When you look at IBM, it is as if you are seeing many different instantiations of Big Blue across time playing out in the present, side by side. It is a bit like being in a fun house of IT, and to be frank, it is hard to see what is going on sometimes. IBM’s categorizations of its business for the sake of Wall Street don’t help.

The mainframe represents the kind of centralized, large scale computing computing that Global 2000 organizations have preferred since the 1960s and have scaled up across more than five decades. The Power Systems line was more about cheap compute – or relatively cheap compute by comparison to the mainframe – that has gradually and, with Power9 processors, dramatically, been enhanced with massive I/O capabilities that made the mainframe useful decades ago and still useful today. The good news for IBM is that both System z and Power platforms did reasonably well in the third quarter, although profits for its Systems business overall were under pressure as the company begins invest in the next cycle of iron and as it is selling less intellectual property from its semiconductor research and development, which gets booked in this part of IBM since it sold off its chip business to Globalfoundries a few years back.

The initial Power9 machines rolled out last December with the “Newell” Power AC922 systems that are at the heart of the “Summit” supercomputer at Oak Ridge National Laboratories and the “Sierra” supercomputer at Lawrence Livermore National Laboratory, but sales of these machines did not really pick up until the summer, when the “Volta” Tesla V100 GPU accelerators that they employ alongside of the Power9 chips were widely. In the spring IBM rolled out the middle of the Power9 line, and in the summer the fatter NUMA boxes came out. Now it is time to see what kind of appetite there is in the market for what IBM has forged as an alternative to Intel Xeon machinery.

IBM does not say anything terribly specific in its financial report for the third quarter, but when pressed, Jim Cavanaugh, the company’s chief financial officer told Wall Street that revenues for Power Systems rose by 17 percent in the period, and added that IBM expected to see similar growth in the fourth quarter we are now in as those NUMA boxes start to move into accounts running large relational databases that back-end ERP suites and SAP HANA in-memory setups doing transaction processing and data warehousing. Cavanaugh initially only said that the Power line had double digit growth, driven by strong adoption of Linux-based variants of the Power9 line – which means not just the machines inside of Summit and Sierra, but baby versions of those that are being installed at commercial settings. We have caught wind of a few baby Summits going in, but have not been able to confirm where. We think some of the revenue for Summit and Sierra have been recognized, and maybe for a few of these other Power AC922 clusters, but we can’t prove it. The 17 percent increase in sales year on year is a pretty good indicator, and a moment that IBM has been waiting for.

The System z line, which has a tremendous amount of operating system, database, transaction monitoring, middleware, and security software, was refreshed with the z14 systems last year, and Cavanaugh told Wall Street this week that in the third quarter this business was still humming along, five quarters into the revamp cycle, with revenues up 6 percent against MIPS capacity shipments that rose by 20 percent. Compared to prior generations of mainframe systems, the aggregate capacity of MIPS shipped on the z14 machines is larger than any other mainframe cycle that IBM has had in its history, which is something to brag about for sure. But what Cavanaugh did not say is that the price per MIPS no doubt continues to fall or IBM would have shown more revenue and profit growth in its Systems business in Q3.

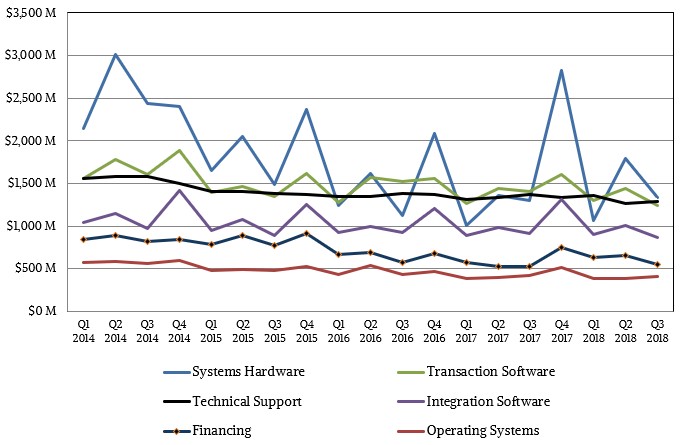

As it turns out, the Systems business booked $1.74 billion in sales to external customers in the period, up less than 1 percent, with an additional $181 million in sales to other IBM divisions for a total of $1.92 billion (down 1.6 percent). Within Systems, we reckon that as reported (distinct from the constant currency figures IBM cites in its financials) sales of systems hardware (including servers, storage, and switching) came to $1.33 billion, up 2.2 percent, and operating systems sales were $406 million, down 3.3 percent. Gross profits were $918 million, we think, which is 52.9 percent of external sales. Overhead dropped that down to $209 million in pre-tax income, which is a figure IBM does give. While this is a lot better than many of the quarters when IBM booked pre-tax losses in Systems, IBM would no doubt like to be more profitable in hardware. Especially considering the billions of dollars it has to invest to create the next generations of z and Power iron.

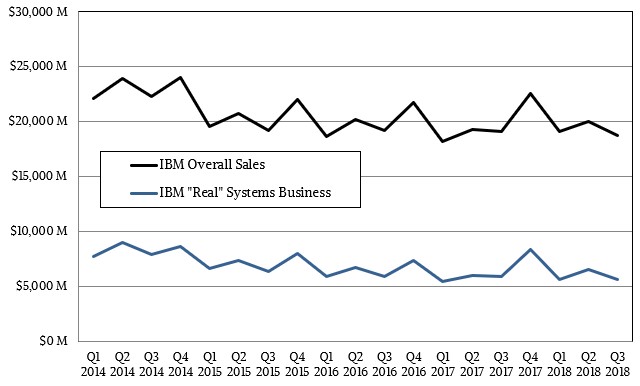

Overall, IBM’s results for the third quarter were lackluster, with revenues off 2.1 percent to $18.76 billion and net income of 1.2 percent to $2.69 billion. This is not a bad business, but it is shrinking, in part because IBM is shifting a lot of its offerings to subscription models, but also in part because the appetite for the vast catalog of services is changing.

If you just look at that raw hardware and operating system figures that IBM gives Wall Street, you would walk away with the impression that IBM’s systems business is considerably smaller than it really is. So much of what Big Blue sells is actually related to software and services on its own systems – the very things that make the company International Business Machines. We do the math every quarter, trying to estimate how this “real” systems business is doing, and it is still quite large, even if it is a lot smaller than it was when IBM still had the System x server business and sold more Unix and proprietary iron.

Our calculations and estimates show that this real systems business, which includes systems hardware, operating systems, transaction and integration software, technical support, and financing revenue streams, came to $5.68 billion in the third quarter, off 4.3 percent. In the trailing twelve months, this business as we describe it generated $26.19 billion, up 5.7 percent, and represented about a third of IBM’s overall revenues. We also think that in the fourth quarter, this real systems business generated $3.18 billion in gross profits, or about 56 percent of revenues, and in the trailing twelve months it amounted to $14.69 billion in gross profits, up 2.5 percent.

Here is the breakdown of sales using this categorization, and only including those portions of IBM’s revenue streams that end up on IBM systems and only provide that core system functionality – not including application software or application hosting or systems integration and such higher level stuff.

This is a very large systems business, and it bears remembering this. There are very few companies that can invest in creating sophisticated systems for HPC and machine learning and advanced databases that don’t just resell Intel components – something IBM most assuredly does not want to do, and stopped doing years ago. There are very few companies on Earth that can take down one or two exascale systems, costing perhaps $400 million to $600 million each, and even pay for the parts in the machines from cash flow. Intel can do it, IBM can do it. Hewlett Packard Enterprise and Dell could do it, but Cray is so small by comparison to the size of these deals that it can no longer do it alone, which is why Cray was the manufacturer on the big machines installed by the US Department of Energy and Intel was the prime contractor.

Our concern is that such systems as Summit and Sierra, which would be as good at traditional HPC simulation and modeling as they are at new fangled machine learning and data analytics, are too expensive to be pervasive and yet too cheap to allow for a lot of profit. The very customers IBM is aiming at with its top end Power9 scale out machinery – HPC centers and hyperscalers – are the very ones that could, in a heartbeat, change their minds or architectures, or just do it all themselves. It is a good thing they still want to offload responsibility to IBM, Intel, and a few others, because it is only through such vendors that there is any hope that technologies will be advanced for the bleeding edge and eventually become the leading edge for enterprises. Which is, after all, the real point of having the technology in the first place. It is for everyone to advance, not just for the upper echelon of computing in each country.

IBM is still in the game, and is still innovating, and it is that rock-solid yet ever-changing System z mainframe, ironically, that still makes this all possible. It is kinda funny when you think about it that way. Intel’s PC chip monopoly and datacenter server chip monopoly do much the same for Intel, affording it the chance to experiment and try to push the envelope.

Someone has to do it.

Be the first to comment