When IBM announced that it was acquiring Red Hat for $34 billion eighteen months ago, one of the things we said that Big Blue needed most and would get from taking over – but not messing with – the world’s largest commercial open source software company was a coherent story that it could tell to its customers about how IBM, which more than any other company helped define data processing, was still relevant to the future.

As it turns out, former IBM chief executive officer Ginni Rometty, who brokered the acquisition of Pricewaterhouse Consulting in 2002 for $3.5 billion as her initial foray to start her boardroom career at Big Blue and sealed her legacy with the acquisition of Red Hat, is getting more than she bargained for with that deal. That PwC deal gave IBM Global Services two decades of revenue and a consulting adjunct to its massive outsourcing business, and the Red Hat deal is going to give Big Blue a future. It is not a coincidence that Arvind Krishna, the new CEO at IBM, brokered that deal, which will define the rest of his career, and that Jim Whitehurst, the CEO at Red Hat before the deal was done, is now IBM’s president and heir apparent. This is exactly as planned, and it is pure serendipity that this new management team, with a more open attitude, is exactly what IBM needs as the coronavirus outbreak hits the world.

We have been watching IBM for a very long time, and with very few exceptions, former CEOs Louis Gerstner, Sam Palmisano, and Ginni Rometty did not answer to Wall Street on the quarterly calls going over the financial results for the company. But Krishna not only sat in on the call this week, but said he would be on all calls going forward, answerable to investors live and in real-time through their proxies at the largest firms who peddle stocks for a living. It was a refreshing change, and now IBM is more like its peers in the infrastructure business. It is a good sign during a bad time. And with the acquisition of Red Hat and IBM’s deep understanding of industries (thanks in large part to that PwC foundation), its massive IBM Research organization for coming up with algorithmic and semiconductor innovations, and its System z and Power Systems platforms, the company is much better situated to help transform the largest organizations in the world that have been its customers for decades to deploy hybrid cloud infrastructure and the artificial intelligence, HPC, and enterprise applications that run atop it.

Given the software platform that Red Hat has built – Enterprise Linux at the core with OpenShift Kubernetes container orchestration and OpenStack cloud orchestration with KVM server virtualization, plus Gluster and Ceph file systems for storage – it is obvious why Krishna talks a lot about hybrid cloud, which means running the same stack inside the on-premises datacenter as runs out in the infrastructure controlled by the many public cloud, including Big Blue’s own IBM Cloud, number four in the worldwide rankings these days after Amazon Web Services, Microsoft Azure, and Google Cloud.

On the call with Wall Street analysts, after being asked how we should measure IBM’s new team to gauge their success, Krishna said, of course, the top and bottom line, and growth in both. And then he said this: “Now, the other one that I think you should hold us to in terms of metrics, other than revenue or a pure financial metric, is the number of clients in which we are engaged with in hybrid cloud. We talk about it from a product perspective, we talk about 2,200 clients to date. But as we begin to wrap those also with services engagements, I think that is the second metric that is effectively a leading indicator towards the overall revenue metrics, because that’s the precondition for that. And that’s where we are driving the entire company to. That’s what I’m focused on. I run a war room on that every week. And that’s what our sales forces are incented to go get done.”

OK, so start the tracker. IBM has 2,200 customers down, and another 47,800 to go. And if IBM can do that, it will have the majority of the Global 2000 plus almost all of the remaining large and reasonably large enterprise customers in the world. And if it can do that, Big Blue will truly be back to being Big Blue again. Perhaps Big Purple. That is a tall order, and it might take a decade or more, but it is not impossible. The Red Hat stack is just as credible as the Windows stack from Microsoft in the enterprise, and when OpenShift is equipped with KubeVirt, which we talk about here and which is going into production at Red Hat soon, then OpenShift can directly manage virtual machines just as it does containers. And then there is no need for the VMware and Microsoft virtualization stacks at all.

This is a very big deal, and it means IBM has the potential to displace somewhere north of $10 billion in revenues (our estimate) that VMware and Microsoft enjoy from the combination of ESXi plus vSphere or Hyper-V plus System Center, respectively.

IBM is not going to be able to win all of those customers, any more than it had a complete monopoly during the mainframe era (it was close for a while at around 85 percent of revenues), or with PCs (peak share was maybe 25 percent), or with Unix servers (it was 20 percent of a peak market and 75 percent and higher of a diminished market). This IBM doesn’t want a monopoly so much as a distributed platform that runs on premises and in clouds and that has an annuity-like revenue stream like it had in the glory days in the mainframe era.

And this is the best chance that IBM has to build it, particularly given the strong monthly billing it already does out of some of the largest enterprises in the world running its System z mainframe platforms and using its outsourcing services across a wide array of machinery. And it is that regular, predictable revenue stream that made Big Blue formidable in the 1960s and 1970s and even into the 1980s, and what is making it somewhat immune to the coronavirus outbreak right now. Krishna elaborated about this:

“We have looked at our revenue portfolio. We believe we are differentiated, although we are not immune from what is happening in the marketplace. We do have some level of stability in our revenue, our profit, our cash – and that is driven by all of the work that we have done over time to transform this company and to optimize our portfolio. We went from 2008, during the last recession, where we were only about 45 percent annuity, and now we are north of 60 percent. We have always been focused on large enterprise versus consumer SMB, and that is playing out well. Our industry concentration is such that over 70 percent of our revenue sits in industries that IDC and Gartner say are going to be either moderately or minimally impacted by COVID-19. So, we are diversified along geographic dimensions, market dimensions, industry dimensions, client dimensions that gives us that strong annuity content to move forward.”

The thing to always remember about IBM is that way down in there, deep down inside, it is still International Business Machines, and it is a systems company and it thinks in terms of complete systems. Maybe there is a team, under Krishna and Whitehurst, that can revitalize that memory and turn it into something that isn’t just milking a legacy or two, but building a new one. The Red Hat acquisition gave IBM a chance to stop buying back its shares to appease Wall Street, and the coronavirus outbreak has given IBM a chance to not only stop making promises about its financial performance, but to do the things that it needs to do to build the next platform. There should be a way to make its Power Systems iron shine and compete well in this future.

Maybe IBM will do it this time after missing the boat so many other times in the past several decades. We contemplated this way back in early 2016, and then again in the wake of the Red Hat deal closing last year. We shall see.

In the meantime, IBM’s first quarter of 2020 was going along pretty good until companies started to feel the coronavirus pandemic in March. At that point, many customers shifted from short-term projects to strategic ones and started to conserve cash to ride out the financial storm. IBM did likewise, shifting 95 percent of its 300,000 employees to work from home, with only 8,000 working onsite in manufacturing and datacenters. All sales and marketing efforts are being done online now, and IBM has booked some big deals helping large enterprises shift to work at home.

“For those clients that did engage at the end of the quarter, there was a noticeable change in priorities, where focus very quickly shifted to the stability of their operations and preservation of cash,” explained Jim Kavanaugh, IBM’s chief financial officer, on the call with Wall Street. “They moved ahead with spending that addressed immediate and essential needs, including running mission-critical processes and securing a remote workforce. For example, we increased infrastructure capacity and services to meet unprecedented demands on critical banking functions for banks in countries ranging from Italy and Spain to the United States, to Australia and Singapore. In Brazil, we developed a platform and a single week to connect patients to doctors via telemedicine. And at a major US insurance company, we helped 40,000 employees to work remote, when they had absolutely no work-at-home capabilities just two weeks earlier. At the same time, the last few weeks have only reinforced the need for clients to modernize their businesses for the new world, and cloud and AI are at the core of their digital reinventions.”

IBM did the same. It stopped share buybacks, which is one of the reasons why it had $12 billion in cash as the quarter ended, up $3 billion from the end of 2019. IBM has excellent credit and doesn’t need to borrow money, but in February, when things looked like they might get weird, Big Blue issued $4 billion in debt to bolster its balance sheet and it also took out $2.5 billion in commercial paper. IBM has $15 billion in credit lines it can tap as well, but says there is no need to do that at the moment.

As the first of the big IT vendors to report financials, the situation could have been worse and it might yet get to be. In the March quarter, IBM’s sales were off 3.4 percent to $17.57 billion, and gross profits fell by 1.5 percent to $7.92 billion. IBM did some restructuring in its Global Services behemoth and also wrote down a bunch of Red Hat assets, as expected, and after that was done actually reported a pre-tax loss of 49 million. After a well-times tax gain, IBM’s net income was off 26.2 percent to $1.18 billion. This is the foundation from which Big Blue will build on.

The company’s Systems Group posted $1.37 billion in sales externally, up 3 percent, and had another $148 million in sales to other units within IBM, down 9.2 percent, for total systems sales of 1.52 billion, up 1.7 percent. Mainframe sales were up 61 percent in the quarter thanks to the System z15 refresh that started at the end of September last year, but Power Systems had a 32 percent decline due, in part, to its substantial focus on small and medium businesses who have been most heavily impacted by the pandemic. Thanks to high-end DS8900 storage array sales (which are based on Power9 servers, by the way), IBM’s Storage division had a 19 percent bump up in sales in Q1. IBM’s total server hardware sales came to just north of $1 billion, up 10.7 percent. Operating systems sales (which do not include Red Hat Enterprise Linux) were off 13.3 percent (we estimate) to $367 million. Add it all up and even with that pretty good sales on hardware, the slump in operating systems revenues pushed Systems Group to a pre-tax loss of $217 million.

But IBM is in this for the systems software it sells on System z and Power Systems machines and the very high margins it commands (north of 85 percent of the sale price) and the annuity stream it affords. Always remember that. IBM’s cognitive applications revenue – we think it means databases – had $1.22 billion in sales, off 10.1 percent as reported, with transaction software hitting $1.51 billion, off 11.7 percent. But cloud and data platform sales (which does include Red Hat) rose by 31.9 percent to $2.51 billion. This software business had $933 million in pre-tax income, down 47.76 percent mostly because of the sales slump for database and transaction software and the writeoffs for Red Hat.

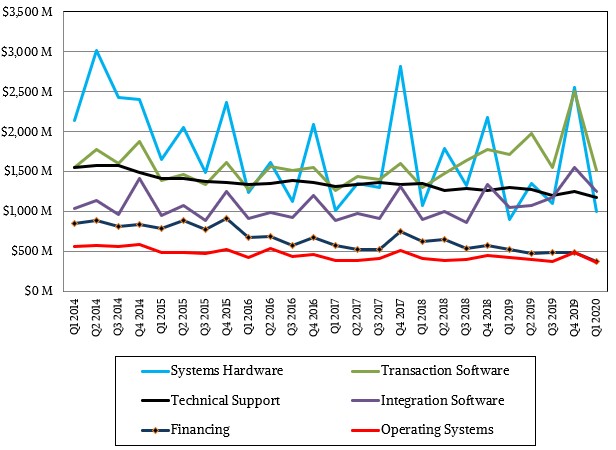

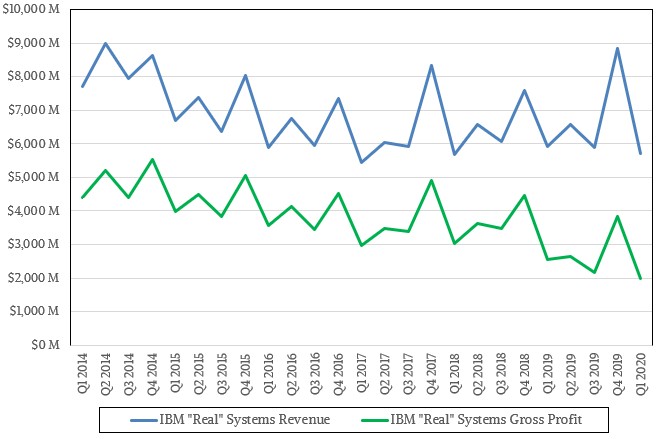

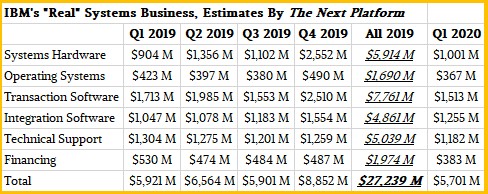

If you go through the IBM numbers and do some estimating, as we do every quarter, then you will find that IBM’s “real” systems business, which includes the server and storage hardware, storage and systems software, transaction processing and middleware, technical support, and financing for IBM’s own System z and Power Systems machinery, came to around $5.7 billion in sales, down 3.7 percent, and its gross profits fell by 22 percent to just a tad under $2 billion. Here’s the breakdown by revenue type for the “real” systems business in the four quarters of 2019 and the first quarter of 2020:

This is a business under pressure, to be sure. But it is still large and healthy, and what IBM is going to build on to create its future.

Wasnt this supposed to be a platform related article than a financial analyst. Since at least the last 10 years or so people have been writing about what appears to be now a black swan event of IBM returning to its glory days. Despite gluing all type of open source and other technologically advanced stuff, IBM has struggled and will continue to struggle. Unlike its services peers, IBM has ZERO investments in services and they will further decline given the new CEO may not want the service baggage. Most of its customers want to stay away from IBM products across hardware and software unless they are locked in. Glorified CEO talks do not align with on the ground reality of how IBM sales team engage in a frustrating and threatening model with their clients. I don’t see any hope for IBM, except the fact CIOs and others who do not want to be held at ransom to arrogant public cloud vendor, may use IBM for some more years. Therefore, the IBM death will be very slow, but it will happen in the next ten years. Everything is not a Mainframe.