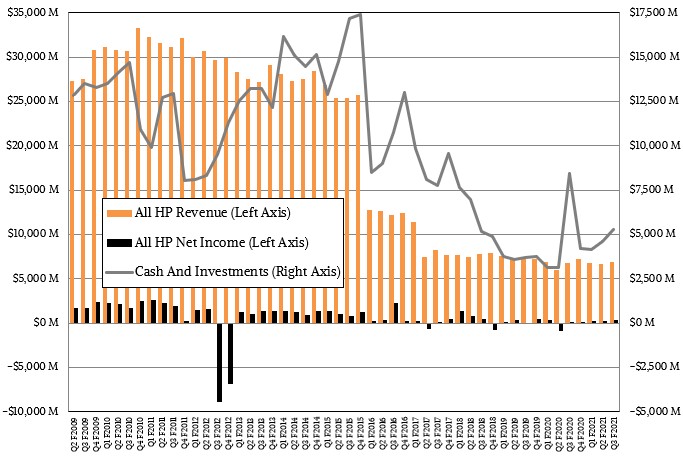

Enterprises large and small that depend on Hewlett Packard Enterprise to build their systems and certify them for an absolutely enormous amount of software and support them during a long life in the field should send Thank You notes to the venerable systems maker. Every business HPE is in is a tough one, and while driving revenues is hard enough in a hyperscale world, making a few bucks to save for a rainy day is even harder.

And every year, quarter after quarter, through so many reorganizations and turnarounds that it is hard to keep track, HPE stays in the game, grinding it out, yard by yard. You can’t help but respect that. It is the triumph of looking forward to the future over the experience of the past. It also portends the place that all IT suppliers, high flying perhaps now, will have to go. Every IT company that survives has to fight to stay relevant after it becomes venerable.

And to be fair, HPE under Chief Executive Officer Antonio Neri has made steady improvement as it has doubled down on the core systems business that it has decided to focus on. But it is never easy, is it?

In the quarter ended in July, HPE’s revenues rose by 1.2 percent to just a tad under $6.9 billion, and its net income came in at $392 million, or five percent of revenues, up nearly infinitely from the meager $9 million in earnings the company posted in the year ago period.

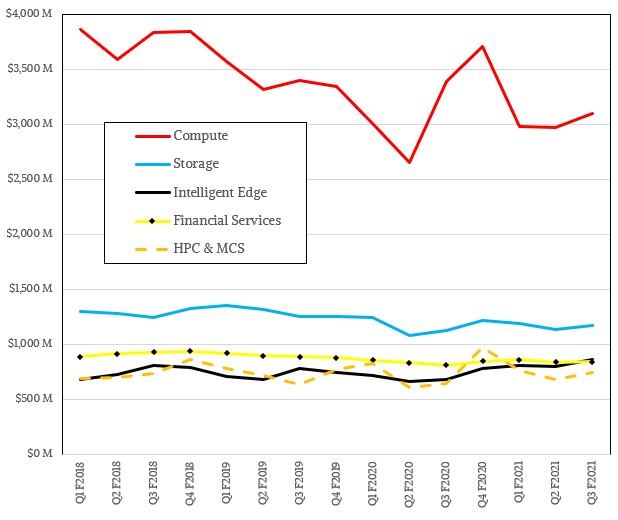

Sales of ProLiant servers, which are put in the Compute group these days along with the relatively small bit of datacenter networking that HPE does, fell by 8.4 percent to $3.1 billion in the period, which is a bit surprising until you consider the supply chain constraints on parts and manufacturing that all OEMs and ODMs are dealing with in the IT sector. Sales might be down here, but operating income rose by 9.1 percent to $347 million, and this is the change that HPE is looking for. Frankly, the enterprise server space is going to be a lot more profitable than the HPC and AI cluster space, unless five decades of history reverses itself. Which it will not.

The High Performance Computing & Mission Critical Systems group, which combines the SGI and Cray supercomputer businesses with high-end Superdome NUMA server sales, posted $741 million in sales, up a pretty good 11.1 percent. But operating income is small here, at a mere $29 million, and significantly fell by 38.3 percent.

We have said this before and we will say it again: Someone has to invest in HPC and now AI architectures, because this work needs to be done, but this is a very tough market to profit from unless you are the semiconductor manufacturer responsible for the compute engines or the memory chips or maybe the flash drives. To illustrate this point, the Compute group’s operating income was 11.2 percent of revenues, compared to a 3.9 percent of revenues for the operating income in the HPC & MCS group.

So while it is wonderful that the HPC & MCS business is up, driven by “a record number of new orders,” as Neri put it in a conference call with Wall Street analysts going over the numbers, and it is wonderful that the order book has $2.5 billion worth of deals in it going out the next few years, and it is wonderful that HPE has an 80 percent win rate on exascale-class systems where it is bidding on them, if you do the math 3.9 percent of $2.5 billion is only $98 million. The profit margins on these deals have to come up, but that may not happen until the “Shasta” systems are more widely deployed in enterprise, government, and academia, where smaller deals command slightly higher profits.

This is always the bet when it comes to profitability of HPC and now AI. Intel and Nvidia are getting most of the profits in these HPC and AI systems. And competition for compute engines will make iron cheaper, but it will not necessarily make HPE profit margins higher. In fact, we doubt that will be the case. If anything, the compute engine vendors, under increasingly competitive pressure as more CPUs, GPUs, and FPGAs are brought to bear, will lean on the margins of their OEM partners more, not less.

Like we said, send Thank You notes.

And for the next several years, HPE will suffer through the shift from transactional sales for equipment on the capital expense budgets of its IT customers to the novel GreenLake subscription model — which is necessary and good — which will go on the operational expense budget with HPE keeping ownership of the gear as it gets paid for in a cloud fashion. HPE has added 200 new GreenLake customers, pushing the total to 1,100, and the annualized run rate for GreenLake revenues was $705 million, up 33 percent year on year. This, we think, is eating into hardware sales, just like switching from perpetual licensing to subscription licensing has done at every major software vendor. Eventually, it will all level out. Like with the $2 billion deal that HPE just cut this week with the National Security Agency in the United States for cloudy pricing on all kinds of HPE gear to be installed in a private NSA datacenter.

Neri wants to have a compound annual growth rate for this GreenLake business that is between 30 percent and 40 percent between fiscal 2020 and fiscal 2023, inclusive.

It is going to get very complex keeping track of sales of systems, but right now the GreenLake numbers go into the appropriate HPE groups and divisions based on the labels on the gear, and according to proper revenue recognition. At some point, far off in the future, maybe all gear will be sold this way. Why not? Why own it when you can get all of the benefits of ownership — control, locality, security — without any of the balance sheet pressure. It makes sense to us. Let HPE’s balance sheet take the heat.

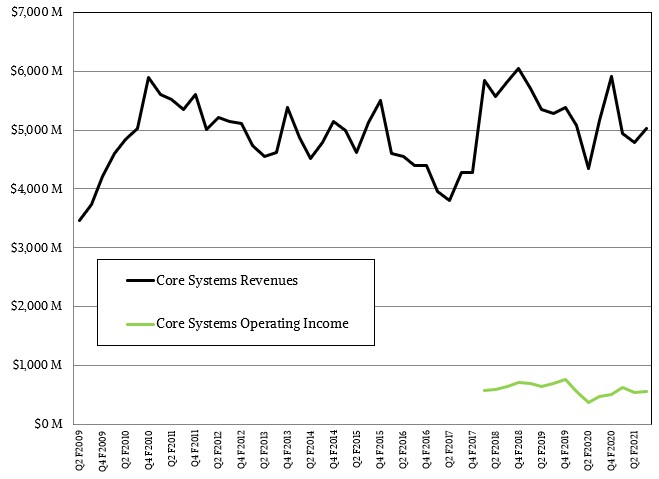

As always, what we care about is how the core systems business at HPE is doing. And this chart, which we have updated with the most recent operating income for servers, networking, and storage, gives you a sense:

If you add that all up, the core systems business at HPE was down 3.6 percent, to just a hair over $5 billion, but operating income rose by 3.6 percent to $554 million, or about 11 percent of revenues. We do not have operating income data running all the way back to 2009, but will see if we can find it and update it.

Be the first to comment