the decades, IBM and others evolved disk drive technology, and Big Blue famously invented giant magneto-resistive (GMR) disk drive heads and the sophisticated aerodynamics that allows 10K RPM or 15K RPM drives in a much smaller 3.5-inch and 2.5-inch form factor to still, almost seven decades later, store a lot of the world’s data. IBM’s technology lives on at Hitachi, which the latter bought from the former in 2002 for $2 billion and which was itself acquired by Western Digital in 2012 for $4.8 billion in cash and stock.

Since its founding in 2009 and its uncloaking from stealth mode two years later, Pure Storage has had the disk drive in its crosshairs, and it raised $529.3 million in venture capital up through 2014 and raised another $425 million in 2015 by going public. And it has been an incredibly long engineering and financial journey for Pure Storage to get big enough to be trusted by enterprises and for flash to get cheap enough that it can take on the disk drive head-on.

And that, on March 15, is what Pure Storage plans to do with its upcoming FlashBlade//E all-flash arrays, and it used its conference call with Wall Street analysts going over the fourth quarter of fiscal 2023 financial results to set the stage for that impending product launch.

Charlie Giancarlo, the entrepreneurial executive who was behind many of the non-router product lines at Cisco Systems – which has made it the IT powerhouse that it is – and who was also a partner at venture capital behemoth Silver Lake Partners, took over as chairman and chief executive officer of Pure Storage back in the summer of 2017, and has been pushing the company hard to grow but to also get profitable. And that has finally happened, and just as the company is getting ready to vanquish the disk drive from the datacenter with the FlashBlade//E launch.

That timing is serendipitous, we think, but the story is certainly richer for it.

Here is the math that Giancarlo laid out on the call. Somewhere between 1 percent and 2 percent of all electricity generated in the world is being consumed by datacenters, and that storage represents somewhere between 20 percent and 25 percent of that datacenter power usage today and is forecast to increase to 40 percent or more of datacenter juice by the end of this decade. Giancarlo added that the vast majority of data in the datacenter – over 80 percent – “remains trapped on magnetic hard disks” and that flash-optimized systems like those from Pure Storage generally use between 2X and 5X less power than competitive SSD-based systems and between 5X and 10X less power than the disk arrays that get replaced by FlashBlade object storage and FlashArray block storage. And thus, says Giancarlo, replacing that 80 of datacenter storage on disk arrays with all-flash arrays (and of course, Giancarlo wants every one of them to be a FlashBlade or FlashArray) can reduce total datacenter power consumption by around 20 percent, and datacenter space and e-waste can be curtailed by the same amount.

“Reducing the world’s datacenter power, space, and e-waste by 20 percent is a very significant reduction in the world of sustainability and needs to be recognized and amplified,” Giancarlo told Wall Street on the call. “This opportunity is resonating not only within the highly specialized field of IT data storage teams, but now also with the entire C-suite, including CIOs, CFOs, and even CEOs.”

The FlashBlade//E that is coming out in under two weeks is all about energy efficiency and the economics to drive adoption. The specifics of the platform have not been announced, the new device is a spin on the FlashBlade//S announced in June 2022 , but one focused on lowering the cost of storage below 20 cents per GB. From the looks of the very basic spec sheet, the FlashBlade//E is using the fatter 48 TB capacity Direct Flash Modules (DFMs) that were the high-end option on the FlashBlade//S, and four of these homegrown NVM-Express flash drives are on a single blade. The recent-vintage 5U FlashBlade chassis can have ten of these blades for a total of 1.92 PB for a single unit (shown in the feature image above). The base FlashBlade//E has two of these units clustered together for a total of 3.84 PB of capacity, and can have up to sixteen 100 Gb/sec Ethernet ports linking it to server infrastructure.

It is not clear how far the FlashBlade//E will scale, but we do know that it scales in units of 5U chasses (or 1.92 a pop) and that at 20 cents per GB, it that is around $768,000 for a base 3.84 PB of raw capacity. Data compression and data de-duplication can make the effective capacity of the FlashBlade all-flash arrays anywhere from 2X to 10X higher, depending on the data. Databases tend to shrink by 2X to 4X, cloudy infrastructure running on virtual servers tends to be somewhere between 4X and 6X, and virtual desktop infrastructure environments can be 5X to 10X. That means that for the typical datacenter workloads, the FlashBlade//E will be somewhere between 2 cents and 10 cents per GB. And this new product, as with prior products, will be available under the Evergreen//One cloud pricing for on-premises installations, which lowers the pain of acquisition because you pay monthly and you don’t have to argue for a big capital investment.

The teasers on the new product also say that it will have 60 percent lower operational cost and 40 percent lower total cost of ownership than legacy disk arrays in the datacenter. It is not clear what Pure Storage is comparing itself to, but probably the top-of-the line Dell EMC SAN and NetApp NAS devices.

We will be keeping an eye on the FlashBlade//E.

In the meantime, the company’s fiscal 2023, which ended on February 5, certainly sets Pure Storage up to radically expand its business now that the price of its all-flash arrays can compete with datacenter-class disk arrays.

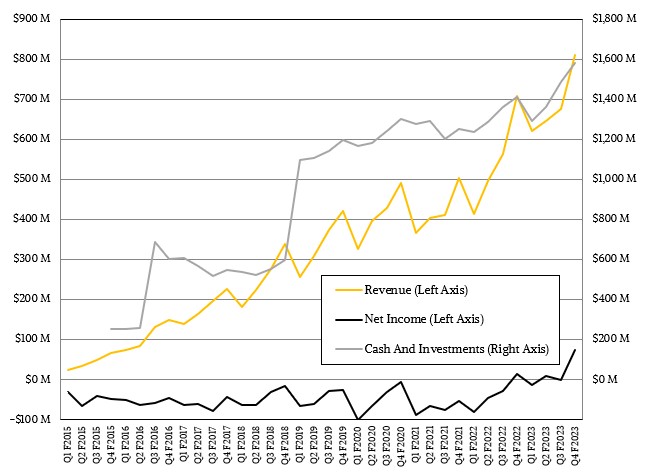

Pure Storage booked $810.2 million in sales, up 14.3 percent, and net income was – well, let’s just say it – actual net income for the third quarter out of the last five, and importantly, was up for the full fiscal year. In the February quarter, net income was $74 million, comprising 9.2 percent of revenues and marking the highest income ever experienced by the company.

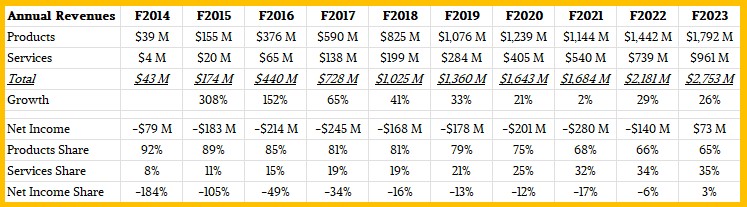

For the full year, Pure Storage had $2.75 billion in sales, up 26.3 percent, and brought $73 million, or 2.7 percent of revenues, to the bottom line.

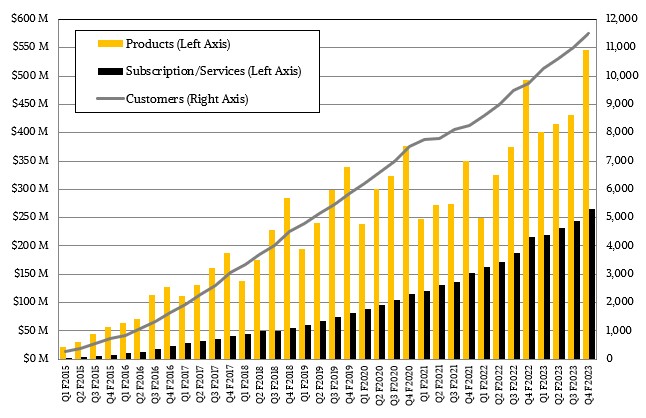

Product sales were up 10.7 percent to $545 million in Q4 and subscription and services revenues rose by 22.7 percent to $265 million. Deferred revenues rose by 28.3 percent to $1.39 billion, and Pure Storage ended the quarter with around 11,490 customers and had around 5,100 employees.

Just looking at the chart above, Pure Storage had tended to have a good Q4 in a fiscal year and the other quarters are more subdued. Subscriptions and services tend to just grow just a tad bit better than linearly and comprised a little more than a third of revenues in fiscal 2023, up from a quarter three years ago and up from 10 percent or so in 2014 and 2015.

Just to show you how jumpy the economy is, Giancarlo said that revenues in the United States for Pure Storage grew by only 6 percent to $552 million, compared to 39 percent growth to $258 million in revenues for customers outside of the United States.

Some of this “decline” is a shift from product to subscription sales under the Evergreen//One program.

“While our development of FlashBlade//E was not done in anticipation of a recession, it couldn’t come at a better time,” Giancarlo explained to Wall Street. “Its operating costs are well below the operating cost of a hard disk environment that it will be replacing. And we did see significant increase in Evergreen//One versus capital purchases last quarter. Every time we see some economic slowdown, whether it was the early COVID days or now, we see a pickup in interest in Evergreen//One. So we’ve already seen that, and we can expect that to continue for the next several quarters. That will have both short-term and long-term effects, overall good for the company but a transition to Evergreen//One from a capital spend also has an immediate reduction of the revenue line.”

The addition of the FlashBlade//E will also have an impact on revenues, with its relatively low price. But clearly Pure Storage thinks it can make it all up in volume – and then some.

Being curious, I checked and found that a 12TB spinning drive currently costs $200 or 1.7 cents/GB. While that’s a factor 10 cheaper than the the flash being discussed, the real question is what’s the cost-per-GB comparison with EMP-resistant punch cards.

You WIN!

Love it.

Well, you can’t just look at the cost of the drive, but the cost of a full-on, enterprise-grade SAN or NAS that can scale and do file or object.

But I see your point. The underlying drive is pretty cheap.

That is the sort of money you pay for WD Red Plus or similar. It is not full-on enterprise grade, but it is designed for use in servers. There will be use cases where it is good enough. It has far better performance than tape, and it still gets used a lot in the enterprise.

The industrial political clock at Flash Memory Summit has been clicking on the demise of rotating media for nearly two decades, the volume eclipse of HDD technology by Flash devices of all types and last year that moment arrived in the consumer products market for sure.

Commercially and expressly in consumer compute, nothing compares with the cost performance of NAND Flash.

I will add however observing this phenomenon boiling up from the bottom and broadening across memories mid-tier that flash transforms a balanced compute system into an appliance, and perhaps, commercial compute is increasingly about application specific work in time. My go to PC appliance example is an enthusiast gaming system. It resembles computare but is it, what about balance?

I will then add for my application which is simply office, analytics and database while I have mid-tier flash, as a data base system the endurance and archival capacity of this trusted platform, a balanced general computing device, would fall into question lacking the foundation of its multiple physical enterprise class disk drives.

If the consumer SSD market can be relied as an example, especially the throw away laptop market, how soon will it take the prophets of disposable tech aiming for performance in every next sale to convince the masses that reliability and trust in the longevity of a solid state recording device no longer matter. Which enters solid state memory?

Mike Bruzzone, Camp Marketing

‘“Reducing the world’s datacenter power, space, and e-waste by 20 percent…’ Mr. Morgan, do you realize that flash wears out faster than HDDs? Maybe you think that SSDs are smaller so they will not produce as much e-waste for the same amount of TB of storage in flash form? But that viewpoint neglects that SSDs cannot be recycled (at least with any ease), whereas HDDs have ball bearings, motors, metal disks, metal arms, and enclosures that can be recycled rather easily (a HDD is just screwed together).