Converged systems are a hot commodity in the IT sector these days. But it looks to us like the hype over various kinds of integrated systems that weld servers and storage together into preconfigured stacks including hyperconverged stacks that literally merge the compute and storage layers on the same servers – is just a bit bigger than the appetite for such iron in the datacenters of the world.

According to the latest statistics from IDC, the market for converged systems, which is a broader definition of such machines that includes integrated systems, certified reference systems, and hyperconverged systems, the market for integrated systems like Oracle’s Exadata and Exalogic platforms, seems to have settled into a fairly steady state pattern. These integrated systems include servers, disk storage, switches, and systems software for managing the whole shebang, and they come from a single vendor. The certified reference systems include the same wares, but include technologies from multiple vendors, like stacks that mix servers from Cisco Systems and storage from either EMC or NetApp, for instance.

The hyperconverged part of this segment of system stacks is a different animal entirely, and continues to grow. But the explosive growth it has seen in recent quarters is slowing, and we think hyperconverged iron will find its natural water mark and perhaps considerably lower than the equity investments in providers of hyperconverged software stacks might suggest is a possible future market size for such machines. It is hard to say, and a lot depends on if large enterprises embrace hyperconverged storage in a more meaningful way. There is a possibility of that, particularly as hyperconverged software is decoupled from specific hardware appliances and companies are allowed to deploy it on the iron of their own choosing.

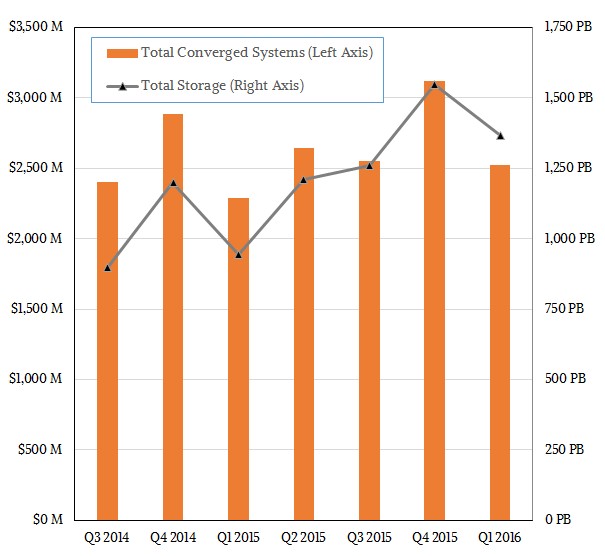

In the first quarter of the year, IDC reckons that converged systems of all types generated $2.52 billion in sales, up 10.4 percent and significantly outpacing the sales of servers and storage overall in the IT sector. In the past three quarters, when IDC has been tracking converged systems in this manner, sales growth has been accelerating, bolstered in large part by hyperconverged system sales and also by increasingly storage rich configurations. Companies are getting a lot more storage for the converged systems dollars, according to IDC’s figures.

The total capacity sold in the first quarter across all converged systems types rose by 44.7 percent to 1,367 petabytes, and even more interestingly, the average cost per TB fell by 23.7 percent to $1.85. In the third quarter, when IDC started tracking converged systems in this manner, revenues were $2.41 billion, but aggregate storage was only 898 PB and the average selling price across these systems was $270 per TB. The capacity has gone up, the price per unit of capacity has come down, and the revenue stream has wiggled up and down but on a generally upward trend line.

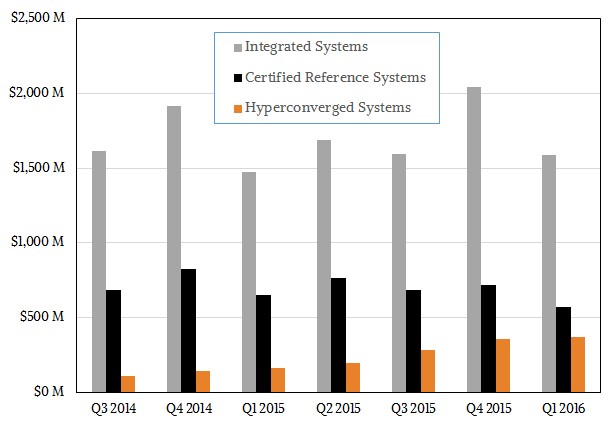

We do not know how the storage that IDC tracks is allocated across the three different converged systems types, but the company does divulge how the revenues break down across these three categories. In the first quarter of this year, integrated systems from a single vendor accounted for $1.58 billion, up 1.8 percent from the year ago period, with EMC holding more than a quarter of the market now that it has taken over the VCE partnership that was started with Cisco and VMware. (This business will soon be part of Dell, of course, once its $67 billion deal, announced last fall, is done.) EMC’s portion of the integrated systems business rose by 22.1 percent in the quarter to $403.9 million, contrasting with the 4.4 percent decline that Oracle saw as sales fell to $379.6 million. Hewlett Packard Enterprise had the most growth in this segment, with sales up 34 percent to $356.9 million and almost closing the gap between itself and both Oracle and EMC. All other players in this area collectively sold $443.8 million of gear, down 21.1 percent.

Sales of certified reference systems, a kind of integrated system that spans multiple vendors, were essentially flat, with $568 million, with the Cisco-NetApp partnership having dominant share of 55.2 percent and EMC having 32.8 percent; others accounted for only $67.9 million in this category, and revenues rose by 18.1 percent, helping buoy this segment of converged systems.

IDC does not yet break out sales of hyperconverged systems by vendor – it needs a little more time to get a sense of this nascent market – but did say that revenues for hyperconverged products rose by 148 percent to $371.9 million. In its brief history, hyperconverged systems have had a weak first quarter in terms of quarter-on-quarter growth, but this one has been weaker than usual, with sales only rising 4.5 percent from the fourth quarter of 2015. That is one quarter the growth rate seen a year ago, but there is every reason to believe that sales of hyperconverged platforms will continue to rise in the coming quarters, boosted significantly by the deployment of these products for greenfield virtualized applications among large enterprises as well as among midrange businesses that are tapping such infrastructure to be their core platforms for all applications.

Given that large enterprises have their own hardware preferences, we think that they will want to have hyperconverged software that is not tied to specific hardware, but at the moment, vendors tend to sell either appliances with restricted hardware compatibility lists or, in the case of SimpliVity, actually require an FPGA accelerator to make the storage hum. When Nutanix fully breaks its eponymous hyperconverged stack free of its own appliances (based on Supermicro iron) or Dell PowerEdge-C machines, we think others will have to follow. We also wonder when someone will open source a hyperconverged stack – something that has not happened yet – and upset all of the applecarts. It might be best for Nutanix to do this before someone else does.

Considering how many servers and how much capacity is put into enterprise SANs – it might be something on the order of $20 billion added up – it is reasonable to wonder when hyperconverged platforms will just be the normal way that enterprises consume compute cycles and storage capacity. This is certainly the vision that Nutanix has of the future, and one that all of the investors that are backing other hyperconverged system vendors hope will become reality.

Be the first to comment