One of the reasons why we have been watching Nutanix since it dropped out of stealth mode in August 2011, two years after being founded, because we had a hunch that the upstart maker of a server-storage half-blood than banned the SAN from the datacenter would transform itself into a platform. Perhaps like the proprietary and Unix platforms – with custom hardware, operating systems, middleware, and databases – that we saw sweep the datacenters of the world in the 1980s and 1990s.

At the time back in 2011, it looked like not only could this emerging Nutanix Complete Cluster sell to hundreds of thousands of midrange and large enterprises and their government and academic counterparts, but it could scale from a few nodes to thousands of nodes with what came to be called hyperconverged infrastructure and provide something as easy to use as the proprietary minicomputers of days gone by or the Apple products sold to consumers. Something that could compete with the Linux and Windows Server stacks, and yet also wrap around them, automate them, and lower their cost when run at scale.

With the combination of virtualized compute and virtualized storage, Nutanix had the foundation of creating a true platform. One that is absolutely not like the disaggregated compute and storage of the hyperscalers and cloud builders, linked by Clos networks, but one that end up giving the same kind of cloudy appliance feel just the same at the user interface.

The original Nutanix appliances had their issues, and that limited their appeal. This is the nature of a startup.

For one, back in 2011, it cost $115,000 for a four-node cluster, or if you want a better indicator of scale, just over $2 million for a rack with 72 nodes comprising a modest 576 cores. Second, the Nutanix stack did not allow compute to scale independently from storage, but eventually Nutanix fixed this issue and made its software available on popular OEM platforms as well as on the cloud. After complaints about the high cost of the VMware middleware upon it largely depended, Nutanix added its own Acropolis variant of the KVM hypervisor – obviating the need for VMware’s expensive ESXi hypervisor – and when the Kubernetes container controller took off, it added this to its stack as well as virtual networking. Admittedly, this is a lot. And as this was all happening, five years ago Nutanix started shifting from hardware and perpetual license software sales to subscription-only software sales.

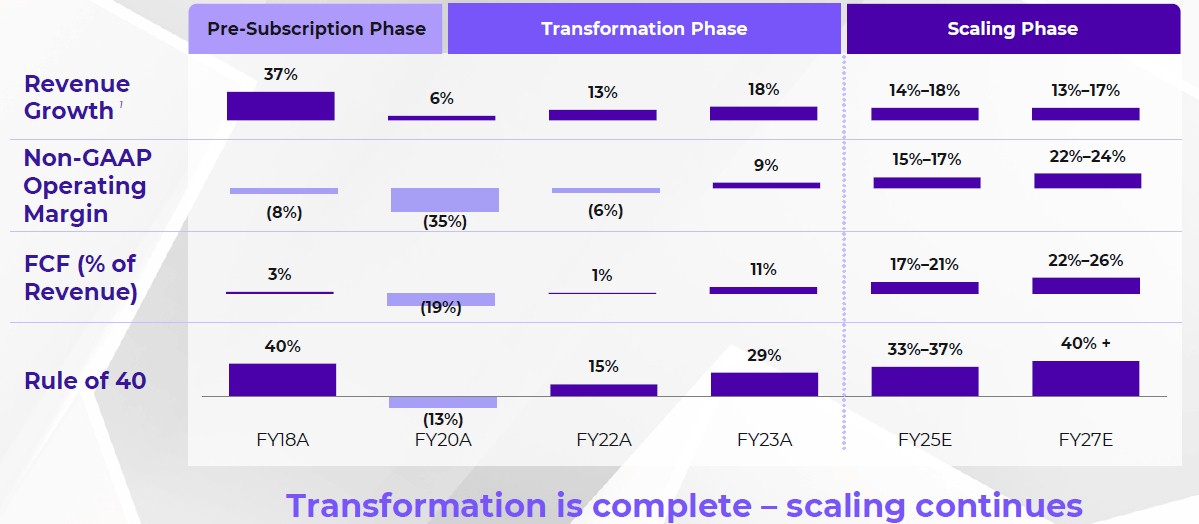

All of these transitions are largely done, and based on what the Nutanix top brass said this week at its annual Investor Day conference, it looks like Nutanix has a path to profitability – and will reach that long-awaited goal perhaps in the next few years.

Should it come to pass, it will have taken nearly two decades to build a Nutanix base large enough to actually pay the bills and pocket some income after the fact. Not many companies have the luxury of taking that long, but apparently Nutanix does. Wall Street sometimes exhibits extraordinary patience, as it has done with both Nutanix and its all-flash storage coterminous compatriot, Pure Storage. Go figure.

By The Numbers

It has been a few quarters since we took a look at the financials of Nutanix, and the Investor Day this week gave us the excuse to circle back and see what has happened and also to talk about what the forecasts are looking ahead through fiscal year 2027.

It is not every public company that puts a roadmap for products or earnings out, and Rajiv Ramaswami, chief executive officer at Nutanix for nearly three years after the exit of company co-founder Dheeraj Pandey exited stage left, must be pretty confident in both the financial roadmap from Nutanix to even bring it up at all. But to be honest, at this point the roadmap to profits is more important than a roadmap of products. At this point, after all the years of transitions and losses, this is about execution. The good kind, not the bad kind.

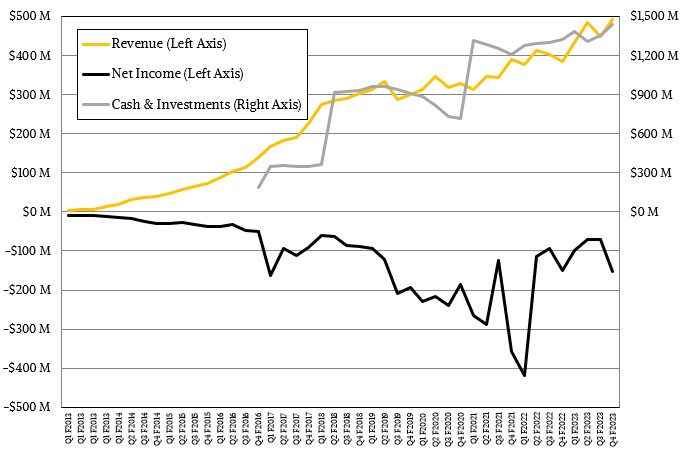

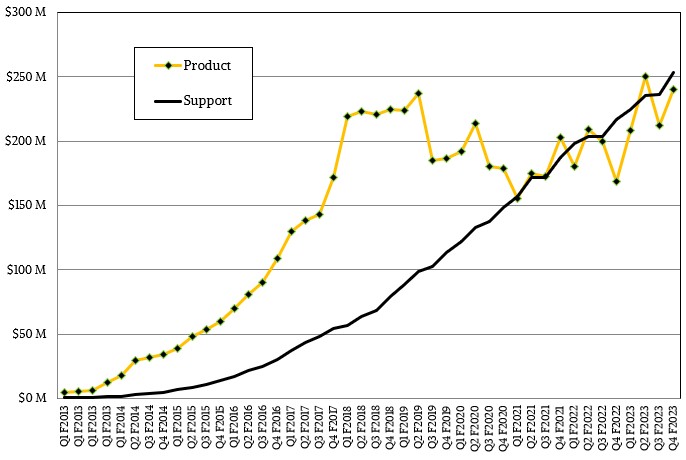

In the quarter ended in July, which is the end of the fiscal 2023 for Nutanix, the company posted $240.5 million in product sales, up 29.8 percent, and support revenues of $253.7 million, up 14.6 percent. The company’s cash hoard grew by 7.9 percent to $1.44 billion. If you didn’t know about the losses, then you might think Nutanix was doing great. And we are not saying that it isn’t, considering the circumstances. The fact is, as you can see from tracking that net loss black line, which really should be a red line now that we think on it, things are getting better. Nutanix is losing less money than it has in the past, and that is because it is growing revenues within its existing customer base as well as adding around 500 customers a quarter to boost that customer base.

Given the size of the IT sector – some 50,000 large enterprises, HPC centers, cloud titans, and large governments and maybe 10X to 20X more midrange customers who make tens of millions of dollars or more in sales a year and tens of millions of smaller firms – we would have expected for Nutanix to have had at least 250,000 customers by now – roughly the size of the IBM AS/400 base, the DEC VAX base, the HP 3000/9000 base, or the Sun Microsystems Sparc/Solaris base in their heydays – and be adding 5,000 customers a quarter until it reached that level.

We have been singing this song for a couple of years, asking if hyperconverged storage is so good then why is it not more pervasive and profitable and also noting that at its current size – market capitalization that averages from $8.5 billion to $9 billion but which has been as low as half that in mid-2022 – about the only companies that could afford to buy it are big cloud builders or ones like Cisco Systems or Dell or Hewlett Packard Enterprise that would not want to do it.

And so Nutanix grinds it out, and intends to keep doing so. For which we have a lot of respect. But at the same time, Nutanix has raised a cumulative $1.1 billion in venture funding and raised $390 million from its initial public offering, which is pretty much still all in its bank account. So Nutanix is by no means a big spender in this regard – it is frugal as all get out. If you look at the past 44 quarters where we have financial data, Nutanix has generated $6.14 billion in sales from August 2012 through July 2023. Put those in the plus column. In the negative column, it spent that $6.14 billion to run the company and then spent an additional $4 billion plus a tiny bit because those are its cumulative losses. That’s $10.15 billion in the minus column.

Some of those losses, by the way, have been driven by stock-based compensation, but that figure is coming down. In fiscal 2021, such compensation – giving shares to employees in lieu of cash, but which get booked like cash coming off the books, represented 26 percent of revenues. This dropped to 22 percent of revenues in fiscal 2022 and to 17 percent in fiscal 2023, and importantly, the company is projecting for it to fall to under 10 percent of revenues in fiscal 2027, which will end in July of that far-off year four years from now.

Now, let’s talk about the future.

Let’s start with the so-called “Rule of 40” that is used by venture capitalists to do a quick health check on software companies and that Nutanix is going to hew to as it looks ahead. The rule of 40, which was popularized around 2015 according to this report from Bain & Company, is simple to say but there are an infinite number of combinations to get there: The addition of revenue growth rate and profit margin should be higher than 40.

What it means is that when you grow fast, you don’t have to have high profits, but when you grow slow, you must find ways to continually exact more profits than you did before. (If we say slowly, why don’t we also say fastly?) You have to adapt, you can just spend your way to profits forever, as Nutanix and Pure Storage have been allowed to do – and to a certain extent, the Amazon online business has always done. The heat is off Amazon because AWS is a profit engine. But the underlying retail business has never been particularly profitable. You can find your way along that 40 percent combined solution space, adjusting it as need be. But generally, as you get bigger, you have to get smarter at extracting profits.

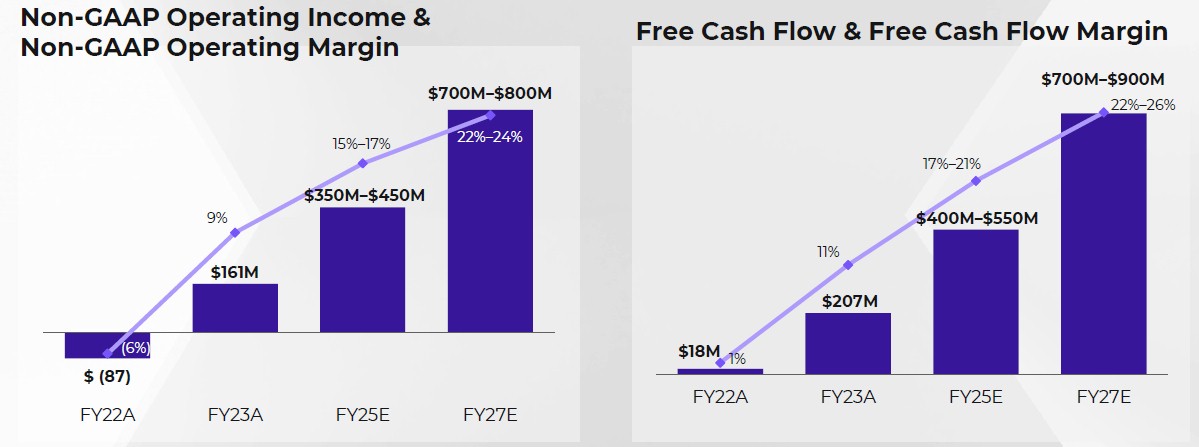

This happened this year, under the prudent guidance of Ramaswami and the team he has put together. So, for instance. The goal for annual contract billings growth set by Ramaswami between fiscal 2021 and fiscal 2023 inclusive was 25 percent compounded annually (CAGR as they say). It actually came in at 27 percent CAGR due to a focus on not just getting new customers but on cross-selling and up-selling and just plain expanding capacity at existing customers. The goal for free cash flow set by Ramaswami was somewhere between $50 million and $150 million as fiscal 2023 came to an end, and Nutanix actually hit $207 million.

Again, this was done during the ongoing transition from appliance sales to software only sales and from perpetual plus support licenses to subscriptions. Just keep in mind how hard it is to do all of this and keep revenue growing.

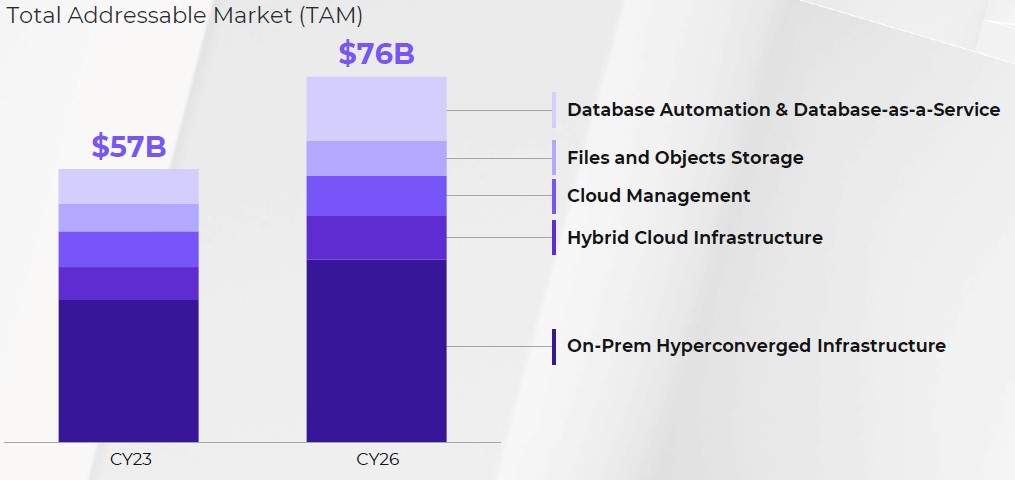

The good news is that these transitions are largely over now, and now growth is growth and it has adapted its business to extract profits from the Nutanix of today and from the market of today. Here is the total addressable market in calendar 2023 and what Nutanix thinks it will look like in calendar 2026, which overlaps by five months with its fiscal 2027:

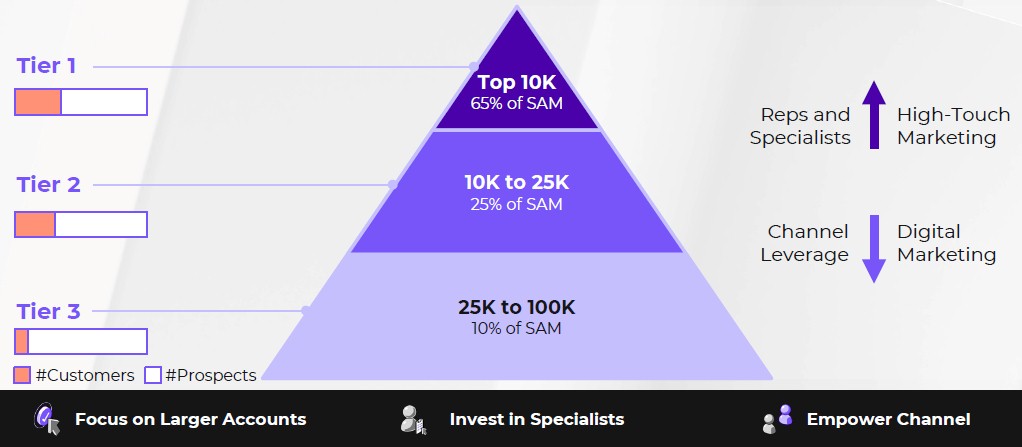

If you do the math on that TAM, it has a CAGR of 15.5 percent. So that is the baseline on which to gauge Nutanix by its own definition of what the TAM is. In its presentations, Nutanix also said that it reckons that there are about 100,000 customers worldwide who are potential customers for its products, and as the July quarter ended, it had 24,550 customers. That TAM customer number is larger than 100,000, but Nutanix is perhaps paring that down to a more realistic number – not all companies who are using IT infrastructure that is virtualized, but only those customers who might possibly switch to the Nutanix stack. This is often called the Serviceable Addressable Market, or SAM.

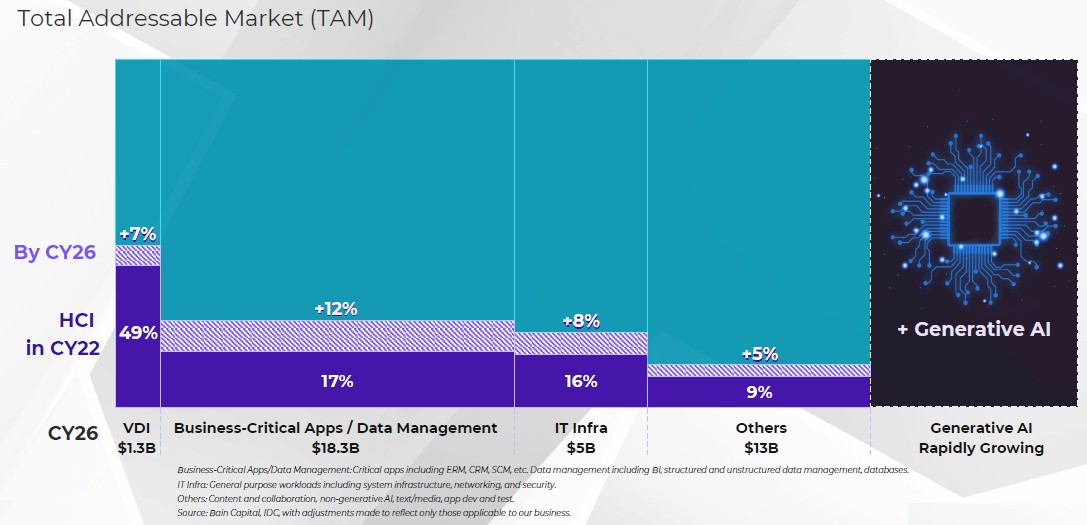

Here is another way Nutanix dices and slices the TAM, where it says there is “room for growth across all workloads” in its presentation:

We have looked at this for a while and it looks like that is not the full TAM for calendar 2026 but $37.6 billion of the $76 billion on the chart above. The percentages in purple seem to show the share of the Nutanix business in each category in calendar 2022 and the stripey lines seem to show the incremental growth in share of Nutanix revenues by calendar 2026. (So us all a favor, Nutanix, and switch the financials to a calendar year. . . . Then things will line up right.) Generative AI, which Nutanix has started to chase with a stack that includes PyTorch and models on top of it, is wide open and not part of the TAM.

Here is how Nutanix characterizes its SAM and how it will attack it to drive revenues and profits in the next four years:

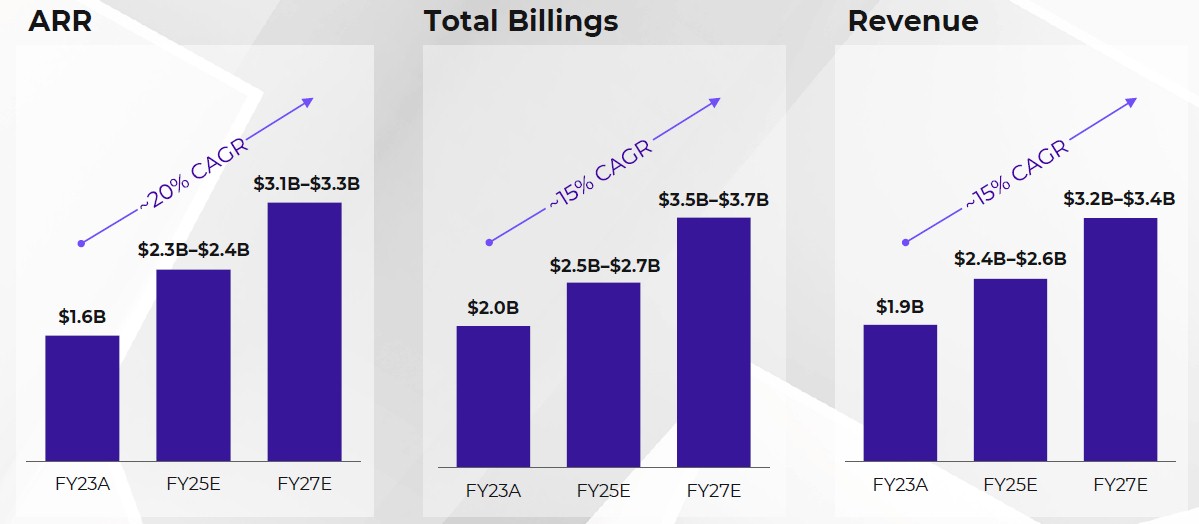

And here, finally, are the growth projections looking ahead through fiscal 2027:

The CAGR for annual contract value (ACV) billings was 27 percent between fiscal 2021 and fiscal 2023, by the way. Which is pretty fast. We won’t see of this will hold up looking ahead because Nutanix is dropping this metric and shifting to annualized recurring revenue (ARR).

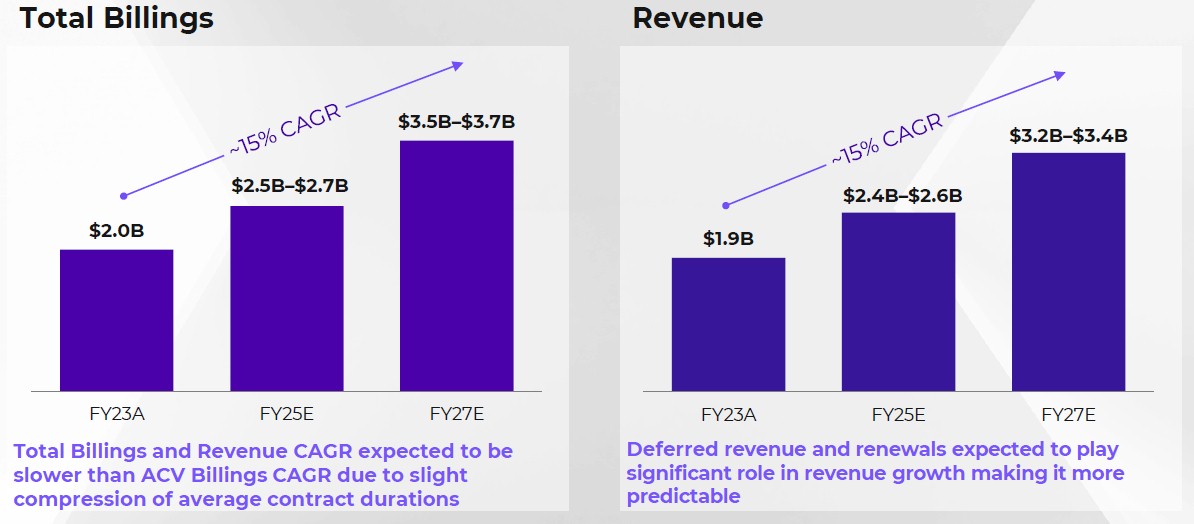

Here is how Nutanix thinks total billings and revenues will swell:

And here are the projections for Non-GAAP income and free cash flow:

And here is a chart that shows how it will all come together to actually meet the rule of 40 and presumably result in a profitable Nutanix that reaches somewhere between $3.2 billion and $3.4 billion in revenues as it exits its fiscal 2027:

Those are two year CAGRs for F2025 and F2027 in the charts above.

No one is brave enough to predict net income in the coming years, as you might expect.

As the first link of the story (2011) fastly establishes, and as the remainder of the article further slowly develops, it’s just a real challenge to build a large family (of customers) while “practicing safe SOCS”! The ratio of hard- to soft- parts often plays an outsize role in getting the golden goose to lay its top-shelf fertilized eggs, in line with the rule of 40. A purely software play is a real challenge there, but if anyone can do it, it might just be a computational outfit that manages to combine the alluring sweetness of Nutella, with the concentrated uplift of Nugenix … hmmm, I don’t know … Nutelnix, for example! 8^d

Ecosystems are most robust when designed to operate under a paradigm where the only constant is change, supported by a broadly heterogeneous diversity of wide-ranging choices. The winning choice at one time eventually loses-out to another pairing, which itself gives way to a third, and so forth, until the first choice (possibly evolved over time) might win-out again, all in a rather cyclic and evolutive way, that never stops, except maybe to expire into possibly unfortunate, or undesirable, extinction.

HCI needs to adapt similarly, focusing on whichever tech pairing is most favored at a given time, and shifting that focus selectively to emerging alternatives as they start to overtake the previous champ. That is quite a challenge, possibly best addressed with a flexible approach and tooling.

Focusing on the dynamic composition of heterogeneous disaggregated systems (CHDS), from the get go, would seem like a smart way to prepare for the eventual (cyclic) shifts in computational paradigms. But as pointed out by ORNL (cf. TNP’s 09/27/23 piece on “Clouded Judgements”), this is a huge challenge today, and likely in the proximal future as well. System heterogeneity results from individual designers and operators seeking to develop an exceptional advantage over the competition (as in mating rituals), and when every system so-becomes an exception (by ecological necessity), there is little hope for a compositional framework that can combine all such exceptions into an eventual highly performant whole (eg. ZettaCthulhu, in the age of Exaflopping).

Luckily, this situation is completely unacceptable. Which is where the ecology of competitive innovation naturally comes to the rescue. It is just such that we can expect the Yin/Yang duality of HCI/CHDS to keep evolving into increasingly better hyper-converged and heterogeneous-disaggregated systems, cyclically winning-out over each other, for the entirety of the forseeable future, keeping change as the only constant, while choice and performance continually improve!

As recently pointed out by Chinese minister for national security Chen Yixin (https://www.theregister.com/2023/09/28/chen_yixin_china_digital_threats/), the “original innovation capability” needs to be strong (and remain so) for this type of ecology to succeed.

There are 32.5 million small businesses in the US ,Small businesses account for 64% of new jobs annually and every year, they create 1.5 million jobs in the US ,99.9% of businesses in the US are small businesses (businesses with fewer than 250 employees)

The vast majority of small businesses make $250,000 or less and have one or two employees.