IT managers at the world’s largest organizations have a lot of reasons to envy hyperscalers, including the fact that they seem to be flush with cash and it looks like they can buy or build just about anything their hearts desire.

While hyperscalers have to cope with scale issues, they do not have as much complexity, so they can pick a technology and run with it. Enterprises, on the other hand, are merging and acquiring all the time and have lots of silos of existing applications that cannot be thrown away.

The need to support existing as well as new applications is what drove the creation of the Spring framework for Java applications, which VMware acquired in August 2009 for $362 million and in April 2011 turned around and open sourced as the Cloud Foundry project under the guidance of Google and TIBCO Software distributed systems expert Derek Collison (founder and CEO of platform cloud provider Apcera these days). Over the years, Cloud Foundry has evolved from a Java framework to a full-blown platform cloud that supports a wide variety of languages and is a contender to be the focal point of software development and management at large enterprises.

This is precisely what VMware was hoping for when it created the Pivotal software unit back in late 2012, which brings together Cloud Foundry, its former Hadoop distribution (which now relies on code from Hortonworks), the Greenplum parallel database, the GemFire NoSQL datastore, and the HAWQ SQL overlay for Hadoop. Of all of the bits of Pivotal, which is about to become part of what is now called Dell Technologies through the $67 billion acquisition of EMC (which owns most of VMware and most of Pivotal), it is probably Cloud Foundry that has had the most effect on the industry, particularly among large enterprises that are looking for something to give them the kind of control and agility that hyperscalers have in their stacks.

This is attested to by the fact that General Electric pumped $105 million into Pivotal as part of that spinout four years ago, and this week Ford, which also wants an agile platform on which to run its applications, led Pivotal’s Series C funding round of $253 million this week, with Microsoft, GE, EMC, and VMware all kicking in some of those funds. It is not clear how much money Pivotal has raised with its other two rounds, but the chatter on Wall Street is that Pivotal now has a valuation of around $2.8 billion, making it not only a unicorn but another software feather in Dell’s cap that makes EMC worth shelling out $67 billion for. (VMware is something of a cash cow, too, and EMC’s wide and deep storage business is no slouch, either.)

Although Pivotal is not a significant piece of the EMC empire, the company does talk a bit about it. Pivotal has over 2,000 employees and booked $83 million in sales in the first quarter of this year, a 56 percent increase compared to the year ago period; the company’s annualized recurring revenue was $116 million in the quarter for the company’s two flagship products, Cloud Foundry, its platform cloud, and Big Data Suite, the mashup of all of the other components that Pivotal sells. That’s more than triple from a year ago, and Pivotal added that Cloud Foundry has a an annual revenue bookings run rate above $200 million and Big Data Suite has created above $100 million in the first quarter.

Pivotal is working with about a third of the Fortune 100, with GE, Ford, Verizon, Home Depot, Comcast, Humana, Lockheed Martin, and Allstate being marquee customers. (We know that BNY Mellon, JPMorgan Chase, Daimler, Siemens, and Hertz are Cloud Foundry users, but we don’t know if they are Pivotal customers or not.) Seven of the top ten banks in the US are using Pivotal tools, as are three of the top five global automakers and five of the top ten telecom companies.

But Cloud Foundry is bigger than Pivotal, and in fact, a number of other companies actually beat VMware to market with commercialized variants of Cloud Foundry. Since the formation of the Cloud Foundry Foundation, which was created in February 2014 and which takes its inspiration from the governing body that manages the open source OpenStack cloud controller project, some heavyweights like IBM, Hewlett Packard Enterprise, SAP, and Intel have backed this particular open source platform cloud horse, with the first three putting together their own distributions, respectively called BlueMix, Helion Cloud Foundry, and HANA Cloud. GE has its own distro called Predix, and Swisscom, CenturyLink, Huawei Technologies, and a number of others have services based on Cloud Foundry, too.

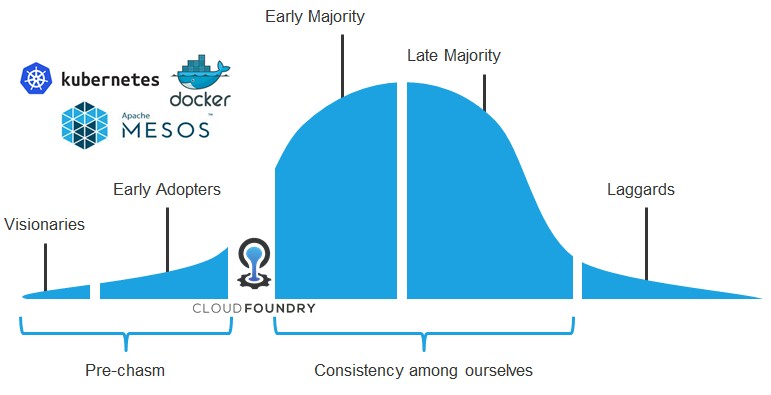

The way that Chip Childers, vice president of technology at the Cloud Foundry Foundation, sees it, Cloud Foundry is crossing the chasm like OpenStack is currently doing (to use a metaphor coined by Geoffrey Moore), has but which emerging technologies for managing infrastructure such as Mesos and Kubernetes have not yet.

There are plenty of people who would argue about what has and has not crossed the chasm of the four technologies mentioned above, and we would say that they all have great potential and have not been widely commercialized as yet – certainly nothing on the scale of VMware’s ESXi, Microsoft’s Hyper-V, or Red Hat’s KVM server virtualization hypervisors, which are the basis for infrastructure clouds. We would add that the evolving Docker stack and Red Hat’s OpenShift are also contenders at the platform layer, particularly as the center of gravity is switching from virtual machines to containers in the software development community.

Childers tells The Next Platform that Cloud Foundry, as a project, has two challenges. The first is to remain consistent across the various Cloud Foundry distributions and services that are out there, and the second is to make the case for Cloud Foundry in a world with all of these alternatives to packing up software and managing their deployment and runtime. To that end, the foundation is putting together its first user survey to try to get a handle on what is going on out there among Cloud Foundry users – something that the OpenStack community has done really well over the past four years. When asked about basic demographics for the installed base was for Cloud Foundry, Childers was perfectly honest and said that the foundation did not know.

Cloud Foundry is multi-tenant by nature, so in a typical organization, companies have one cluster running it. For compliance reasons, sometimes development teams are separate from production workloads on separate clusters, and sometimes an organization has separate Cloud Foundry clusters to keep data and apps isolated for security and auditing reasons. Childers says having one cluster is far more common, however, among users in production, and this stands to reason given that the whole point of a platform cloud is to create a single, elastic runtime for applications. While there are a healthy number of companies that grab the open source Cloud Foundry code and self-support, most organizations using Cloud Foundry are going with a distribution with formal tech support, as far as Childers knows from interacting with customers.

One of the biggest factors driving Cloud Foundry platform cloud adoption is not just the agility that comes through the automation of the runtime for distributed applications, but the idea that Cloud Foundry can be a substrate that runs across private clouds and multiple private clouds.

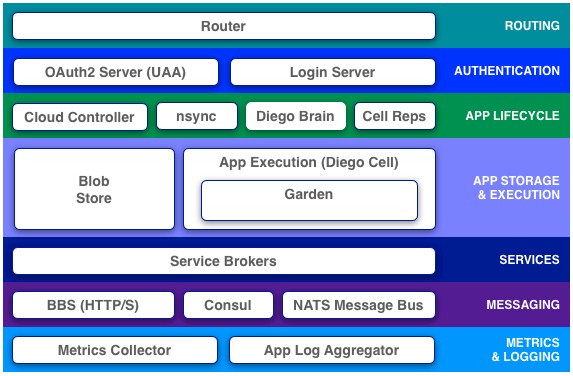

Here is how Childers characterizes the situation: “People are looking to find a way to allow a platform to service their application teams and do all of the undifferentiated heavy lifting – aggregating logs across the application portfolio, or knowing that if they push five instances of an application out there, five instances are actually running, or in-bound traffic routing – instead of piecing together a whole bunch of different technologies that were not designed to work together cohesively. They want a system that will work on any infrastructure platform, and maybe they will use multiple, and it will give a consistent and straightforward experience to the application team.”

The main competition for Cloud Foundry is not OpenShift or other platform cloud services, but organizational inertia, says Childers. “Once a company gets over the initial hurdle, they deploy more and more Cloud Foundry and applications on top of it. Inertia is a big problem that we run into, and with Amazon Web Services, a monopoly cloud is the other big competition. Our users are concerned about that. Although there are a lot of benefits that companies can get from the services that the megacloud providers might offer, you are only really going to get that experience from that one vendor. And so they really do like the idea of letting those megaclouds exist to create commoditized infrastructure – let them worry about the capital – but at the same time they want flexibility and Cloud Foundry is very good at running on those clouds.”

The two core elements of Cloud Foundry are BOSH, which is a distributed systems application deployment platform that has been broken free and is seeing some uptake independently of Cloud Foundry. (As we have discussed in the past when talking about the possible components of the next modern platform.) Over top of this is the elastic runtime layer that converts BOSH into a platform cloud. Even before Docker containers were invented, Cloud Foundry had come up with its own container system, called Warden, and the current Garden Linux container is a direct descendant of it. There is also a Garden Windows container that is capable of running .NET applications for Windows Servers. The community is putting the finishing touches on a new container scheduler code-named “Diego” and over the long haul, Cloud Foundry will support the container format established by the Open Container Initiative, which it is instrumental in.

Be the first to comment