Make of this what you will: IBM’s server business is up and has grown for four quarters in a row, but as best as we can figure, its real systems business – the collection of hardware, software, and services that it peddles on its own iron – has not grown because its software sales are flagging.

Whether Wall Street or its competition wants to believe it or not, and despite the intense competition that the company faces in just about every one of its market segments, Big Blue is still one of the bellwethers for the IT segment. Not the flashy, bleeding edge companies who these days know more about building systems for their specific workloads, but for the many tens of thousands of large enterprises around the world that are juggling a level or workload complexity and stiff regulatory environments that would give Google, Amazon, Microsoft, and Facebook a rude awakening if they had to cope with it all. So when you look at IBM, you are looking at a conservative IT environment that is risk averse because the companies here do not have monopolies from which to extract vast funds that cover their mistakes and that enable their staggering investment in hardware and software. (No one is saying IBM or its customers doesn’t invest in innovation, so don’t take that the wrong way.)

IBM wrapped up its 2015 year in a report to Wall Street after the market closed yesterday, and anything short of stellar news is going to make the stock market jumpy these days, with China in a tizzy and making the rest of the world dizzy. In the fourth quarter of 2015, IBM’s sales were $22.6 billion, down 8.5 percent in large part due to the sale of its System x server division to Lenovo last October. The company’s net income fell by 18.1 percent to $4.46 billion, but this is also understandable because it booked a $2.1 billion gain from the sale of that server business this time last year. For the full year, IBM’s revenues were off by 11.9 percent, not just because of the System x sale mind you, but its net income rose by 9.7 percent to $13.2 billion. Like it or not, IBM is for the full year a healthier business than it was, by these measures. But, it is far from the IBM that had single digit revenue growth and double digit profit growth in the late 1990s and 2000s, and it is certainly not the blue chip stock from the 1960s and 1970s, when IBM was as profitable as Google (relative to their respective revenues) and arguably much more of a monopoly and a bigger influence on the IT sector of their respective times.

In the quarter, IBM’s external sales of systems hardware, which includes servers, storage, and some minor other bits of gear, came to $2.37 billion, and other IBM units bought $131 million in gear for a total of just a smidgen over $2.5 billion. Pre-tax income from continuing operations was $349 million. That revenue was flat as reported (including some System x revenues a year ago as the Lenovo deal was getting finished and implemented), and pre-tax income for IBM’s Systems group was actually higher at $388 million. These numbers have some currency effects in them, since IBM takes its sales overseas and reports them in US dollars. If you look at local currencies where IBM sells its gear, then Big Blue’s hardware business was up 3 percent. IBM does not report revenue figures for its remaining Power Systems and System z product lines, but Martin Schroeter, IBM’s chief financial officer, said on a call with Wall Street analysts that the mainframe line had a 21 percent revenue bump in the final quarter of the year although profit margins fell as is the case at this point in the cycle. (We think IBM was under price pressure as the System z13 product line that launched in January 2015 was seeing its upgrade cycle slow.) IBM says that it added 50 new mainframe customers for the year – the installed base was only around 6,000 customers a few years back, so every little bit helps – but Big Blue didn’t say how many accounts it lost (and we expect the number to be larger than 50, by the way, but perhaps not much larger). For the year, System z mainframe hardware revenues were up 35 percent, and had double digit growth in every quarter, Schroeter said – something very few other parts of the server market can brag about.

The Power Systems line has also grown four quarters in a row, and was up 8 percent at constant currency, which has to be an immense relief to the company. IBM attributes some of this growth to its enthusiastic embrace of Linux on Power8 machinery, but has not given a sense of how much of the Power Systems pie is driven by scale-out Linux machines intended to compete against Intel Xeon servers.

While flash storage is doing well, traditional monolithic disk arrays continue to crash (in the sales sense, not literally) and IBM bought object storage upstart Cleversafe just in time to try to prop it up.

On an annual basis, IBM Systems group had an 8 percent revenue bump at constant currency and excluding the effects of the System x and IBM Microelectronics divestitures, pre-tax profits rose by $600 million.

If you do the math from IBM’s presentations, where it breaks down revenues for servers, storage, operating systems, middleware, and various kinds of servers, as we at The Next Platform do every quarter, looking at the real numbers as opposed to some theoretical constant currency figures, IBM sold $1.65 billion in servers (66 percent of its hardware total), an increase of 9.6 percent year-on-year. Storage, meaning disk, flash, and tape as a single category, fell by 11.5 percent to $801 million in the fourth quarter. If you drill down into Software Group, which posted $6.77 billion in external sales plus another $748 internally, and do a calculation based on the fact that operating systems represented 7 percent of IBM’s Software Group revenues, then base systems, as we think of them, accounted for $2.18 billion in revenues in the final quarter of 2015, rising 3.8 percent.

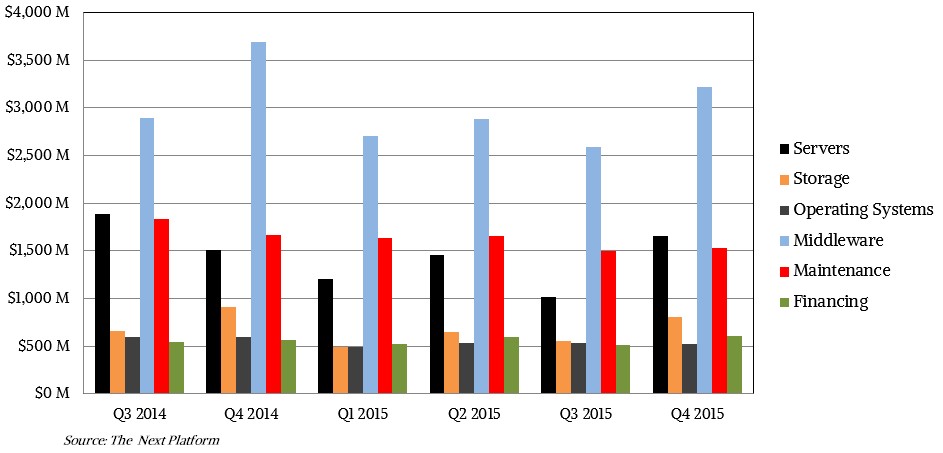

This is not IBM’s real systems business, of course. If you allocate database, transaction processing, and other middleware as well as maintenance services and financing to systems, then you get a better idea of how Big Blue’s core systems business is doing (and why it might have been willing to part ways with its chip and X86 server business). We took what we think is an intelligent stab at such estimates, allocating these elements to IBM systems and to the systems of others, and ignored the latter. Here’s what it looks like when you do that for IBM’s business since the System x divesture:

As you can see, the server hardware part of the systems business is up, which we can see from the IBM figures, but the operating system portion has dropped by 10.8 percent and middleware on IBM’s own Power Systems and System z lines, as best as we can estimate, is off 12.8 percent to $3.22 billion. Toss in $1.53 billion for maintenance (down 7.7 percent) and $609 million for financing of IBM’s own systems (up 8.7 percent in our model) and you get a real IBM systems business that raked in $8.34 billion in revenues, off 6.5 percent from the final quarter of 2014. This is not so bad given the divestitures, when you think about it.

There has been much crabbing about the way IBM allocates revenues for its cloud business, and we are equally skeptical about how such sales can be accurately reported. (When is a private cloud not just server virtualization? What accountant or official at the US Securities and Exchange Commission decided that?) In any event, Schroeter said that in 2015, IBM’s cloud business grew by 57 percent and posted $10 billion in revenues. Of this, $5.6 billion was for private clouds where IBM sold servers, storage, and software to help customers build their orchestrated and virtualized infrastructure. The rest – $4.6 billion – is presumably a mix of SoftLayer public cloud infrastructure revenue and platform and software services running on IBM’s infrastructure that it sells for a fee. The “as a services” businesses, as Schroeter called them, grew by 60 percent in 2015, and had an annualized run rate of $5.3 billion as the company exited the fourth quarter.

Be the first to comment