Amazon Web Services is not the largest IT supplier in the world, but it is well on its way to attaining that position as it has notched up another quarter of growth in what is a tough economic climate. AWS should surpass Lenovo this year and Dell before too long, and over the longest of hauls AWS has a good chance to catch Microsoft; it has already blown by IBM, Hewlett Packard Enterprise, and Cisco Systems. A lot depends on where you want to draw the lines between consumer computing and datacenter.

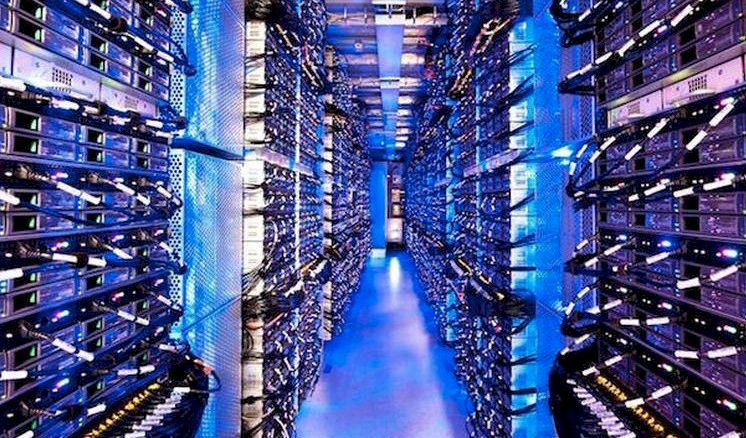

Suffice it to say, Amazon Web Services is clearly and cleanly an IT provider, it is big, and it is embiggening every day. As Brian Olsavsky, chief financial officer at Amazon, pointed out to Wall Street in a conference call going over the numbers for the second quarter of 2022, AWS has 84 availability zones in 26 geographic regions, and it is planning to add eight more regions with 24 additional availability zones. That is a 31 percent increase in regions and a 29 percent increase in availability zones, which is a little bit less than the revenue growth rate AWS currently has. This makes sense, since existing zones have existing customers that are increasing their usage (on average) and then new customers come in on the existing regions and zones (adding to the revenue stream), and then AWS brings on the new regions and zones. All the time, these regions and zones have truckloads of servers, storage, and switching coming into the datacenters that comprise the zones, which have redundancy built in because that is how modern datacenters work.

What AWS does not have, even though it sells the perception of it, is infinite capacity. But it is about as close as spending somewhere around $120 billion since AWS was founded can make it look infinite. In the second quarter, about 40 percent of the $16.77 billion in capital investments that the Amazon parent company made – or around $6.71 billion – was earmarked for AWS, and Olsavsky said on the call that in 2022, that rate would rise to 50 percent. Which means in the second half it will be averaging somewhere around 60 percent of capital spending for the math to work out.

This is an enormous amount of money and a humungous amount of infrastructure, which is why there are only a few clouds in the world that span the globe with millions and millions of servers like AWS does. This is a rich company’s game, like finding oil, drilling it, refining it, and getting it distributed to gas tanks.

In the June quarter, AWS revenues rose by 33.3 percent to $19.74 billion, and operating income rose by 36.3 percent to $5.72 billion. Capital expenses are trending down a bit and so is operating income, which suggests to us that at least some of the millions of customers who use AWS are being more mindful of the capacity they burn each hour than they might otherwise, given the edgy state of the global economy.

In the June quarter, AWS revenues rose by 33.3 percent to $19.74 billion, and operating income rose by 36.3 percent to $5.72 billion. Capital expenses are trending down a bit and so is operating income, which suggests to us that at least some of the millions of customers who use AWS are being more mindful of the capacity they burn each hour than they might otherwise, given the edgy state of the global economy.

Some of that downward trend in operating profits is due to AWS giving customers discounts, vouchers, and other incentives as they move more and more applications to the cloud – or all of them, in some cases – which is an investment that will pay off in droves in the coming years as those companies get more and more addicted to the AWS platform. This is mainframe history running in reverse and then running forward.

“AWS continues to grow at a fast pace, and we believe we are still in the early stages of enterprise and public sector adoption of the cloud,” Olsavsky explained on call. “We see great opportunity to continue to make investments on behalf of AWS customers. We continue to invest thoughtfully in new infrastructure to meet capacity needs, while expanding AWS to new regions, developing new services, and iterating quickly to enhance existing services.”

That is a quote that could be applied to any quarter in the past ten years or the next ten, and Amazon rarely says anything dramatic about AWS on these calls. Olsavsky did say that operating income was hit by stock-based compensation increases and wage hikes for engineers and other tech workers in the AWS business. And the volatility in electricity and natural gas prices and generally increasing energy costs were also putting pressure on profits, too, according to Olsavsky.

Contrary to what is happening at many of its competitors, AWS is not seeing a very aggressive discounting environment except in the case mentioned above when customers are going “all-in,” as the company is fond of talking about. (We do not believe there are many Global 2000 companies that are all-in with the cloud, much less with one of them. Some are mostly in, for sure.)

“We’re very happy with the growth rate,” Olsavsky said of AWS, and frankly, this is a god growth rate for this stage in the development of AWS and the cloud market, but at some point many years hence, AWS will be running at 2X gross domestic product and that is about it. “We’re happy with the adoption of the cloud. As you hit a potential rough patch in the economy – I think the last time we saw this was back in 2008-ish – it’s hard to draw lessons from that. But we did notice that it did help our cloud business at the time because, again, when you’re trying to launch a new product or service and you are faced with building your own datacenter and getting capital for a datacenter and building it yourself or moving to the cloud and essentially buying incremental infrastructure capacity, the cloud computing really shows its value. So we’re prepared, just like during the slowdown in 2020, to help customers optimize their costs and will help any who are scaling down.”

This has aways been the case in the IT market, of course, but at a much coarser granularity physical servers bought to process over years instead of ethereal capacity bought for hours.

Be the first to comment