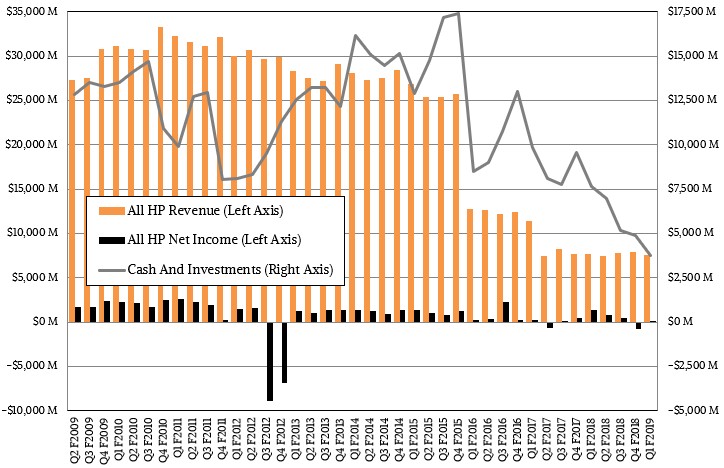

There are two camps of server makers in the world. Those that are aimed at hyperscalers and cloud builders, which buy in lots of 50,000 or 100,000 servers and which therefore have enough leverage for the tail to wag the manufacturing dogs. This is a very cutthroat business with very little margin. And then there is the enterprise market, which is evolving in many ways parallel to the hyperscalers and cloud builders but which has slightly more complicated needs as well as lower volumes, and therefore not only will manufacturers charge a premium. They can actually get away with it.

Hewlett Packard Enterprise has made no secret that it wanted to get out of the former and concentrate more on the latter, and it has spent the past year and a half basically removing itself from chasing what it calls Tier 1 server deals, which encompasses not only the Super 8 – Amazon, Google, Microsoft, Facebook, Alibaba, Baidu, Tencent, and JD.com – but also a handful of smaller Internet giants and a few telcos and other service providers.

If you take out the effect of the Tier 1 sales that HPE had in the year ago period, then its core compute business actually grew by 3 percent in the first quarter of fiscal 2019 ended in January; if you leave that Tier 1 business in, which was a lot larger four quarters ago, then the compute business at HPE declined by 3 percent. That’s what Tarek Robbiati, HPE’s chief financial officer, told Wall Street analysts this week when going over the numbers. That Tier 1 system business, which largely involved the Cloudline machines developed in partnership with Taiwanese manufacturer Foxconn, is largely done at HPE, but it is still having an effect on its revenues and profits. In the quarter, HPE’s overall sales were down by 1.6 percent to $7.55 billion, but if you take out the effect of this Tier 1 business, even as it is much smaller now, HPE’s revenues actually grew 1 percent. Two years ago, this Tier 1 business, which included servers, switches, storage, and a smattering of software, comprised about a third of HPE’s server revenues, we estimate. It is hard to say how small that Tier 1 business is now, but we reckon it was around $400 million in Q1 fiscal 2019, and most of it was for servers. Sales of products to the Tier 1 vendors – who are never named, but we suspect that Microsoft and eBay were big clients of HPE’s custom gear at one point, among others – are expected to dwindle enough to not have much of an effect by the end of the year.

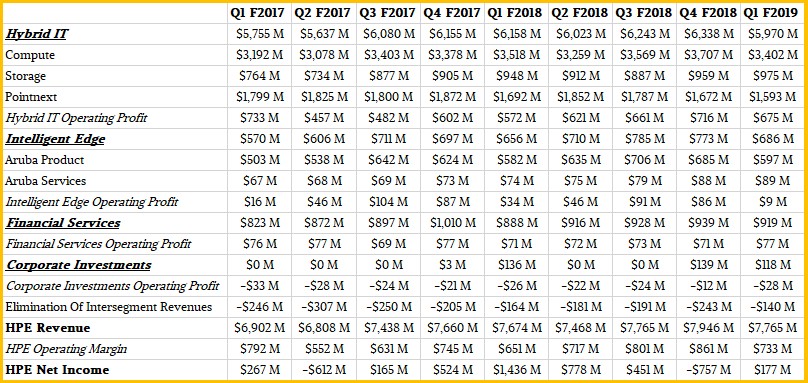

In the Americas region, which includes North, Central, and South America combined, sales of compute grew in the “double digits,” according to Robbiati. HPE has rejiggered some of its product categories and the way it is recognizing revenue, and now Datacenter Networking appears to be consolidated into Compute underneath its Hybrid IT category; HPE also rejiggered its Pointnext services category and tweaked the Intelligent Edge category, which includes its Aruba wired and wireless networking gear and other edge computing.

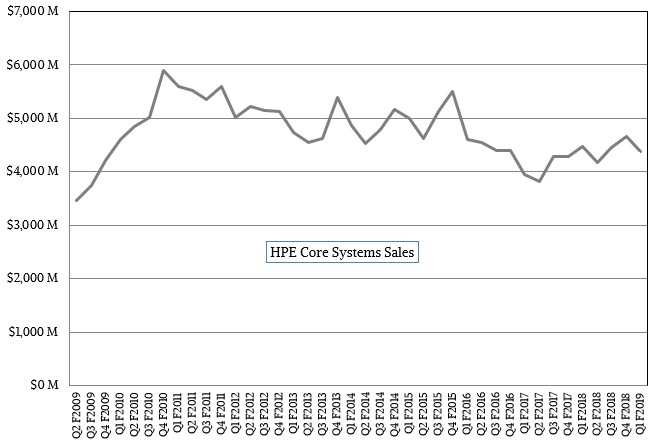

As is the case with IBM, it is difficult to try to reckon what the core, underlying systems business at HPE looks like, and it is getting tougher for a number of reasons. For one thing, mixing up compute and networking obfuscates the core compute, and we have said for some time that the datacenter networking business at HPE, which largely came from its acquisition of 3Com many years ago, is so small it would not want to break it out separately for very much longer. Moreover, the Pointnext division includes the break/fix services for HPE’s systems as well as for the new “GreenLake” hardware as a service packing and pricing that the company has been offering for several months and which HPE chief executive officer Antonio Neri says now has 450 customers. This systems business provides cloud-like utility pricing for HPE systems and it has been growing at a double digit rate as well and will soon be at a $1 billion annualized run rate. That is still small compared to the core ProLiant business, and it is on par with the Synergy composable infrastructure business (reported in the Compute sector underneath Hybrid IT), which Neri says now has a $1 billion annualized run rate.

Here is how the various HPE divisions have done in the past two years:

The overall compute business, which is dominated by ProLiant rack servers at this point with a smattering of hyperscale machines like the Cloudlines and a slightly smaller slice of Synergy composable systems, fell by 3.3 percent to $3.4 billion. Within the Compute segment, what HPE calls value compute (roughly translated to ProLiant servers) grew by 19 percent year on year, high performance computing systems rose by a staggering 59 percent, and hyperconverged systems that mash up virtual compute and virtual SANs rose by a stunning 70 percent.

Storage sales, led by 3PAR and Nimble arrays and related software, grew by 2.8 percent in the period, to $975 million. All flash arrays, which were spearheaded by Nimble products, rose by 20 percent, and generic sales of big data storage that underpin systems like Hadoop rose by 25 percent.

The Pointnext mashup of services, which include tech support services relating to hardware and software and various consulting services that are being pulled back in smaller geographies, declined by 5.9 percent, and Neri stressed that this decline is absolutely intentional as HPE focuses on deals where it can win and be profitable. It seems to be working, because operating profits in the Hybrid IT group rose by 18 percent to $675 million in the first quarter of 2019, against sales of 5.97 billion, down 3.1 percent.

The Financial Services group at HPE continues to plug along, financing its gear, and generated $919 million in sales, up 3.5 percent, and an operating income of $77 million, up 8.5 percent. HPE Financial Services has a portfolio of $13 billion in assets under management, and has $600 million in cash and $11.4 billion of its own debt against those assets, which are mostly out under lease to clients. About 55 percent of the financial arm’s sales come from the Americas, 30 percent comes from EMEA, and the remaining 15 percent comes from Asia/Pacific.

As we said, it is tough to get a good sense of how the core systems business at HPE is doing anymore, but if you add up compute and storage, here is what it looks like:

Over time, as Pointnext GreenLake services ramp, as HPE expects, we will see how sales of iron sold under a consumption model are called out and how this impacts sales of ProLiant and Synergy servers. It is tricky to talk about this, and no system maker wants to reveal too much about its business. Only just enough to make Wall Street happy and not enough to let rivals really understand what is going on. But 450 customers who are consuming $1 billion worth of capacity, as seems to be the case with the Pointnext GreenLake services, is material and, we think, should be called out separately in some fashion for the sake of clarity and so HPE can legitimately brag about the success it is having with this effort.

Be the first to comment