When you want to build a software business in the 21st century successfully, you have to borrow some ideas from the 20th century. There are basically two ways. And document database maker MongoDB has employed both methods and is growing fast because it has maintained the first tactic with key accounts while using the second tactic to build a huge pyramid of customers out on the cloud, some of whom will turn into key accounts.

The first strategy, epitomized by the IBM System/360 mainframe, the Oracle database, the Sun Microsystems Sparc server and its Unix and then Java platform, is to go after a core set of advanced IT customers who have some pressing needs and address them like crazy. Eventually, if all goes well and the engineering and manufacturing costs allow it, there is some trickle down to smaller, but still reasonably large, customers who have similar if less complex or highly scaled problems, thus allowing market expansion.

The other strategy, best illustrated, is to build a vast base of the pyramid on less sophisticated technology suitable for a large number of customers with modest needs, and then build more and more sophisticated and scalable platforms and build up to having something that is suitable for large enterprises in a decade or two. Microsoft’s Windows Server and Red Hat’s Enterprise Linux – and indeed, the idea of any Linux in the enterprise – fall into this camp.

It has been a while since we took a look at MongoDB, one of the pioneers in NoSQL document databases, and with the company just turning in its first quarter of fiscal 2023 financial results and hosting its MongoDB World conference in New York, we thought now was a good time to see how the company’s evolution and adoption by IT organizations is going. We will be going into the company’s announcements from the conference and having a chat with the company’s chief technology officer, Mark Porter, separately as part of our coverage.

Before we get into that, we are not going to review the entire history of MongoDB, which went public in 2017 and was the first “pure play” database maker to do so in many decades. You can read our coverage about the history of MongoDB here from June 2020 and watch an interview with Asya Kamsky, principal engineer at the company, here when MongoDB participated in our The Next Database Platform event in September 2020. That latter interview is interesting in that MongoDB was founded with the idea that people naturally think in terms of documents and that many types of applications work best storing data in documents, and by using a document database that can scale – that scale part is the tricky bit – simplifies the infrastructure and the ease of programming. Kamsky explains why MongoDB believes that a large portion of the workloads in the datacenter, particularly those running on expensive and scale-limited legacy relational databases like those from Oracle, IBM, and Microsoft, would run better if they were on MongoDB.

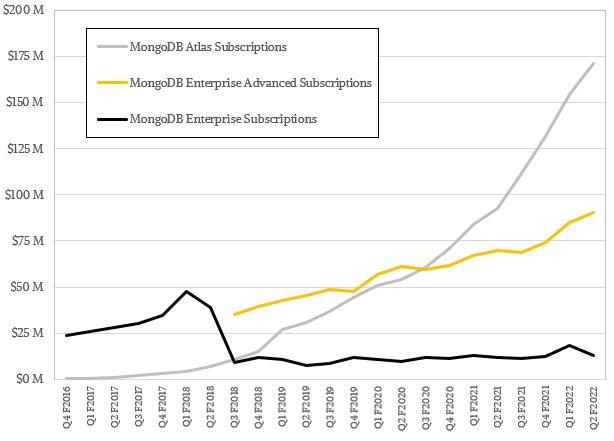

Building the MongoDB database in the first place and getting it to scale to thousands of nodes was the first task that had to be done to build the peak of the pyramid, and the founders of MongoDB did a pretty good job of building a stable NoSQL database that could scale linearly across a cluster and therefore take on some pretty big jobs. But the advent of the Atlas cloud-based service based on the MongoDB database in 2016, which is now supported on most of the regions across Amazon Web Services, Microsoft Azure, and Google Cloud, was seminal. It gave MongoDB a way to get lots more customers using its NoSQL database and to start small and grow fast. Over that time, MongoDB was tweaked to support multi-cloud configurations spanning all of these clouds at once, severely degrading any vendor lock in on these clouds. (And making their own native document databases less attractive in the bargain.)

The company is also building a platform, which is something we recognize when we see it. MongoDB has been augmented with Atlas Data Lake and Atlas Search, whose functions are obvious from the name, also adding Realm Sync database synchronization through the acquisition of a company called Realm and has been building up a platform around its NoSQL database to make it more appealing and more sticky. The buildout of that platform will continue this week, and so will the theme of “cloud first” that we hear from a lot of companies these days.

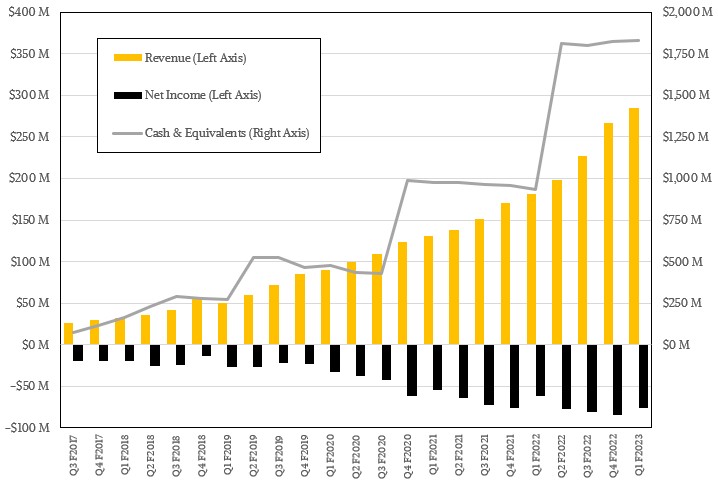

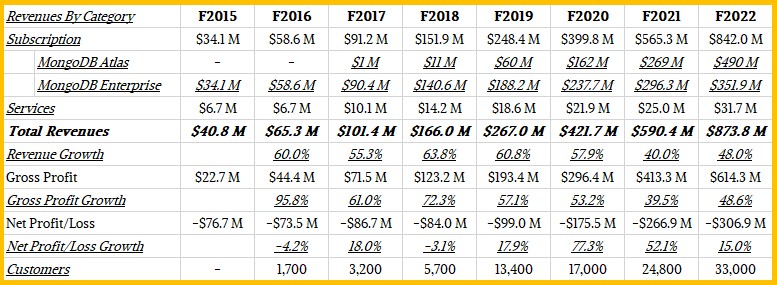

To get a handle on how the company has pivoted masterfully to the cloud, let’s look at some numbers. In the first quarter of fiscal 2023 ended in April, MongoDB posted sales of $285.4 million, up a very decent 57.1 percent. The company is still losing money, and posted a $76.1 million loss thanks in large part to relatively high expenses for sales, marketing, research, and development, which is necessary when you are taking on the hyperscalers and cloud builders as well as the relational database incumbents. MongoDB has gone back to Wall Street a few time to float more and more of its shares, and there is plenty of appetite for them even though it has posted $1.05 billion in cumulative losses against $2.66 billion in cumulative revenues in the past 23 quarters that information on its financials has been available.

Wall Street was plenty patient with an Amazon that never seemed to make any money in retail, although ti sure did eat revenues, and has been even more patient with storage upstarts Pure Storage and Nutanix, which hail from the same era in the belly of the Great Recession in 2009. These transitions take time – sometimes decades – as you all well know. Well, unless you are Snowflake and you limit yourself to analytical data warehousing. MongoDB is a transactional system, and that presents all kinds of engineering problems, which as far as we can tell, MongoDB has tackled as well as any of the other alternatives.

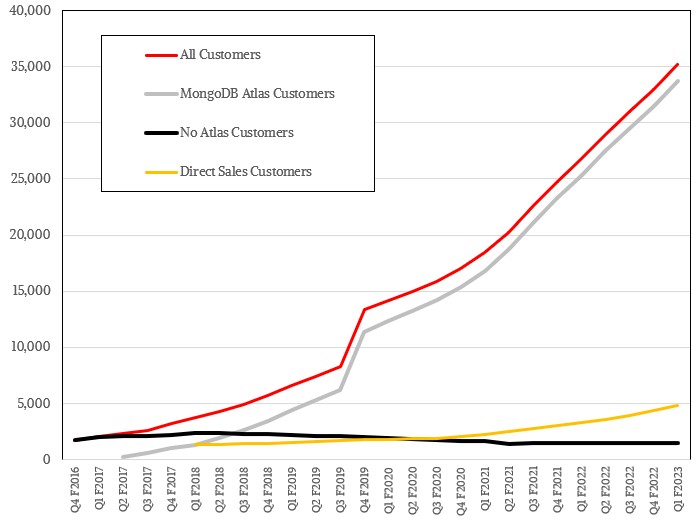

If time is money – and it certainly is up until the point of death – then MongoDB, with $1.83 billion in cash and investments in the bank, has plenty of time to be patient as it steadily builds its customer base with Atlas and tends to the 1,500 customers that only use MongoDB Enterprise or MongoDB Enterprise Advanced on premises and the now 4,800 direct sales customers it takes extra special care of, as any enterprise infrastructure company does.

And it does well to keep doing so, too. In the quarter ended in April, those MongoDB Enterprise and Enterprise Advanced customers, who run the software on-premises or in a cloud or co-lo of their choice under their own management, represented $103 million in subscriptions out of a total of $274.6 million in total subscriptions, with the Atlas cloud version and its adjuncts driving another $171.3 million. Services – by which is mostly meant professional services for installing and tweaking the database because subscriptions include support – comprised $10.9 million in sales for the quarter.

In a way, MongoDB built the top of the pyramid first with MongoDB Enterprise and Enterprise Advanced and is now putting the much fatter pyramid base underneath it with Atlas. Six quarters ago, the Atlas services was at subscription revenue parity with the MongoDB Enterprise software stack, with $71 million in sales for the former compared to $73 million for the latter. At the time, based on the numbers that MongoDB has put out, we reckon it had about 1,500 customers not using the Atlas service, compared to a stunning 21,100 customers who were.

Fast forward to the April quarter, and MongoDB has 33,700 Atlas customers running on one of the big clouds and it still only has 1,500 customers who are not running Atlas. We can’t tell how many customers are doing both self-managed MongoDB and letting MongoDB, the company, do the managing for them, but what we can tell for sure is that real companies are using more and more Atlas.

Back in late calendar 2016, Atlas customers were, on average, spending on the order of $500 a quarter on Atlas, and that tripled to $2,000 per quarter in two years and now, six years later, it is up by a factor of 10X. (Remember this is an average spending across all of those customers.) This is a good indicator that customers are finding multiple ways to use Atlas.

It will be interesting to see if we see MongoDB repatriation to on-premises datacenters, co-los, or outposts at sometime in the future, as has been happening because of the high cost of buying cloud infrastructure at a certain scale. You can sure bet that MongoDB does not want to promote that idea because it can charge a premium for a SaaS offering of its NoSQL database and, now, all of the things it is wrapping around it with its platform buildout. The company could charge a hefty premium for the self-run MongoDB stack and thereby discourage customers, but then it risks the ire of its largest 1,500 customers who still represent just under half of its subscription revenues and, with services added in, probably more than half of total revenues.

It is an interesting line to walk, and the best way to walk it is to do what MongoDB is doing and that is to let the customer decide whether self-managed on-premises, outpost, or cloud or vendor-managed SaaS on the cloud is the right path. If anything, when MongoDB gets big enough and closer to profitability, it may want to consider an outpost strategy where companies want sovereignty over their data but vendor managed services to control and patch the database. That’s what we would ask for if you put a humongous NoSQL database to our heads.

What we want to know is when MongoDB might be an actual profitable company, not just a fast growing one. Microsoft has millions of customers running Windows Server and SQL Server, Oracle has 430,000 customers running its databases, applications, and middleware, and IBM has somewhere on the order of 175,000 enterprise customers, most of whom use a variation of its DB2 database.

Let’s have some fun with extrapolation from the table above. Revenue growth in the past three years has averaged 50 percent, with a slowdown in fiscal 2021 when the pandemic was at its worst. There is a chance that revenue growth could accelerate back about 50 percent per year as more IT projects get back on track, and even with a recession, which always accelerates technology transitions, MongoDB could see lots of growth as it displaces legacy databases. At such a growth rate, MongoDB will hit about $1.3 billion in sales in fiscal 2023, $1.9 billion in fiscal 2024, $2.9 billion in fiscal 2025, and $4.3 billion in fiscal 2026. If the company can pull on the spending reins along the same trend lines it has been doing for the past eight fiscal years, then it should break even in fiscal 2025 and actually turn a profit in fiscal 2026.

If Wall Street didn’t believe such a thing, MongoDB would not have so much money in the bank. And if our estimates turn out to be right, after this is all said and done – which is easier said than done – MongoDB will still have more than $1 billion left in the bank after incurring losses in the next three fiscal years, and it should have around 70,000 customers, give or take.

But that is just spreadsheet witchcraft. The tough work is making those ethereal numbers into real dollars.

Be the first to comment