It is hard to tell which part of the systems market is lumpier – that for traditional HPC systems like supercomputers or that for massive cluster deployments for the hyperscalers that run public clouds and public facing applications on a massive scale. But what we do know for sure is that the HPC market is slowing down, and that the bellwether for that market, Cray, is doing better than that market according to its latest financial results.

Despite the softness in the traditional HPC market for clusters to run simulations and models (partly driven by the political climates around the globe) and even with some delays in getting Intel “Knights Landing” Xeon Phi and Nvidia “Pascal” Tesla motors into clusters, Cray was not only able to close the five big deals that were the key to its fourth quarter for 2016, but it was able to turn in the largest revenue quarter in its history and the second largest revenue it has ever produced.

This is a remarkable feat, given all of the issues, including a “smoke event” caused by the failure of a power component at its smaller factory in Chippewa Falls, Wisconsin that happened during the second quarter. (That event damaged five smaller systems that are part of some larger projects, which were stored in the bay where the smoke event happened; it is important to note, once again, that this was not a fire, and it was not in any way the result of a failure in a Cray computer.)

Among these five systems were three XC40 systems based on the Knights Landing Xeon Phi processors from Intel, which were installed at Los Alamos National Laboratory and at the National Energy Research Scientific Computing Center in the United States and at Kyoto University in Japan. Another was the XC50 system at the Swiss National Supercomputing Center (CSCS) that employs Tesla P100 coprocessors from Nvidia to do its number crunching. The fifth machine should be a shared system for Los Alamos National Laboratory and Sandia National Laboratory, but cray did not confirm this on its call with Wall Street analysts. We do know that the fifth supercomputer is not the prototype Knights Landing machine at Argonne National Laboratory that is a precursor for the “Aurora” supercomputer that Cray is working with Intel to install in the lab in 2018 based on future “Knights Hill” Xeon Phi processors.

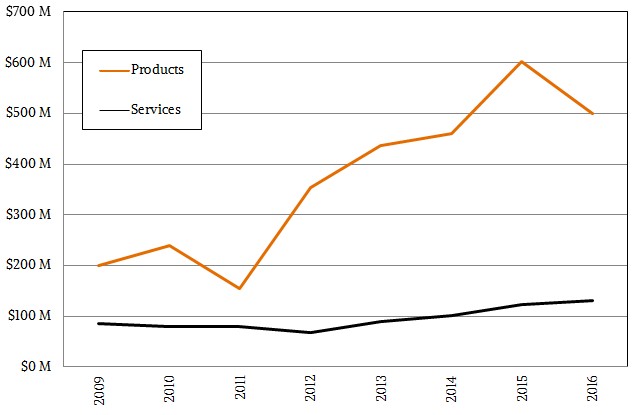

In the fourth quarter, Cray posted product sales of $311.4 million, up 33.7 percent, an astounding amount of business for any HPC company to push in one quarter and representing 62.4 percent of all product revenues booked for the year, the highest proportion of sales that Cray has ever booked in a fourth quarter in its history. Given processor product cycles, Cray has been booking a lot of its sales in the latter half of each year for quite a while now, but even this is remarkable. And so is the fact that it was able to get the components for the five key systems all in place, build and install the machines, test them, get them accepted by customers, and book the revenue all before December 31 rolled around.

The system suppliers to hyperscalers in particular and to enterprises in general have it a whole lot easier. There is not a complex acceptance process that holds up the money as has been the tradition among HPC customers.

For the final quarter of 2016, Cray’s services revenues remained steady, rising 1.8 percent to $35.2 million.

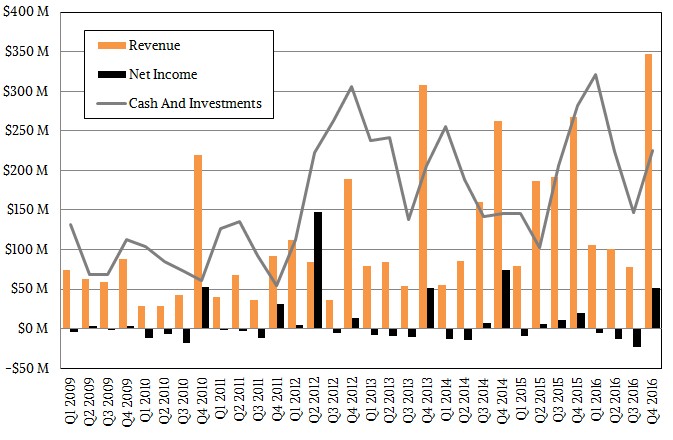

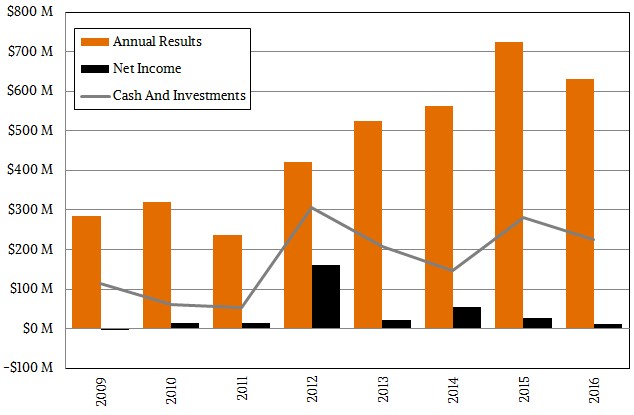

As we have pointed out time and again, with a company like Cray and the lumpy nature of the market that it serves, you have to examine the company on an annual, not quarterly, basis. The following two charts illustrate why. Here is what Cray’s financial performance looks like quarterly, starting back at the Great Recession:

Some years, thanks to the confluence of budget timing and chip roadmaps, the business is more even throughout the year, and sometimes a lot of the business piles up big time in the fourth quarter. Here is what Cray looks like on an annual basis with the same data:

The company is still on a general trajectory upwards and it is still profitable, although its profits are under pressure no doubt because of the increasing size and complexity of the machines it is building for the HPC centers of the world as they push on towards exascale-class machinery.

That said, revenues were still off, and that is not as much fun as the four years of almost linear growth has been for Cray. In 2016, revenues fell by 13.1 percent, to $629.8 million, and net income was down by 61.5 percent, to $10.6 million. Product sales were off 16.9 percent to $499.4 million, and within this, storage revenues were off by 20 percent (a revenue figure was not provided). Services revenues for 2016 rose by 5.7 percent to $130.4 million.

Considering how cut-throat the HPC market is and all of the things Cray had to bring together to book that revenue, showing any black ink at all is an accomplishment. Again, enterprise customers do not push their vendors this hard – one more reason why Cray wants to expand its commercial footprint. Many large HPC centers are funded by governments and academia, they are on ever-tightening budgets and they have very aggressive bidding on iron.

“We had a strong fourth quarter, closing the year out by completing all the large acceptances and most of the smaller ones we were working on for 2016,” Pete Ungaro, president and chief executive officer at Cray, said on the call going over the numbers. “We finished the year with strong cash balances and despite ongoing challenging market conditions, we delivered solid profitability for the year. While it was disappointing to see our revenue growth take a step back in 2016, when you take a longer view of our results, such as over the past few years, you will clearly see that we are delivering strong growth and winning in the market. While our market can be lumpy, we are continuing to see very slow conditions in supercomputing, as we discussed on our last earnings call, with fewer opportunities, both in total numbers and dollars. In fact, we believe the high-end of the market which we service was down by more than 25 percent on a revenue basis in 2016 and down even more on a bookings basis. This clearly had a significant impact on our results for the year, despite continued strong win rate and our industry-leading market share.”

Ungaro added that the timing of a rebound in the upper echelons of the HPC market where Cray plays was uncertain, and that Cray is not at this point able to provide a reasonable range of revenue expectations for this year. Brian Henry, Cray’s chief financial officer, did tell Wall Street to expect revenue to be around $55 million in the first quarter of this year, and that like other system makers, the tight supply of memory (both DRAM and flash) and higher prices would put pressure on the bottom line.

One of the things that has not been as strong as expected for Cray was sales of its CS series of clustered systems. This capacity part of the HPC market, which standards in contrast to the capability-class XC machines that Cray sells based on its “Aries” interconnect, is all about flops per watt and dollars per flops and is particularly competitive – especially with Hewlett Packard Enterprise, Dell, and Lenovo all chasing deals and all in tight partnerships with Intel, just like Cray.

Another part of the market that was a little slower was those commercial accounts that Cray has been focusing on, with a long-term goal of getting a third of its revenues from outside the traditional HPC market. Ungaro said that the focus on commercial customers effectively doubled Cray’s addressable market, and there is no reason to believe that enterprises in the manufacturing, energy, life sciences, and financial services verticals cannot benefit from an XC-class machine for all kinds of jobs, not just simulation and modeling. Deep learning is one potential area where Cray could see enterprise adoption, and Cray just demonstrated it could scale deep learning frameworks across 1,000 Nvidia Tesla GPUs on the XC50 at CSCS. And Petroleum Geo-Services, a service provider that does reservoir modeling in the oil and gas industry, is using deep learning on Cray systems with GPUs to do better seismic modeling.

This is how the HPC trickle down effect to enterprise is supposed to work. It just takes time.

RELATED STORIES

Cray’s New Pascal XC50 Supercomputer Points to Richer HPC Future

Taking A Long View On HPC And Beyond

Cray Sharpens Approach to Large-Scale Graph Analytics

Future Cray Clusters to Storm Deep Learning

Cray CTO Connects The Dots On Future Interconnects

What’s Really Driving HPC Decisions in Oil and Gas?

I am a LT investor with some knowledge of the computer industry. I put my life savings into Cray and find that I am short-changed at the expense of Short term Traders. I have looked carefully at the trading range, and understanding the sensitivity of its nature, given the amount of gov’t contracts, wonder what is meant by the financial code word “lumpy”. A dividend would take the lumps out for good.