Software is not actually eating the world, but it is absolutely smashing out of appliance-style boxes and creating a massive, interconnected overlay atop aggregations of very shiny and powerful hardware. And that is why Arista Networks, one of the upstart switch and router makers that was founded on the idea of creating an integrated networking software stack atop merchant silicon, has acquired software-defined networking pioneer Pluribus Networks as it also reports a very good second quarter.

Pluribus Networks dropped out of stealth with server-switch hybrids back in early 2014, with the hopes of converging compute and networking into a single interconnected fabric it called Freedom. The Freedom server-switches mashed up switch ASICs and X86 CPUs into a single device with a converged network/compute operating system with the idea of eliminating latencies on the network as well as allowing for horizontal scaling of compute and network together, much as hyperconverged storage mashes up virtualized compute and storage to allow it to scale.

The original Freedom switches, which are historically interesting, came in two flavors and spawned competitive “god box” offerings from Arista Networks, Juniper Networks, and Cisco Systems, which we profiled way back in April 2015. One Freedom switch paired Broadcom’s Trident-2 ASIC with one Xeon E3 processor, while the other had an Intel Alta FM6400 ASIC (from its Fulcrum Microsystems acquisition) matched to a two-socket Xeon E5 server. Depending on the configurations, the Pluribus Freedom machines cost between $25,000 and $80,000, not including a KVM hypervisor, which added another $10,000 on top of that.

While the server-switch hybrid did not take off, the ability to add software-defined functions to switches, routers, and other compute engines in the datacenter and telco network certainly did, and Pluribus Networks dropped the hardware and focused on the Netvisor fabric it had created to stich the Freedom switches together. In recent years, Pluribus Networks has partnered with Nvidia to move its software stack to Nvidia’s BlueField DPUs, targeting service providers who want to offload networking functions from servers while at the same time making their compute farms more secure and do more application work. A little more than two years ago, Arista Networks bought some of the assets of Big Switch Networks to add Big Cloud Fabric, which it rebranded as Converged Cloud Fabric, to its software stack.

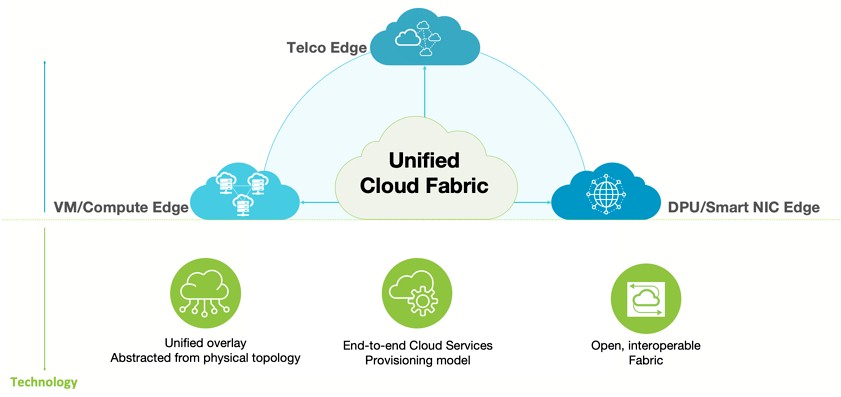

However, this Big Switch stack was not really designed for the kind of edge networking that is becoming more common among hyperscalers, cloud builders, service providers, and large enterprises, and after getting out of the server-switch hybrid business several years after emerging from stealth, Pluribus Networks has spent years building just such software, which Arista Networks is now calling its Unified Cloud Fabric.

This Unified Cloud Fabric, formerly known as Adaptive Cloud Fabric, is based on that Netvisor ONE stack and was co-developed in conjunction with telco switch maker Ericsson starting in 2016, and it has obviously evolved over the years to encompass other use cases and devices, notably the concept of DPUs as the gatekeepers to storage and compute in the datacenter and as a secure endpoint on the network. Netvisor ONE runs on switches, routers, DPUs, and other edge devices like 4G and 5G base stations, and has been augmented with a DPU Fabric Manager that can span thousands of DPUs to configure, manage, and monitor them. The Unified Cloud Manager spans datacenters (including hybrid cloud setups) and can traverse both network underlays and overlays to present a single, unified view of a network of all kinds of gear stitched together with software.

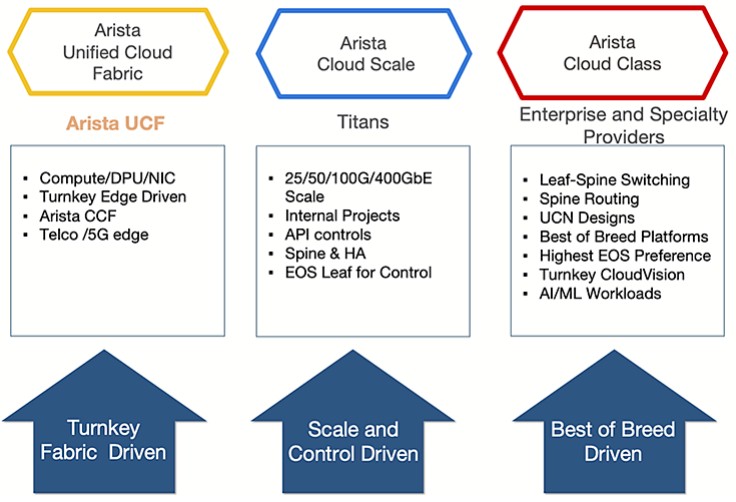

With the addition of Pluribus Networks, Arista Networks has three different classes of customers that it can chase with its switch and routing hardware and its homegrown EOS switch operating system, Big Switch fabric and telemetry software, and now edge networking:

Of course, many customers will employ multiple stacks to build different parts of their networks. Arista Networks did not divulge the financial details of the Pluribus Networks acquisition, but the company raised $137 million in six rounds of funding – some of it before uncloaking, a bunch of it in the years after uncloaking, and $20 million of it in the fall of 2021 after it had pivoted to unifying the network at the edge and across DPUs. (And remember, sometimes the cloud is an edge, not a core, when it comes to both compute and networking.) Pluribus Networks and Arista Networks have worked together for years, and the latter is acquiring the former as much to get 140 software engineers and sales people as it is getting its hands on edge networking software.

That brings us to the second quarter numbers for Arista Networks.

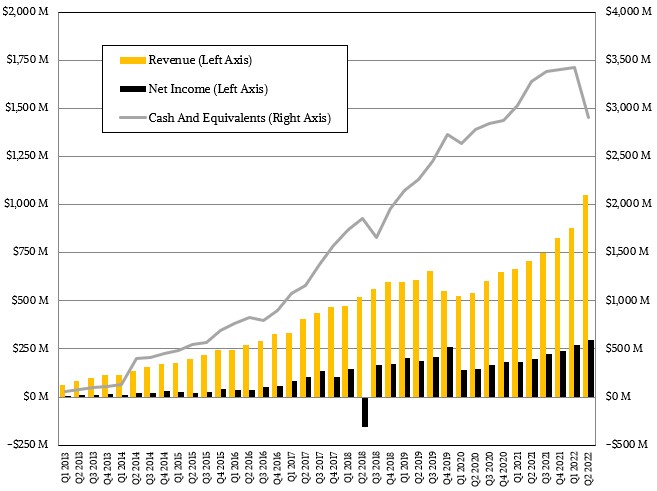

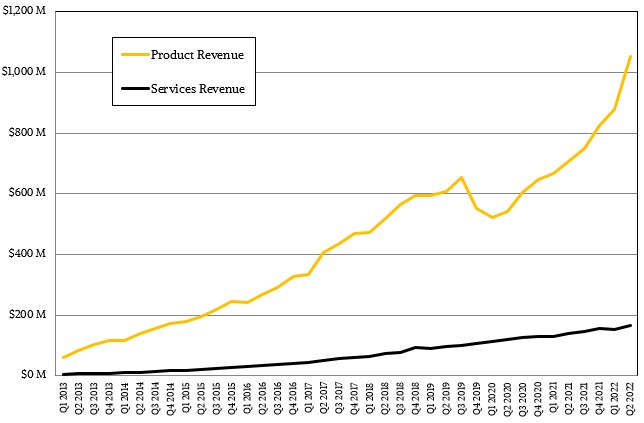

In the June quarter, Arista Networks had $885.8 million in product sales, up 56.4 percent year on year, with software licenses and services revenues of $185.1 million, up 17.4 percent, and software subscription sales of $19 million, up 12.8 percent. If you just carve our services as a unit, revenues were $166.1 million, up 17.9 percent. Total sales were $1.05 billion, up 48.7 percent, and the first time Arista Networks brought through the nine digit dollar barrier in a quarter.

Net income rose nearly in lockstep with sales, up 51.9 percent to $299.1 million, which represented 28.4 percent of revenues, down a bit from prior quarters but still a pretty healthy return.

Arista Networks did not disclose a price for the Pluribus Networks when the announcement was made, but it did burn $522 million in cash during the quarter, which may or may not be an indication. The company did buy $483.7 million of its own stock in the quarter, and if you do the math that would suggest that it paid somewhere around $337 million for Pluribus Networks and another small networking company called Untangled (with only ten employees) in the quarter. That suggestion would be wrong. The 10-Q just posted, a few days after the announcement was made, and Arista Networks paid $150 million for both companies.

Now, on to the talk about the supply chain. Sales and therefore profits at Arista Networks are very much constrained by supply chain woes, as has been the case for several years now.

“We have left no stone unturned in supply purchase commitments,” Jayshree Ullal, the company’s chief executive officer. “They just keep going higher and higher. This quarter, we reported $4.5 billion. So there is no lack of desire in Arista’s part to fulfill the demand we have. We are clearly going in with strong demand, strong backlog, et cetera. However, we need all the components to come together, and the component problem continues. It has been bad in Q1. It’s no better in Q2, and we’re not foreseeing much improvement in Q3. So perhaps in 2023, we will get some relief. But again, to get relief, we have to have all the components come. If we’re missing one component, we can’t build a system. So our guide reflects that and our behavior in how we acquire components is reflecting that. We’re still not getting the components. Many of the components have 70-week lead times, and therefore, we have to plan multiple quarters and years for that.”

With the hyperscalers and cloud builders all wanting to do massive 400 Gb/sec Ethernet rollouts inside of their datacenters as well as invest in datacenter interconnect (DCI) pipes between their datacenters and regions, it would be interesting to know how much business is on the table that cannot be fulfilled by Arista Networks or any of its competitors as they stare down this uncooperative supply chain.

One thing that Arista Networks is not worried about is the Intel Xeon SP product cycle, and specifically the rumored delays with the “Sapphire Rapids” Xeon SPs, which is a rerun of the “Ice Lake” Xeon SP delay in 2019 and 2020 that had a big impact on Arista Networks.

“The last time we experienced this with Facebook, as many of you may remember, it was a little more nightmarish scenario for us,” Ullal conceded. “Because of delays, they skipped an entire server cycle, and Arista certainly felt it – that sneeze turned into pneumonia for us. But this time around, I think there are many more competitive options.”

And we certainly see that in the financials for both Intel and AMD, and expect AMD will continue to eat market share as much as its wafer agreements with Taiwan Semiconductor Manufacturing Co will allow, and Intel will be able to mop up whatever is left with Ice Lake and even earlier generations of Xeon SPs. The chip that has the best performance is the one you can actually get your hands on these days. Ditto for the switch.

Be the first to comment