China represents a huge opportunity for chip designer ARM as it looks to extend its low-power system-on-a-chip (SoC) architecture beyond the mobile and embedded devices spaces and into new areas, such as the datacenter and emerging markets like autonomous vehicles, drones and the Internet of Things. China is a massive, fast-growing market with tech companies – including such giants as Baidu, Alibaba, and Tencent – looking to leverage such technologies as artificial intelligence to help expand their businesses deeper into the global market and turning to vendors like ARM that can help them fuel that growth.

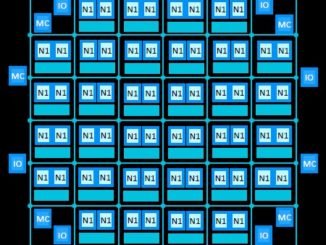

ARM Holdings, which designs SoCs and licenses those designs to third-party companies, has more than 1,000 such partners worldwide, including more than 200 in China alone, where over the past decade, the number of ARM-based chips shipped by Chinese partners has jumped 114-fold. The company has a dominant position in the mobile device market, with ARM-based chips powering the bulk of smartphones and tablets on the market around the globe. The rise of the IoT, the growth of hyperscale computing environments and the greater focus on energy efficiency in the datacenter has created opportunities for ARM to push beyond those mobile and embedded computing areas and rapidly grow its addressable market possibilities. That includes moving deeper into the Chinese market.

That effort already is well underway. Along with the 200-plus partners it already has in China, some US ARM-based chip makers are looking to push their way into the growing market. For example, Qualcomm officials early last year unveiled a plan to create a joint venture with the Guizhou Province – a rising tech center in China – with the goal of building ARM-based server chips for the China market. Qualcomm officials last month said the joint venture, called the Huaxintong Semiconductor Technology Company, has begun creating a new CPU based on Qualcomm’s ARM chip designs.

In addition, as outlined by The Next Platform, Chinese chip developer Phytium Technology is creating 64-bit server chips called “Earth” and “Mars” that are based on the ARM architecture. For its part, over the past several years has made an effort to increase its presence in China. In 2015, the company announced a partnership with Chinese smart device platform maker Thundersoft to launch the first ARM Innovation Ecosystem Accelerator program to drive IoT R&D among OEMs and startups using ARM technologies, including a Cortex-based IoT SoC and the company’s mbed IoT platform. A year ago, ARM was one of several companies – others includes Dell, Huawei, Lenovo, Baidu, Alibaba and Chinese National Software and Service to create the Green Computing Consortium that is aimed at creating green computing technologies to be used in China and to drive development of big data and cloud computing development based on the ARM architecture.

ARM was bought last year by Japanese conglomerate Softbank for $32 billion, one of a number of acquisitions over the past several years in a rapidly evolving semiconductor market.

Now another path is being cleared to help ARM continue its push into the Chinese market. The chip designer and Chinese private equity firm HOPU Investment Management are creating an $800 million to invest in startups and small technology companies in China and abroad that are developing new products and applications for AI, autonomous vehicles, cloud computing, big data and the IoT based on ARM technologies. ARM contributed $40 million to the HOPU-ARM Innovation Fund, which will be managed by HOPU. Other Chinese financial and investment institutions also have contributed to the fund. ARM officials see the fund as a way of growing the chip designer’s ecosystem in the country.

The fund will be geared toward emerging technologies, in particular AI and IoT. The use – and promise – of AI has exploded in recent years with the rise of such training methods as deep learning and machine learning, which use neural networks to essentially enable machines to learn in a fashion similar to humans. AI has broad applicability across a wide range of industries and is fueling the drive behind such efforts as self-driving vehicles and big data analytics. Hyperscale players like Google, Facebook, and Amazon are driving the development of AI technologies and the use in their own businesses. The same can be said for their Chinese counterparts, such as Baidu, which through its Baidu Research arm is helping to propel the research and development into AI and machine learning, which will help in such areas as image recognition and natural language efforts. The new ARM-HOPU Fund is designed to drive not only technological innovation but also to help finance the R&D work.

“IoT and AI are core technologies in the next wave of computing and China is helping to drive the rate of innovation in these fields,” said Allen Wu, executive vice president and president of Greater China for ARM. “ARM China’s long-term vision is to work closely with local industry to build an innovative open ecosystem offering core technologies with global capability.”

As we have discussed before, China is a highly attractive market for most tech vendors, including chip makers. Intel, AMD and IBM – through its OpenPower Foundation – all are looking to become bigger players in the country, despite hurdles that government lawmakers have put up in an effort to grow the country’s in-house tech ecosystem. The country has been wrestling with the United States over worries about national security related to technologies from the other country. At the same time, China is looking to become more competitive with the United States in the technology space. US tech companies ranging from Hewlett Packard Enterprise and Intel to AMD and – as noted – Qualcomm are partnering with Chinese companies as a way of getting a better foothold in the Chinese market.

Which is very odd considering China is striving for IP / Tech independence. Tying yourself to a Japanese owned company you main Pacific rival looks very counterproductive to the politburo party goals.