We have argued, even a decade and a half before The Next Platform was founded, that no one would ever move all of their IT infrastructure to a utility, what we now call a public cloud. And as the public cloud really took off as a product with the launch of Amazon Web Services’ Elastic Compute Cloud service in March 2006 and then became a big idea, people took it a little too far. They drank a little too much of the orange Kool Aid coming out of Seattle.

While there are literally millions of companies and individuals using cloud computing capacity in the world today, and depending on who you ask about half of the IT capacity sold in the world is going to the hyperscalers, cloud builders, and biggest service providers that are offshoots of the big telecom and cable companies. This has been a wild success, even for the 15 year ramp that it has taken. But the hybrid cloud – a mix of on premises IT facilities with one or more public cloud or service providers – is still going to be the future for a long time, if for no other reason that there are trillions of lines of code running on legacy IT systems in the world that actually do a lot of the work inside of companies – the so-called systems of record that don’t get all the attention like the flashy systems of engagement – all that data analytics and machine learning – soak up.

But here’s the question: Can a systems company that has survived for more than a century become a dominant player in this hybrid cloud world? Is this exciting enough to be thought of as a system, as the venerable International Business Machines has been known for throughout most of its history? This is not the transition from punch card tabulators to mainframes, when IBM became the very symbol of modern computing. But IBM very much, under chief executive officer Arvind Krishna and president Jim Whitehurst (formerly CEO at Red Hat), wants to become the symbol of hybrid cloud in the enterprise. Unfortunately for IBM, the big public clouds – the important ones are AWS, Microsoft Azure, and Google Cloud – want to move in on the on-premises turf by extending their cloud infrastructure down into the corporate datacenters of the world.

It is with this in mind that we contemplate IBM’s third quarter financial results, which pale in contrast to those of its public cloud rivals. IBM has certainly done a lot to create what could be an independent cloud stack provider – buying SoftLayer several years ago and Red Hat last year certainly helped, and so will spinning off its hosting and outsourcing businesses, which are so 1980s and 1990s. When that is done, perhaps next year, IBM should turn in maybe $60 billion in revenues and maybe $5 billion of that – a mere one-twelfth – will come from Red Hat.

The fact is, even with all of these changes, IBM will still be dependent on keeping its core systems businesses going, which generate a lot of its revenues and a very large portion of its profits thanks to its vast installed base of mainframe software. The mainframe is lurking in all kinds of places, and is very hard to replace for a lot of complicated technical and economic reasons. But that is not exciting, like taking down big pre-exascale supercomputer deals, as Big Blue did in conjunction with Nvidia and Mellanox (when they were separate companies) a few years back. We seem to have an IBM who is not as interested in HPC and AI as it was two years ago, which is peculiar given the nature of IT these days. That may not be the intent of Big Blue, but that is the perception of many on the outside of the company.

This is a company whose server platforms are largely focused on relational database processing, and we think a pie chart showing the revenues of IBM platforms broken by System z versus Power Systems and across database, HPC, AI/analytics, and other would be illustrative. If you put a gun to our heads we would guess that 80 percent of the workloads running on mainframes are databases with the other 20 percent being infrastructure like transaction processing monitors and application serving middleware, and Power Systems would probably not be all that different except there would be a slice – maybe something on the order of 10 percent of revenues – that would represent HPC and AI/analytics.

Perhaps selling off the System x server business was not such a good idea unless IBM had a plan to replace all of that lost revenue and subsequent sales of software and services. Perhaps IBM should have bought Red Hat a long time ago and ditched most of the Global Services before it did that. Hindsight is easy, foresight, not so much.

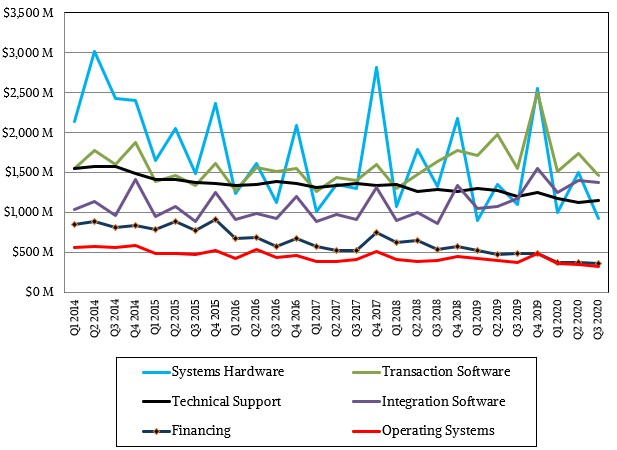

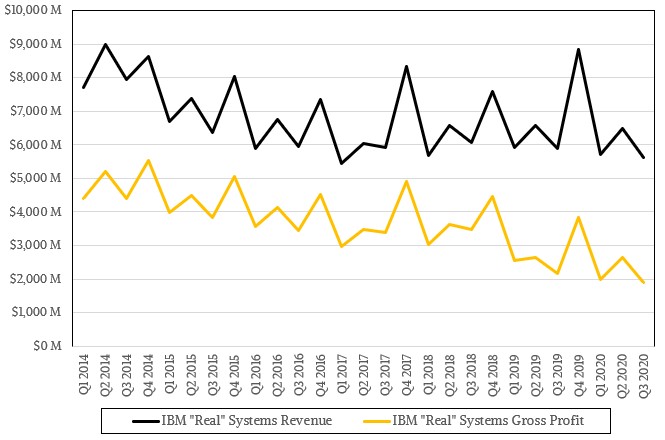

In the quarter ended in June, IBM’s sales fell by 2.6 percent to $17.56 billion, and gross profit was up a smidgen to $8.43 billion, pre-tax income was up 20 percent to $1.83 billion, but net income rose by only 1.6 percent to $1.7 billion. Sales to channel partners and customers of IBM’s systems were down 15.1 percent to $1.26 billion, plus another $240 million in sales to other IBM units (mostly the Global Technology Solutions outsourcing and application hosting business that it is spinning off). Our model shows IBM pushing another $330 million in its legacy operating systems – z/OS on the mainframe and AIX and IBM i on Power Systems. Not Red Hat, which is counted separately but which is probably north of $1 billion in revenues in the current quarter. The whole Systems group had a 37 million pretax loss, and that is mostly because the Power9 servers are at the final year tail of what has turned out to be a nearly four year cycle. If IBM put Red Hat operating systems and support into Systems group, where it belongs, and also pulled its own hardware and software support into Systems group and out of its Global Technology Services division, where it doesn’t belong, it would have a much larger and probably more profitable Systems group.

The System z15 machines that debuted a year ago have done what they could to fill in the gap, but there just isn’t enough revenue from even the increasing demand in compute that both of these lines have. This is the curse of Moore’s Law: Every 18 months – and now 24 months or sometimes 30 months – you have to sell twice as much capacity to get the same amount of money. IBM lengthening out the time between System z and Power processor generations has reduced costs, but it has also reduced excitement and lengthened the upgrade cycle. And, doubling the performance for each generation in a database market that does not see a doubling in processing needs every two or three or even four years means revenue has to go down. There is no bargaining with that. And the only reason this has not happened yet in the X86 server market is because we are not yet fully computerized in our lives like corporate database processing is.

But.

Mark my words.

There is a day when that day will come. There are only so many people on Earth and only so many hours a day to fiddle around with our phones, and at some point, the big clouds and hyperscalers of the world will constitute the majority of compute capacity and the rapacious need for capacity will abate. At least until the robot army is building its space fleet to conquer Alpha Centauri. And even then, there will be mainframes across the Local Group doing the payroll. . . .

Back to IBM’s systems business.

As you know well by now, each quarter we try to figure out how IBM’s “real” systems group is doing. We allocate portions of software, services, and financing to IBM’s own systems as well as the actual systems sales IBM reports.

When we do all of that guesstimating, we reckon that IBM’s overall systems business brought in $5.61 billion for just the base machinery, not including database software that really jacks the number up. That constituted 32 percent of its sales, and when it jettisons a little less than a third of itself with the NewCo spinoff announced a few weeks ago, these core systems will represent about half of revenues at the company. If you did an honest reckoning with Red Hat systems software added in – call it half of the $5 billion or so in Red Hat revenues expected in calendar 2021, or another $610 million or so per quarter – then this real systems business will be more than half of the revenues. That cloudy stuff that is layered on top, databases, the IBM Cloud, and various kinds of consulting services through Global Business Services will represent less than half of IBM’s sales. And really, a lot of that is tied to the IBM systems, in the final analysis.

IBM is like two worlds unto themselves that sometimes overlap with the world of hyperscalers and cloud builders. IBM needed SoftLayer and Red Hat to make itself hybrid first, and perhaps there is a way yet to do that and get the New Big Blue growing for real. At 5 percent growth per year, it will take until 2030 for IBM to get back to generating $100 billion a year. At 10 percent growth – which seems impossible for IBM as a whole but why not do the math – IBM could hit that run rate in early 2026.

Thanks for your very timely and very perceptive article: AT ITS HEART, IBM REMAINS A SYSTEMS COMPANY, in a week when IBM has lost 15 % of it’s market capitalization, as IBM stockholders question IBM’s uncertain future.

You correctly focus on the absolute core strength and advantage of IBM over all competitors, which is the Systems group, specifically IBM System z mainframe and IBM i

However, you do not further explain to IBM executive management the fundamentally obvious and immediate and easy path to unique major IBM growth and success which include:

* Tripling the capability and productivity of IBM employees through AUTOMATION

* Multiplying the value and IBM revenue from those trillions of lines of customer code (think unique superb customer applications like Apple apps which are far superior to SAP, as in the prior wildly successful and profitable IBM Installed User Programs)

IBM executive management has gone tragically astray in trying to copy the strengths of it’s newer and more nimble competitors like Microsoft, Google and Amazon, while squandering unique IBM strengths, and you can help in saving and growing IBM by having the courage to alert IBM how to help itself.