The second 5 percent chunk of server shipment market share for chip maker AMD is probably going to come easier than the first 5 percent share, which was attained as AMD exited the fourth quarter and, significantly, was a stake in the ground that chief executive officer Lisa Su drove into the ground in late 2016 as the “Naples” Epyc ramp got under way.

Everybody has been watching to see if AMD would make its server share numbers, and as expected, big deals with the hyperscalers – mainly Amazon, Microsoft, and Tencent – helped bring home the market share bacon for the Naples Epyc generation.

“Fourth quarter server unit shipments more than doubled sequentially based on growing demand for our highest end, 32-core Epyc processors with cloud, HPC, and virtualized enterprise customers,” Su explained on the call yesterday after the market close with Wall Street analysts. “As a result, we believe we achieved our goal of mid-single-digit server unit share exiting 2018. We had another strong quarter of cloud adoption, highlighted by industry leader Amazon announcing new versions of their most popular EC2 computing instances powered by Epyc processors. Businesses can easily migrate their AWS instances to AMD and save 10 percent or more based on the technology advantages of our platform. Microsoft Azure also announced general availability of their AMD based storage instance in the quarter, as well as a new HPC instance powered by Epyc processors that is 33 percent faster than competitive X86 offerings.”

Su called out some HPC system wins, including clusters based on Epyc processors going into Procter and Gamble, the US Department of Energy (the NERSC-9 “Perlmutter” system), and the University of Stuttgart, and notably a system at Lawrence Livermore National Laboratory that employs both Epyc processors and Radeon Instinct GPU accelerators that will be employed for data analytics and machine learning workloads. While there has been a fair amount of tire kicking and testing among enterprise customers and HPC centers said Su, it is the hyperscalers and cloud builders who are driving the shipments of Epyc processors at this point, and it is these same customers who will be at the front of the line for the Rome Epycs, which are socket compatible and which will provide a big bump in performance when they are launched in the middle of this year and ramp in the second half.

“As we look into 2019, I would expect that the early Rome deployments will also be cloud based,” said Su. “It will be the first ones, but we have a strong set of enterprise platforms. And as I mentioned earlier it is the breath of the OEM platforms that gives us good confidence that we were going to a broader set of workloads and having broader coverage in the market. In terms of share assumptions, we will have to see how the markets and year play out. But I think what we have said before is that after reaching the mid-single digit market share in the fourth quarter of 2018, we would expect it would take another four to six quarters to reach 10 percent market share. And I think we are still in that range.”

AMD is perhaps hedging a bit on when it might get 10 percent of shipment share, but the situation perhaps warrants more optimism.

With the next generation “Rome” Epyc processors coming around the middle of this year, as planned, AMD is using a mix of 7 nanometer compute core chiplets etched by Taiwan Semiconductor Manufacturing Corp and 14 nanometer memory and I/O circuits etched by GlobalFoundries. AMD has renegotiated its wafer and fab agreement with GlobalFoundries giving it freedom to choose a foundry for any process that is smaller than 12 nanometers and committing to GlobalFoundries for anything that is at 12 nanometers and larger. (GlobalFoundries spiked its 7 nanometer research, development, and supposedly ramping production last summer, basically saying the volumes of prospective customers did not justify the enormous investment and the probable losses from moving to the next node, but AMD and IBM, to the big server chip designers dependent on GlobaFoundries, had seen the writing on the wall and had shifted to TSMC and Samsung for their future chips, respectively.) The point is that the Rome chip will offer 2X the integer and 4X the floating point performance of its Naples predecessor, and this is not the kind of performance bump that Intel will be delivering in its mainstream Xeon SP processors this year.

With Intel not getting to 10 nanometer “Ice Lake” Xeons until early 2020 in any kind of volumes, there is a three quarter window from Q3 2019 through Q1 2020 that AMD should be able to win big deals against the “Cascade Lake” and “Cooper Lake” tweaks to the current “Skylake” Xeons SP processors etched in 14 nanometer processes at Intel’s own fabs and if there is any further slip in the 10 nanometer processes used to manufacture the Ice Lake Xeon SPs, then AMD will surely benefit more from this than will the Arm collective, led by Marvell and Ampere at this point with their ThunderX2 and eMAG chips, or IBM with its Power9 chip.

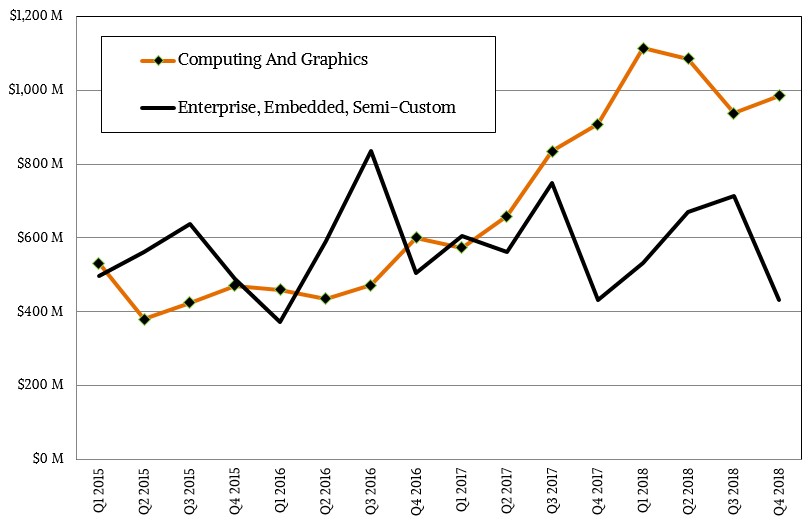

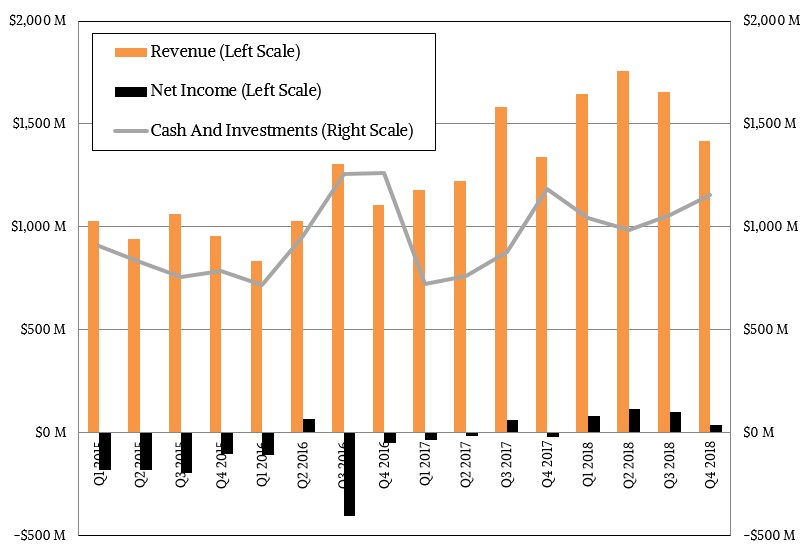

While the server market is growing nicely at AMD, and the datacenter GPU business, led by the latest Radeon and Radeon Instinct GPU accelerators, is also growing, the server business is apparently not yet profitable according to Wall Street, and this was something that was raised on the call and not disputed by either Su or Devinder Kumar, AMD’s chief financial officer. But the Epyc average selling prices have been on the rise as cloud builders and hyperscalers buy up the Epyc stack, and that has closed the gap quite a bit. Kumar stopped short of saying that the Rome Epycs will push the server business to profitability, but clearly this is something that AMD desires and that will be possible as 2019 comes to a close and 2020 ramps. It may hard to reckon how this datacenter business is doing because a portion of it – the server chips – is in the Enterprise, Embedded, and Semi-Custom division and another portion of it – the Radeon and Radeon Instinct GPU accelerators – is in the Computing and Graphics division.

AMD gave some hints about how its datacenter business was doing for the first time, and eventually we think that AMD will break this out separately in its financial presentations when the revenue streams become more meaningful and predictable. Su said that the total datacenter business in the fourth quarter of 2018 drove a “mid-teens” percentage of revenues. If you do that math literally, 15 percent of the $1.42 billion in sales for the overall company means that datacenter CPUs and GPUs collectively drove about $213 million in sales in Q4 2018. If we do some rough estimating about CPU and CPU shipments for the prior three quarters in 2018, we think that AMD did somewhere north of $400 million in datacenter sales for all of 2018, and there is a very good chance that it can grow this significantly even with an expected downdraft that is much steeper than the typical 10 percent sequential decline going into Q1 2019. We can see AMD doubling its share of CPUs and GPUs in the datacenter this year and more than doubling its revenues, which would be quite an accomplishment indeed. Depending on what Intel and Nvidia do, AMD could do even better.

There’s only one way to find out, of course. We will have to live through it, and one thing for sure, it won’t be a boring year for compute.

In the fourth quarter, AMD’s revenues rose by 5.9 percent to $1.42 billion, and the company shifted from a $19 million loss in the year-ago period to a $38 million gain this time around. For the full year, AMD raked in $6.48 billion in sales, up 23.3 percent, and net income was $337 million, a whole lot better than the $33 million loss in 2017. The long plan that AMD put in place six years ago and that has been masterfully engineered by Su and her team is working, and the company has but a tiny slice of the $75 billion total addressable market that it is chasing. Time to buy a networking company, and complete the stack. Mellanox is in play, we hear, and it makes a whole lot more sense for AMD to buy it than it does for Microsoft.

What a way to spend eleven hours today.

I’ll offer two AMD 2018 volume estimates.

First is on channel data. Second is my objective counsel aiming for one traditional Intel desktop run of 60 million units strategically to be industrially competitive.

On channel data by quarter the cumulative result;

Epyc = 1,097,938 units at OEM price is AMD gross per unit $660.10 that is 79% off XSL full line 1K AWP

Thread ripper = 5,677,624 units OEM price AMD gross per unit $286.26 is 50% off Xeon W full line 1K AWP

Note I count both Epyc and TR in Enterprise Segment

Ryzen desktop and mobile = 26,065,428 units at AWP $106.89 is 60% off Coffee Lake desktop full line 1K AWP

GPU = 17,882,168 units at AWP $75.37

50,733,158 total units Average Weighed Price is AMD gross $127.83

Q1 = 13,473,259; Q2 = 14,335,964, Q3 = 11,673,935, Q4 = 11,250,260

Now intuitively production at 60 M units with another 30 M in progress. Sixty million units observes product category average quarterly volume and rounds up, assumes more volume missing from the record of channel data through back half of year.

Epyc = 1,500,000 units AWP $483.17 is Intel XSL full line parity price 85% off 1K

Thread ripper = 6,500,000 units AWP $250.03 is 55% off Intel 1K full Line Xeon W

Ryzen desktop and mobile on volume channel data does not see at 32,000,000 units AWP $87.07 or 1K AWP *3 on stakeholder split $261.20 for equal weight grade’s procurement is $4.04 per thousand less than Coffee Lake desktop full line 1K AWP $265.24

GPU at 20,000,000 units at AWP $67.39

AMD 2018 = 15 M units per quarter average

Either way by product category revenue spilt is;

Epyc = 11.18%

TR = 25.07%

Ryzen = 42.97%

GPU = 20.79%

Platform staff, “Su said that the total datacenter business in the fourth quarter of 2018 drove a “mid-teens” percentage of revenues. If you do that math literally, 15 percent of the $1.42 billion in sales for the overall company means that datacenter CPUs and GPUs collectively drove about $213 million in sales in Q4 2018.”

My data has Epyc revenue down in Q4 by 49.7% and 58.64% from Q2 and Q3 respectively showing just 8.54% of total in quarter revenue. On Dr. Su’s statement and Platform $213M whole estimate suggests $91,760,000 in DC GPU revenue. Epyc Q1 = $69.16M and Q2 = $241.2M and Q3 = $294.15M and Q4 $121.24M. I record GPU in GPU not Enterprise.

During Q4 TR outsells Epyc 4.16 to 1 on volume. TR is also down from prior quarters by 32%, 27% and 26% respectively. In Q4 32C 2990WX represents 48.9% of TR volume; 24C 2970WX = 0.69%, 16C 2950X = 29.2%, 2920X = 0.54%, 1950X = 8.47%, 1920X = 5.27%, 1900X = 6.93%

On my bump up in Ryzen to 32 M is 5,934,572 more than channel volume weight suggests or 1,483,643 per quarter.

Epyc = 375,000 per quarter average = 2.5%

TR = 1,625,000 per quarter average = 10.83%

All Ryzen 8,000,000 per quarter = 53.33%

Current volume split is 85% desktop and 15% mobile

GPU = 5,000,000 per quarter = 33.33%

Mike Bruzzone, Camp Marketing

Threadripper is not an enterprise vetted/certified part and even if the Threadripper/TR4 Motrherbard platforms support ECC those MBs are not vetted/certified for ECC usage. Only the Epyc/SP3 motherboard platforms are fully vetted/certified to work as error free as possible with ECC memory.

No consumer MB maker is going to spend the necessary funds to fully Vett and Certify any TR/TR4 MBs for ECC memory usage. And no engineering firm will use any other parts except the CPU/MB Professsional Parts with the proper vetted/certified CPU/MB platform ECC support.

All that AMD needs to do is begin offering some newer Epyc/Naples SKUs like the Epyc 7371 that was just released in Q4 2018 that run at much higher clock rates. The Epyc 7371 is a 16 core part so let AMD release some higher clocked 24 and 32 core Epyc parts and watch those Epyc/Naples ASPs go higher.

Epyc/Rome is still on its initial Shakedown Cruise with potential server/HPC customers so that’s 2H 2019 before Epyc/Rome expected to begin shipping. Producion workloads can not be trusted to any parts that have not been properly and thoroughly vetted/certified!

@ HigherClockedInNaple

Not sure why there is no bottom up VAR program to address certification with Fortune around town at the intersection of bank on one corner, insurance the other, financial and manufacturers in region. No excuse at all to wait.

Virtual compatibility lab, followed by integration lab is a business growth technique no one has forgotten.

Take that AR in your region and start that movement.

Let your AMD sales contact know we’re not going to participate in neglect anymore, and needprograms to coordinate and put in place on deliverables to resolve these barriers to adoption take this AR and start a movement where ever located.

It’s not that AMD sales does not know as you’ve explained but news to me; hummmm.

Thank you.

mb