VMware burst onto the datacenter scene a little more than a decade ago, during the last big recession, when server virtualization appeared at exactly the right time when server spending was going to be seriously curtailed by economic forces.

Server virtualization allowed enterprises to slice and dice first their servers and then their storage appliances to enable them to run more workloads and store more data on the same or fewer numbers of pieces of hardware, a boon for organizations that were tired of spending money as they over-provisioned their datacenters to isolate workloads. This could be done with virtual machines instead of distinct physical machines, and soon thereafter VMware was scooped up by storage giant EMC just ahead of VMware’s initial public offering and then, in 2016, by Dell when it bought EMC for than $67 billion.

Then along came the public clouds – then hybrid clouds – software-defined everything and, soon after, containers, creating challenges for a company that during its early years proved to be a challenge for traditional hardware makers. In an increasingly distributed IT environment, where data and applications are not only housed in and accessed from a central datacenter but also a combination of public clouds and now the fast-developing edge, the network becomes the key connector between all these environments and the pathway for workloads and data to move around.

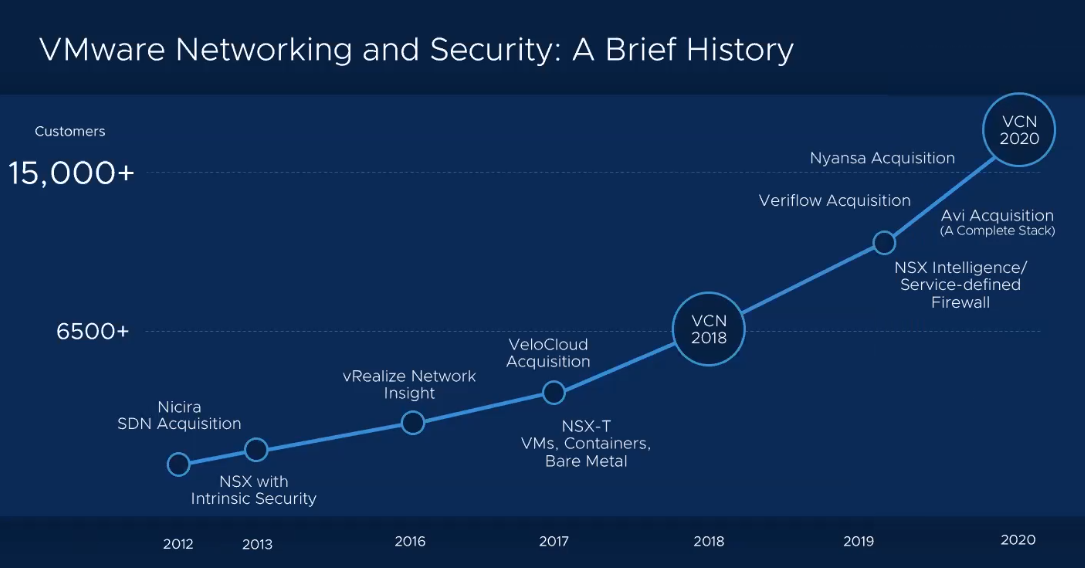

VMware began to lay the groundwork for its own networking portfolio in 2012, when it spent $1.26 billion to buy Nicira, a startup in the then-nascent software-defined network (SDN) scene. SDN arrived on the scene with the promise of making networks more programmable, scalable and flexible by decoupling network tasks from the underlying hardware, essentially enabling organizations to run third-party software atop increasingly commoditized switches. Nicira’s technology formed the basis for VMware’s NSX SDN offering, which has become among the top SDN products in a highly competitive market.

Since then, VMware has steadily built out its networking portfolio through in-house innovation and acquisitions, making itself a player in the software-defined datacenter (SDDC) and cloud spaces. In 2016, the acquisition of Arkin Net brought greater network visibility capabilities through vRealize Network Insight (VRNI), unveiled the same year. A year later, VMware bought VeloCloud for $449 million, a move that gave it entrance into the crowded and fast-growing software defined-WAN (SD-WAN) market, which gave enterprises connectivity options beyond traditional and expensive MPLS for its branch offices, an important capability at a time of growing workforce mobility, the cloud and the edge. Also in 2017, the company rolled out NSX-T, a flavor of the SDN technology independent from VMware’s vSphere technology and that focuses on cloud-native applications, supporting multiple hypervisors, bare-metal infrastructures, containers and multicloud environments.

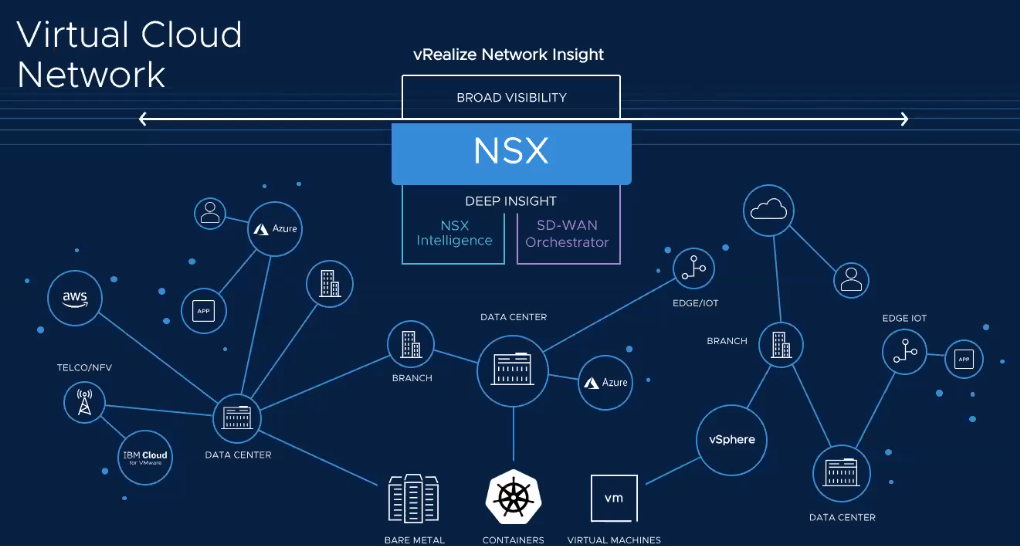

In 2018, VMware announced Virtual Cloud Network (VCN), which pulls a lot of this networking and security together. It includes NSX both in the datacenter and Amazon Web Services (AWS) and Microsoft Azure public clouds, the VeloCloud SD-WAN technologies, Hybrid Connect to move VMs between locations and AppDefense for securing VMs and containers. VRNI also is used for insight into the network.

Since then, VMware has continued to build up its networking portfolio, including in 2019 buying Veriflow for network verification and troubleshooting, Avi Networks for application delivery in multicloud environments and Nyansa for artificial intelligence (AI)-based network analytics. The company also unveiled the NSX Intelligence distributed analytics engine and a service-defined firewall.

“The concept behind the Virtual Cloud Network was really clear,” Tom Gillis, senior vice president and general manager of VMware’s Networking and Security business unit, said during an online press conference. “In an increasingly heterogeneous enterprise infrastructure environment, virtualization can pull all these computing resources together and make your infrastructure more agile, more efficient, more nimble. As we move to the cloud, as we move computing to the edge, our enterprise computing landscape is more heterogeneous than it was five years ago. That means I’ve got some type of compute that runs out in the branch office. I’ve got datacenters that are virtualized, I’ve got datacenters that are not virtualized I’ve got legacy mainframe hardware and more and more. I’m going to the public cloud, and [there are] these really interesting hybrid cloud cases in between where it’s the VMware Stack running on Amazon metal or it’s Amazon metal running in your datacenter or Microsoft metal running in your data center with Azure Stacks, so there’s just an increasingly interesting but complex enterprise landscape. Virtualization simplifies that, pulls it all together and allows our customers to take full advantage of these various forms of computing infrastructure.”

Two years after the launch of the Virtual Cloud Network, VMware is seeing some momentum. According to Gillis, there now are more than 15,000 VCN customers, including 90 of the Fortune 100 companies and eight of the top 10 telcos and growing an average of 50 percent each fiscal year. The vendor says that some customers have seen their capital expenditures fall by as much as 59 percent and operating expenses by up to 55 percent. It’s a component of the VMware Cloud Foundation – the company’s hybrid cloud platform that is available on a broad array of hyperscale cloud providers, including AWS, Azure, Google Cloud, IBM Cloud, Oracle Cloud and Alibaba Cloud. It also helps enterprises to more efficiently run their private clouds.

“One of the trends that’s really been driving this adoption customers are looking for a complete solution,” Gillis said. “Customers don’t want a piece their datacenter together from this vendor and that vendor and I’ve got to patch this thing and worry about the upgrade on that thing and manage the lifecycle of all this. They just wanted to work and want the datacenter to be something that powers their applications because the software is eating the world machinery, the powers of software that’s eating the world ought to come pre-configured and pre-loaded, and that’s the thing that’s driving the adoption of VMware and the Virtual Cloud Infrastructure.”

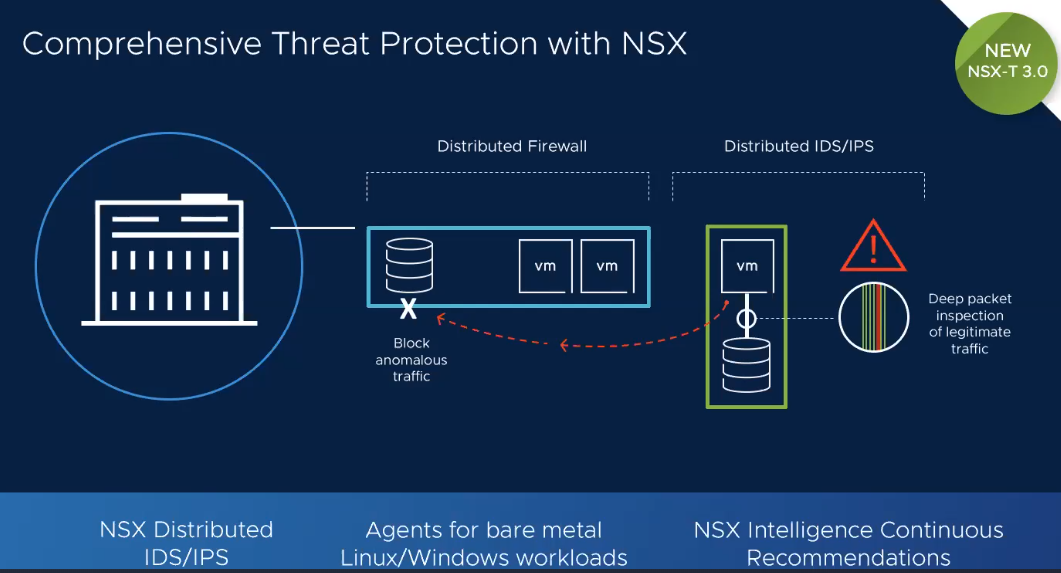

VMware this week bolstered its networking and cloud efforts with enhancements to some of the components of the portfolio, including rolling out NSX-T 3.0 and VRNI 5.2, which bring greater automation and visibility from Layer 2 switch to Layer 7 application firewalls, load balancing and intrusion detection and prevention (IDS/IPS).

Included in this is the introduction of NSX Federation in NSX-T 3.0, which includes fault isolation domains and global policies that are synchronized across an enterprise’s entire environment, regardless of locations. Businesses can now better contain network problems to a single zone to reduce the impact of problems. In addition, VRNI 5.2 includes flow-based application discovery across multiple VMware platforms. It uses machine learning techniques for a better understanding of applications. Both can be leveraged by enterprises to bring more cloud-like characteristics into their datacenters.

NSX-T, which has supported VMs, containers, bare metal servers and Kubernetes, is now extending such network services as switching, routing, distributed firewalls, micro-segmentation and load balancing to vSphere with Kubernetes – released last month – VMware Cloud Foundation 4, VMware Tanzu application portfolio and non-VMware Kubernetes platforms. VRNI, which is available on premises or via software-as-a-service (SaaS), offers deeper visibility and analytics into such areas as network communication density and application patterns. It also now supports AWS Direct Connect and NXT-T 3.0 and comes with enhanced Kubernetes visibility.

Security improvements come via the IDS/IPS for the Service-defined Firewall. For telcos, they can use the VCN to build scalable networks to support the ongoing 5G and edge strategies, not only using NSX as an SDN layer for virtual network functions (VNFs) but also VMware SD-WAN as an overlay in conjunction with 5G. VMware also is working with Microsoft to bring SD-WAN to Azure Edge Zones, which businesses can use to leverage Azure services and deploy VNFs, including VMware SD-WAN. The SD-WAN technology is integrated with the Azure portal to bring zero-touch provisioning.

The enhancements announced this week are part of a trend toward greater automation within the SDDC and the network and the adoption of 5G, according to Gillis. He and other VMware officials also are predicting greater network integration with hyperconverged infrastructures.

“Our infrastructure in the future is going to be more automated more intelligent, more programmable and the last piece of the puzzle here is it’s more integrated,” he said. “Hyperconverged infrastructure is a very, very interesting indicator of where the industry is going. Hyperconverged infrastructure pretty much marries tightly integrated storage and compute, but networking is generally separate. … Networking is really going to become part of compute, which I think is super interesting and you still have to have an interconnect fabric on the back, but it’s going to be about moving packets, which is very different than what we have today. It’s almost coming out of the other direction, but networking has compute and could become compute.”

Sanjay Uppal, senior vice president and general manager of VMware SD-WAN, agreed, adding that “compute can become part of networking and what we’re seeing is based on certain use cases. Whether it’s a loyalty app or whether it’s IoT integration, it wants to run some VM out there because they have some applications that they want to run at the edge. It’s really deploying network infrastructure and then putting a sprinkling of compute on top to give customers the ability to run a VM or two, or a couple of containers – the important pieces” and then centrally managing it all.

Be the first to comment