Might doesn’t make right, but it sure does help. One of the recurring bothers about any technology upstart is that they are smaller Davids usually up against vastly larger Goliaths, usually with a broader and deeper set of technologies covering multiple markets. The best way to get traction in one market, then, seems to be to have significant footing in several markets.

This is the strategy that ARM server chip and switch ASIC maker Cavium is taking as it shells out approximately $1.36 billion to acquire network and storage switch chip maker QLogic. The combination of the two companies will have just under $1 billion in revenues, approximately doubling the size of Cavium and giving it an additional $2.2 billion in addressable market to chase in the datacenter, according to Syed Ali, president and CEO at Cavium.

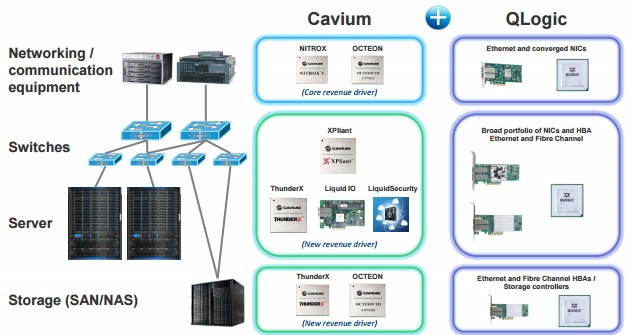

Cavium, which was founded in 2000, got its start making network processors based on the MIPS RISC processor architecture formerly controlled and used by supercomputer maker SGI. The company acquired ARM chip maker Star Semiconductor in August 2008, laying the groundwork for its move from MIPS to ARM cores in its network devices and, ultimately, its expansion into ARM server processors with the ThunderX processors that were announced two years ago and which started shipping in volume late last year. Three months after Project Thunder was unveiled and just after having uncloaked from stealth mode itself, upstart switch chip maker XPliant, which is taking on Broadcom, Cisco Systems, Mellanox Technologies, Intel, and Hewlett-Packard in the datacenter switching space, was snapped up by Cavium.

XPliant had been operating in stealth mode for three years, developing its CNX family of programmable and malleable Ethernet switch ASICs, which are jockeying with Broadcom for a place in datacenter switching and taking on other upstarts like Barefoot Networks, which itself just uncloaked with its Tofino chips. Cavium made an initial $15 million investment to help XPliant get its start and bought the company for $40 million in cash and $35 million in stock. The top-end CNX88091 ASIC has 3.2 Tb/sec of aggregate bandwidth and can drive 32 ports at 100 Gb/sec speeds or 128 ports at 25 Gb/sec speeds, but more importantly, it has features that allow for new protocols to be added to the switch chip on the fly – something that the hyperscalers and cloud builders of the world very much want and that all IT shops will eventually benefit from. Cavium has six companies building switches based on the XPliant ASICs right now, but has not divulged who they are.

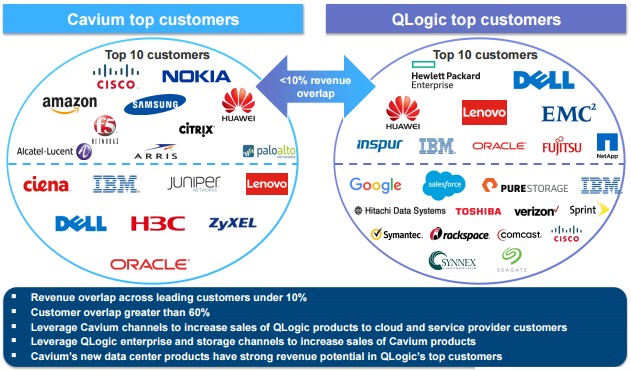

The XPliant acquisition and the investment in the ThunderX line of processors are the largest investments that Cavium had made to date, but they are as much about the future of the datacenter that is currently being created by hyperscalers and cloud builders. The QLogic acquisition is a much bigger deal in that it gives Cavium an established customer base into which it can cross-sell its own Octeon, Nitrox, ThunderX, and XPliant products. Similarly, QLogic sells chips and adapters for Ethernet and Fibre Channel networks (the latter being used for enterprise-style storage area networks that are still very popular), and has its own customer base of OEMs and ODMs.

As Ali put it in a call with Wall Street analysts going over the deal this week, the XPliant and ThunderX chips are beginning to get meaningful revenue, but they do not have a revenue stream (not yet at least) that QLogic does and with Cavium and QLogic having very little overlap (under ten percent revenue across the top customers), the combination creates a “diversified, pure play infrastructure semiconductor manufacturer with exposure to growth markets across compute, networking, and storage.”

In Fibre Channel networking, QLogic has been the top provider based on revenues for the past dozen years, and has been shipping 16 Gb/sec switches and adapters for some time and is now first to market as it ramps 32 Gb/sec parts. This may sound old fashioned, but somewhere between 70 percent and 80 percent of the all flash arrays sold today link to servers through Fibre Channel adapters, according to Ali. And in Asia, which is a few years behind Western Europe and North America in some aspects of IT gear, Fibre Channel switch and adapter sales are ramping fast an QLogic is riding up that wave.

What may be a bit surprising is that QLogic is the number two supplier of ASICs for 10 Gb/sec Ethernet, according to Ali, and presumably the number two behind Broadcom, which was acquired last summer by Avago for $37 billion and which has continued to operate under the Broadcom name. (Broadcom has its own line of “Vulcan” ARM server chips in development, which have not been announced yet, and has approximately 65 percent of the datacenter Ethernet switch ASIC market with its “Trident” and “Tomahawk” families of chips.)

Ali said that QLogic was sampling its own ASICs for supporting the 25G Ethernet standard, no doubt a variant of the one used in the “Big Bear” line of 25G Ethernet adapters we told you about in February. “They have strong design wins for these products at all of the major server OEMs for the 2017 server cycle, which will enable strong growth as these new solutions ramp,” Ali said.

It is not clear what Cavium will do over the long haul with the converged ASICs and switches that QLogic sells, which support both the Ethernet and Fibre Channel protocols. But it seems likely that Cavium will continue selling both types of ASICs as long as customers want them. Of that increased total addressable market, about $1.7 billion comes from Ethernet products and $500 million comes from Fibre Channel products; Ali did not say what Cavium’s addressable market was before the QLogic acquisition, but given what Cavium is trying to do in server and switching, it was already arguably many billions – if not tens of billions – of dollars.

After the deal is done, Cavium intends to mothball legacy products, including Fibre Channel switches that it sells under its own brand, competing against some of its customers. Excluding these products, the remainder of the QLogic business has been growing at about 8 percent per year for the past three years, and Cavium expects to be able to accelerate the growth here above 10 percent going forward for the remaining product sets, which will drive somewhere between $400 million and $410 million in sales. The Cavium believes that it can cut operating and capital costs by around $45 million a year across the combined companies, a savings level that it can reach by the end of 2017 according to its projections. So QLogic will help the bottom line immediately (at least on a non-GAAP basis) and moreso into next year.

Doubling its revenue stream is not coming cheap for Cavium, however. QLogic has $355 million in cash, which helps pay for some of the costs, but to fund the deal Cavium will be using $220 million in its own cash and will be issuing $400 million in new Cavium equity and paying for the rest with $750 million in financing. This debt will be paid down from cash flow over the next several years.

While Cavium is not afraid to take on Intel head-on in datacenter compute with the ThunderX line of ARM server chips, the many-core ThunderX devices are perhaps better suited to take on Intel in storage clusters and storage array appliances where Xeon processors have become the de facto standard of modern machinery, much as has happened with compute in the datacenter. Ali explained that Cavium has had aspirations in storage, but has yet to derive meaningful revenue from it, but with QLogic having a much bigger footprint in storage, the cross-selling of ThunderX chips, particularly variants aimed specifically at accelerating storage workloads and where the hefty Xeon SKU is overkill, present a good opportunity for Cavium going forward.

When the deal is done, Cavium will be a supplier to the top ten server OEMs and the top ten storage OEMs, and it will have not only a presence among hyperscalers, cloud builders, and service providers, but also among enterprise customers that QLogic has catered to for many years. It will also have a much more mature software stack in certain areas, such as for network adapters. The QLogic adapters have a rich stack, for instance, that supports Windows, Linux, and other platforms, and this is something that Ali said might take Cavium five to seven years to create for its own LiquidIO network adapters, which are popular with hyperscalers and cloud builders. Now, this stack can be moved to the LiquidIO hardware, enabling it to accelerate sales of these adapters into the enterprise.

Ultimately, this deal is all about access to the enterprise storage customer base through the OEMs that QLogic has long relationships with. “The customer relationships that QLogic has will allow us access, and access is one of the big needs before you can win a design into companies like EMC, NetApp, and others,” said Ali. “So we are very, very excited about the potential in the storage market.”

The obvious question is how big is big enough, with Intel utterly dominating compute, holding much sway over storage, and increasing its efforts in switching. If you look at it from the point of view of the datacenter, Qualcomm does not do switching and has aspirations in compute with its future ARM chips (which remain unnamed external from the company), but it has deep pockets and a very large business selling chips for mobile devices. Applied Micro has its own networking business, which is funding its expansion into servers with its X-Gene product line, but with $159.3 million in sales for its fiscal 2016 year ended in March, Applied Micro is shrinking, has been spending huge sums on research and development that has pushed it into the red for several years, and is now about one fifth the size. Cavium has also not been profitable in the past four years, mostly due to its own ambitious R&D program, but it has been growing, with sales of $259.2 million in 2011 and hitting $412.7 million in 2015.

The irony is that Cavium and Applied Micro are making the most noise and getting the most footing with the ARM server chips, and Qualcomm and Broadcom, which are much larger companies, will potentially benefit from all of the efforts of their smaller and innovative rivals.

With the QLogic buy, Cavium has increased its odds for success and its ability to put together a larger R&D team that can potentially address both the hyperscale/cloud and enterprise parts of the IT market. It is a pity that it would cost something on the order of $15 billion to buy Xilinx, because if Cavium had compute, networking, and FPGAs it would be a very interesting combination indeed. Xilinx had sales of $571 million in fiscal 2016 ended in April with $145 million of net income. Xilinx has $3.34 billion in cash and investments, and maybe what should really happen is that Xilinx should buy Cavium once the QLogic deal is done and create an even larger and diversified semiconductor company focused on the datacenter.

Qlogic is heavily committed developing into the Open Power Consortium where Cavium now splits to hedge Thunder competitive emphasis across 2 platform camps? Intel x86 and Power, that shows more compliment subsystem momentum when ARM camp still takes on everything.

Where Cavium, and all the large multi cores, truly requires system bandwidth including too support real time in-memory analytics.

Appears Cavium is striking out on its own in relation to the Mellanox et al in ARM movement. And do I smell an Intel law suit, near future, challenging the Omnipath substitute?

Mike Bruzzone, Camp Marketing