To build a very large IT business often takes a channel approach, where manufacturers sell a certain amount of their own product – say to the key 10 percent or 20 percent of their accounts – and then offload the rest of the sales job to a third party.

This channel approach works reasonably well when the economy is humming along and the supply chains of parts coming in one side of the factory and the channel going out the other side are flowing. But having channels can be a huge problem when things go wrong, as certainly has happened in many ways for more than two years during the coronavirus pandemic.

But Arista Networks, which sells directly to its more than 8,300 customers, doesn’t have that problem. And in fact, thanks to the pandemic and the steadily growing businesses of its largest hyperscaler and cloud builder customers, it has the most visibility into product demand that it has enjoyed in the history of the company, now stretching out well into 2023, because these “cloud titans,” as Arista Network calls them, can’t afford to not have switching as they roll out new regions and expand existing ones.

That doesn’t mean life is easy-peasy for Arista Networks. These hyperscaler and cloud builder customers are among the toughest on Earth and they demand the lowest cost, the best performance, openness, and trial periods at a scale that is akin to a supercomputer deployment before they accept the networking gear and therefore allow Arista Networks to recognize the revenue. And just like every other hardware manufacturer in the IT hardware business, Arista Networks has been nagged by parts shortages and other supply chain issues just like every. These issues were all on display during its call with Wall Street going over the financial results for the company for the first quarter of 2022.

Not that you could see any of these issues from its revenue and profit in Q1.

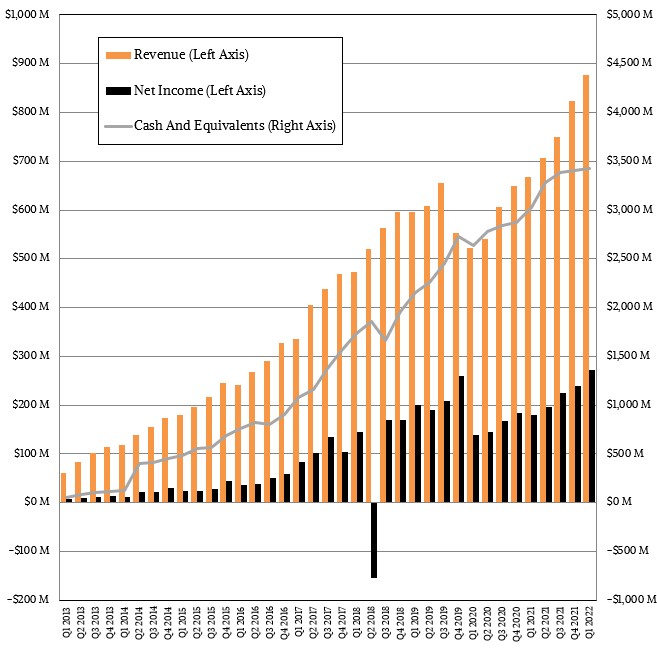

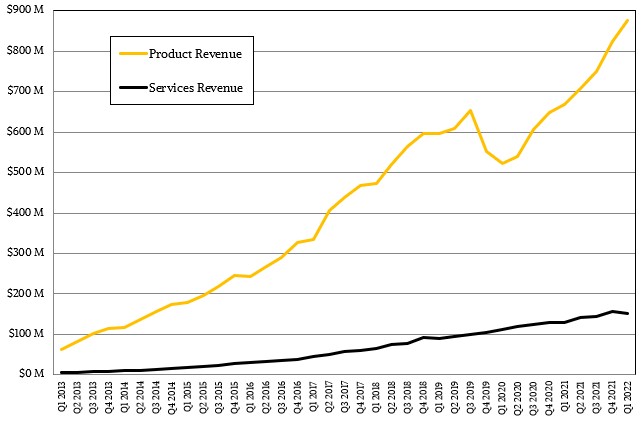

In the quarter, sales were up by 34.4 percent to $727.4 million, with about $50 million of that being revenue on gear already installed at a cloud titan that could finally be recognized. Services revenues rose by 18.6 percent to $152.3 million, and within this, software subscription revenues were up 11.1 percent to $16 million and combined perpetual software license and support revenues for hardware and software were up 17.9 percent to $168.4 million. Add it all up and total revenues came to $877.1 million, up 31.4 percent, and take out all the costs, depreciation, and taxes and net income was up 50.9 percent to $272.3 million.

Arista Networks ended the quarter with $3.42 billion in cash, up 13.1 percent from the year ago period, and total deferred revenue was $1.1 billion, up 7.6 percent, and amazingly, purchase commitments from its customers rose by a stunning 53.6 percent to $4.3 billion. Ita Brennan, the company’s chief financial officer, said in the call with Wall Street analysts that this increase in commitments largely represented orders for switching gear in 2023 and beyond. We think a lot of this is for 51.2 Tb/sec switching gear, which will deliver 800 Gb/sec ports into the hyperscalers and cloud builders.

This level of purchase commitments by customers is quite a change from before the pandemic, when Arista Networks was lucky to get warning about big orders six to eight weeks ahead of when it needed to start delivering them. To be fair, many of the contracts it does with cloud titans are for buildouts over three year terms across many datacenters and their encompassing regions. The difference now is these customer shave to tell Arista Networks what they are really doing so it can hope to meet demand. If they don’t, it not only won’t – it can’t.

And in a time of potential economic uncertainty, knowing you can count on big customers with very healthy businesses and fast growing capacity needs is the same thing has having a gold mine with rich veins. And hence the intense focus on its two biggest customers, Microsoft and Meta Platforms, and no Microsoft deal with Nokia for part of its network stack is going to change that.

Arista Networks did not divulge the purchase commitments it is making for parts to ensure it can meet demand, but some of these purchase commitments are not being fulfilled by the company’s suppliers and hence the difficulty in meeting demand, which exceeds supply and has for several quarters now.

Earlier this year, as we previously reported, Arista Networks was projecting 30 percent revenue growth for the full 2022 year, and with an anticipated $950 million to $1 billion in sales in the second quarter of 2022, that means it will grow between 32.9 percent and 36.5 percent in the first half. That extra growth now makes it a lot easier to hit the targets as the end of the year comes around.

We do not think that Arista Networks is sly, underpromising so it can overdeliver on its revenue growth. The company really is wrestling with some component shortages even after it has made contractual purchase commitments with its own suppliers – and then it has had to scramble to find parts, sometimes paying 100X for these components than it would have otherwise. Which tells you it is not a switch ASIC that is causing delays, but some other relatively modest component. There are two or three vendors that are causing it particular grief – the parts and the suppliers were not named – the bottlenecks have to do with semiconductor manufacturing and testing shortages. (Testing is a big problem because the companies that make testing equipment have their own shortages. . . . And so the snake eats its own tail.) Also, when orders are delayed, customers ask for expedited shipment from the factory, which also eats into profits.

In any event, Arista Networks warns that gross margins will be impacted by these several parts shortages to the tune of 2 percent to 3 percent, but again, its profits are not really showing the hit – at least not yet. And a price increase instituted in December will roll through and start taking effect with new deals being done in the coming quarters, and there is a chance that there will be another price increase later this year or early next year to cover costs for deals done in 2023 and 2024.

Imagine how much revenue and profit Arista Networks might have booked had there not been issues. Or, maybe, just maybe, this level of sales and clarity can only come about because Arista Networks has surpassed Juniper Networks to be the number two switch vendor in the datacenter and has long since left Hewlett Packard Enterprise and Huawei Technology behind and is therefore a safer bet than everyone but Cisco Systems, thus snowballing its business. And frankly, as far as the hyperscalers and cloud builders are concerned, if Cisco had not broken out its Silicon One switch silicon and rearchitected ASICs for the merchant switch and router markets with a single architecture, maybe Arista Networks would have even been more dependable than Cisco itself at this point.

One more thing. When there are shortages like the IT industry is experiencing, there is always the temptation on the part of customers to double book orders and then cancel one after another one comes in. This is not an easy thing to do with Arista Networks because it sells directly, and this is not a concern, says Jayshree Ullal, the company’s chief executive officer.

“Because we don’t fulfill through channels, and so much of our orders are very intimate relationships with our customers, we really believe the orders are not double booked or double ordered,” Ullal said on the call. “There may be some. But the majority of our cloud orders, enterprise, cloud provider, service providers – these are relationships and dialogue conversations we have regularly. So we have no reason to believe at this point that there’s double booking going on of any kind. There could be a minor percentage, but nothing major.”

That’s a hedge statement just in case there is some, we suppose.

Be the first to comment