The top brass at FPGA maker Xilinx are not hosting calls with Wall Street because of the pending $35 billion acquisition of the company by AMD, so we are left to get our own insight out of the financial report and accompanying statement that Xilinx has released for its latest quarterly results.

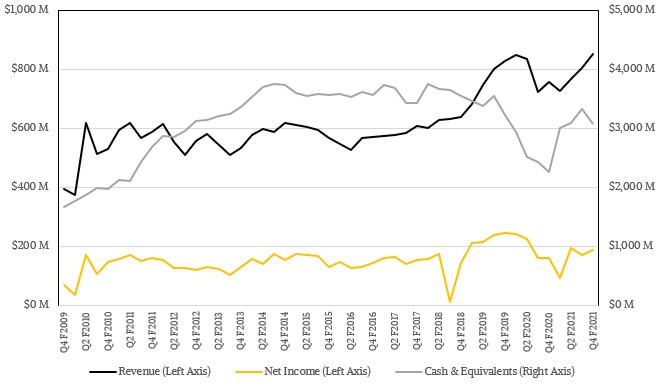

In the quarter ended April 3, which is the end of the fiscal 2021 year for Xilinx, the company posted sales of $851 million, up 12.6 percent year on year and up 6 percent sequentially from the third quarter of fiscal 2021 ended in early January. Net income grew faster than sales, rising 16 percent to $188 million compared to Q3 F2020. To help drive those sales, Xilinx has introduced what it calls a “cost-optimized” variant of the N-1 generation of UltraScale+ programmable logic devices as well as the full and final rollout of the current, or N generation, “Everest” Versal ACAP devices.

Xilinx previewed the Versal devices and its ACAP approach back in March 2018 and did a much deeper dive into the variations on the ACAP theme in October 2018. The Versal devices are all etched in 7 nanometer processes from foundry partner Taiwan Semiconductor Manufacturing Corp, which is the most advanced node commercially available anywhere right now, and the Versal product line includes five different families aimed at different parts of the datacenter, edge, and embedded markets where FPGAs are currently deployed. There is a sixth variant that employs HBM2E memory to boost memory bandwidth into the device.

“We are pleased with our fourth quarter results as we delivered record revenues and double-digit, year-over-year growth in the midst of a challenging supply chain environment,” Victor Peng, president and chief executive officer at the company, said in a prepared statement. “Xilinx saw further improvement in demand across a majority of our diversified end markets with key strength in our Wireless, Data Center and Automotive markets, the pillars of our growth strategy. Our teams have executed well and we remain focused on continuing to meet customers’ critical needs. Our investment and strong execution toward our platform strategy are paying off as we are now in full production shipments of our 7nm Versal series, which is the culmination of a multi-year effort and a long-term growth driver for Xilinx. We also introduced new platforms for edge compute including Kria, an adaptive system-on-module (SOM) platform, as well as a cost-optimized UltraScale+ portfolio, to enable and accelerate innovation and AI at the edge.”

Xilinx burned a little cash in the quarter, but its cash pile was still at $3.08 billion as the fiscal year came to an end. For the full twelve months, revenues were off 0.4 percent to $3.15 billion and net income was off 18.4 percent to $647 million.

Some of that income hit was due to competitive pressure from FPGA rival Intel, some of it was due to competitive pressure from GPUs and other custom ASIC accelerators, and some of it was due to increased costs due to supply chain issues in the wake of the coronavirus pandemic. That has driven down net income as a percent of revenue, which stood at 25.1 percent in fiscal 2020 and dropped to 20.5 percent in fiscal 2021, but you have to remember that this is a hardware business – or more precisely, something in the wonderful no man’s land between hardware and software, if you want to be precise – and bringing that share of revenue to the bottom line is remarkable. A good software company with intense competition can do 15 percent of revenue as net income, and one with the lion’s share of its market can do 20 percent and sometimes 25 percent. In the trailing twelve months, for instance, Google parent company Alphabet had $196.7 billion in sales and brought $53.4 billion to the bottom line, which is 26.1 percent.

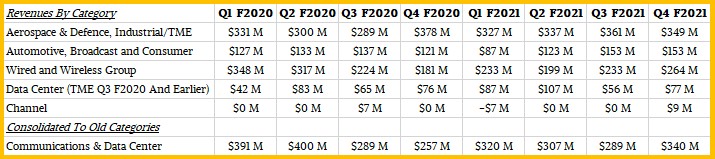

Here is a breakdown of Xilinx sales by product category, in tabular form, for the past two fiscal years:

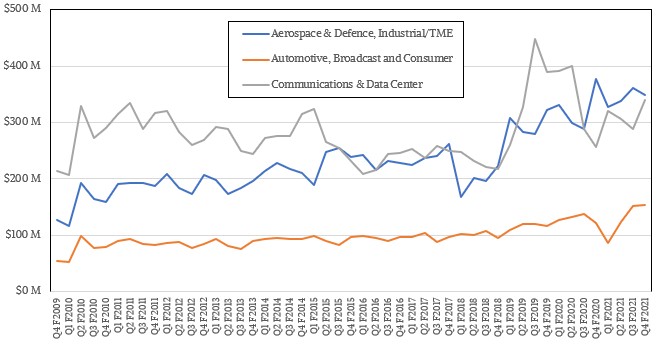

And for those of you who like to eyeball longer trends, here is a chart that provides a mostly consistent view of Xilinx sales for a longer period of time – back to the Great Recession, when everything changed:

We lumped things together in a way that is consistent with how Xilinx presented its financials many years ago to see the bigger trends. These days, Xilinx breaks out its Data Center division separately, and in Q4 F2021 said that datacenter products represented 9 percent of overall revenues, which works out to $77 million. Xilinx said that was 5 percent down compared to Q4 F2020 but up 28 percent sequentially from Q3 F2021.

Test and Measurement was consolidated into the Data Center group sales at Xilinx until Q3 F2020, so it is hard to get an apples to apples comparison with TME sales now merged with aerospace, defense and industrial customers, but if you ignore this, then sales of FPGAs for datacenter use cases rose by 1.3 percent in Q4 F2021 and rose by 40.5 percent to $326 million for the full fiscal 2021 year. This compares to a 31.6 percent decline in the Wired and Wireless group, to $846 million, and a 12.9 percent increase in the Aerospace & Defense, Industrial/TME group, to $1.4 billion. Sales in the Automotive, Broadcast, and Consumer group fell by 6 percent in fiscal 2021, to $483 million.

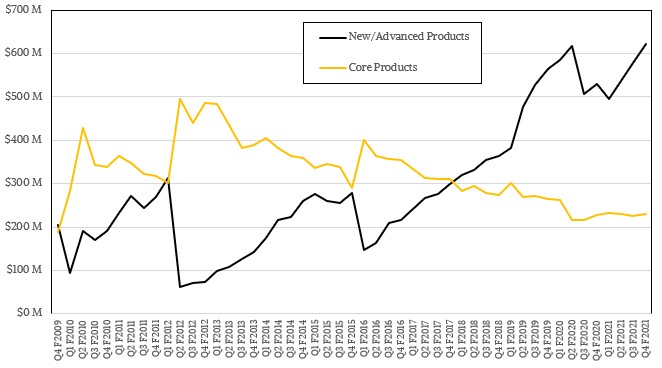

What continues to hold is that the most advanced FPGAs are continuing to drive most sales at Xilinx, as you can see here:

The core products, which are etched with earlier manufacturing technologies, include Virtex-6, Spartan-6, Virtex‐5, CoolRunner‐II, Virtex-4, Virtex-II, Spartan-3, Spartan-2, and XC9500 products plus their software and support. The advanced products include Alveo server cards and related products and Versal, UltraScale+, UltraScale, and 7-series products.

The thing to remember about FPGAs is not so much how much revenue they drive, but how much general purpose compute they remove from their markets and how much custom ASIC revenue they are a leading indicator for. It is hard to be precise, but every FPGA sale takes out what would have been a bunch of CPUs, and depending on the workload, it can be tens of devices. But, FPGAs also sow the seeds of some of their own destruction because as the volume increases for something and the performance demands rise, it makes some sense at some point to go from an FPGA implementation to an ASIC implementation. We have never heard of anyone moving backwards from custom ASICs through FPGAs and back to general purpose CPUs, but anything is possible for the right technical or economic reasons. If there is anything that is true about IT, it is that everything is in flux, all the time.

One last thing: here is a neat fact that Xilinx talked about, and which is key, we think, to the Xilinx acquisition. The Vitis software development platform has over 76,000 downloads and there have been an additional 23,000 downloads for the Vitis AI add-ons that help turn FPGAs into machine learning inference engines. Xilinx also said that over 20,000 developers have been trained to use its software development tools and further stated that it has over 1,000 software partners and that there are over 200 commercial applications that have been created to run on cloud and on-premises FPGAs. It is unclear why there are more ISV partners than there are applications, but perhaps there is a lot of custom FPGA programming happening in the market.

By the way, the shareholders of both AMD and Xilinx have overwhelmingly approved the AMD takeover of Xilinx. Now, it is up to the regulators to decide.

Quite frankly, AMD corporate should recognise what they’ve acquired and leave it the hell alone.

One thing they definitely should recognise that aside from extra fab cability got from acquiring another silicon manufacturer, this one has vast amounts of experience in areas AMD never ventured into, success where AMD have failed when it came to embedded SOC/PL/Hybrid silicon.

If you pulled apart almost anything that had a ASIC or FPGA or CPLD (or a combo of in a set) being the heart and brain of the construct, there’s a pretty high odds it’s one of three mainstream brands of such devices, unless it’s some obscure Chinese PL device based – but Xilinx devices tends to be a very usual suspects especially for a FPGA/CPLD pairing.

They, the hard working souls at behind the Xilinx brand know their market and what it takes to deliver a wide flexible range of PL/SoC, so let them do what they do best without AMD’s corporate minions and demons undermining their established working practise. Sure, tackle what’s broke and unviable, but also remember that what’s a money pit of not viable research now always becomes a valuable tool or battle changing weapon eventually.

AMD should not leave Xilinx alone. Xilinx is desperate to get into the datacenter. The right bit of engineering and they could bump Intel on their butt. Xilinx has started down the open source road but they won’t let go of the bitstream. This is where the magic is. Imagine a Zen module and an FPGA. It it’s done right it will rock the computing world. If done wrong they’ll look like Intel’s lame attempt at he task.

http://bit.ly/WhoIsSteveCasselman

Much ado about incidentals.

The big reward in play is the ~non public synergies that lie in store for the marriage.

I am confident the two parties know exactly what they are doing.

AMD should not leave Xilinx alone. Xilinx is desperate to get into the datacenter. The right bit of engineering and they could bump Intel on their butt. Xilinx has started down the open source road but they won’t let go of the bitstream. This is where the magic is. Imagine a Zen module and an FPGA. If it’s done right it will rock the computing world. If done wrong they’ll look like Intel’s lame attempt at the task. http://bit.ly/WhoIsSteveCasselman