When we talk about the major cloud players, Amazon, Google, Microsoft, and to a lesser extent, Rackspace Hosting and a few others tend to dominate the conversation. Interestingly, although it is a robust, well-supported and rich environment for a range of enterprise applications, the IBM SoftLayer cloud tends to get lost in the shuffle.

Granted, unlike those aforementioned providers, IBM doesn’t have the colorful infrastructure building story that starts from the ground up like Amazon does. They lack the startup appeal of a company like Google. They are on par with Microsoft in terms of a long-term application base for existing users, but were behind Microsoft in quickly cobbling together and marketing a public cloud offering. So if all of this is true, what does it mean for the future of IBM’s cloudy ambitions when so much of their focus, not to mention outward messaging is focused on cognitive computing and their growing Power systems business, along with OpenPower Foundation efforts.

.

Hotel giant Marriott is adopting a hybrid cloud environment to offer faster digital services to web-savvy guests and uncover insights about traveler preferences for its more than 4,000 properties across the globe.

.

Tractor Supply Company the largest rural lifestyle retail store chain in the United States, is working to revamp and migrate the company’s online retail operation to a hybrid cloud solution from IBM. This will give customers an easier way to connect, browse and shop for goods.

IBM’s cloud strategy, in the wake of the above statements, is to focus on what they have always done best—catering to large customers with an enterprise-grade, robust, and fully integrated stack from top to bottom, including the critical management and orchestration layers. To do this, and to serve those customers at the very top, however, means dissociating from public cloud as a key enabler. Rather, IBM is recognizing the needs for its upper-tier customers to keep a blend of in-house and cloud-based systems and software. In other words, by taking the hybrid cloud approach and moving from systems to services in a way we have not seen to date.

Just to level set, let’s take a quick look at the skin IBM has in the cloud game. It’s more than meets the eye, but this scattered nature of its offerings might be just the trouble. It’s difficult to tell where new and old services meet; where the SoftLayer cloud and their Bluemix cloud base interweave, and more important, what applications and frameworks mesh with all of this and in what contexts.

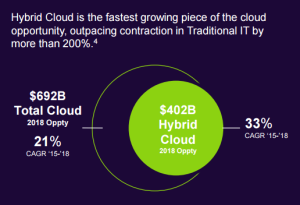

IBM is seeing the cloud opportunity in a slightly different way than some of its competitors in the public cloud space. Given their historical reach into large-scale enterprise with existing applications and systems, their strategy is wrapped around hybrid cloud. Accordingly, they are lining up their portfolio to match the needs of large customers who have some workloads running on-site, some in IBM’s cloud datacenters, and others that seamlessly scale between the two with IBM Platform Computing as the orchestration layer.

However, despite the mixed messaging among its many products distributed across its sweeping cloud territory, IBM appears to be gaining ground and pulling together a stronger story for customers, which now include the likes of Siemens, VMware, and Bell Canada for cloud-based analytics, Medtronic, Apple, CVS, and others for IoT initiatives, and perhaps most important in terms of revenue, a total of 70 $100 million contracts for hybrid cloud (in 70% of the cases), which includes broad adoption by insurance giant AIG, healthcare behemoth, Anthem, and most recently, a $200 million deal with the largest telco in Indonesia, Indostat.

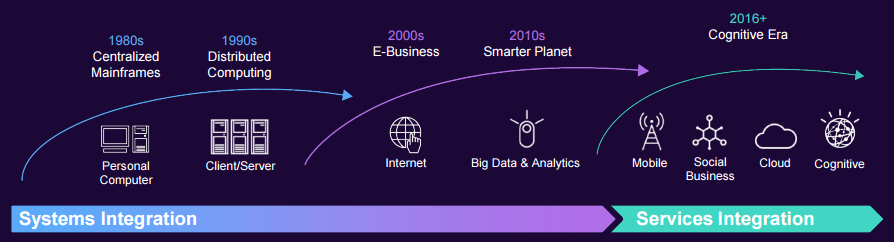

Ultimately, these and other moves add up to a total of $10.2 billion in cloud revenue for IBM across 2015, as the company reported during its Investor Day event. The big money is being driven by hybrid cloud, which the company claims is the real enabler for their enterprise push in 2016 and beyond. More specifically, IBM is transforming its approach, moving from “systems integration to services integration” by focusing on both hybrid cloud and software as a service, both of which focus the analytics lens on their cognitive computing portfolio, which includes Watson as well as related analytical services tied to both Bluemix and SoftLayer to aid developers and IT managers. IBM execs laid out the trajectory for 2016 and the lead-up in the chart below, which as you can see, emphasis integration between far more sources, all of which are being viewed as falling into the cloud services camp—from its analytics, IoT, mobile, and related businesses.

To add further weight to the new vision IBM is rolling out for its cloud, consider also the investments that were made in 2015, including the addition of 65 new cloud services, which will run in one of the company’s 46 datacenters—eight of which were completed in 2015. To round out ecosystem, IBM claims there are over 20,000 new developers each week on Bluemix. Key partnerships, including those with VMware, whose customers are now able to branch their VMs out to the IBM cloud, and projects like WebSphere Connect, which lets developers pull in their own data and applications are opening the path to broader adoption, as are efforts like the GitHub Enterprise as a Service offering and Watson services. Over the course of 2015, the company finished moving all of its widely used software to the cloud and initiated 235 million instances of WebSphere to support those over the year.

In short, while we are always watching as IBM rolls out new services and extensions for enterprise customers and developers, meshing this into a cohensive picture of the distributed offerings is an ongoing challenge. This might be because IBM itself has been trying to configure the many pieces and moving parts that form its future, but armed with two large toolsets–their Watson analytics push and the realization that hybrid cloud is path to the future, 2016 might be the year that the IBM cloud story resolves itself and makes a much grander, more cohesive entrance into this pressurized cloud atmosphere.

IBM is going the right move here by putting always the client first and moving them to the hybrid cloud, providing full flexibility.