The ProLiant server is still the workhorse for plowing datacenters and sowing money at Hewlett Packard Enterprise, much as it was for the datacenter division at Compaq nearly two decades ago. The server market is constantly changing, and it is undergoing another drastic shape shift, from disaggregation to composability to high performance and often hybrid computing in its many guises. The one thing that has remained fairly constant is that it is tough for HPE to make some money from all of the millions of servers it pushes into datacenters around the world each year.

On an absolute basis, HPE’s revenues in the fiscal third quarter ended in July were down, but if you look at only continuing operations – pulling out money from businesses it no longer owns or operates from prior quarters to make a more fair compare – then HPE’s revenues of $7.76 billion were up 4 percent year on year. Net income rose by a factor of 2.7X to $451 million, which sounds great, but at $165 million net income was particularly weak in the year ago period, so that is a very easy compare.

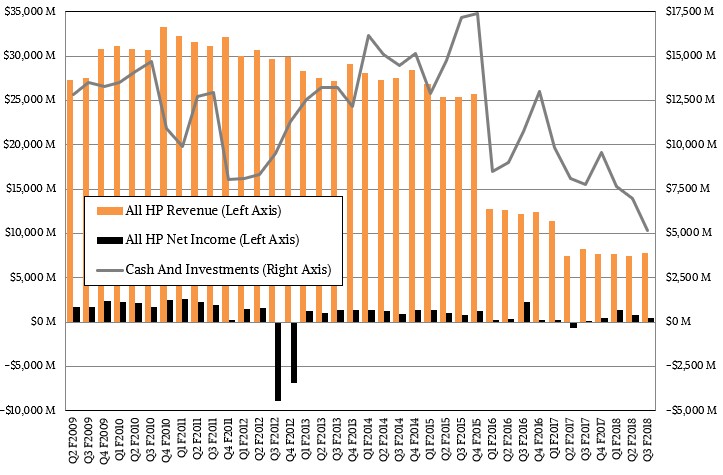

Hewlett Packard sold off a bunch of its parts, including its PC, printer, software, and a whole bunch of its services businesses, and has been consequently contracting in the past four years, which is obvious from this chart below:

The idea behind selling off these businesses was to keep the profitable bits and make a smaller company look better. This always sounds reasonable in theory, just as ganging up all of these businesses did in the first place and gaining synergies and economies of scale and scope. But these buildup or breakdown strategies do not always pan out, except for the executives who drive stocks up as they build the conglomerates or break them apart. The fact remains that the remaining HPE still struggles to get the kinds of profits that one of the largest suppliers of IT gear expects from itself and that Wall Street desires. This says a lot more about the datacenter than it does about HPE, we think. It is not easy to pull profits in this cut-throat IT sector, and anyone who tells you otherwise is either misinformed or lying.

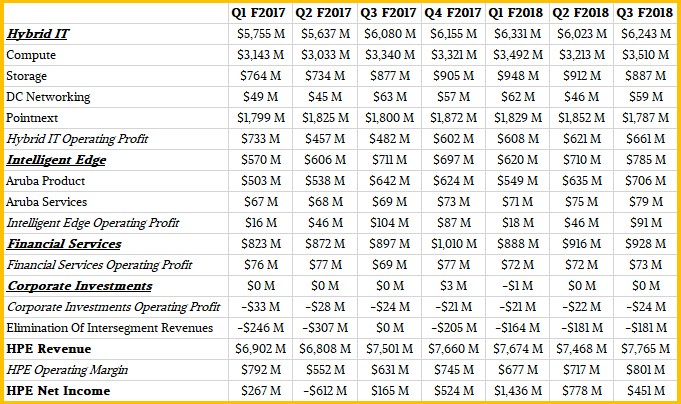

Starting a few quarters ago when Antonio Neri took over as president and chief executive officer of HPE after the departure of Meg Whitman, the company reorganized its business units and chopped itself into three parts:

- Hybrid IT, which is all of compute, networking, storage, and a slew of technology services lumped under the banner of PointNext

- Intelligent Edge, which includes the Aruba wireless networking products and services related to them, and

- Financial Services, which as the name suggests is HPE being essentially a bank for customers who want to lease or rent capacity from it rather than buy it outright.

Here is what the past seven quarters of sales and operating profits under this new categorization looks like:

That’s a lot of data to walk through, so let’s just focus on the results for the third quarter and look at the trends for the core HPE datacenter business over time since the Great Recession.

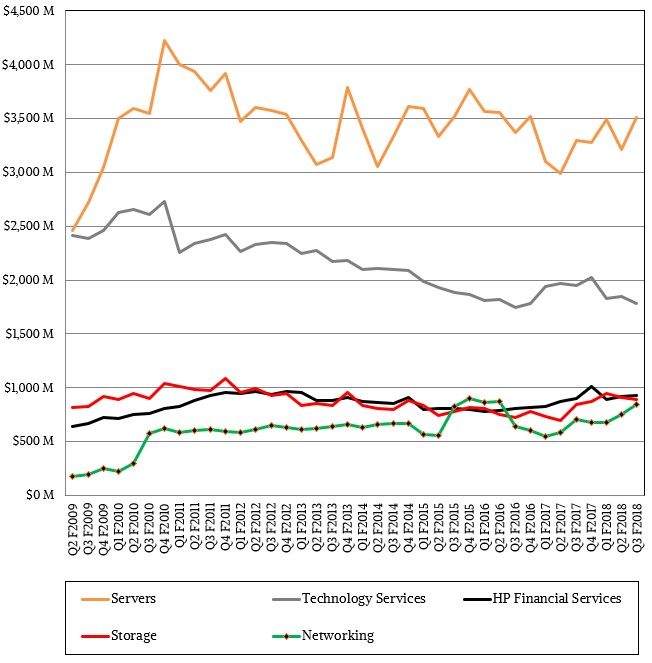

The core Compute business at HPE has been under pressure as Tier 1 service providers – who are never named – are investing elsewhere to buy their servers, very likely with ODMs and causing HPE to back away from pushing its Cloudline minimalist machines last year. HPE pushed $3.51 billion in servers in the period, up 5.1 percent (but only up 2 percent at constant currency), and operating margins expanded for the server business to 10.6 percent, which is pretty good for tin pushers. The core ProLiant business had 10 percent revenue growth, in fact, thanks largely to more feature rich machines being sold and more than offsetting the 11 percent decline in sales of Cloudline servers to those Tier 1 service providers – this is about a $400 million business per quarter for HPE, give or take, according to Aaron Rakers of Wells Fargo Securities, whose math we trust – and a “low double digit” decline in the aggregate number of machines shipped. About 25 percent of the revenue increase year on year was due to DRAM price hikes alone, apparently.

The ProLiant Gen10 rollout, based mostly on Intel’s “Skylake” Xeon SPs as well as a smattering of AMD “Naples” Epyc 7000s, is humming along, comprising half of shipments in the quarter. Interestingly, as part of its “Next” company reorganization, HPE has chopped the number of different server configurations by 60 percent and the number of options by 80 percent, bringing the total number of SKUs for servers down by 75 percent. This has presumably cut costs for both configuring machines and having parts inventory laying around in the warehouses and therefore on the books, and therefore has boosted profits a bit.

In a call with Wall Street analysts, Neri said that the hyperconverged segment of its business, which includes SimpliVity server-SAN hybrids as well as the Synergy composable systems (which now has 1,600 customers worldwide), now has an annualized combined run rate of more than $1 billion. (That is still significantly smaller, however, than the business HPE has with the Tier 1 suppliers, even after quite steep declines.) Without getting into specifics, Neri said that the Synergy composable systems had “record revenue,” but we have a hard time believing it is actually material in the same way that core ProLiant servers are. It will be many years before this is the case, although we do think all future systems will be disaggregated and composable. Neri added that HPE’s business in the HPC sector was up 9 percent in the quarter, driven in part by its SGI acquisition two years ago, and that it has 35 percent market share in this segment. This is by far HPE’s best market penetration, we think, with Dell making such heavy inroads with its aggressive pricing on PowerEdge gear and custom iron.

The loss of some Tier 1 customers because there was no profit in it for HPE at all has had an adverse impact on the company’s datacenter networking business, which is a third the size in the trailing three quarters of fiscal 2018 as it was in the same quarters two years ago before HPE started to walk away from this cut-throat competition. The networking business, minus Aruba wireless products and services, fell by 6.3 percent to $59 million, and was off 10 percent at constant currency. The storage business slowed, growing only 1.1 percent as reported (down 2 percent at constant currency) as traditional appliances are being gradually replaced by denser and cheaper kinds of storage servers for many use cases.

Add them all up, and the Hybrid IT part of HPE’s business – really most of its remaining business – had sales of $6.24 billion, up 2.7 percent and basically flat at constant currency.

Tim Stonecipher, HPE’s chief financial officer, said on the call that IT spending was healthy and that HPE was able to pass on the increased costs of DRAM and flash memory to server and storage buyers, and added that DRAM prices appeared to have peaked and flash prices were moderating. Stonecipher added that HPE expected for server sales to continue to climb, particularly as it intentionally slows Cloudline server sales to the Tier 1s and the ramp of the Proliant Gen10 servers continues to accelerate at enterprises, which do tend to pay a higher premium – but not very much higher – than hyperscalers and cloud builders. And when the DRAM and flash prices really start to come down – and they will – the compares could get very tough indeed if shipments are also declining. It’s a good thing that FPGAs and GPUs are also expensive to help boost topline revenue, but they also kill profits if the price is not precisely right.

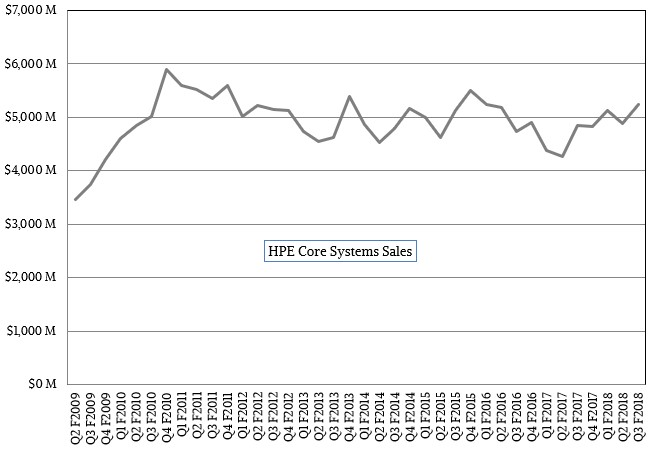

Here’s the funny thing. Despite all of the changes – the acquisitions and spinoffs, the changes in management, the upheavals in servers, storage, and networking – as the chart above shows, the core systems business of compute, networking, and storage at HPE has been fairly steady for the past decade. It may not generate cash like IBM’s mainframe business did, or even what HPE’s old Unix server business did, but it is still fairly stable and, as we have said before, someone has got to make the gear.

Be the first to comment