When we analyzed the financial reports coming out of hyperconverged platform maker Nutanix thirteen weeks ago, we lamented the fact that while Nutanix defined a new market and is one of the leaders in that market, it has been unable to expand its market fast enough to become a profitable company even after being in the field for more than a decade. And this quarter, with Nutanix reporting yet another tough quarter, but a new partnership with long-time application and server virtualization platform maker Citrix Systems, that got us to thinking.

Which is always dangerous.

And the thought is simple enough: Should Citrix Systems and Nutanix just merge and create a more integrated and consolidated platform that will make the software of the two more appealing to a larger pool of customers? The answer could be a very qualified, Yes.

Not all platforms descend from on high from supercomputer centers or hyperscalers or cloud builders. VMware built a very respectable and elegant server virtualization platform ahead of the Great Recession that was suitable and necessary for a lot of customers looking to forgo a server upgrade generation or two, or at least to get more work done on the servers they were going to buy. VMware’s GSX Server started in the middle, with a product aimed at midrange customers with modest compute farms, and its ESX Server had some enterprise-grade features that grew into the ESXi hypervisor and the vSphere management layer for it that some 400,000 enterprises have adopted to date. The company used to say 500,000 customers, as when we did a deep dive on it back in April 2018, and even further back, VMware used to say 600,000 customers. In any event, even with fewer customers, VMware grew to become an $11.8 billion company in its fiscal 2021, bringing 17 percent of that to the bottom line.

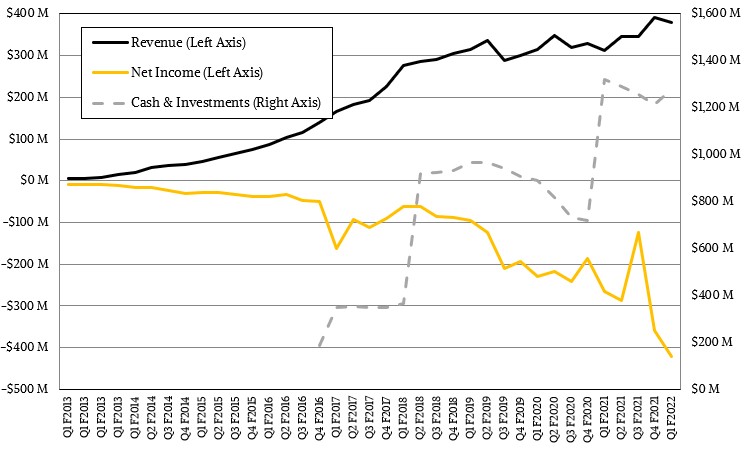

Here’s the revenue, income, and cash for Nutanix over time:

Nutanix has not been as fortunate, with a customer base of only 20,700 and driving revenues of $1.46 billion in the trailing twelve months ended in October. And more concerning is the fact that the company has posted a net loss of $1.19 billion against that increased revenue over the trailing twelve months, a loss that has grown by 30.8 percent over that span of time. To be fair, a lot of these costs that drive the losses at Nutanix are due to stock-based compensation that the company is doling out to key employees – the total employee count was above 6,000 when it was divulged last quarter but has not been updated for this quarter – to keep them motivated and engaged (we presume).

On a free cash flow basis, Nutanix is heading towards breakeven, which is good. But the actual accounting looks rough, and there is no way to sugar coat it.

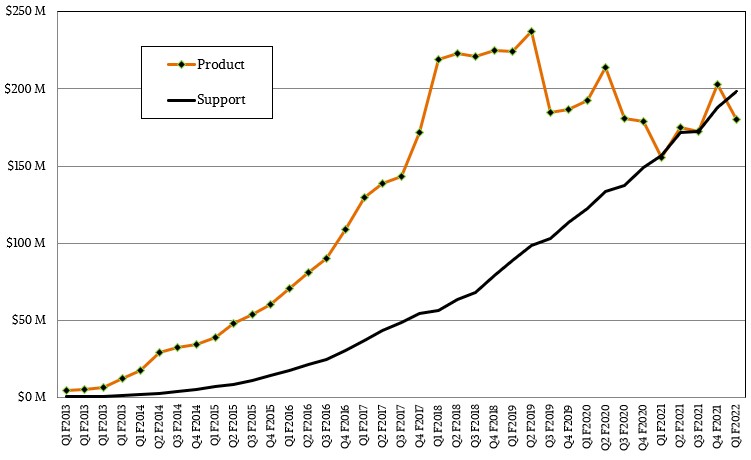

In the quarter ended in October, product revenues at Nutanix rose by 15.6 percent to $180.1 million and support revenues grew by 26.4 percent to $198.4 million; total revenues therefore grew by 21 percent to $378.5 million, but net losses more than doubled to $419.9 million. Somehow, and gratefully for a good company with a good product that is trying to go mainstream, Wall Street is very patient with Nutanix, and it has a market capitalization of $7.1 billion as we go to press.

Here is the split between products and services revenues at Nutanix:

Citrix Systems, after some woes of its own, has seen its stock drop by 42 percent from its recent local maxima set in January 2021 and now has a market capitalization of only $10.4 billion, down from $17.9 billion as the year began. Citrix has shrunk, in terms of market capitalization, while Nutanix has stayed more or less in the same range over the past couple of years. (It was trading considerably higher a few months ago.) But here is a big difference between Citrix and Nutanix: Citrix has a diverse base of application virtualization technologies that have been rebranded in recent years but we know them as NetScaler, the various Xen products – XenApp, XenServer, XenDesktop – but which are now called Citrix ADC and Citrix Virtual Apps and Citrix Hypervisor. There is the Cloud.com cloud management tools way deep in there and Kaviza VDI, too. The company knew how to cobble together a platform to virtualize applications and servers – it is no VMware, mind you – but Citrix was absolutely a contender and it still generated $3.18 billion in revenues in the trailing twelve months ended in October.

And – here is the important bit – it has over 400,000 customers worldwide.

That’s 20X more than what Nutanix has. So a partnership between Nutanix and Citrix is definitely designed to help the two of them, but perhaps there is a better way to weave together the two and create an application management and virtualization platform that seamless works across on premises and cloudy infrastructure. Citrix was bullied into selling off its GoTo series of online applications by Elliott Management for $1.8 billion to LogMeIn in 2017 – which probably would have made a killing during the coronavirus pandemic – and then Elliott Management and Francisco Partners took it private in December 2019 for $4.3 billion. (That was probably a very lucky deal, considering the timing, for those two private equity firms, eh?)

It is our job to look for the next platforms, and this one would affect a lot of enterprises and some government and academic organizations should a merger of Citrix and Nutanix ever come to pass. All we know for sure is that the name of the combined company would almost certainly end in “ix” and it might be able to help the underlying Acropolis platform that Nutanix has created grow. The partnership with Nutanix is an admission of sorts that its own former XenServer/Cloud.com/Kaviza/XenApp stack is not the next platform. But maybe Acropolis plus XenApp plus Kubernetes can be for a lot of organizations.

Citrix doesn’t want to be in the infrastructure business – we know this because it quit it years ago and it has done precisely nothing since to indicate it wants back in.

“with Nutanix reporting yet another tough quarter”

Did we look at different financial results then? Nutanix just delivered their 5th quarter beat in a row.

Outperforming expectations of Wall Street is not the same thing as being profitable.

Better,ntnx,BMW and ctxs merge into one!!