The Hewlett Packard that Carly Fiorina and Mark Hurd created through aspiration and acquisition is hardly recognizable in the increasingly streamlined Hewlett Packard Enterprise that Meg Whitman is whittling.

We joked earlier this week that with its acquisition of VMware and EMC and the sales of its outsourcing and software businesses that the new Dell was stop trying to be the old IBM. Well, the same is true of the new HP. It is not clear when and if Oracle will get the same memo, but it seems content to build engineered systems, from top to bottom, and we think this makes good sense since Oracle controls a complete software stack and neither HPE nor Dell do.

The trouble that Dell and HPE found themselves in is that they did not build platforms fast enough as the market shifted away from selling or reselling licensed software and putting platforms together piecemeal for customers and towards companies using a public cloud as a platform or companies using a set of open source components figuring it out on their own. Frankly, companies like IBM, HPE, and Dell charge too much for such integration services, they take too long, and companies are always dependent on others to make changes to that platform because they lack expertise. The old adage about IBM in the early 1990s, quipped by a frustrated CIO – “You can find better, but you can’t pay more” – applies well to the traditional approach to building enterprise platforms. Dell recognizes that it needs EMC and VMware to build a true platform – or perhaps several – and HPE seems content to partner with key software suppliers to have several platforms in the field and sell the hardware that underpins it all.

In conjunction with announcing its third quarter results for fiscal 2016 this week, HPE said that it was spinning out its non-core software assets to Micro Focus, a company that was best known as a supplier of COBOL compilers and legacy hosting environments for IBM mainframes and minicomputers that a couple of years ago bought the Attachmate conglomerate and therefore took control of Novell and SUSE Linux. Under the agreement, SUSE Linux will become the preferred Linux operating system for HPE server platforms and HPE will be getting behind the SUSE Linux OpenStack distribution, too.

The spinoff-merger agreement that HPE is cooking up with Micro Focus is similar to the one that the company did back in May with Computer Sciences for $4 billion (plus a stake in CSC that is worth $4.5 billion). The sales of the Enterprise Services group to CSC essentially undoes the $13.9 billion acquisition of outsourcing innovator Electronic Data Systems back in 2008. In this case, HPE is shedding its big data software, including its Vertica columnar database (acquired in 2011 for an unknown amount), plus various bits of acquired software from Mercury Interactive (which it bought for $4.5 billion in 2005), Opsware (which it bought in 2007 for $1.6 billion), and the ill-fated Autonomy, which the old HP bought in 2011 for $10.2 billion and then wrote off $8.8 billion relating to the acquisition a year later. HPE is keeping its OneView software, which underpins its Project Synergy composable infrastructure efforts, and its own operating systems, which are not worth much at this point.

Under the terms of this deal, HPE will have a 50.1 percent majority stake in the combined HP Software-Micro Focus companies, which will be run as Micro Focus and by Micro Focus. There was much talk about how Micro Focus will be more focused on extracting revenues and profits from these HPE businesses, but this is silly. Anything Micro Focus will do, HPE could have done. The reality is that Meg Whitman cannot build a big enough software business to matter, so she is taking the cash now so HPE can focus on being the leader in infrastructure.

It is not as much cash as it looks like. That $8.8 billion that HPE is pegging the deal’s worth at consists of a $2.5 billion cash payment from Micro Focus and a valuation of HPE’s stake in Micro Focus being worth $6.3 billion. HPE will take a $700 million charge to extract the software business from itself and pass it over to Micro Focus, which means its net cash from the deal will be more like $1.8 billion. After the deal closes, Micro Focus will have about $4.5 billion in annual revenues.

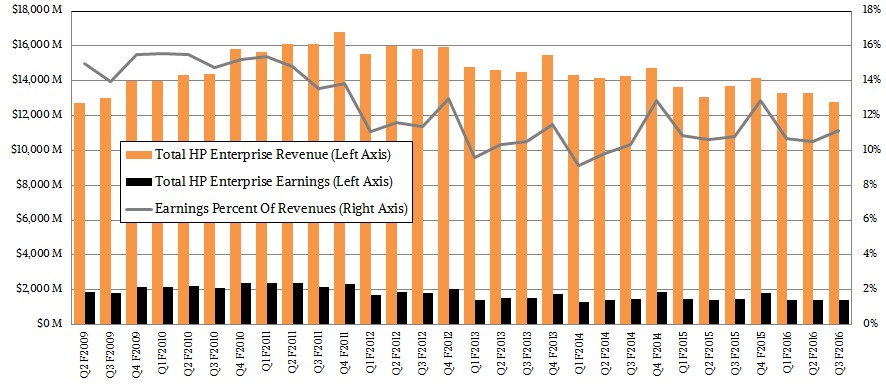

With the split of HPE from HP Inc, the PC and printing company, HP went from a company with approximately $100 billion in annual sales to an HPE with around $50 billion in revenues. With the divestiture of Enterprise Services to CSC and the spinoff of the software units to Micro Focus, HPE will drop to around $28 billion in revenues. So two of the lines in the chart below – most of the Enterprise Services and most of the Software revenues – will essentially disappear:

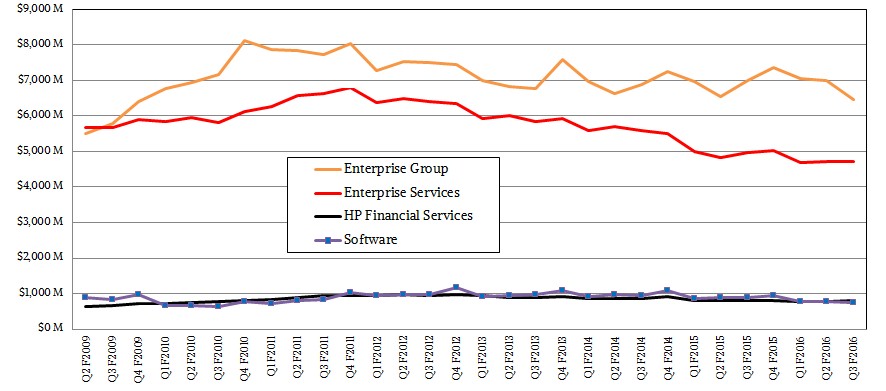

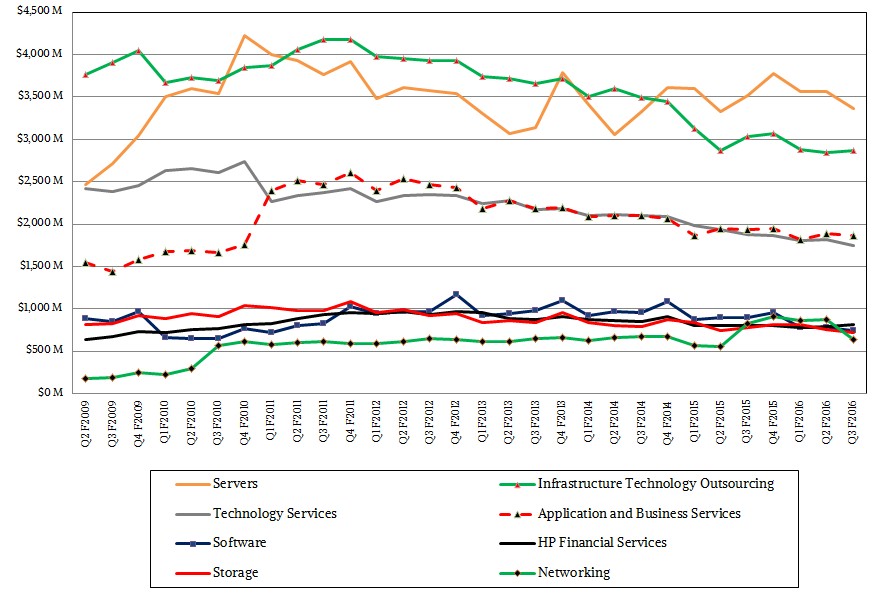

If you want to drill a little deeper into it, here is how the HP and HPE enterprise businesses have changed over time:

The Infrastructure Technology Outsourcing and Application and Business Services lines are going to CSC, and most of the Software line is going to Micro Focus.

HPE is not just selling off assets, but is also acquiring them, as evidenced by its $275 million deal to buy hyperscale and HPC server maker SGI for $275 million last month. In a conference call with Wall Street analysts going over the Q3 numbers, Whitman highlighted the SGI deal a number of times.

“The SGI acquisition will further strengthen our position in the $11 billion HPC segment as well as the high growth data analytics segment,” she said. “High performance computing and big data analytics are exciting areas for us as customers are increasingly looking for ways to gain deeper and more contextual insights from the ever-expanding volumes of data. Industries like financial services, semiconductors, and energy are all increasing their HPC investments.”

We were under the impression that the energy sector, thanks to lower oil prices, was actually cutting back. Whitman also said that with the SGI acquisition, HPE would be the leader in the HPC market, and that this would draw down to a two horse race between HPE/SGI and Cray, adding that “many of the other competitors – like Dell and Lenovo – they are not in that high performance compute business.”

Again, they and we beg to differ with Whitman’s assessment. IBM as well as Dell and Lenovo most certainly are players in the HPC space, and while SGI brings HPE about an incremental $533 million in annual revenues (based on SGI’s fiscal 2016 results, which we analyzed here) and that will make it larger than Cray, which estimates its sales will be in the range of $650 million in 2016, down from a rosier forecast of $825 million it made earlier this year.

SGI will no doubt be bolstering the server and storage businesses at HPE, with some lift in networking and systems software, too. HPE also now has its own HPC variant of the SUSE Linux operating system, which SGI created for its UV family of systems, and the link with Micro Focus, which owns SUSE Linux, is now that much tighter. We would not be surprised to see an HPC variant of SUSE Linux tuned up for HPE ProLiant machines and another variant for Cloudline servers running OpenStack and Docker containers. If Micro Focus makes money on Linux, HPE does, too, however indirectly.

In the quarter ended July 31, Enterprise Group, which will comprise the bulk of the trimmed down HPE, had $6.48 billion in sales, down 8 percent. HPE’s server lines, anchored by the ProLiant general purpose rack, tower, and blade systems and also including its Cloudline hyperscale boxes and Apollo HPC and big data systems, had a 4 percent drop to $3.37 billion in sales. Tim Stonesifer, HPE’s chief financial officer, said that “solid growth” in sales to “tier one” enterprises and into HPC centers was offset by pressure in the core ProLiant servers. (Dell had similar issues with its SMB customers and its PowerEdge general purpose line in its most recent quarter, as we reported.) Stonesifer added that HPE was making changes in the executive ranks and in its go-to-market strategy to address the market coverage issues it was facing, and was pleased that HPE’s sales reps and channels emphasized profits over share gains and anticipated that HPE held market share in servers in the second calendar quarter that overlaps with its fiscal third quarter. HPE does not provide operating profits by division, so we can’t show this.

As with other big IT suppliers, legacy storage arrays are being hammered by cheaper clustered storage running open source stacks or hyperconverged storage running virtual SAN software. HPE’s all-flash 3PAR arrays had a 70 percent jump in the quarter, and the key modern products (all 3PAR arrays plus SVA arrays plus XP arrays) rose by 5 percent. But storage overall fell by 8 percent to $724 million. In the call, HPE kept talking about how networking had grown, but its financial reports show networking sales were down 22 percent to $639 million in the quarter. Technology Services, which is the break-fix service for HPE gear and software, fell by 7 percent to $1.75 billion.

Add it all up, you get Enterprise Group sales of $6.48 billion and an operating profit of $815 million, down from an operating profit of $881 million against sales of just a tiny bit over $7 billion in the year ago period. Server margins might have held, but it doesn’t look like anything else in Enterprise Group did.

HPE Enterprise Services had $4.73 billion in sales, down 5 percent, but operating profits here rose by 38 percent to $393 million. Software revenues, not helped by a rumor of the software asset sale, were down 18 percent, and operating income fell by 29 percent to $131 million. HP Financial Services had $812 million in revenues, up a smidgen, with operating income of 80 million, down 8 percent.

In sum, HPE had $12.2 billion in revenues, down 6.5 percent, and net income of $2.27 billion, up by a factor of 10X. But don’t get too excited. HPE booked a $2.17 billion gain on its asset sale of its H3C server and storage operation in China, and had it not been for that, its net income would have probably been flat. That is progress of a sort with a revenue dip, mind you.

The article states “Under the terms of this deal, HPE will have a 50.1 percent majority stake in the combined HP Software-Micro Focus companies” but this is not correct – HPE Shareholders will own 50.1% of the combined company.