Call them integrated systems, or platforms, or engineered systems. Call them what you will, but they have become a sizeable – but nowhere near dominant – part of the systems market. IDC calls them integrated systems, and reckons that sales of such systems have been slowing in recent quarters. The appetite for such integrated machines may have found its natural level in the market, or it may just be taking a pause as 2015 gets rolling and a number of transitions are working themselves out.

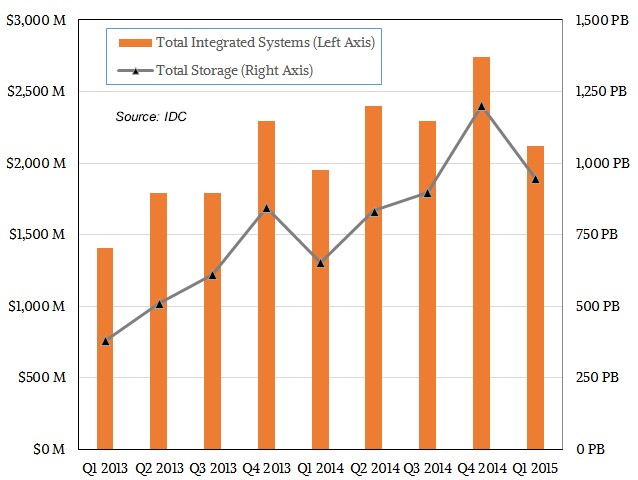

In the quarter ended in March, IDC calculates that companies worldwide consumed $2.12 billion in integrated systems, representing 8.3 percent revenue growth compared to the year-ago period. Across all types and brands of these integrated systems, these machines accounted for a combined 945 PB of storage, which was a 44.5 percent rise in aggregate capacity compared to Q1 2014. The growth rate for storage capacity on these systems is slowing along with revenues (which stands to reason, of course), and if you plot out IDC’s data over the past several years since it has been tracking integrated systems, you can see that there is a pretty rough correlation between overall integrated system sales and storage capacity on those systems:

Generally speaking, the revenue growth is slipping faster than the storage growth, and that is due to a number of factors. For one thing, the cost of compute capacity over the past three years that IDC has been tracking integrated systems has come down thanks to Moore’s Law, and ditto for raw disk and even flash capacity in these integrated systems. Customers are getting better deals on their iron and that pushes down revenues. In 2012, some $5.2 billion in integrated systems with a total of 1,344 PB of storage capacity were sold, according to IDC, and that grew to $9.38 billion in sales and 3,585 PB of storage capacity in 2014. Generally speaking, servers account for around $50 billion a year in sales, storage around $25 billion, and switching around $25 billion, so integrated systems are somewhere a little less than 10 percent of the combined markets. That share in a market that large is still pretty impressive, even if some may be disappointed that integrated systems are not showing the kind of growth they did two years ago.

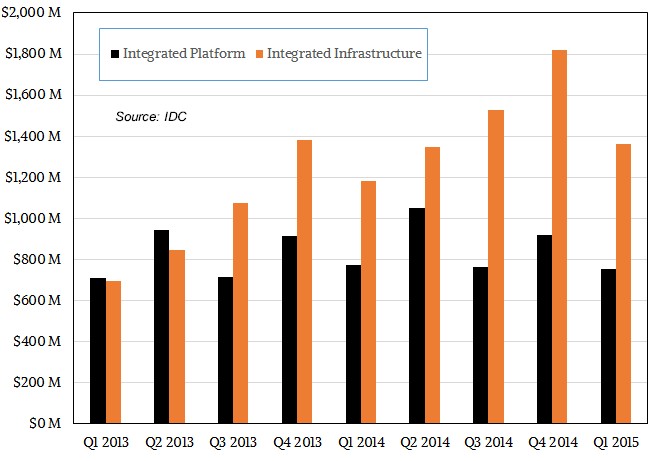

IDC breaks the integrated systems market down into two pieces. Integrated platforms are machine like Oracle’s Exadata database clusters or Exalogic application server clusters. IBM still sells PureApplication integrated platforms based on the Flex System modular machines it sold off to Lenovo Group last fall, and variants of Hewlett-Packard’s Converged Systems are packaged with application and system software, too. These integrated platforms often include not just systems, storage, and switching, but also operating systems and other systems software that is aimed at supporting a specific workload and, importantly, is tuned for that workload.

In the first quarter of 2015, IDC says that these integrated platforms accounted for $755.4 million in revenues, down 2.5 percent from the year-ago period; total storage consumed by these systems came to 184.5 PB. That is 35.7 percent of the overall integrated systems revenue, but only 19.5 percent of the overall storage. (This is due to the mix of software added to the machines as much as anything else.)

Given the nature of these integrated platform systems, which are usually the basis for very large enterprise application projects, you would expect them to have a long sales lead time and to follow the ups and downs of what is going on in the top 5,000 or so enterprise accounts in the world. After these settle into the market, they will have choppy sales much like hyperscale clusters do or HPC systems at the largest supercomputer centers, and equally importantly, they will tend to rise at the beginning of Intel Xeon server chip product cycles as customers try to buy the latest-greatest stuff.

In the latest rankings for integrated platform sales, Oracle by far dominated the space, with just a tad under $392 million in sales, but growing only 5.8 percent. IBM’s sales dropped by 44 percent to $42.4 million, and HP’s Converged Systems sales rose by 53.7 percent to $23.8 million. Hitachi has entered the market and brought in $25.2 million in sales, and other vendors accounted for $272.1 million in revenues, declining 13.1 percent from Q1 2014.

Making any kind of predictions in the integrated platform space is somewhat difficult, Kevin Permenter, senior research analyst for Enterprise Servers, explained to The Next Platform, with IBM and Lenovo in transition, Hitachi entering the market, and Hewlett-Packard pushing to grow. “None of us know how deep the shift for IBM is going, but we will know soon,” he adds.

In May, IBM previewed a new integrated system called the PurePower System that weaves together Power8-based server nodes running Linux or AIX, its Storwize V7000 storage arrays, and various switches from Brocade, Mellanox, and Lenovo to create a successor to the Flex System (the hardware at the basis of its PureApplication System integrated platforms). This is currently shipping supporting Red Hat Enterprise Linux and is managed using the OpenStack cloud controller as well as IBM’s own PowerVM hypervisor, PowerVC security software, and the Nagios configuration management tool. These PurePower machines just started shipping on June 19, so it will take some time for IBM to get traction. IBM has said that its next generation of PureApplication platforms will be based on this hardware as well, and they will launch in the second half of this year.

The interesting bit is that from the time that IDC started tracking the integrated systems market three years, ago, the integrated platforms and integrated infrastructure parts of the market were roughly half of the space. Integrated platform sales have their ups and downs and growth has been slowing, as you see in the chart above. Sales of raw integrated infrastructure systems – those with converged servers and switching with storage added in, sometimes from a third party, sometimes not – were doubling in 2013 and then started to slow in 2014. In the first quarter of 2015, across all vendors of such gear, sales came to $1.36 billion, an increase of 15.5 percent year-on-year. The VCE partnership now controlled by EMC and pushing the Unified Computing System from Cisco Systems grew at nearly twice that rate and hit $329 million. IDC is not providing the figures, but we estimate that the EMC-Cisco partnership pushing its VSPEX setups (also based on UCS servers and networking) generated $202 million in sales (up 12.3 percent), and the Cisco-NetApp partnership that marries UCS converged machines with NetApp storage arrays had $307 million in revenues (up 14.5 percent). If you add up all the Cisco iron underneath the raw integrated infrastructure pushed in the first quarter, it drove 61.5 percent of sales. This is the kind of market share Cisco likes, and it is actually a bit lower than the quarterly averages.

In prior reports, EMC/Cisco setups made the top three, but this time around, HP’s Converged System stacks have knocked them out. HP grew its sales in this category by 40.4 percent and hit $242.6 million in sales. All other vendors, including EMC/Cisco, accounted for $483.9 million in sales, and if you back out EMC/Cisco as number four on the list (which we think it is) other vendors accounted for something on the order of $282 million in sales all told, growing more or less in synch with this part of the market.

The integrated infrastructure systems accounted for 64.3 percent of the overall integrated systems revenue but, with 761 PB of total capacity across all systems sold, which is 80.5 percent of all the capacity that went onto integrated systems. That is a higher ratio of storage, but there is also less software content in the revenues in integrated infrastructure setups.

The last time IDC did a forecast for integrated systems was back in the fall of 2014, and that was before year-end figures for 2014 and these numbers for the first quarter of 2015 were available. So Permenter says you have to take the forecast with a grain of salt. Once the second and third quarter figures for 2015 are out, IDC will have better data from which to make a long term model.

“We anticipate strong growth going forward for the overall market,” says Permenter, and to be specific for both The Next Platform and the raw infrastructure portions of the integrated systems space. That forecast from last fall, which is subject to revision, calls for a 19 percent compound annual growth rate between 2013 and 2018, with sales hitting somewhere around $17 billion at the end of the forecast period. That is a nearly doubling of the market, and that also represents a much faster growth rate than the overall systems and storage markets at large. We shall see what actually happens.

Be the first to comment