The American landscape is littered with dead malls – once-thriving shopping centers now abandoned, filled with rubble, with empty department stores and food courts echoing with the ghostly shouts of 1980s teenagers in acid-washed jeans and big hair.

A few years ago, VMware was looking like it would soon join the dead mall of technology companies. VMware’s business was built on virtual machines running in datacenters, but enterprises were moving fast to the cloud and later to containerized applications orchestrated by Kubernetes, either on the cloud or in on-premises datacenters because they needed a substrate that could support applications on both.

Faced with comparable industry transitions, past industry titans – remember Digital Equipment Corp? – dug in, insisted the new technology was a fad, and joined the dead mall. Microsoft almost went that way – it spent a decade cherishing its Windows/Office engines, generating mountains of cash for investors but getting pounded by upstarts Google, Amazon, and Apple before doing an about-face and becoming a leader in the cloud.

VMware’s top brass sneered at Amazon in 2013. Carl Eschenbach, then VMware president and COO, dismissed Amazon as “a company that sells books” that VMware and its partners could “collectively beat.” Pat Gelsinger, VMware’s chief executive officer at the time, told partners at that if “a workload goes to Amazon, you lose, and we have lost forever.”

But Gelsinger also said: “We want to own the corporate workload. Own the corporate workload now and forever.” That sounds, in retrospect, like the seed of a potential alliance with Amazon, where VMware could own the workload even when the workload had moved to the cloud.

Just that has emerged as a pillar of VMware’s strategy beginning in 2016, when VMware and former enemy Amazon announced a partnership to run VMware workloads on Amazon Web Services. It already had a partnership with IBM at the time, and later announced partnerships with cloud leaders Microsoft, Google, and Alibaba.

VMware decided to get ahead of the container threat, supporting the newfangled technology as well as VMware’s traditional virtual machines. Though VMware made a false start there, creating its own container technology, it eventually embraced the new industry standard Kubernetes for container orchestration. We can’t blame VMware for the false start; Kubernetes was unexpected, kneecapping once-hot startups such as Mesosphere and Docker that, like VMware, were developing their own container managements stacks.

Last year, VMware launched its strategy, with software called “Project Pacific” and “Tanzu,” to add Kubernetes support to its flagship vSphere server virtualization software, along with tools to develop applications for both containerized and virtual applications on private, public and hybrid clouds. Today, VMware releases products to serve that strategy. Additionally, the company is laying out a vision for how more than a year of acquisitions – including some big-ticket purchases – will integrate into VMware’s strategy.

VMware had planned to deliver this milestone news in a high-profile, two-day event for journalists and analysts in San Francisco and VMware’s headquarters in nearby Palo Alto, California. VMware canceled the event a week ago, citing concerns over COVID-19. The associated announcements, however, move forward.

Kubernetes On The March

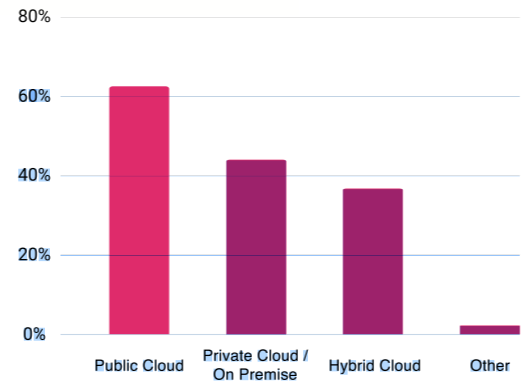

VMware’s Kubernetes support comes as enterprise support for the technology explodes. Some 78% of survey respondents are using Kubernetes in production, “a huge jump from 58% last year,” according to a September-October 2019 survey by the Cloud Native Computing Foundation, which sponsors Kubernetes and other cloud technologies. “Public cloud is the most popular datacenter approach, chosen by the majority of respondents – 62 percent in 2019 and 77 percent in 2018,” the CNCF says.

Hybrid is the choice for 28 percent of respondents, indicating wide support, says CNCF – good news for VMware, which relies on hybrid cloud for its strategy.

Some 84 percent of respondents are using containers in production, “an impressive jump from 73 percent in 2018, and from 23 percent in our first survey in 2016,” the CNCF says.

VMware bills its strategic shift as “app modernization,” combining new containerized and legacy applications — meaning applications running on VMware’s virtual machines.

To fuel that transition, VMware has made a series of acquisitions in the last two years or so, and it’s highlighting the outcomes of those acquisitions this week.

Among these acquisitions were Heptio, acquired in 2018, which provides products and training, support and professional services to help organizations deploy and operate Kubernetes; the purchase price was $550 million. Also acquired was Bitnami, which distributes libraries of containerized virtualization software, last year. Additionally, VMware acquired Kubernetes specialists Pivotal Software last year, for $2.7 billion. VMware was already partnering closely with Pivotal on Kubernetes and container deployments; the two companies were both majority owned by Dell Technologies (as VMware still is). At the same time, VMware acquired Carbon Black for enhanced security, for $2.1 billion.

All those acquisitions are integral to VMware’s app modernization strategy, announced today.

Kubernetes Is Critical

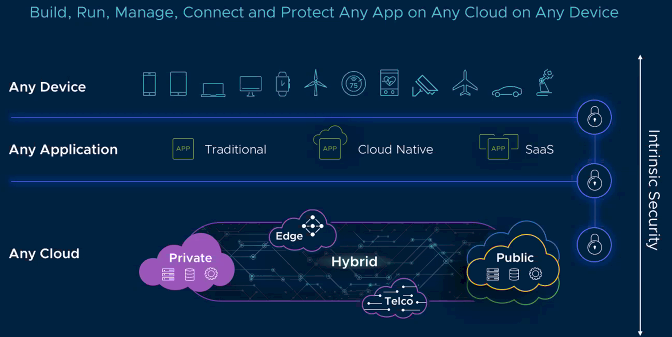

And Kubernetes support is key to VMware’s “any device, any application, any cloud” strategy, Gelsinger says, speaking on a webinar Friday to provide advance briefing of this week’s announcement for journalists and analysts. VMware’s Workspace One provides device management, for the “any device” part of the slogan.

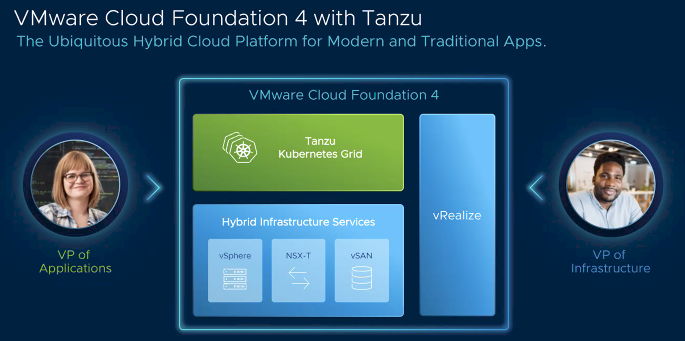

This week’s debut bolsters the “any application” part of that strategy. VMware is making a bid to be “the ubiquitous, essential infrastructure to enable our customers’ digital transformation,” Gelsinger says.

And VMware already has partnerships in place with Amazon, Microsoft, Google, and Alibaba, as well as private and public cloud support, for the “any cloud” part of the slogan. Kubernetes support and other app modernization updates today bolster the company’s cloud integration.

Application modernization is something that all enterprises are concerned with, large and small. Every vertical industry, including financial services, healthcare, pharmaceuticals, and retail, is dealing with two current disruptions, VMware research and development vice president Craig McLuckie – who was one of the creators of Kubernetes at Google along with Joe Beda, who co-founded Heptio with McLuckie and who is now part of the VMware collective. Business is becoming ever more software driven, whether that’s financial services companies fending off new, online-based banks; retailers competing with online stores; or auto manufacturers building more intelligent vehicles.

The ability to “use software efficiently and improve developer productivity is an absolute imperative,” says McLuckie. And enterprises need to make better use of the cloud and network edge, and the issue is that integrating these new technologies with legacy is difficult, but organizations need to “bridge back to the existing environments that they’re living in,” McLuckie says, adding that integrating those technology environments is the goal for the VMware Tanzu portfolio, McLuckie says.

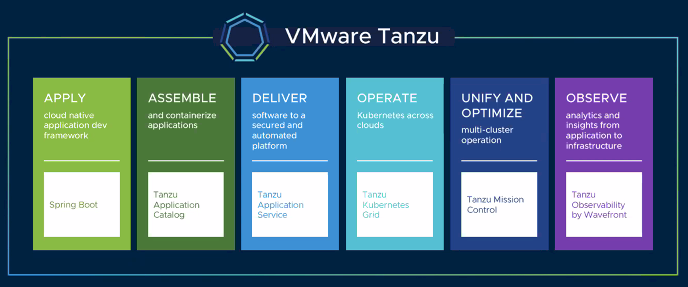

Tanzu is VMware’s platform for building applications fast, running Kubernetes, and managing the entire application footprint. The Tanzu portfolio is designed to provide consistent support for VMware vSphere, as well as Amazon Web Services, Google, and any of the other hyperscalers.

“We look at this as a complete stack for traditional and modern application modernization…. providing the ability to construct a common substrate in which applications can be deployed, delivering the capabilities to centrally manage the things that need to be managed at scale, and then delivering a robust set of tools that unlock developer productivity,” McLuckie explains.

Tanzu includes a variety of programs, including Spring Boot to create standalone, production-ready applications. Tanzu also includes an application catalog, and operations, optimization and observation tools provided by Wavefront, which VMware acquired in 2017.

VMware is “all in on Kubernetes,” says McLuckie. “We see this as being an incredibly powerful unifying force in the in the industry today.” Kubernetes “provides an elegant way” to span vSphere, the public cloud and network edge.

“We look at Kubernetes as being this Goldilocks abstraction, high enough to hide away the specifics of infrastructure, low enough to be able to run pretty much anything,” McLuckie says.

Tanzu Kubernetes Grid, a component of the Tanzu portfolio, includes essential elements to modernize applications, providing lifecycle management to make it easier to consume Kubernetes, McLuckie says. Kubernetes Grid extends Enterprise PKS, Pivotal’s Kubernetes toolset. Kubernetes Grid goes beyond PKS by integrating with the vSphere product base and spanning the public cloud and network edge.

As part of the modern apps strategy, the new Tanzu Applications Catalog provides access to a variety of open source applications that have been curated for security, maturity and overall readiness for the enterprise data center, McLuckie says. The applications catalog is based on VMware’s Bitnami acquisition.

vSphere Meets Kubernetes — Again

A big part of VMware’s app modernization strategy is focused on vSphere, which is the fancy name for the ESXi hypervisor plus the vCenter console that manages it. “What we’re doing is fundamentally modernizing vSphere itself,” said Kit Colbert, vice president and chief technology officer of VMware’s Cloud Platform Business Unit. “We’re architecting it to integrate with Kubernetes. This is a pretty foundational change.”

VMware announced Kubernetes integration with vSphere at its annual VMworld developer, customer and partner conference last year, as Project Pacific. VMware is now delivering that integration in vSphere 7.

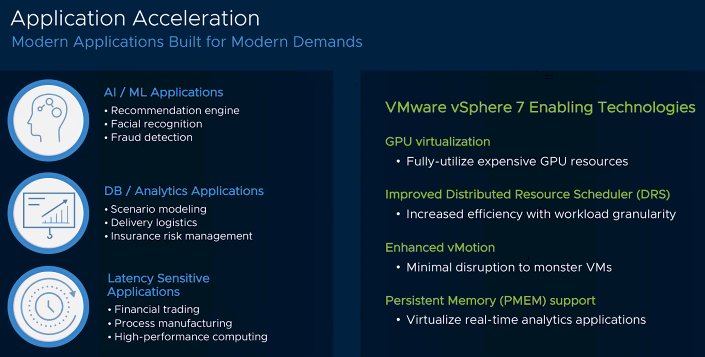

“What this can provide is a really versatile platform that can support not just a company’s existing applications, but also the new ones that they’re building as well,” Colbert said. Those new applications, including AI and machine learning, are being built with Kubernetes, while existing applications are built with virtual machines. vSphere supports the IT operations team as well as developers.

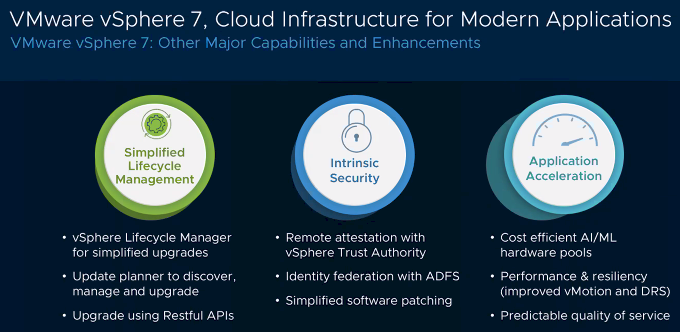

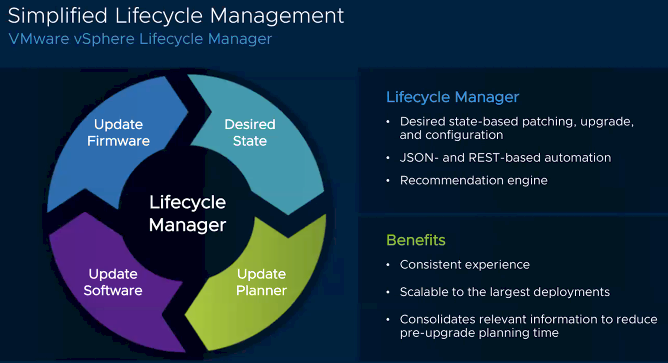

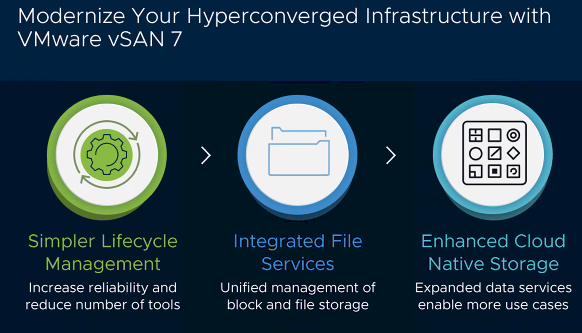

Simplified lifecycle management tools are designed to support the needs of today’s enterprises, who need to manage hundreds or thousands of vSphere instances at scale, with automated APIs.

Additionally, vSphere 7 provides security and application acceleration capabilities, Colbert says.

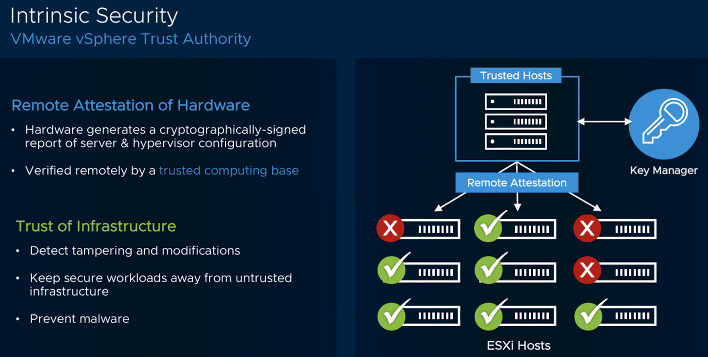

Operators can use trusted hosts to approve other hosts. Hosts that are locked down and physically secured, with access from only a small group of trusted administrators, can then attest to the security of other hosts on the network, demonstrating that they haven’t been modified and can run securely and safely. Additionally, vSphere 7 can perform certificate management, identity federation, and operate in the cloud, on premises, and on the edge.

vSphere 7 optimizes for AI, using technology VMware scooped up with its acquisition of Bitfusion last year, to help customers get better use of their GPU infrastructure. GPUs are currently located in silos around the enterprise, and underutilized; Bitfusion can merge those silos into a single pool of capacity that any authorized app can use, Colbert said.

The Bitfusion capability brings VMware and vSphere full circle – just as the company’s virtual machines allowed data center operators to optimize server resources and use underutilize capacity, Bitfusion allows enterprises to optimize GPU resources.

Building A Cloud Foundation

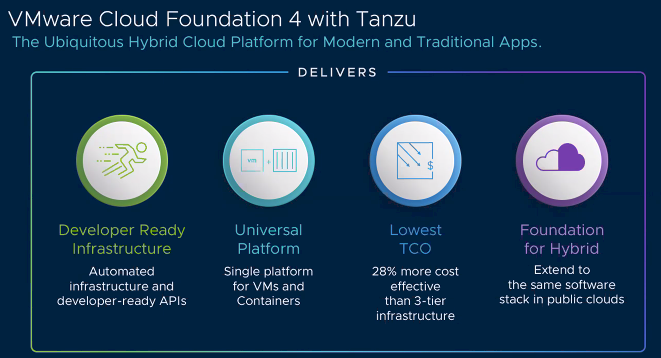

Additionally, VMware rolled out Cloud Foundation 4 with Tanzu, to enable operators to deploy components and manage application lifecycles. It includes lifecycle management tools, vSphere application server, NSX-T application networking, and vSAN storage networking.

Cloud Foundation 4 includes an upgrade to vSAN for storage networking, with updated NFS 4.1 file services and enhanced cloud native storage.

The Competitive Landscape

VMware faces tough competition here; particularly with IBMs $34 billion acquisition of Red Hat last year, giving IBM its own strong Kubernetes, multicloud platform with OpenShift.

VMware sees a half-dozen Kubernetes platforms: In addition to itself and IBM, it also sees Google Anthos, Amazon Web Services, Rancher and other startups providing their own offerings. “VMware’s position here is we are enterprise grade, at scale, and a proven brand,” Gelsinger says. Moreover, it integrates with AWS, Microsoft Azure, Google and Alibaba. A big percentage of OpenShift runs on VMware, and Gelsinger says he recently affirmed the OpenShift partnership with IBM’s new CEO, Arvind Krishna, who took the top spot in January.

With VMware’s Tanzu and Cloud Foundation announcements this week, the company lays out a strategy for bringing the company forward into the cloud and Kubernetes era. But incumbent vendors have always had a lot of difficulty making that kind of paradigm shift, and VMware faces tough competition. We’ll be watching to see how this plays out. So far, VMware has taken a number of different stabs at containers, and it has not gotten a lot of traction for its approaches. Remember Photon Platform and vSphere Integrated Containers and VMware Kubernetes Engine? We do.

Mitch Wagner is a veteran technology journalist and content marketer, formerly executive editor of Light Reading and Informationweek. He writes, he edits, he hosts podcasts, video and webinars, and he’s active at mitchwagner.blog, @mitchwagner, linkedin.com/in/mitchwagner/ and Mitch Wagner’s Newsletter. He lives in San Diego with his wife and too many pets. Email Mitch at mitch@mitchwagner.com.

Thanks for the clear roadmap. I will share with my students.

Small correction: The vmware cto’s name is Kit Colbert, not Kip.