By every measure we can get our hands on, 2022 was a bumper year for server shipments and server spending, which is good indicator for the appetite for new kinds of applications and the expansion of existing applications in the world at large.

But what is going to happen this year? The odds are that spending on servers as well as on the switching and storage that follows it in the datacenter, is going to cool a bit but still grow. But if any of the economies go up on the rocks in any of the major regions –the United States, Europe, China, or Japan – then all bets are off. So far, despite the general tightening of spending by governments and corporations increasing interest rates by central banks, organizations are still spending on infrastructure even if they are, in some cases, cutting back on personnel. The consensus, particularly for the tech giants, is that they were perhaps a bit exuberant in their hiring in the past two years during the coronavirus pandemic and they are realigning their workforces to the current conditions to keep their cash flowing.

Cash is definitely going to be king in 2023, both for startups and for industry stalwarts. So expect a lot of careful hoarding and very targeted IT spending.

As we start the new year, we are contemplating what might happen in the server market in particular with a number of major technology shifts underway or impending. AMD announced its “Genoa” Epyc 9004 series of X86 server CPUs back in November 2022, and Intel is getting ready to announce its “Sapphire Rapids” Xeon SP X86 server CPUs next week. And there is a steady drumbeat of advancements and shipment increases for Arm-based server CPUs as well.

This is all happening against a backdrop of IT spending just to maintain the infrastructure in place and to increase it to support expanding and new workloads. We analyzed more than a decade of IT spending trends (including forecasts into 2023) back in October, and it bears repeating here to remind you of the trends against which we will contemplate what will happen in the X86 and Arm server markets – the key ones that matter in the datacenter these days with some important exceptions like IBM’s Power and z platforms that are used predominantly for transaction processing against relational databases.

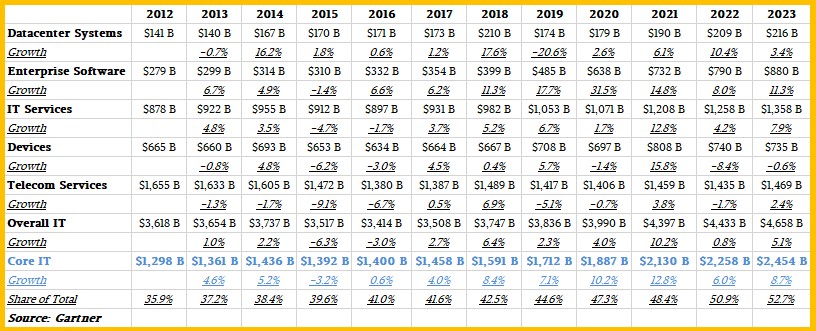

Here is the spending on IT wares from Gartner from 2012 through 2021, with forecasts for both 2022 (which was not finished when this forecast was put out in October of last year) and 2023 (which obviously is only a few days old).

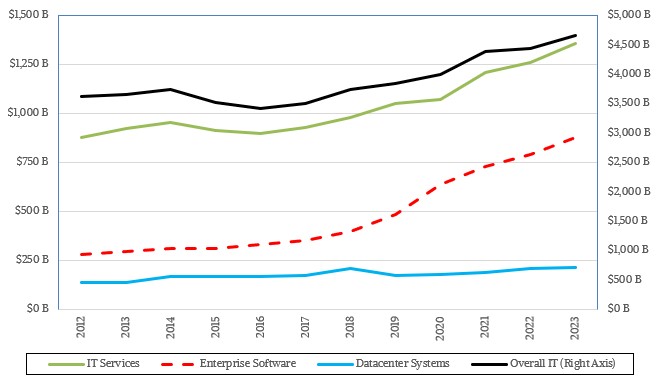

And for those of you who like your data visually too, as we do, here is a chart showing trends in datacenter spending versus other kinds of IT spending over the past decade plus one year:

The important points in the data for the sake of this discussion is the spending on what Gartner calls Datacenter Systems – servers, switching, and storage added together. In 2021, spending on this IT hardware (with its related systems software added in) rose by 6.1 percent to $190 billion, and is expected to increase by an even more impressive 10.4 percent to $209 billion in 2022 as organizations adjusted to the pandemic. Spending on core IT – Datacenter Systems, Enterprise Software, and IT Services, but not including Devices and Telecom Services – is expected to rise by only 6 percent to $2.26 trillion in 2022. Looking ahead, spending on this core IT hardware, software, and services in 2023 is forecast to grow by 8.7 percent to $2.45 trillion, but Datacenter Systems spending is only expected to rise by 3.4 percent to $216 billion. Enterprise Software and IT Services (which includes IT infrastructure) are expected to grow by 11.3 percent and 7.9 percent, respectively.

Servers are apparently going to do better than switching and storage, if the prognosticators at IDC are to be believed. As we reported a few weeks ago, IDC reckons that spending on X86 servers will rise by 12.6 percent to $112.3 billion in 2022 while spending on non-X86 servers will rise by 27.9 percent to $11.8 billion. The growth for the non-X86 portion is being driven by Power Systems and System z upgrade cycles at IBM and the adoption of Arm servers by the hyperscalers and the cloud builders. In 2023, the expectation is for sales to grow in both of these segments, but for growth to cool. IDC is betting that non-X86 servers will rise by 18.2 percent to just a tad under $14 billion, while spending on X86 iron will rise by 4.9 percent to $117.8 billion.

To peel this apart a bit, we had a look at the excellent server data that analyst Aaron Rakers of Wells Fargo puts together each quarter. Let’s have a look at the X86 market over the past two decades and see how this market has grown and how AMD is faring against Intel and its own historical activities in the server space.

Here is the general trend of X86 server spending and shipments since 2002:

The Gartner dataset that Rakers publishes only goes back to 2002, so we can’t see the Dot Com Boom and then its bubble popping, but you surely can see the dive in server consumption and spending in the Great Recession in the middle of 2008 and through early 2009. But consumption resumed, of course. As it always does because software is indeed eating the world. But if you look over the past few years, you can see the relatively large swings in spending thanks to the weirdness in the economy during the pandemic and also due to the vicissitudes of the hyperscalers and cloud builders, who can buy or not as they see fit. And they buy in such volumes that they can cause a server bull or bear market.

In general, X86 server revenues are growing faster than shipments, and that is thanks to richer configurations of servers and also due to the inclusion of expensive networking and accelerator components in the upper echelon of the X86 server market. X86 server average selling prices were hovering around $4,000 a pop twenty years ago, and now are twice that. (Some of that increase is inflation, of course.)

Here is the X86 market carved up by CPU shipments through the third quarter of 2022:

And here is what the situation looks like for server CPU revenues through the third quarter of 2022:

The AMD share gains on server CPU shipments is a bit less steep than we were expecting two years ago, but the AMD share gains on server CPU revenues is right on track. And that means AMD is doing an excellent job of getting a high average selling price for the latter generations of its Epyc processors even as it is also increasing its volumes. As the third quarter came to a close last year at the end of September, AMD had 21.7 percent server CPU shipment share and 28.1 percent server CPU revenue share. As we have said in the past, we think that AMD has a potential to reach a 40 percent shipment share, but from the look of things, it might be able to get a 40 percent server CPU revenue share with only a 33 percent server CPU shipment share if these trends persist. And there is nothing in the Intel Xeon SP roadmaps to lead us to believe that the trends will not persist.

Draw your own lines, and be mindful of the differences between supply wins and design wins. For those workloads that eat cores and have moderate needs for memory bandwidth, AMD is going to be able to sell whatever it can make. And it will be able to make more processors in 2023 than it could make in 2022, and with the Genoa line, they will be better processors commanding an even higher premium. For those workloads that benefit from I/O, vector math, and matrix math acceleration, Intel is going to have plenty of design wins, but it will largely be playing a game of supply wins, mopping up whatever AMD cannot supply and probably at a fairly aggressive price, too.

It will be interesting to see how this plays out in 2023 and the years ahead as the AMD and Intel server CPU roadmaps are unfolded and made real in silicon.

The wild card is the Arm server CPU, which is a very small portion of the market, but finally, after an exasperating dozen years, getting some real traction. Here is how Rakers, with the help of some Gartner data and his own forecasts, thinks the Arm server market – not just the CPUs, but shipments and revenues of whole machines – is doing in terms of shipments in the past several years and what it looks like out through 2026:

This is very interesting indeed. Arm servers are a lid that is going to keep a lid on the X86 market controlled by AMD and Intel, and that pot is going to keep getting hotter and hotter as more Arm machinery is deployed and finds workloads at the hyperscalers and cloud builders. If these projections are right, the X86 server market is going to be held to a flat 13.9 million machines a year. Amazing. The last time we saw something like this is when RISC/Unix machines entered the datacenter in the late 1980s or the X86 architecture became an option in the datacenter in the early 1990s. Frankly, if Amazon, Ampere Computing, Alibaba, HiSilicon, and a few others keep making better CPUs, we would not be surprised if that Arm server share does not grow.

That said, 19 percent shipment share in 2026 is ambitious enough, and we think Arm server revenues will be considerably lower than this share initially as these machines taker over core (and relatively modest) Web infrastructure workloads at first.

Arm shipments, according to Gartner, have been relatively modest: Around 77,000 machines in 2020, 252,100 machines in 2021, and an estimated 540,400 machines in 2022. But the projections are for 934,600 machines in 2023, 1.71 million in 2024, 2.54 million in 2025, and 3.2 million in 2026.

The success of Arm in the server depends on the enthusiasm of the hyperscalers and cloud builders as they run their own workloads and then the appetite customers will have for cheaper computing from their cloud vendor provided that either homegrown or Ampere Computing Arm server chips can keep consistently delivering better bang for the buck. AWS is definitely going to keep the heat on here, and so will Oracle, Tencent, Microsoft, and Google, which are all deploying Ampere Computing chips. According to Gartner, Arm server sales in a quarter just broke through $1 billion for the first time in Q3 2022. (It came close in Q4 2021 with an AWS rollout of Graviton2 machinery.) And the big clouds are definitely going to be very happy to change a legacy premium for X86 capacity, so don’t expect AMD and Intel to try to compete against Arm any more aggressively than necessary.

Imagine a world where the server revenue pie is 40 percent to 50 percent for Intel, around 40 percent for AMD, and 10 percent to 20 percent for Arm. It doesn’t take a lot of neurons to imagine it or GPUs to calculate the odds, does it?

Separate from all of this money talk, server architectures are changing fast and developments in compute, storage, and I/O could radically change the landscape. And recessions, as we have always contended, do not change server architectures, but certainly do accelerate their deployment. In some ways, a recession would cause a purge – but at one hell of a cost. It’s probably best to avoid a recession if possible – particularly if you are Intel and maybe AMD. All it will do is bend those revenue numbers down and kill what remains of profits in the systems business, which has long-term implications in terms of investments in future technologies. No one, including the hyperscalers and the cloud builders, wants to shoulder the technology development burden alone. Although they certainly want to give their component suppliers that impression.

Be the first to comment