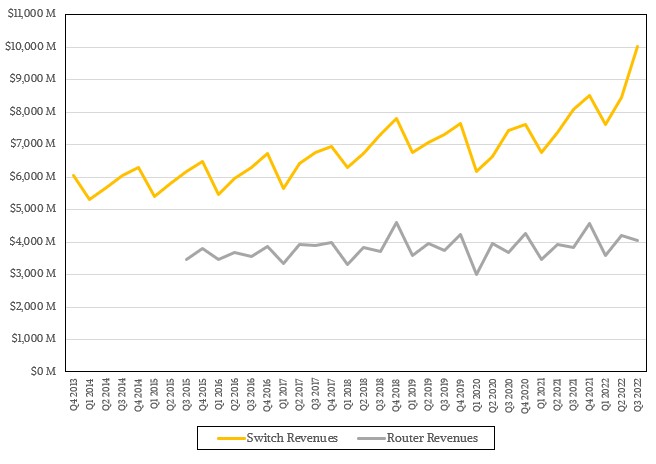

If there is a recession underway – and we are not convinced that there is even a little bit – then the Ethernet switch market did not get the memo. And the Ethernet router market has stopped checking its email just in case.

Don’t get us wrong. The global economy is skittish and stumbling in many areas. But IT is so integral to what everyone does that at least in the aggregate, the Ethernet market is continuing to show good vital signs. This is thanks to the ramping rollouts of 200 Gb/sec and 400 Gb/sec switching, which is necessary for modern applications and for balancing out the increasing compute and storage needs of all manner of applications.

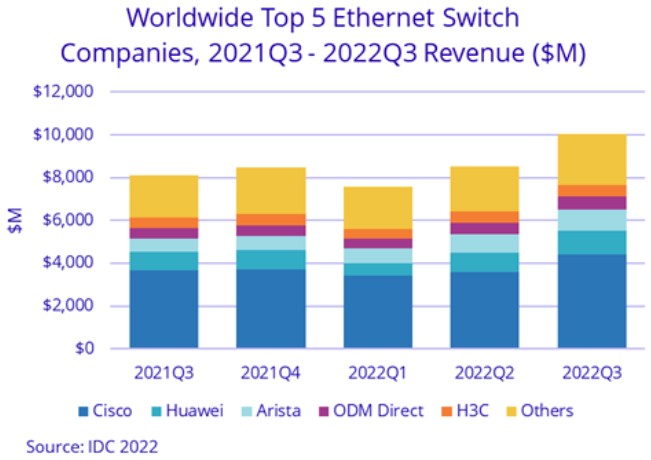

In the third quarter ended in September, IDC reckons that just a hair over $10 billion in Ethernet switches across the datacenter and campus segments were sold, and increase of 23.9 percent year on year. By our math – and we have to do a lot of math to flesh out the data IDC releases publicly to get a better sense of what is going on in the Ethernet market – we think 222.7 million Ethernet ports shipped, up 7.4 percent and accounting for an astonishing 2,972 exabits per second of aggregate switching bandwidth, up an even more astounding 68.3 percent compared to Q3 2021.

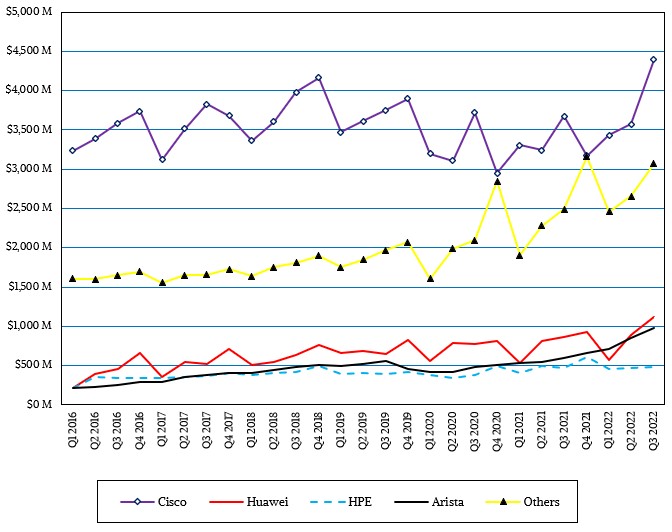

Router sales have been basically the same, on average, for as long as IDC has put revenue figures out for the first time back in Q3 2016, and there were no real surprises this time around. Router sales worldwide came to $4.06 billion, up 5.6 percent, and while routing is still very important for connecting datacenters and are the backbone vertebrae of the global Internet

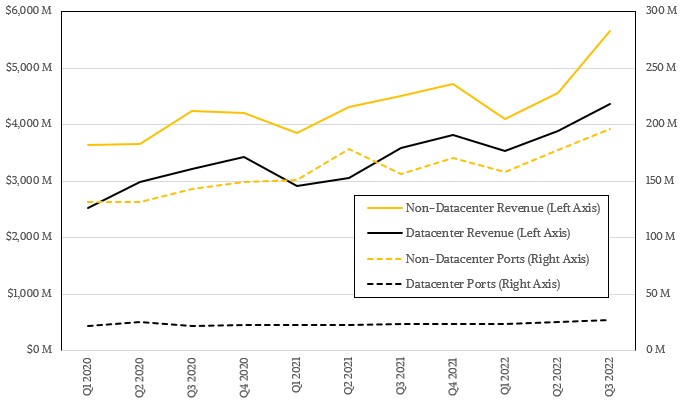

One of the more interesting bits of data that IDC started giving out in recent quarters is a split of Ethernet revenue shares and port shares in the datacenter and non-datacenter (mostly campus and office, but also having an increasing edge component) parts of the market. We now have enough of a dataset to display the breakdown of this over many quarters now. Take a look:

If you do the math – and once again, we have to because we only have deltas on the data, not the real data, from IDC – then it looks like the datacenter Ethernet switch market consumed 26.7 million ports, up 14.7 percent, and drove $4.36 billion in revenues, up 21.7 percent. The non-datacenter part of the Ethernet switch market comprised a much larger 196 million ports, up 25.3 percent, and drove sales of $5.66 billion, up 25.6 percent. Clearly, connecting to each other and connecting to the datacenter infrastructure requires almost an order of magnitude of connectivity, but because of the low port speeds that have very low costs at this point in history – mostly 1 Gb/sec with a smattering of 2.5 Gb/sec, 5 Gb/sec, and 10 Gb/sec – the non-datacenter part of the market only drove 1.3X more revenues than the datacenter part during Q3 2022.

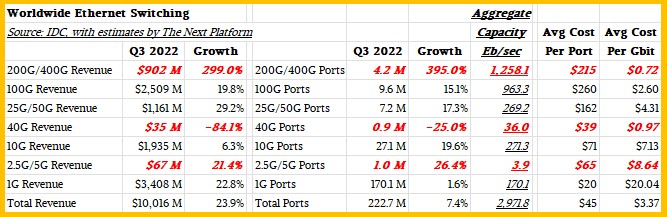

Each quarter when we see the IDC Ethernet data, we like to aggregate the revenues, ports, cost per port, and cost per bit flitted and then plot out how these factors have changed over time. So without further ado, here is the aggregation table for Q3 2022:

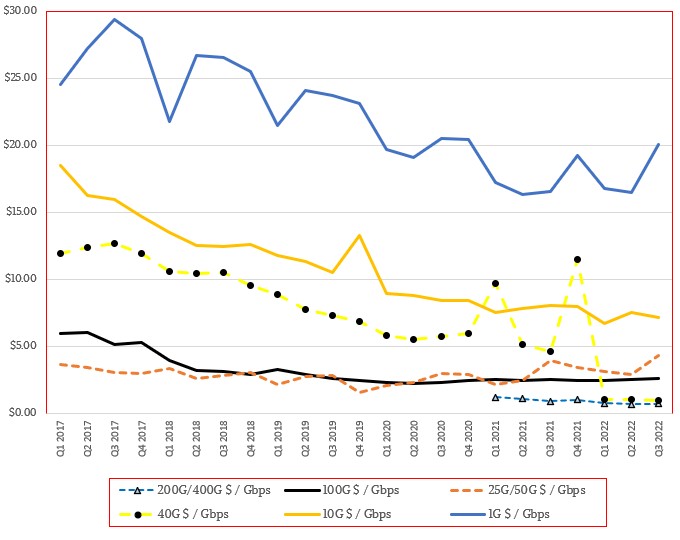

And here is the plot of cost per bit by Ethernet switch bandwidth tier:

IDC has never released the revenues and port counts for the 200 Gb/sec and 400 Gb/sec band or for the 2.5 Gb/sec and 5 Gb/sec band. Ditto for 40 Gb/sec switching, which IDC stopped talking about explicitly a few years ago. Any data in bold red italics are estimates from The Next Platform based on what IDC has said and the solving of simultaneous sets of equations from comparative quarters; sometimes, it is a hunch that is then corrected over quarters to make all of the data we do know fit. It’s all a tricky bit of witchcraft, we openly admit. But, there is no other way for us to get an understanding of what is going on.

As best as we can tell, the datacenter part of the business represents the bulk of any switches that run at 40 Gb/sec or higher speeds plus about a third of the switches that run at 10 Gb/sec speeds. It looks like there might be a 10 Gb/sec upgrade cycle going on in some datacenters, and we reckon this would be at small and medium businesses, not large enterprises and certainly not at HPC centers or for AI systems.

The interesting bit to us about all of this data and math is watching the cost per bit go through fluctuations over time and across bandwidth tiers. While the cost per port on the slower speed Ethernet switches is low, the cost per bit transferred as part of the total bandwidth is nonetheless still very, very high for low speed switches and is now very, very low for high bandwidth switches. The average cost of a gigabit of data pushed through an Ethernet switch running at 200 Gb/sec or 400 Gb/sec was 72 cents in the third quarter, by our math, and the only thing that was cheaper are ancient 40 Gb/sec switches that are still sold in very small quantities as companies expand their old networks rather than switch to new ones. (Har har har.)

The cost of the average port in the 200 Gb/sec and 400 Gb/sec Ethernet switch bands came to a mere $215 in Q3, and were higher than the average 100 Gb/sec port. The cost of a 1 Gb/sec port is averaging a little over $20, but the cost per gigabit bit is therefore $20. The cost of the 1 Gb/sec port is a little more than an order of magnitude lower than for the 200 Gb/sec and 400 Gb/sec band – $20 versus $215 – but the cost per gigabit moved is 28X lower on the faster Ethernet switches. Interestingly, 100 Gb/sec ports do not look like a very good deal now and are both more expensive on average than the 200 Gb/sec and 400 Gb/sec bands and a lot more expensive on a cost per gigabit basis.

This was a pretty good quarter for all of the major Ethernet switch makers, as this chart makes pretty clear. And it was particularly good for Cisco Systems, which has been under attack for the past decade and a half from upstarts wielding switch ASICs from Broadcom and, to a lesser extent, other suppliers like Nvidia/Mellanox, Intel/Barefoot, Innovium, and others. We think a lot of this has to do with Cisco’s SiliconOne switch and router chips, which are sold on the merchant market like Broadcom as well as in Cisco’s own gear.

Here is a chart that shows vendor shares over time:

Juniper Networks, which is still a major rival to Cisco in the router space, has dropped out of the top four Ethernet switching vendors, and if Hewlett Packard Enterprise is not careful, it could be next. HPE’s partner in China, H3C had about $541 million in sales, up 7.5 percent year on year. HPE’s switching business only grew by 2.5 percent and only pulled in $481 million. Huawei Technology, by comparison, broke through $1.1 billion in sales (up 28.6 percent) and Arista Networks came in at $972 million (up 66 percent). Other vendors outside of the top four (and including H3C) accounted for $3.07 billion in sales, up 23.1 percent and more or less matching the pace of the market at large.

A lot of those “Others” are ODM suppliers selling to the hyperscalers and cloud builders, of course. Huawei, Arista, and even Cisco now are selling into these hyperscalers and cloud builders, too, and we have no problem believing that half of Ethernet switch revenues in the datacenter are coming from these customers, just like half of servers are.

Typo :

which has been under attach

which has been under *attack*