Two and a half years into the global coronavirus pandemic we all have upgraded our home IT infrastructure. And after several fibrillatory interest rate shocks by the major governments to try to curb inflation in the world economy, spending on PCs has consequently taken a nose dive. And a glut of back-generation GPUs on the market as cryptocurrency mining changes algorithms is going to also hurt those who make datacenter CPUs and GPUs.

Nvidia took its financial hits back in August, with gaming GPU sales falling $1.58 billion sequentially to just over $2 billion in its second quarter of fiscal 2023 ended in early May, and luckily Nvidia does not have a CPU business aimed at PCs or else it would have taken a double whammy back them and probably for a few more quarters as inventories burn down. AMD is not so fortunate, in that it sells both CPUs and GPUs for client devices, but like Nvidia, it is fortunate in that it has a growing and vibrant datacenter business that counterbalances the PC crash to a certain extent.

With the crash, datacenter has very likely become AMD’s largest and most profitable business, just as it has become for Nvidia. The latter’s datacenter business is around 2.4X as large as the one that AMD has amassed, but with the “Genoa” and “Bergamo” Epyc 9000 series chips on the horizon and Intel slipping with its “Sapphire Rapids” Xeon SP processors, we think that AMD is going to have a very good couple of quarters. In fact, we think these as-yet-unannounced Genoa and Bergamo chips are very likely starting to shipping to hyperscalers and cloud builders and therefore are already helping to cushion the blow.

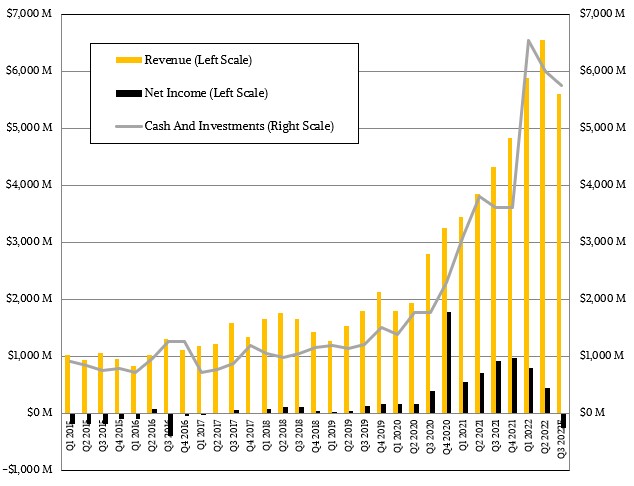

Even if revenue comes in at around $5.6 billion, as AMD warned Wall Street late yesterday when it announced preliminary financial results for the third quarter, it is important to remember that at that level, sales will have increased by around 30 percent year-on-year even if revenues are going to drop by about 14.5 percent sequentially. We think that when the numbers are all done, AMD will probably post a net loss of around $250 million and will eat into its cash by about that same amount, but will still have around $5.8 billion of cash in the bank when Q3 2022 is done. This loss will be driven more by continuing investments in future products than any other underlying fundamentals.

Things have been far, far, far worse for AMD in its long and formerly rocky history. AMD’s problem is the shock the economy is under due to inflation and the crude tool of interest rate hikes to try to restrict our exuberance as consumers to try to curb that inflation.

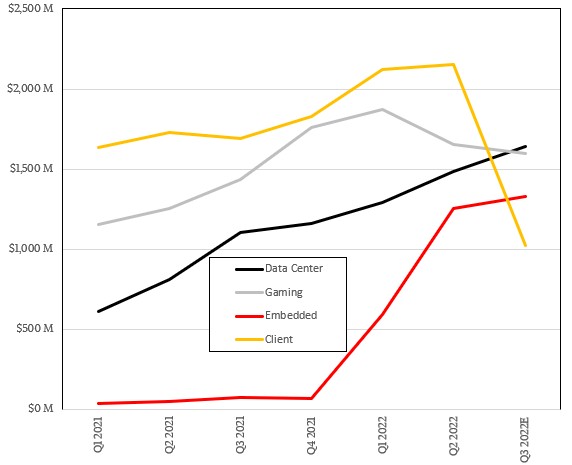

In its preliminary results statement, AMD said that its Data Center group would post sales of around $1.6 billion, and we are guessing it will be closer to $1.64 billion when all the beans are counted. This would represent a 48.5 percent growth in this business year-on-year and still a 10.7 percent growth sequentially from Q2 2022. We think this will be lower than AMD expected, but not due to the appetites of the hyperscalers, cloud builders, and HPC centers of the world, but skittishness on the part of enterprises, governments, and academic institutions around the globe.

AMD said that its Client group, which sells CPUs and GPUs for client devices like desktop and laptop PCs, would have around $1 billion in sales; we think it will be around $1.03 billion, down 39.4 percent year on year but down 52.4 percent sequentially. We also think at these numbers, AMD is not particularly profitable in the Client group and could even be losing some money. We shall see when the operating income numbers are presented in the full financials on November 1.

Gaming GPU sales are expected to hold up reasonably well – unlike at Nvidia, which has a much bigger cryptocurrency contribution to its sales than perhaps it knew and certainly more than it ever wanted to speculate about publicly – with AMD pulling in around $1.6 billion in sales for Q3, which will be up 11.6 percent and down only 3.3 percent sequentially. The Embedded group, bolstered by the addition of Xilinx to the financials this year, will hit around $1.33 billion in sales, up 5.8 percent sequentially and up by a factor of 16.8X year on year because AMD’s embedded business was tiny before it ate Xilinx.

The numbers from both AMD and Nvidia demonstrate all too well how important it is to sell different kinds of compute engines across a wide variety of markets. While it is true that with such a hybrid approach there always seems to be something going wrong that limits profit and revenue growth, that hybrid vigor is nonetheless what helps a company make it through all of its hard times. IT suppliers who forget this – IBM and Hewlett Packard come immediately to mind – pare themselves down to a very tight market that makes them necessarily less resilient. And sometimes less relevant. Microsoft and Dell, and to a lesser extent Cisco Systems, seem to understand this.

Be the first to comment