The company was named International Business Machines for a reason, and over the several decades that IBM concentrated on peddling managed services and consulting services to the largest corporations on Earth, with its Global Services behemoth representing two-thirds of its revenues, the company lost touch with, and took for granted, the machine part of its rich and long heritage.

And it also became irrelevant to the largest infrastructure companies on Earth at the same time. You know, the ones who design and have custom built half of the servers installed in the world.

And so, in the wake of the spinoff of its managed services and outsourcing business into Kyndryl, representing about a third of the company’s revenues in 2020, IBM finds itself being closer to the Big Blue of days of old – but with a lot less size and might relative to the size of the IT industry.

IBM has kept the parts of Global Services – technical support, financing, machine buybacks and reselling, systems integration, various kinds of “business transformation” consulting, and application operations – that naturally complement the systems it designs and sells, and it is helpful to remember sometimes that IBM is the last of the OEMs that still maintains a complete hardware-software stack. In fact, IBM has two of them – System z mainframes running a variety of proprietary operating systems (mainly z/OS, formerly OS/390 and MVS, but also some z/VM and a lot of Linux) and Power Systems running IBM i (formerly OS/400), AIX, or Linux. This might not mean much to a lot of people, but to somewhere around 145,000 companies in the world, it matters a lot.

And so, with the passing of the IBM that was held together by Louis Gerstner and run with mixed success by Sam Palmisano and Ginny Rometty, we turn to the IBM that has been created by Arvind Krishna, who was behind the acquisition of Red Hat and the Kyndryl spinout and who is trying to do a reboot after an IBM 13.0 update. There have been many IBMs in the company’s history, which dates all the way back to the Tabulating Machine Company that Herman Hollerith founded in the wake of doing the data processing on punch card machines for the US Census in 1890. Every decade or so, we get a new IBM because times change and companies that do not change do not survive.

This IBM, streamlined by Krishna and donning a Red Hat, is very much focused on helping its existing customers embrace cloud in its many guises while at the same time trying to attract the attention of those key Global 20,000 companies who need the kind of expertise that Big Blue can bring to bear on a global scale in a way that may not be flashy, but is absolutely unique.

That said, these days IBM says “hybrid cloud” way too much. We know what hybrid cloud is, but we have no idea what IBM is doing when it counts hybrid cloud revenue – any more than anyone ever understood what the hell Big Blue meant when it said “cloud revenue.” To us, cloud revenue means something very precise – virtualized and often containerized utility capacity that can be turned on whimsically and turned off instantly, and has metered pricing based on usage – and as far as we can tell, IBM has a pretty broad definition of what “cloud” was and what “hybrid cloud” is. Much broader than ours if about a third of Big Blue’s revenues – $20 billion, mind you – come from “hybrid cloud” as it explained in its fourth quarter financial presentations.

To give you some perspective, IBM has about 120,000 customers on Power Systems running IBM i (mostly on single-socket machines with a handful of cores), maybe another 20,000 or so customers running AIX (and mostly on very large Power NUMA systems with four, eight, or sixteen sockets and dozens to hundreds of cores), and maybe 5,000 to 6,000 customers running System z mainframes, which IBM has started calling just Z – suddenly capitalized – and which we will not. Call it 145,000 unique customers, and many of them have multiple machines for development, production, and high availability, so the installed base of gear is probably on the order of 250,000 unique systems, maybe 300,000 machines, tops. Many of those machines have dozens to hundreds to thousands of unique virtual machines with distinct memory spaces running operating system instances, so IBM is in control of millions of instances in a world that probably has on the order of many hundreds of millions of instances. It just so happens that, as far as IBM’s customers are concerned, those millions of instances are the absolutely important ones.

This time last year, IBM and Red Hat had helped 2,800 customers build hybrid clouds, an installed base that took years to build, and over the course of 2021 it did hybrid cloud engagements at another 1,000 customers, boosting the base to 3,800 customers. Do you honestly think that 3,800 customers out of a base of 145,000 customers – a mere 2.6 percent of the IBM customer base – is driving a third of IBM’s revenues? We definitely do not.

Hybrid cloud is a deployment model, and it can be part of a strategy, to be sure. Hybrid cloud can even be a central part of a strategy until it becomes, well, normal. Like virtualized and containerized infrastructure has been for some time. But International Business Machines would do well to emphasize that it is a systems company, with a global reach, technical and industry depth, and the ability to scale its systems as far and as wide as any enterprise needs them to. If IBM ever wants to get to $100 billion in revenues and a $1 trillion market capitalization, it is going to have to sell a lot more systems to a lot more customers.

As we have said in the past, Red Hat is the foundation of that future system, and in the long run, IBM may not care if it creates its own processors and systems. We would point out that co-design of hardware and software is paramount and on the rise among the hyperscalers and cloud builders, and only a fool would ignore this. But there is not really room for IBM to create X86 or Arm processor alternatives to its platforms, and there is not much profit in the X86 and Arm server businesses anyway. But if people want to buy systems, and not have multi-vendor throat choking, maybe IBM would do well do start up an Arm server unit and try to crush Intel and AMD with it.

There are stupider ideas. It is far better to have 1 million happy customers and $100 billion in sales and maybe net income on the order of 10 percent or 15 percent of revenues than the average $56.75 billion in sales that Big Blue has averaged over the past three years – with far fewer customers – and the 9 percent of revenues dropping to the bottom line. (These numbers take out the Kyndryl sales and profits, of course.)

By the way, just to bring the point home, two and a half decades ago, IBM had 275,000 AS/400 customers, about 100,000 RS/6000 customers, and maybe 15,000 mainframe customers. A bigger base is a more diverse and healthier one, and rather than trying to maximize share price and doing all kinds of financial engineering instead of real engineering, maybe IBM’s former leaders should have been thinking about that. (Intel fell into the same trap.) IBM’s current leaders, having cleaned house, now have a chance to THINK, as IBM founder Thomas Watson, would have encouraged, if not chastised, them to do. The IBM of the past several decades did everything right financially, but did not see the future of systems like Google, Microsoft, and now Amazon Web Services did.

The IBM Company needs to THINK BIG, in fact.

We suggested five years ago that what IBM needed to do was buy up the OpenPower partnership – acquire Nvidia, Mellanox, and Xilinx before they all got too expensive – and to get back into creating systems. Nvidia and AMD were certainly listening, and so was Intel, which is creating its own GPUs and bought Barefoot Networks and FPGA maker Altera (among many other things).

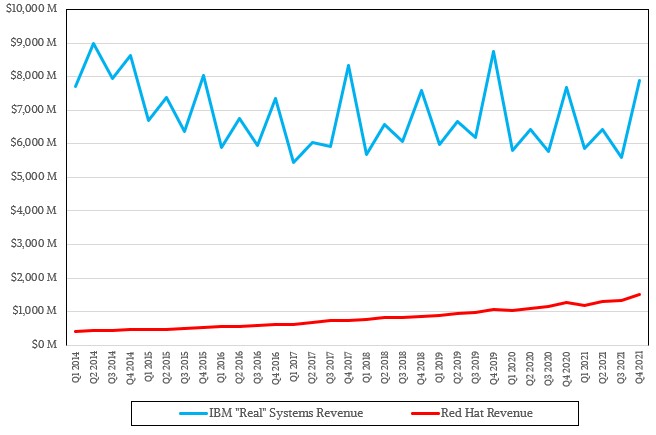

Those are 2019 and 2020 strategies. IBM needs a 2025 strategy, and something that is more than praying the Red Hat business can grow faster than the mainframe and Power systems businesses decline. We have shown that it can, by the way, and the IBM systems businesses is falling a little faster than Red Hat can grow and so the overall systems business is not quite bending up yet on average. And that is with a massive injection of spending by Kyndryl on IBM mainframes, Power Systems, and storage as it was sinning out from Big Blue in November.

Still, clearly Red Hat is helping the overall systems business at IBM:

The data from 2019 through 2021, inclusive, shown in the above chart for the “real” IBM systems business is based on a new model we have create based on IBM’s new product groups and subcategories, which it announced at the end of last year and backcast to Q1 2019 to help Wall Street make comparisons. We have aligned our new “real” systems model to be consistent with our old model, and the good news is that nothing that was spun out of Kyndryl was included in that base systems revenue stream we were after anyway. So making the new and old models line up was pretty easy, and are within a few percent of each other. So we think we still have a pretty good idea of what the underlying systems business – servers, storage, networking, operating systems, middleware, tech support, and financing – looks like.

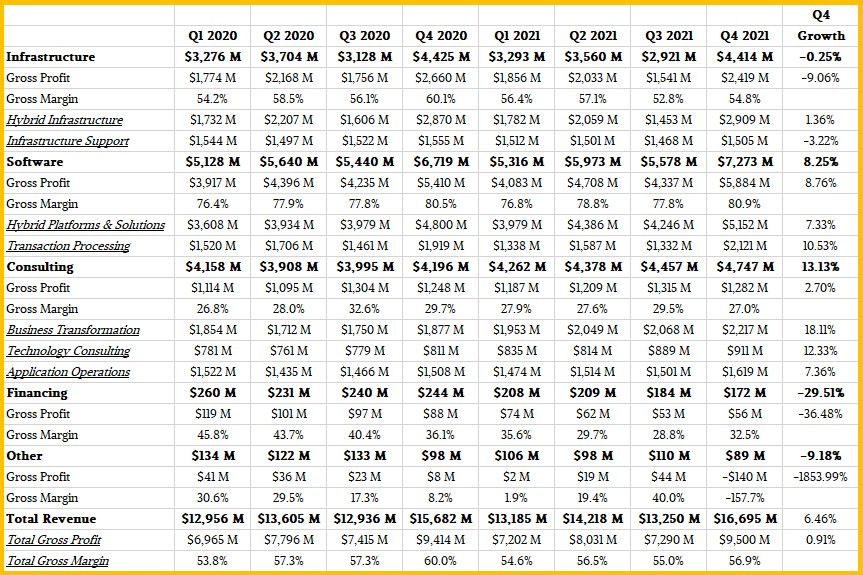

In IBM’s current financial reporting, it has five broad groups – Infrastructure, Software, Consulting, Financing, and Other. The Infrastructure Group includes sales of System z and Power Systems servers, IBM flash, disk, and tape storage, whatever networking it resells, and the tech support for these products. Infrastructure has also pulled in the reselling of certified pre-owned IBM iron that is taken in trade from customers when they buy new IBM machinery, which used to be part of Global Services. If customers do leases or other kinds of financing for such second-hand gear, that part of the revenue stream ends up in the Financing group, as does financing for new hardware and software licenses.

IBM calls all of this iron “hybrid infrastructure,” which is completely silly, and the company is no longer providing much in the way of guidance on how System z, Power Systems, and storage are doing uniquely. We did learn from the call with Wall Street analysts going over the fourth quarter of 2021 financial results that System z sales were down 4 percent year on year at constant currency, and that includes the hardware and the operating systems together for the first time. The other “distributed infrastructure” – meaning Power Systems plus storage, again including operating system sales where appropriate – was up 7 percent. We think that sales of the Power10-based “Denali” Power E1080 helped here, but Jim Cavanaugh, IBM’s chief financial officer, said this growth was “driven by pervasive strength across our storage portfolio.”

At constant currency, hybrid infrastructure sales were up 2 percent, and 5 percent of that growth came from Kyndryl buying up like crazy, which means sales actually fell by 3 percent absent Kyndryl. As reported, hybrid infrastructure sales in Q4 2021 were off 1.4 percent to $2.91 billion, and infrastructure support sales were down 3.2 percent to $1.51 billion; add it up, and the Infrastructure group had sales of $4.41 billion, down a quarter point compared to the year ago period. and gross profits fell by 9.1 percent to $2.42 billion.

The Software group includes hybrid platforms and solutions, which again is a very silly name, and that is a hodge podge of Red Hat Enterprise Linux, OpenShift, and Ansible, plus various system automation tools (which generated more revenue than Red Hat in 2021), plus “data and AI” tools ranging from data management tools to statistical and AI analytics tools to weather models and asset and supply chain management, plus various security wares and services related to them. Transaction processing software includes Db2 databases, WebSphere middleware, and actual transaction processing middleware such as the CICS tool on mainframes. The mainframe drives the vast majority of IBM’s sales here, and in our systems model, we do not count databases and higher up middleware but we do count transaction monitors and integration software – and only that which we think is being deployed on IBM System z and Power Systems platforms. With all of those constraints, we estimate that about half of IBM’s software revenues represent the code that is part of base systems.

You have to draw the lines somewhere.

The Software group had sales of $7.27 billion, up 8.3 percent, in Q4 2021, with the hybrid platforms and solutions hodge-podge up 7.3 percent to $5.15 billion and the transaction processing and database portion up 10.5 percent to $2.12 billion.

The Consulting group is significant, but not really material to our casing of Big Blue’s “real” systems business. But it generated $4.75 billion in sales, up 13.1 percent year on year. The Consulting group does implementation of IBM and third party software, integration of AI with existing applications, architects hybrid cloud setups, and runs applications and cloud infrastructure on behalf of customers. These are all pretty substantial businesses, but not as profitable as infrastructure and nowhere near as profitable as software. But they give IBM an opportunity to peddle those wares.

The Financing group does various kinds of leasing and rental arrangements, and generated $172 million, down 29.5 percent year on year as IBM focuses more on financing deals for its own iron and less on deals for hardware and software from other IT suppliers as IBM has done for many years in the past.

The final category is Other, which we think is mostly the sale of intellectual property and some bespoke research.

Here is a summary table that shows how the core IBM did, minus Kyndryl, over the past two years:

And because it is easier to see trends in a chart, here is a summary of the various categories showing how they did for the past three years:

Add it all up, and IBM had $16.7 billion in sales for Q4 2021, up 6.5 percent, with a gross profit of $9.5 billion, up 2.8 percent, and net income for continuing operations of $2.46 billion, up by a factor of 2.1X. The entire Red Hat business, which is accounted for separately still, had sales of $1.5 billion, up 19 percent and more or less consistent with the growth the open source juggernaut had before IBM started its acquisition dance in October 2018.

Be the first to comment