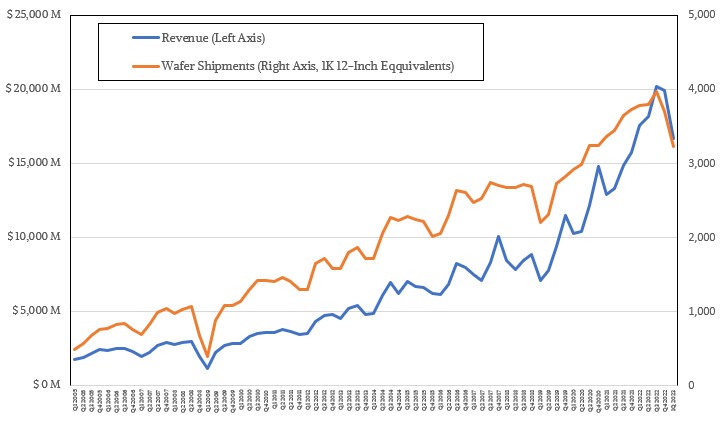

Every three years or so, Taiwan Semiconductor Manufacturing Co has a personal recession. Sometimes, this personal recession involves a decline in revenues and it always has to do with a decline in silicon wafer etching starts (as measured in 12-inch wafer start equivalents) on a year on year basis. Sometimes, when things are really bad, the declines are not just on an annual basis, but on a sequential basis, too.

This was the case in late 2008 and early 2009 when the Great Recession hit, and it was true again for two quarters in the second half of 2015 and yet again in late 2018 and the first half of 2019. Some of this yad to do with the vicissitudes of the PC and smartphone markets, some of it had to do with manufacturing process transitions. And oddly enough, when the coronavirus pandemic hit in early 2020 and was with us for more than two years, there was not a personal recession – meaning two straight quarters of decline – but rather the demand for smartphones, PCs, and high-end processors in servers was so high that TSMC just powered through all of that economic uncertainty and met this huge wave of demand as we switched to work from home.

The irony is that the pandemic is largely under control now (even if it is perhaps not really over), and TSMC is having a tough time keeping its fabs running at full tilt on its leading edge as well as its mature chip making processes. This during the tail end of a chip shortage.

Go figure.

The question we all have to ask because TSMC is the most important chip foundry in the world is whether this personal recession is a lagging indicator, meaning it is really just an expression of companies buying too much supply last year and needing to burn down that capacity, or is a leading indicator, meaning that it is predicting some arduous times to come for the IT market and the global economy in general. TSMC didn’t matter so much back during the Dot Com bust, so we don’t have data to correlate there. But the timings between TSMC slowing down and the global economy slowing down are interesting. To out eye, it looks like sometimes TSMC leads, and sometimes it lags.

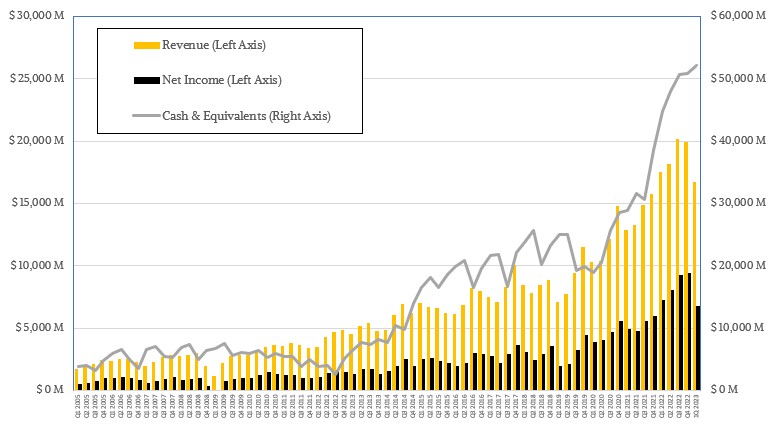

In the first quarter of 2023 ended in March, TSMC booked $16.72 billion in sales, down 4.8 percent, which stood in stark contrast to the 36.1 percent, 36.3 percent, 35.9 percent, and 26.7 percent growth it had in the prior four quarters. Net income was growing even faster over the prior quarters, but fell by 6.3 percent year on year in Q1 2023, to $6.8 billion, and representing 40.7 percent of revenues. Which is still amazing and three points higher than average levels of profitability set by TSMC over the prior five years.

The wafer start recession is for real. In the fourth quarter of 2022, TSMC hit a historically high 3.97 million 12-inch wafer equivalents started during the quarter, and that fell by 0.6 percent year on year to 3.7 million wafers in Q1 2023. More disturbing is that the decline was 6.8 percent sequentially in Q4 2022 and another 12.8 percent sequentially down in Q1 2023. The average revenue generated per wafer continues to be high, at $5,181, but peaked historically at $5,384 per wafer in Q4 2022. The average revenue per wafer from 2018 through 2021 was $3,623, just to give you some context, and has been gradually on the rise.

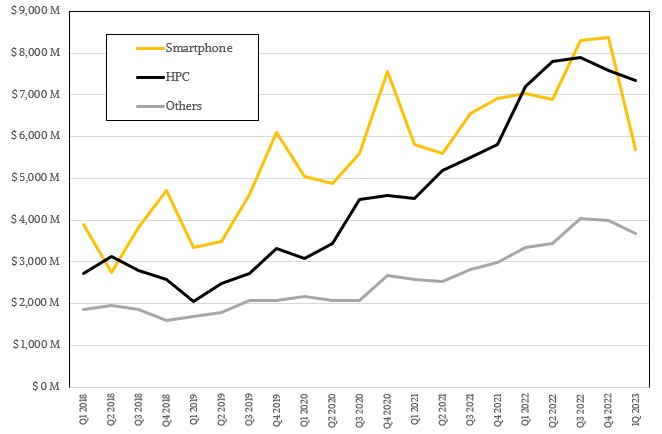

The reason, of course, is that TSMC has the most advanced foundry in the world for compute engines. And what is hurting the company so bad is a rapid decline in smartphone sales, and PC chip sales, which are glommed into a category that TSMC calls “HPC” but which we might call CPUs, GPUs, FPGAs, and custom ASICs. (It would be fascinating to see revenues broken out by datacenter, PC, smartphone, and other.)

By comparison, the Internet of Things, Automotive, Digital Consumer Electronics, and Other segments, which are broken out in TSMC’s financial presentations, represented only 22 percent of revenues in Q1 2023. Interestingly, that so-called HPC segment had 2.1 percent revenue growth and accounted for $7.36 billion in sales. Smartphone chip manufacturing revenues were down 19.1 percent, and we think that if you backed out PC chips, then the manufacturing of chips for the datacenter is still probably going strong even with the economy being a bit choppy.

We could say more if we had those datacenter chips – server CUs, GPU accelerators, FPGAs, network switch and router ASICs, SmartNIC and DPU chips, and so on – broken free from the PC and edge stuff in the HPC segment. But TSMC has not revealed such information, and it is dubious using the HPC segment as a proxy for the datacenter because there is a lot of PC data in there.

The main thing to consider is that TSMC’s utilization rate in its fabs is dropping, which is always bad for a chip foundry and which needs to run at maximum utilization to produce profits, while at the same time its electricity costs have risen by 15 percent in the second half of 2022 and has been jacked up by 17 percent starting this year by 17 percent. The ramp of the N3 process, based on 3 nanometer geometries, expanding fabs into the United States, which has been a bit of a nightmare, and general inflation are whacking profits, too.

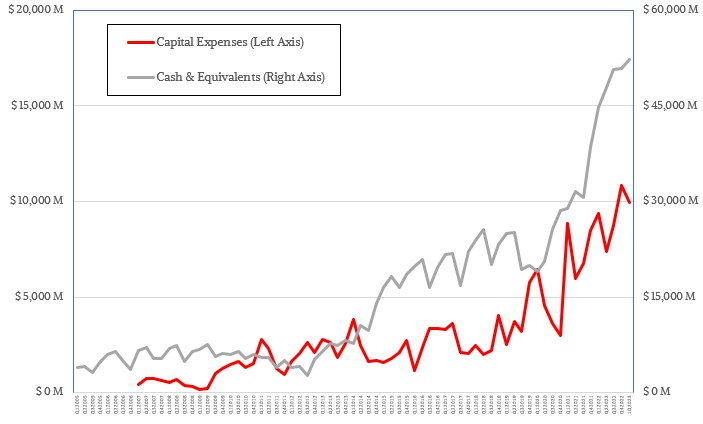

Given all of this, TSMC needs to cut some costs, and it is going to come out of the capital expense budget, which is now expected to be somewhere between $32 billion and $36 billion. TSMC reiterated that it is ramping the 3N process this year and that the capacity it can bring to bear will be full utilized in 2023 and will contribute to revenues in the third quarter of this year and represent a mid-single digit percentage of wafer output in 2023, driven by the HPC and smartphone segments. The refined N3E process is set for volume production in the second half of this year, and the number of tapeouts for N3 and N3E are more than twice as high as the level set by the N5 5 nanometer process at the same point in their development cycles.

TSMC’s N2 process, which pushes down to 2 nanometer transistor geometries, is set for volume production in 2025, and more than a few CPU, GPU, and custom ASIC designs will depend upon it.

The TSMC fab in Arizona, which is starting with the 4 nanometer 4N process that is used for Nvidia GPUs and CPUs, is set to start volume production in 2024. A 28 nanometer fab expansion in Taiwan has been mothballed in favor of more advanced processes.

Rumours shmumours but it seems (rumours) that Apple has been setting things in motion to increase enthusiasm for its A17- and M3-based phones and PCs this Fall. They apparently (shmumours) reserved the whole of TSMC N3 production for themselves — which should give them some nice product announcements: 1st 3nm smartphone, 1st 3nm PC, and the chips could be 1.5x faster than current ones, or more (humours?). It seems that it takes 4 months to bake these delicious chips at 3nm (must be a very low temperature recipe), and 80 mask layers of fine pastry and fruity goodness to etch them right (yummy!). This’ll hopefully help bring those TSMC curves back in the expected direction!

Glad to hear they won’t need to cook the books then (which I hear tastes like wood … or that chicken in Sugarhill Gangs’s Rapper’s Delight)!