If any new hardware technology is going to get traction in the datacenter, it has to have the software behind it. And as the dominant supplier of commercial Linux, Red Hat’s support of ARM-based servers gives the upstart chip makers like Applied Micro, Cavium, and Qualcomm the leverage to help pry the glasshouse doors open and get a slice of the server and storage business that is so utterly dominated by Intel’s Xeon processors today.

It is now or never for ARM in the datacenter, and that means Red Hat has to go all the way and not just support the ARM community, but get the full Red Hat Enterprise Linux supported equally to the way it supports Xeon, Power, and System z processors today.

Make no mistake. Red Hat has been enthusiastic about ARM’s efforts to get its low-power processor architecture into the datacenter almost since the time the chip designer first broached the idea at the beginning of the decade. Over the years, Red Hat has used ARM-based servers in open source software projects like its Fedora Linux development release, which provides the foundation for its commercial Red Hat Enterprise Linux stack. Three years ago, Red Hat was one of the key drivers of the ARM Server Base System Architecture – or SBSA – specification to give OEMs and ODMs a framework for building datacenter systems based on the ARM architecture, and it has a special quasi-commercial edition of Red Hat Enterprise Linux that runs on ARM.

Moreover, the software company has worked with other vendors and groups like Linaro to develop standards and policies for products running on ARM-based servers while continuing to push ARM support in its own offerings. For example, on the roadmap for Red Hat’s distribution of Ceph, an open source object storage platform with block and file overlays, is support for the ARM architecture.

Red Hat’s evangelism was on display this week at the Red Hat Summit in Boston, a three-day event that drew some 6,000 developers and executives. Taking up a healthy chunk of showroom floor space was ARM and several of its ecosystem partners, including Qualcomm, Cavium, Linaro and cloud provider Packet, which offers server slices running Intel Xeon E3 and E5 processors but also systems powered by Cavium’s ARM-based ThunderX systems-on-a-chip (SoCs). In addition, the software vendor hosted a panel discussion that included executives from those companies who brought the message that ARM-based servers are real and they’re being used now, and that development is continuing in both hardware and software that will only accelerate the adoption.

“Any idea that ARM in the datacenter is a myth is a misconception,” said Jeff Underhill, director of open source enablement at ARM. “We have got to address some misconceptions to let people know where we are on this journey. It’s a marathon, not a sprint, and we’re well on our way.”

The marathon description is an apt one. As far back as 2010, ARM executives were talking about chipping away at Intel’s dominant datacenter market share within a few years, setting up expectations that the low-power SoC architecture that is found in most of the world’s smartphones and tablets would by this time be a growing player in enterprises. In January 2016, ARM’s top brass threw down the gauntlet, saying that ARM chips could capture 25 percent market share in the datacenter.

However, the development of datacenter-ready ARM chips and the software ecosystem has taken time, and Red Hat has been particularly cautious about supporting the full RHEL as a peer to Xeons, and at the same time Intel has been aggressively innovating on its own Xeon chips to defend against incursions by ARM and others, such as IBM.

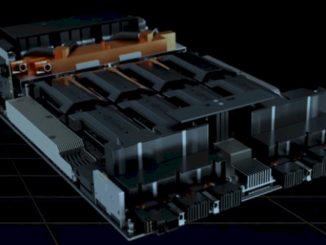

However, there is a demand for a second silicon option in datacenters by hyperscalers and other server makers that want competition to drive better pricing and innovation, and ARM continues to build out the capabilities of its architecture. In March, the company introduced its multi-core DynamIQ architecture that will deliver up to eight different cores in a single SoC cluster that can run at different speeds, enabling users to more easily optimize the chips for particular workloads. As The Next Platform has noted, the new architecture also offers faster access to accelerators and greater resiliency for use with such emerging workloads as artificial intelligence, robotics and self-driving vehicles.

Big cloud providers like Google and Facebook, which make much of their own datacenter infrastructure and software, traditionally have been open to adopting alternative technologies that help meet their high demands around performance, power and costs. It may take longer for enterprises to embrace the architecture, but many of the hurdles that are in the way are being cleared, Jon Masters, chief ARM architect for Red Hat, tells The Next Platform. On the hardware side, the SoCs from the likes of Cavium and – soon – Qualcomm will be challenging Intel’s Xeons in terms of performance and price. In addition, the software ecosystem continues to grow, and standards and policies are coming together that will help mask any architectural differences not only between ARM and Intel chips but also between the various ARM SoCs being produced by the various chip makers. The datacenter is becoming increasingly software-driven, and such standards and policies will mean that developers won’t have to concern themselves with the makeup of the underlying infrastructure when creating their applications.

“It’s all about new workloads,” Packet founder and CEO Zachary Smith said. “I don’t care if it’s X86 or ARM. A few years from now, 90 percent of workloads will be new.”

The variety of ARM chip vendors and the ability to run systems based on ARM SoCs from disparate vendors also will be an advantage, according to the panelists. Workload optimization will continue to grow in importance in the datacenter, and enterprises will be able to mix and match as needed, for example, using a chip from one vendor for memory-intensive applications while running one from another chip maker for I/O-based workloads. Proponents also note that ARM-based SoCs are being used throughout the datacenter, including storage and networking systems as well as servers.

In addition, big names in the tech industry continue to come around to ARM. Microsoft caused waves at the Open Compute Summit earlier this year when officials announced a variant of the Windows 2016 operating system that runs on the ARM architecture that is being used in the software giant’s Azure cloud. Microsoft also announced two platforms powered by Qualcomm’s Centriq 2400 and Cavium’s ThunderX2 ARM chips that are part of Microsoft’s Project Olympus efforts, and that will be contributed to the Open Compute Project (OCP). Masters said another key will be having more top-tier OEMs and ODMs come out with ARM-based systems. Hewlett Packard Enterprise offers some power-efficient Apollo server modules powered by ARM SoCs, and others, such as Dell EMC, have said they are ready to come out with ARM servers based on demand. Some ODMs, like Gigabyte, already have ARM-based servers on the market. As more major system makers bring such servers to market, more enterprises will be willing to take a look, Masters said.

The acquisition of ARM last year by Japanese tech giant Softbank for more than $32 billion also will have an impact on ARM’s datacenter plans.

“The Softbank deal changed the game for ARM in terms of terms of resources and in terms of scale,” Masters said, adding that ARM is no longer a slave to the quarter-to-quarter demands of a public company and noting ARM’s expectations of capturing 25 percent of the datacenter chip market in the coming years. “I think they can do that, but to do that, you need resources, and now they have those resources.”

ARM and its advocates are facing a somewhat skeptical industry that has been waiting for the chip maker to make good on its datacenter promises and that still remembers boasts from almost a decade ago. It’s taking a wait-and-see approach, but Underhill and other ARM officials focus instead on what’s been accomplished to this point and the work going on behind the scenes that has yet to come into public view.

Larry Wikelius, vice president of the software ecosystem and solutions group at Cavium, said the industry is on the brink of a “big architectural shift. It’s still early days. We’ll look back at this time as the time when the flywheel got moving.”

That said, now would be a good time to get the full RHEL stack supported on ARM chips and to be a full peer to Xeon chips, particularly with AMD’s Naples X86 chips and IBM’s Power9 chips, which will be able to run RHEL out of the gate. The Development Preview of RHEL has been out for nearly two years, and it is time.

Be the first to comment