Any aspirations that the Hewlett-Packard that we knew for nearly a decade and a half to build a conglomerate that resembled IBM in its own former enterprise breadth and depth of software, services, and systems is now over with the company spinning out its Enterprise Services business and focusing very tightly on its core hardware and related software businesses.

In conjunction with the posting of its financial results for the first quarter of its fiscal 206, the trimmed down Hewlett Packard Enterprise, which has not included the PC and printer businesses since last year, announced that it was going to get a little bit slimmer after it sells off its Enterprise Services business to CSC, which coincidentally (or perhaps not) is run by an ex-IBMer who is more than familiar with Big Blue’s Global Services behemoth.

While technical and professional services are part of every enterprise datacenter budget, they are not part of the platforms that companies build, but rather the means by which they get built in many cases. But more times than not in the past couple of decades, the services business has been about maintaining legacy systems on the cheap while companies transition to new architectures, and generally speaking, this is a very people-intensive endeavor where profits are hard to come by.

This, more than any other reason, is why HPE has decided to spin off Enterprise Services, which is an amalgam of the old Electronic Data Systems business that the former HP acquired in 2008 for a whopping $13.9 billion, and the services arm of Compaq, which HP bought in 2001 for $25 billion. Dell, which spent years trying to build a conglomerate that spans all aspects of the datacenter, has also decided to spin out its services arm (which is largely based on its 2009 acquisition of Perot Systems for $3.9 billion, a reaction to HP’s EDS buy as much as anything else) for $3 billion. HP reckons that the merger of its Enterprise Services group with CSC will yield about $8.5 billion in value to HPE shareholders, who will get $1.5 billion in a cash dividend; HPE is also shifting $2.5 billion in debt to CSC and will have a $4.5 billion stake in CSC. The new CSC will have around $26 billion in revenues and about 5,000 customers worldwide. IBM doesn’t break out Global Services as a separate business any more, but it was roughly twice as large as this in 2015 in terms of its revenue stream.

What is interesting to us here at The Next Platform is that HPE is focusing down on the most core datacenter products it has, including servers, storage, switches, systems software (including operating systems and a smattering of management tools, databases, and other selected middleware), plus financing for the whole kit and caboodle for those customers who want to use other people’s money to fund their IT infrastructure. The resulting HPE after the spinout of Enterprise Services to CSC is going to be considerably smaller than the HPE that was just separated from the PC and printer business last year – about $33 billion in annual sales – but it is a good guess that this leaner HPE will be a lot more profitable. HPE will also not be going through round after round of restructurings in the services business, which it has endured since buying Compaq in 2001 and which accelerated in the wake of the acquisition of EDS in 2008.

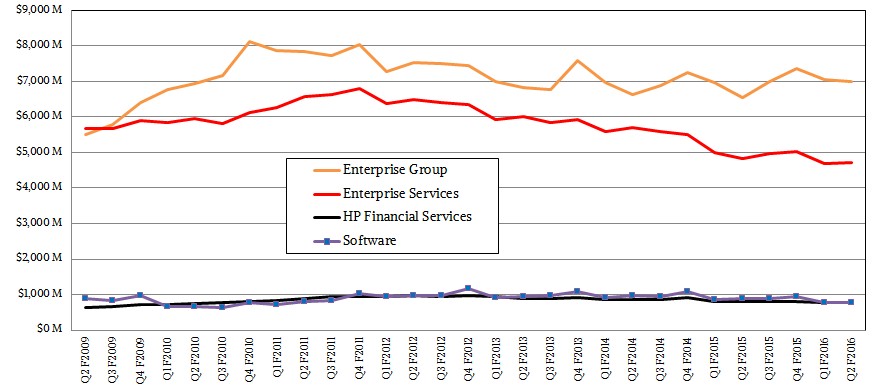

In the most recent quarter, for example, HPE had $4.72 billion in revenues in Enterprise Services, down 2 percent, and had an operating profit of $317 million, up 84 percent. This might seem like a pretty good thing, with profits swinging higher in services, but in the same period from the end of January through the end of April, HPE’s Enterprise Group (which makes datacenter hardware) had just over $7 billion in sales, up 6.7 percent, and posted an operating profit of $817 million, down 11.8 percent. Even with that decline in profitability, which was due to competitive pressures as well as foreign exchange rates against the US dollar and further commoditization of all kinds of hardware, HP is bringing 11.7 percent of revenues to the middle line in Enterprise Group compared to only 6.7 percent of revenues for Enterprise Services – and that is after making lots of job cuts over the past several years in the services arm.

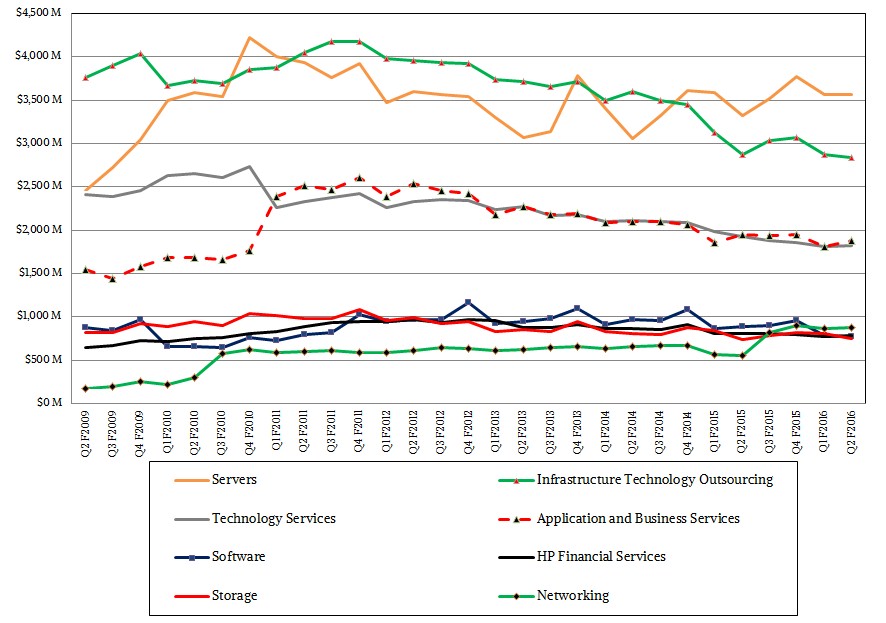

In the quarter ended in April, HPE said that Enterprise Group showed growth in every geographic region and across every major product category for the second quarter in a row, and this marked the eighth quarter of margin expansion. (Bragging about this to enterprise customers as well as hyperscalers, cloud builders, and HPC centers will only encourage them to bargain for deeper discounts, of course.) The company’s server revenues rose by 7 percent to $3.56 billion, with growth in rack, tower, and density optimized architectures. “We continue to see servers as a growth driver, and given the strength of our portfolio we anticipate healthy demand for compute through the remainder of the year,” Meg Whitman, HPE’s CEO, said on a call with Wall Street analysts going over the numbers.

Interestingly, the CSC deal includes a three year commitment to keep pushing HPE iron in Enterprise Group accounts as the business transitions over, while still allowing CSC to do the deals with other IT suppliers on existing and new contracts where customers want alternatives.

On the storage front, HPE booked $752 million in sales, up only 2 percent, as legacy storage arrays continue to shrink as new clustered storage systems and all-flash arrays continue to grow. The 3PAR all-flash arrays saw nearly 300 percent growth in the quarter, according to Whitman, about twice as fast as the market at large. But this growth in all flash is only fast enough to HPE to maintain, more or less, not actually grow storage appreciably. (All storage platform providers with a mix of legacy and new architectures have the same problem, this is not by any means limited to HPE.) HPE’s networking business shot up by 57 percent in the quarter to $874 million, thanks to its partnership with the Unisplendour unit of Tsinghua in China and its acquisition of Aruba Networks last year. In datacenter switching, HPE saw 18 percent revenue growth in fiscal Q2.

HPE’s Technology Services unit, which provides tech support for its wares, fell by 6 percent to $1.82 billion, and its Software group was down 13 percent to $774 million and its Financial Services group was off 2 percent to $788 million.

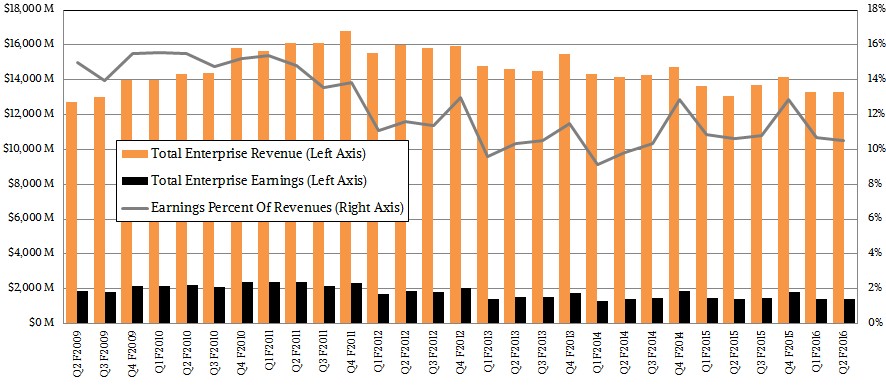

Here are the trendlines for HPE as it is currently configured, including the infrastructure technology outsourcing and application and business services parts of Enterprise Group:

If you add up the elements of the core systems businesses at HPE, including servers, storage, and networking, those pieces comprised $5.19 billion in revenues, up 12.1 percent year-on-year. HPE does not break out operating margins on a product category basis, so we cannot see how profitable these core hardware bits are compared to Technology Services, which are added to hardware sales to yield Enterprise Group revenues. Margins for its Technology Services division could be quite high, and are probably better than for its core hardware business.

The issue that HPE has is not that it needs to stabilize its businesses, but as the revenue lines above show, that they are flat to slightly declining over the long haul since the end of the Great Recession, when as we all know, everything changed. Even if HPE managed to grow its software business substantially, it would only bring it back to levels it saw in 2011 through 2014. Its financing business is tied to hardware and software sales, so if these are flat to down, then it will also be flat to down over the long haul.

The choice that HPE seems to have is to make it up in volume in the datacenter, wringing more costs out of its supply chain through partnerships like it has with Foxconn and Tsinghua (among others), and try to boost its box shipments faster than the unit prices are coming down across the IT industry for servers, storage, and switching. This is a very tough row to hoe, but it is indeed the battle that all IT suppliers are fighting as they compete for budgets. As you can see from the chart above, this volume strategy has worked with servers to a certain extent in the past several years, and acquisitions and growth have bolstered storage. As long as HPE continues to offer a wide variety of products to meet a diversity of demands, it will be able to hold its own against a surging Dell that is on the edge of finishing its own monster acquisition of EMC for $67 billion and that is hell bent on pushing hardware in its myriad forms.

Be the first to comment