At this point in the 21st Century, a surprisingly large portion of the manufacturing, warehousing, distribution, marketing, and retailing of every good and service known to humankind is dependent on a piece of circuit board with two Xeon processors welded to it, wrapped in some bent sheet metal with a few blinky lights peeking out of the darkness.

Back in 1885, as the United States was beginning its rise to power, Reverend Josiah Strong declared in his populist book, Our Country: “As America goes, so goes the world.” National borders and national interests still exist, but networks cross boundaries and workloads flit around the datacenters of the world and the whole concept of nation is a bit outdated and porous even if it is still, as both Brexit and the election in America show, a powerful metaphor that people cling to. Meanwhile, the world is a globe, there are no borders from space, and we all live together, metaphors be damned. And we think that the rise and fall of the server market is as good a proxy for gauging what is going on in the world as any other indicator we can think of, including the Dow Jones Industrial Average breaking through 19,000 as it did last week ahead of the Thanksgiving Holiday in the United States,

So, as the server goes, so goes the world.

This is one reason why it is important to keep an eye on Hewlett Packard Enterprise, the increasingly slimming down and focused part of the former HP conglomerate that is focused on the enterprise, hyperscale, cloud, and HPC datacenters of the world. HPE is still the dominant peddler of those two-socket boxes that are the workhorses of the global economy, with maybe 40 million of these machines plowing away at our workloads, which number in the billions across the tens of millions of companies of any appreciable size.

HPE did not have a great quarter in servers, and it is important – as always with the new HPE and the old HP – to try to separate the company’s woes from those of the market at large. As was the case with former conglomerate and former number one server seller IBM, with HPE there always seems to a few things going wrong whenever a few things are going right on the financial front, and growth is hard to attain. IBM has shed so many businesses, as HPE has done and continues to do as it rids itself of most of its services business through a spin-merger with CSC and most of its software business through a spin-merger with Micro Focus, that its business remains complex; HPE will be a lot less complex once the spin-mergers are finished and, we think, an even better indicator of enterprise spending on core infrastructure than it has ever been in its history.

Hopefully that will be a good thing for HPE. Given the intense – and ever increasing – competition in the markets for servers, storage, and switching, we are not so sure. HPE does not have a legacy mainframe business to extract profits from as it transforms itself, as Big Blue has done for the past two decades. (Time is running out on that transformation at IBM, and chanting cognitive and cloud continuously does not make IBM a force in either cloud computing or machine learning. Calling databases running on mainframes does not name them cognitive, either.) HPE will get the benefit of the doubt for a few more quarters from customers and Wall Street as it pares down and hones its datacenter business, and the company is betting that this focus will give it leverage that rival Dell, which is embiggening itself massively with EMC and VMware, is trying to get from the exact opposite strategy.

HPE By The Numbers

Both IBM and HPE have been shedding units and acquiring other businesses as well as putting some more discipline in their sales processes, both internally and through their channels, to extract more profits from a much smaller revenue stream. It takes a certain amount of fortitude to walk away from deals that may be great for parts and software suppliers but terrible for the bottom line of the business, and long gone are the days when any of the system makers could count on system software lock in drive their revenues. IBM still has this with its mainframes and for its Power Systems running AIX and IBM i, to a certain extent; HPE’s OpenVMS and HP-UX businesses are miniscule by comparison, and any money that is being spent on Linux or Windows Server, the two dominant corporate operating systems and the two main profit pools for systems other than Intel Xeon processors, goes to Red Hat and Microsoft.

At some level, it is amazing that any server maker can make any profits at all, especially in a world where contract manufacturers will build systems for pennies on the dollar – a level that global retailers get by with an order of magnitude more revenue than HPE or Dell or Lenovo can muster from their systems businesses. The wonder is not so much that the hyperscalers design their own machines and have ODMs build them, but rather that any server maker can scratch out a living selling to the big (and very different) four markets of hyperscale, HPC, cloud, and enterprise and that everyone doesn’t just say to heck with it and do what Google does and go to Quanta Computer. Dell and HPE have, in their own ways, formed their own ODMs and they count on the inertia of enterprise customers and their buying preferences – and their lack of volume buying power – to bring them revenues and profits.

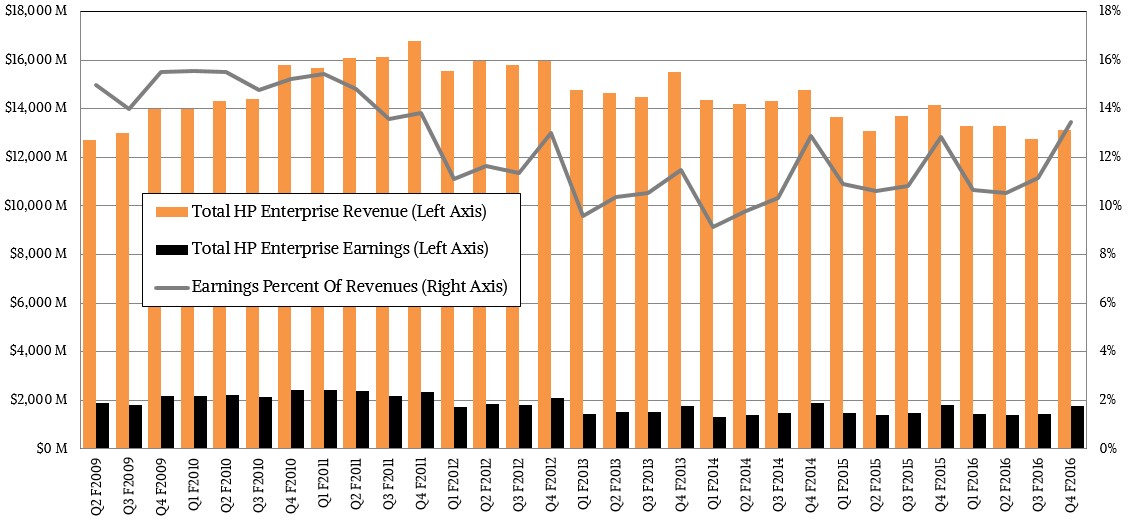

This did not exactly pan out for HPE in its fourth quarter ended in October, as the recent numbers show. But it is important to remember that a wiggle up or wiggle down is not a business collapsing. We live in interesting times right now, to put it mildly. In the quarter, HPE’s revenues were down 7.2 percent to $12.48 billion, and thanks to the costs of the separation of the former HP into two businesses as well as the spin-mergers, net income was only $302 million compared to $1.39 billion a year ago and down significantly from $2.27 billion in the prior quarter when HPE booked $2.17 billion in gains from its Mphasis and H3C divestitures and was able to bring $2.27 billion to the bottom line. As has been the case with IBM during its many-year transition, HPE makes more money selling off businesses than actually doing business, and this is obviously not sustainable.

That said, even after blowing $10.5 billion on Autonomy when it aspired to be a software player and writing off most of that investment, HPE has been able to squirrel away cash from operations and from sales of businesses and has just under $13 billion in the bank – about one quarter’s worth of revenue at its current size. That gives HPE plenty of time to maneuver. The company has also reduced its debts, which are currently in balance with its cash, and it will pull ahead as the spin-mergers get done and pay down its debts from cash flow. The numbers are, in fact, moving in the right direction. Even the revenue trends for the core HP enterprise segment through last year and for HPE this year show this. As revenues have dropped, HPE has been pulling a larger percent of revenues to the middle line as operating profits. All HPE needs to do is dig in with its channel and sell.

That was apparently a bit of an issue in the final quarter of fiscal 2016 for HPE.

HPE chief executive officer, Meg Whitman, told Wall Street analysts that the company needed to “shore up core ISS rack” by making improvements in the channel and its “quote to cash” operations and get “more focused on the distributors and the VARs for its volume-related ISS rack business.” That is a complex way of saying that, for whatever reason, HPE is not pushing as many servers as it would like through its channel partners, although the actual explanation as to why this is the case was not revealed. For all we know, it could be that channel partners are not seeing as much demand as they anticipated from enterprise customers, something that Intel said it experienced in its most recent quarter and, frankly, we would expect that Dell and Lenovo are experiencing as well as other OEMs and ODMs. We think that customers are aware that “Skylake” Xeons are coming in the middle of 2017 and those that can wait are waiting since these processors are going to represent an important architectural change. Toss in the American election and the uncertainty this is causing in the global economy, and we are not even a little surprised that HPE’s enterprise revenues are down.

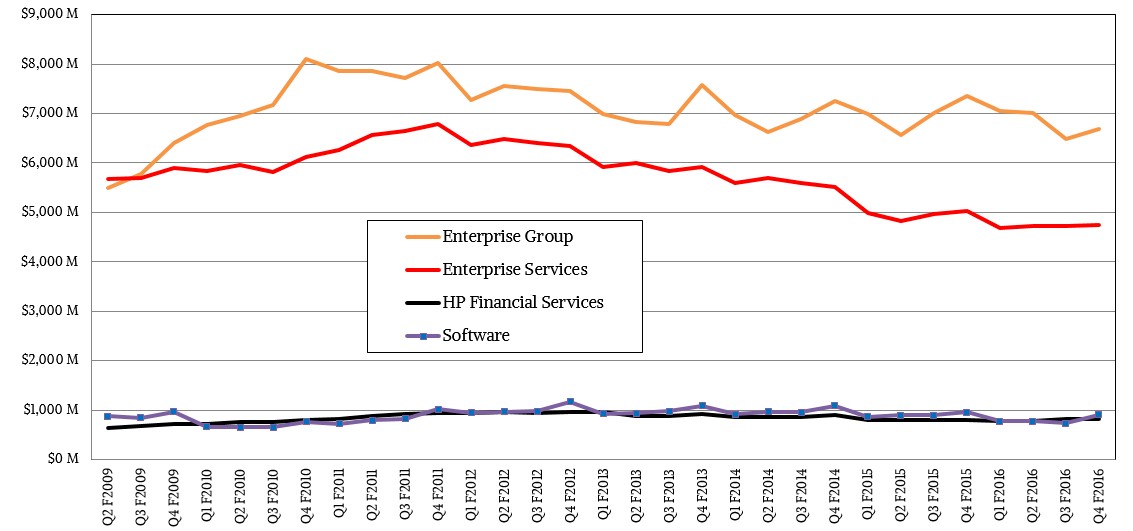

In the quarter, HPE’s Enterprise Group, which sells servers, storage, switching, systems software, and technical support services for all of these wares, had sales of $6.68 billion, down 9.2 percent, and operating income was $883 million, down 11.7 percent. HPE might be walking away from deals to preserve profits in the Enterprise Group, but the profits are shrinking faster than the revenues and that is not the way that Wall Street likes it.

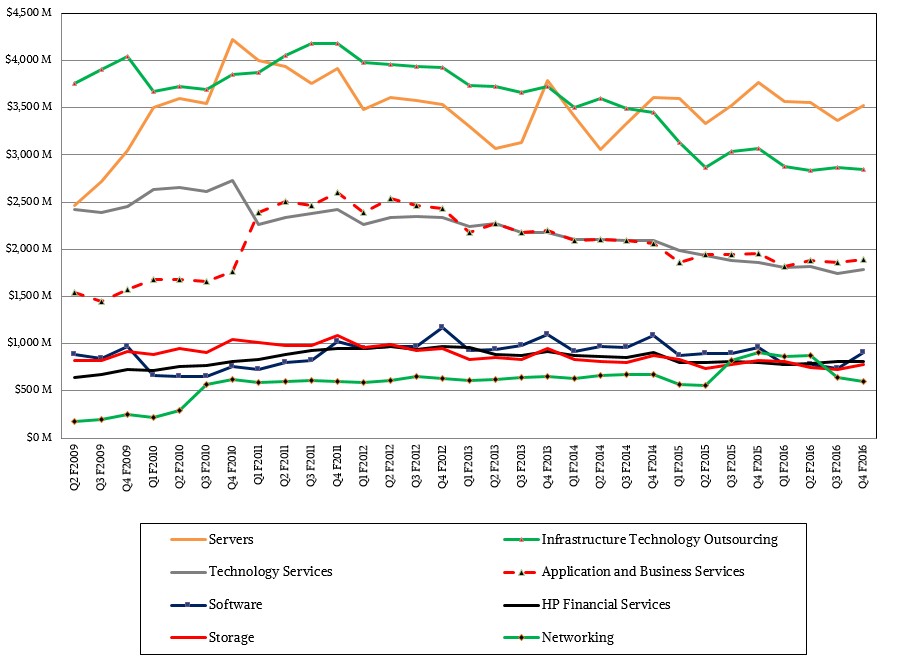

Within Enterprise Group, server sales were off 6.6 percent to $3.52 billion, and as Whitman’s comments indicated, the pressure was on the ProLiant blade and rack servers that are core to the new HP’s business. Whitman said that the spinoff of the Enterprise Services unit to CSC is opening up opportunities to other services giants, such as Accenture, PwC, Wipro, and Tata, who normally would think of HPE as a competitor, so this will help ProLiant servers in the long run. The Synergy line of composable systems are starting to get traction, and the acquisition of supercomputer and rackscale system maker SGI finished as the quarter came to a close, which will help a bit in future quarters. But sales into the tier one accounts, meaning hyperscalers and cloud builders, was off. Whitman added that she was focusing on tier two and tier three customers, where the margins were higher, and focusing less on tier one hyperscalers and cloud builders. The lower the volume at the customer, the better the margins. When an SMB customer moves to the cloud, it kills HPE’s profits – kinda forever. Ditto for Intel, by the way, which is why Intel suddenly started talking about having 50,000 customers build their own clouds.

Storage and switching had their issues in the final quarter of HPE’s fiscal 2016, too. Overall storage sales were down 3 percent as legacy storage products (meaning traditional disk arrays and tape products) were down. But, said Whitman, new-fangled storage products, which now represent 56 percent of sales was up 1 percent, including converged and hyperconverged storage, 3PAR arrays with a mix of disk and flash or all-flash. That traditional storage was off 11 percent, but the combination of 3PAR arrays plus high-end XP and EVA arrays grew 2 percent. All-flash versions of the 3PAR arrays doubled their revenue, and all-flash makes up about 50 percent of 3PAR revenues at HPE, and all-flash only comprises around 10 percent of storage revenues today. HPE sees this as an opportunity for growth, but another way of interpreting this is to say that maybe all-flash can only make up 20 percent of storage revenues in the datacenter rather than to think that it can grow by a factor of 9X to saturate the market.

In networking, while Aruba wireless LAN products have helped bolster HPE’s networking business, the revenues have dropped back down, as you can see from the chart above. You can see how the 3Com acquisition boosted sales a few years ago and this revenue stream held up for a while. HPE is counting on its partnership with Arista Networks to give its networking biz a push and for continued growth in the Aruba line, which was up 13 percent in the quarter to get the networking business humming again. But with overall networking sales down 34 percent (in part due to the divestitures of systems businesses in China) to $599 million, HPE has a lot of ground to make up in networking. If HPE just straight out acquired Arista, which has a market capitalization of $6.65 billion, it could boost its networking business back to levels it used to enjoy.

With the remaining bits of software and services that it will retain plus the core Enterprise Group and HP Financial Services businesses, Whitman says that the new HPE will target a $250 billion IT opportunity that is growing at between 2 percent and 3 percent per year. The goal will be to eat share and grow faster than that market, and to have more than 15 percent share of that pie. “We are already well-positioned to lead in these areas and you will see us continue to invest in a targeted way,” Whitman said.

Buying Cray presents an interesting opportunity and would be a significant investment in a very high-end future. Cray has a market capitalization of $810 million as we go to press, and would be much less costly and we think more interesting to acquire than even Arista. Hmmm.

IBM could die out now(Not Likely) but some of its IP has been converted over to that ARM Holdings style licensed/licenseable IP. So much so that even IBM’s singular fortunes will not matter much! So IBM could fail in some markets and go on with that IBM research division and any IP that IBM can license to third party producers which could very well keep IBM’s shell around for a good while. The most valuable assets that IBM has is that R&D and whatever licensing revenues that IBM can obtain from the OpenPower/OpenCAPI and other IP that IBM has for revenues that will not easily disappear based on IBM’s own computing market failures/successes.

HP Enterprise could very well make use of its own licensed Power9 offerings using AMD’s(Via OpenCAPI/CAPI2) GPU accelerators and CAPI2 interconnect compatibility or go with Nvlink/CAPI2 and go with Nvidia’s GPU accelerators at the cost of that more Proprietary Nvidia lock-in, If any power9 customers chose Nvidia/NVLink. It’s interesting to see that AMD is a Founding member of that OpenCAPI group while Nvidia is more of an associate member! Nvidia hedging its bets comes to mind with OpenCAPI/CAPI2 compatibility along side its own NVLink IP!

Any and all of the Server/Workstation/HPC system market players in addition to HPE and IBM will be able to take advantage of the much more healthy competition for CPU, GPU, FPGA, and others processing hardware made available via some of that ARM Holdings style licensed IP business model availability for ARM, Power9/Power(OpenPower, OpenCAPI), and any other licensable CPU/GPU/Interconnect IP. As well for the new movements towards OpenCAPI and other open interconnect IP from ARM, IBM, and those many new standardized interconnect foundations/groups announced over this past year or so. There will even be some more x86 based competition to give HPE some lower cost x86 options relative to the higher cost on the current incumbent x86 market share holder’s pricy kit. This is the one really bright spot on the horizon for HPE, IBM and any other makers that produce server/workstation/HPC products based on any CPU/GPU and other procesing hardware used for these markets.

In fact HPE has a very healthy mainframe-business with their Tandem/NonStop systems, which was not mentioned in the article. They just recently migrated their NonStop operating system from Itanium to x86.