In many ways, Arista Networks still behaves like a startup even though it was founded twenty years ago, rollout out its first products a little more than a decade and a half ago, went public a decade ago, and now as over 10,000 customers and over 100 million Ethernet ports sold that generated a cumulative $32 billion in revenues for hardware, software, and support.

According to chief executive officer Jayshree Ullal, the company is on track to boost revenues in 2025 by at least 17 percent to $8.2 billion, and judging that the company grew nearly twice as fast in 2024 as expected, this high end of the guidance only given a few months ago for 2025 – the range was originally 15 percent to 17 percent revenue growth for this year – we think there is a chance that this is a conservative growth estimate.

In the call with Wall Street going over Arista’s financial results for Q4 2024, Ullal is pointed to the upper deck of $10 billion in annual sales, but is not yet ready to call that out loud to Wall Street for 2026 specifically. But it is well within the realm of possibility to do so. If the services part of the Arista business continues to grow at 35 percent per year in 2025 and 2026, that means that hardware product sales only have to grow by 13.6 percent to $6.68 billion this year to hit that 17 percent growth target for the company overall to reach $8.2 billion. And in 2026, product sales would have to accelerate to 19.2 percent growth to just a tad under $8 billion to match the tad over $2 billion in services sales to inch over the $10 billion finish line.

On paper, or more precisely in the cells of our arista-financials.xlsx spreadsheet model, this looks easy enough. Almost assured, in fact.

The upside could be a lot larger. Ullal said on the call that the $70 billion total addressable market for 2028 that Arista is chasing is comprised of four parts, which range around a quarter of the pie each.

One slice is the core datacenter and cloud networking business that represents the bulk of Arista’s revenues today. Another slice is routing, edge, security, and observability – what it calls adjacencies to its core datacenter switch business. Another slice is AI system back-end networks. The other third is campus networking and other switching needs of enterprise customers who do not count as cloud titans and who do not as yet make up a big chunk of the company’s revenue and profit streams. But count on this: Breaking into enterprise accounts might not be easy, but they will be a lot more profitable than doing business with the hyperscalers and cloud builders who have always been Arista’s marquee customers.

The trick is to keep the cost of sales into these many tens of thousands of future accounts smaller than the extra profits that come from selling good systems at lower volumes to less pesky and picky customers.

We will be watching to see how this all goes in the next three years. But this is a good backdrop against which to contemplate Arista’s financial results for the fourth quarter of 2024 and the full year.

In the quarter ended in December, Arista’s hardware and software license revenues stacked up to $1.61 billion, up 22.7 percent year on year and up 5.5 percent sequentially. Software and services revenues represented 18.3 percent of total sales and rose by 34.9 percent to $353.3 million. Software subscriptions were $30.9 million of that and normal tech support services represented the remainder of $322.3 million. Services sales were up 40.1 percent in the quarter, which shows that even though the Arista customer base is no longer growing all that fast, customers are taking more and more of its wares.

Total revenues for the Q4 2024 came to $1.93 billion, up 25.3 percent and up 6.6 percent sequentially.

For the full year, Arista had $5.88 billion in product revenues, up 17 percent year on year. Services revenues rose by 34.7 percent to $1.12 billion, breaking through that $1 billion barrier for the first time. (And yes, we know that numbers are not barriers, but milestones, but then again, having run a bunch of businesses, we treat arbitrarily rounded numbers as barriers and have fun breaking through them. So there. . . . We suspect others who run businesses do much the same.)

Add it up, and total revenues for Arista rose by 19.5 percent in 2024 to $3.1 million bucks above $7 billion. The company has $8.3 billion in the bank, which is plenty of enough cash to do interesting things aside from buying back its own shares to keep Wall Street happy.

Considering that Ethernet switching for general purpose campus and datacenter use cases is in recession, as we talked about as 2025 was getting started, thanks to a shift in focus on AI spending, Arista’s business is all the more remarkable. And given all of this, it is no surprise that Arista has not attained its goals of reaching $750 million in campus switch sales last year. It will, and probably this year.

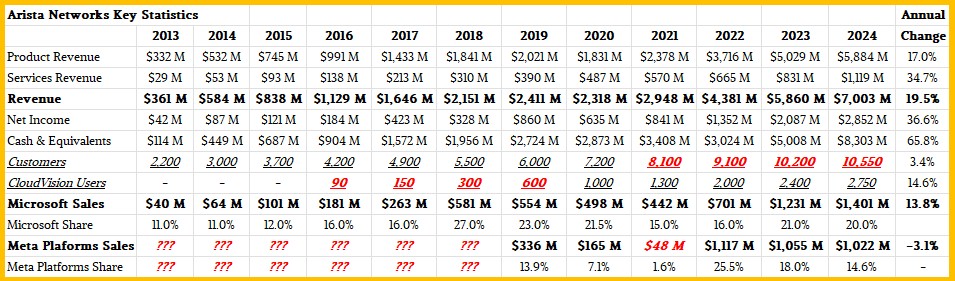

Here is a summary table that runs from 2013 through 2024, showing how customers have grown over time and the dependence of Arista on Microsoft and Meta Platforms, its two largest customers:

Arista used to give out official numbers on its customer count, but has danced around a hard number for a number of years. We have filled in the gaps in bold red italics. We are also tracking the adoption of Arista’s CloudVision network telemetry tools.

Microsoft and Meta Platforms do not buy switches exclusively from Arista, but without question it was these two companies that busted the Arista switches open and compelled the company to allow for their respective SONiC and FBOSS network operating systems to be run on Arista iron as a peer to the company’s own EOS operating system. (All three are based on Linux and are heavily customized to the point of not looking like the Linux that we all know and sometimes often love.)

Microsoft keeps buying lots of switches for all kinds of functions, as does Meta Platforms. We have no idea what share of the networking budget at either company is going to Arista, but what we do know is that Ullal thinks Microsoft and Meta Platforms will each comprise more than 10 percent of the company’s revenues in 2025 (which means the precise percentage has to be provided per rules of the US Securities and Exchange Commission). We know that Oracle, which is a hardware partner in OpenAI’s Project Stargate AI cluster buildout, is now among its cloud titan customers, as is Apple now, too. They are not yet 10 percenters, however.

Based on what Arista’s top brass has said over the years, we have been able to piece together this profile of the company’s business by customer and product line:

Once again, estimates made by The Next Platform are shown in bold red italtics.

The cloud titans – what we call the hyperscalers and cloud builders – represented 48 percent of Arista’s sales in 2024, up 33.4 percent, significantly faster than the overall growth of the company. Enterprise and financial institutions made up another 35 percent of the base, up only 16.2 percent year on year. Service providers – those telco and other communication companies that build large infrastructure to either rent it out or to offer services of their own to customers – accounted for $1.19 billion in sales, off 3.3 percent.

By product line, core cloud and datacenter products drove 65 percent of sales in 2024, or $4.55 billion, up 19.5 percent compared to 2023. Ullal said that routing and campus gear accounted for 18 percent of revenues, and if you make some assumptions about campus, you can back out routing. Which we have done.

We think Arista’s routing business was up like a rocket in 2023 and grew more modestly in 2024, hitting $637 million. And if you do the math, that means campus switching accounted for $623 million in sales, up 15 percent. Edge and other use cases (such as peering and datacenter interconnect) accounted for $1.93 billion in sales, more than double that of last year and we think driven by DCI more than edge.

Looking ahead on the AI front, Ullal is sticking to her prognostication from a quarter ago that has Arista selling at least $750 million in AI back-end networking stuff and another $750 million in related front-end network upgrades to drive AI systems; together, these are called the “AI center” by Arista.

We think a lot of customers are waiting for the 800 Gb/sec Ethernet gear to be more available and come down a bit in price – and the Nvidia “Blackwell” GPUs to be available in high volume – before they commit to the top-end network speeds. This might be why Microsoft and Meta Platforms did not spend more with Arista in 2024 than it did. Everyone is waiting for new GPUs to buy new networks for them.

To end, let’s do some math. Call “AI center” networking 25 percent of that $70 billion TAM that Ullal mentioned above. Arista commands about 45 percent share of ports above 100 Gb/sec speeds in the datacenter right now, and we think it can stand toe to toe with Cisco Systems and Nvidia in AI networking. That is about $8 billion in AI networking in 2028 for Arista if current trends persist.

Be the first to comment