At its heart, and until the day it dies, if a corporation ever really dies, International Business Machines will be a platform company, no matter how much it tries to bamboozle itself or Wall Street or Main Street otherwise. And sometimes, when we examine Big Blue’s quarterly financial results, it puts us in a mood because IBM doesn’t seem to want to acknowledge this fact and therefore it talks about itself the wrong way and limits its own success and therefore that of its customers and partners.

We don’t use the first person a lot here at The Next Platform, but perhaps you can allow me the luxury for a moment. Since I started covering the IT sector in the summer of 1989, my rough reckoning is that I have probably written the IBM quarterly earnings story somewhere well north of 200 times, across the multiple publications that I have worked on simultaneously in that time. That’s probably more than any other human being doing IT analysis today. Don’t get me wrong. I am not bragging, but just pointing out a fact, and I love what I do for a living and I hope it shows. But sometimes, when I listen to the Wall Street conference call, I just want to give IBM a nudge and help it try to understand itself a little better.

This is one of those times. (Pencil snap.)

Let’s start with the basics. As best I can figure, IBM has somewhere around 5,000 unique System z mainframe customers running proprietary z/OS (formerly MVS) or Linux operating systems, maybe somewhere on the order of 50,000 to 75,000 unique Power Systems customers running AIX or Linux (the error bars are big on that estimate), and around 120,000 unique Power Systems customers running the proprietary IBM i (formerly OS/400) operating system. Let’s call it 200,000 unique customers using its systems, and it probably lost that number of customers – mostly small and medium businesses – when it sold off its System x server business to Lenovo in January 2014 for $2.3 billion. Not a smart move in light of the Red Hat acquisition six years later because IBM no longer sells the server type that most Red Hat customers use. Or just in general if you want to be a platform company with Machines as your last name. SoftLayer, the basis for the IBM Cloud public cloud, had over 100,000 servers and over 25,000 customers back in 2012 before IBM bought it. There is some overlap between customers using on-premises IBM systems and capacity on the IBM Cloud, but we have no idea what that might be. Big Blue never talks about how its customers actually do hybrid cloud and what kind of revenue that drives. (Another pencil snap.)

We similarly have no idea what the overlap is for customers who use IBM’s managed infrastructure services and will have their systems spun out into the free-standing as-yet-not-fully-named NewCo by the end of the year. IBM announced the NewCo managed services spinoff in October 2020, which serves around 4,600 customers worldwide and drives around $19 billion in sales. We have no idea how this spinoff will affect IBM’s “cloud” revenues, or its Power Systems and System z sales, but we reckon NewCo will probably end up being IBM’s largest system customer, which will be interesting to watch.

That is the vertical part of IBM’s platform business, which includes servers and storage, operating systems, and usually a slew of middleware and development tools and sometimes a database management system and often various kinds of analytics tools.

There is a horizontal part of IBM’s platform business, which it took control of from that $34 billion deal to acquire Red Hat, announced in October 2018 and completed in July 2019. We don’t know how many on premises, public cloud, and hybrid cloud customers Red Hat has, but it is probably millions in total and if the 80/20 rule holds, there are probably something on the order of 5,000 really important customers, another 15,000 important ones, and maybe several tens of thousands of significant ones with the rest being relatively small potatoes in terms of revenue generation.

Ideally, what IBM should do is get Red Hat running well on all of its hardware platforms (including the IBM cloud and the offerings from NewCo), which it has been doing all along because Linux is a big part of the sales pitch for Power Systems and System z iron, while at the same time getting as many Red Hat customers as possible to use its hardware platforms. The former is a lot easier than the latter – particularly without IBM having an X86 server or an Arm server for sale. Most companies will not move to a Power server and even fewer will out of nowhere decide to buy a mainframe to run Linux, as evidenced now by two decades of X86 customers largely ignoring the marketing because IBM does not provide the low-cost server platform with its Power Systems and mainframes, despite their many benefits to those who need an I/O monster, are even more costly per unit of raw performance.

To be fair, as IBM chief financial officer Jim Kavanaugh pointed out in the call with Wall Street going over the Q4 2020 results, the installed base of mainframe capacity (as measured in MIPS, or millions of instructions per second) has grown by a factor of 3.5X in the past decade, and 60 percent of that capacity base is running Linux using the Integrated Facility for Linux (IFL) engines that are a lot cheaper than those running z/OS, or the System z Application Assist Processor (zAAP) for running Java on the cheap, or the System z Integrated Information Processor (zIIP) for accelerating DB2 database functions on the cheap. To give you a better sense of perfect elasticity, the aggregate installed base of the X86 server market between 2010 and 2020 has increased by around a factor of nearly 15X – or more than four times faster.

This is what IBM is up against as it tries to keep that core vertical platform business based on Power Systems and System z going as it builds out that horizontal platform based on Red Hat Enterprise Linux and OpenShift (the commercial-grade Kubernetes) with an occasional move into JBoss middleware, Red Hat storage (Gluster or Ceph), or Red Hat Enterprise Virtualization (the commercial-grade KVM hypervisor).

These are the two platforms – two vertical and the other horizontal – on which current IBM CEO Arvind Krishna and future CEO Jim Whitehurst actually have to build a new and improved IBM. We have some thoughts on how this might play out, but first, let’s get into IBM’s fourth quarter results as a basis for our analysis and forecast out to the end of 2029, which explains in part why IBM spent so much money on Red Hat.

Taking it from the top, IBM posted revenues of $20.37 billion, down 6.5 percent, with gross profits of $10.52 billion, down 5.2 percent, and net income of $1.36 billion, down 63.1 percent thanks to a $2.04 billion charge for “structural actions” during the quarter. IBM managed to pay down $3.9 billion of its Global Financing debt out of cash flow, but it still has $40.4 billion in core debt plus another $21.2 billion in Global Financing debt, with total debt of $61.5 billion. (That core debt is mostly the cost of buying Red Hat.) The company has $14.3 billion in cash and securities on hand, which makes that core debt seem less bad. At some point, IBM needs to throw off more cash to pay down that debt.

IBM’s Systems group, which peddles servers, storage, operating systems, and a bit of switching here and there, posted external sales of $2.5 billion plus another $196 million in sales to other IBM groups (such as the one that will become NewCo later this year). By playing around with the numbers IBM hints at, we reckon Big Blue had $2.09 billion in system hardware sales, which includes servers, storage, and that tiny bit of switching reselling, and another $408 million in operating system sales (not including Red Hat revenues, which are sold as support contracts within Global Technology Services). The Systems group had a gross profit of just under $1.49 billion and a pre-tax income of $455 million.

In constant currency, IBM’s System z was business was down 24 percent against a very tough compare given that Q4 2019 was the first full quarter its System z15 mainframes were shipping, and this year there is a pandemic. Power Systems had a 16 percent decline, storage had a 17 percent decline, and operating systems had a 14 percent decline. IBM reckons that $1.1 billion of the $2.

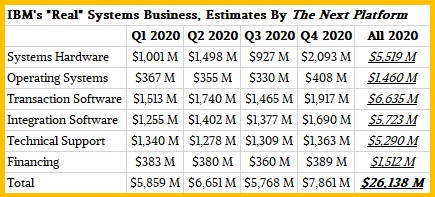

This is the core of that IBM vertical platform business. Other aspects of its Cognitive & Cloud Software (mostly transaction processing and integration software in our assessment), technical support, and financing make up the remainder of this business. Not all of the software and services that IBM sells run on its own platforms, of course, and over the years we have taken our best stab at how much of this revenue is allocated to its Power Systems and System z iron. Since the addition of Red Hat to the company, we were not sure how to handle it, but going forward we are pulling it out of the IBM divisions where it is booked so we can get a clean figure (relatively speaking, of course, since this is all witchcraft of a sort) for that core IBM vertical platform business. In the table below, Red Hat is in the numbers in the appropriate categories, and again, Red Hat Enterprise Linux is in Technical Support because it is a support subscription, not a purchased or rented perpetual license as is the case for IBM’s own operating systems.

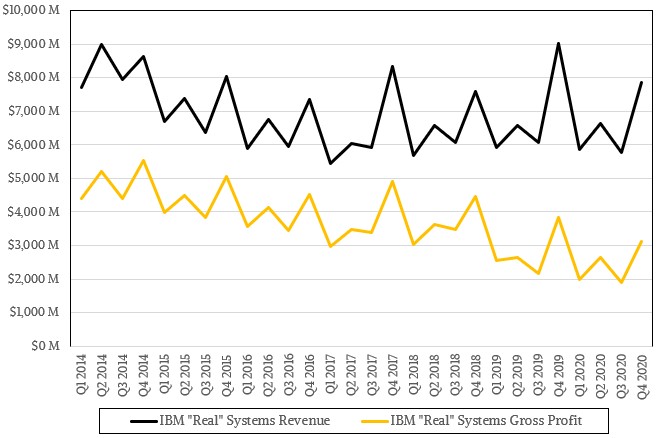

Here is a trend chart since Q1 2014, when we started doing this presentation along with IBM’s recast financials as Ginni Rometty took over the company.

Here is the thing that we like to point out. IBM’s “real” systems business in 2020 generated $26.14 billion, down 5.2 percent, and generated gross profits of $3.13 billion, down 13.5 percent, by our math. That vertical platform business is on par with the $26.1 billion Intel generated in its Data Center Group, but Intel is wickedly more profitable, with operating profits (not gross profits) of $10.571 billion in all of 2020 for this group. (We know which business is easier at this point, that is for sure – even despite the foundry issues and the intense competition and the product delays.)

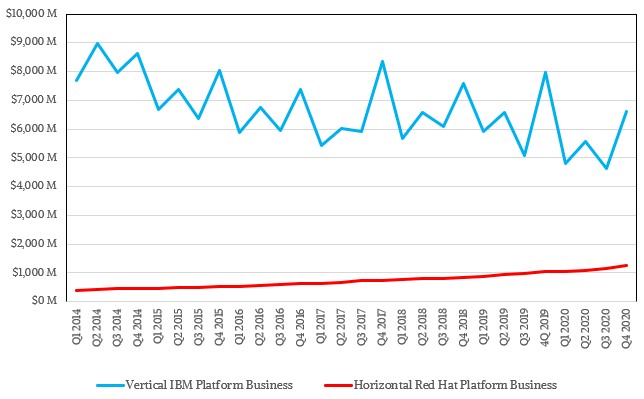

Now we get to the fun part, comparing and contrasting that core IBM vertical platform business with the acquired Red Hat horizontal platform business, where Red Hat for the most part sells the stuff from the operating system and storage up through the container or virtualization layers. In the chart below, we take Red Hat’s quarterly revenue all the way back to Q1 2014 and run it up against IBM’s “real” systems revenues as we calculate them. Starting in Q3 2019, when Red Hat was first fully incorporated into IBM’s results, we take the Red Hat revenues out of the IBM “real” system revenues. So now we can see the vertical IBM platform revenues against the horizontal Red Hat platform revenues over time. As you can see, without Red Hat, IBM’s platform sales were continuing on their decline, albeit at a pace where the decline was slowing. (Admittedly, it is hard to see that through all the ups and downs of the Power Systems and System z product cycles and the effect of some big supercomputing wins in 2017 and 2018.)

Look at how Steady Freddie that Red Hat business is. It looks like a Boeing 747-400 taking off.

While that is interesting, what we want to know is what happens to quarterly revenues for the Red and the Blue if we roll this movie forward a decade from the Red Hat acquisition. To do that, we have to make some assumptions, of course. One assumption we are going to make is that the decline in the IBM vertical platform business will be no worse than the average over the quarters in the past three years. We think IBM is down to the diehards for both System z and Power Systems, and we also do not expect a sudden rise in Power Systems sales. (Anything is possible, particularly if IBM has a sudden change in attitude as Power10 approaches.) In any event, that decline is, on average, 4.1 percent year on year each quarter. Since IBM took over Red Hat, it has averaged just under 20 percent revenue growth year on year each quarter, although admittedly the coronavirus pandemic has not been great and it is a bit soft in the middle of 2020.

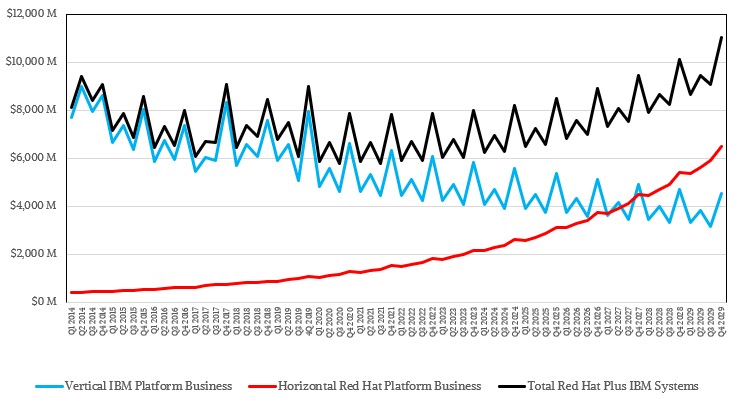

Here is what happens if you roll this data forward until the end of 2029:

If you look at Q4 2020, the Red Hat platform business is running at around $1.26 billion, up 19 percent, while the IBM “real” systems business minus Red Hat is running at $6.6 billion, down 17.1 percent. The Red platform line keeps plugging along with the linear growth – not exponential – and the Blue platform line keeps declining linearly and ever so slowly, and in 2027 they start crossing in a few points. From that point forward, the Red Hat platform business overtakes the legacy IBM platform business, but the important thing is this: The overall IBM platform business has, by these numbers, already stabilized and will remain stable as Red Hat fills in the IBM legacy gap in the coming years, and eventually, IBM’s overall platform business starts growing in earnest. In this simple model, by the final quarter of 2029, that legacy IBM platform brings in around $4.5 billion in that quarter and in that same quarter the Red Hat platform business brings in $6.5 billion, giving IBM a total platform business, at $11 billion, that is 1.6X as big as the one IBM had when it completed the Red Hat deal in 2019.

Equally importantly, by the end of 2025, IBM will get its bait back on the $34 billion Red Hat deal, and in the four years following, it will add another $84 billion to its coffers. This is, of course, assuming that IBM can keep the Red Hat business growing at 20 percent.

The bet is that there is enough hybrid cloud business to make this happen. With a customer base on the order of maybe 300,000 across its legacy platforms, its core Red Hat shops, and its IBM Cloud, Big Blue can probably take a big bite out of that $1 trillion opportunity it keeps talking about. The 2,800 OpenShift customers is a start. That’s about 1 percent down, 99 percent to go.

At some point IBM will have to explain what its AI revenues are and how they can grow, since all it talks about are “hybrid cloud and AI” being the company’s future. But that is a story for another day. And it is not the whole story of IBM for sure. No matter what it says.

Assuming exponential growth for RedHat over the next ten years sounds implausible to me as does a linear decline in Power and other stuff. While I don’t know what will happen, I’m pretty sure it won’t be that.

As far as I can tell IBM is in an awful mess and spending billions in RedHat may have made things worse.

I wonder what would happen if they stamped the name IBM on some reasonably designed EPYC server and shipped it with a lifetime license for RedHat preinstalled.

I agree on all fronts. That was not meant to be what I thought the probable scenario was–but the one they were looking at as they contemplated the deal. This is the best possible case scenario. I think it far more likely that the resulting “systems” business remains flat and slightly less profitable over time. But guessing the future is hard. I just wanted to show the shape of what might be, and what drove this deal and how IBM will drive itself.