It has been almost six years since the founders of Big Switch Networks started sitting in the research group meetings at Stanford University, which served as the birthplace for software-defined networking, and times have certainly changed.

SDN has defied a simple definition, and we have seen the term applied to many areas – SDN datacenter switching fabrics, SDN datacenter overlays, SDN WAN overlays, SDN monitoring fabrics, and more. With so many different product categories, it is hard to answer the question: “Where is SDN today?” But if we restrict that question to the datacenter SDN category, however, we can have a grounded dialog.

In datacenter SDN, distinct architectural options have emerged, comparisons to the status quo are quantified. Vendor products have emerged underneath each option, and the competitive landscape is increasingly well understood. There are SDN overlay products – VMware NSX, Nuage VSP, Plumgrid ONS, and so on – and SDN unified underlay/overlay fabrics – Cisco ACI and Big Switch Network’s Big Cloud Fabric.

So where are we in the evolution of the datacenter SDN market? Let’s answer that in two different ways that mirror what we see in daily conversations with end users.

Where Is Datacenter SDN In The Hype Cycle?

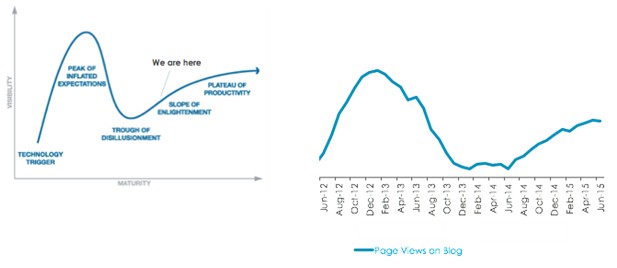

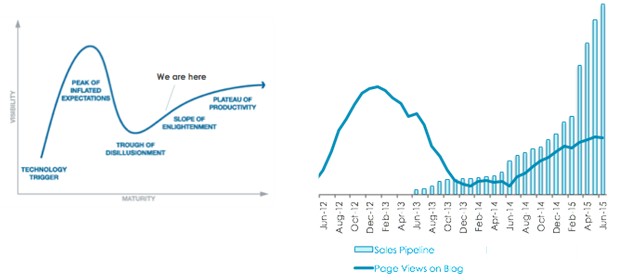

We are believers in the Gartner hype cycle. The company’s analysis uses an aggregation of analyst ratings based on hundreds (or even thousands) of inquiries, briefings, and client projects. While we don’t have access to that data, and Gartner itself does not break out datacenter SDN specifically, a data set that we have access to is page views on the Big Switch Networks blog (shown below).

As a datacenter SDN pure play, and as a blog site that is often referenced as part of more general industry news unrelated to the company, this blog pageview metric has become my best quantitative measure of “buzz” around datacenter SDN.

Aside from the entertainment value of hard data that is a near perfect fit with the Gartner hype cycle curve, the take-away here is that the datacenter SDN category is currently well past the trough of disillusionment and climbing its way up the slope of enlightenment.

Overlaying Big Switch’s total sales pipeline on top of this curve, we can see a pattern emerge that has been predicted by Gartner analysts in countless other areas of enterprise infrastructure: Vendors typically don’t start seeing material product revenues until the technology is entering the slope of enlightenment.

With the data at hand, we can say that one answer to “What is the state of datacenter SDN?” is that we are climbing up the slope of enlightenment.

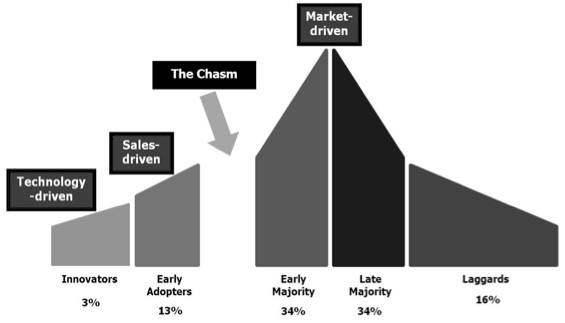

Has Datacenter SDN Crossed the Chasm?

Another perspective comes from Geoffrey Moore’s Crossing The Chasm. Five years ago, when we were just starting Big Switch Networks, most of our meetings consisted of a small collection of CTO types, both vendors and users who debated over vocabulary and architecture. The entire community consisted of people that Moore calls Innovators, outlined as such:

Two years ago, early datacenter SDN products were almost done but the benefits of SDN overlays and fabrics were mostly conjecture. The industry has passed through a period of perspective setting, and through a period where vendors figure out their differentiation with product announcements. An increasing number of our meetings were with people who would fit the profile of Moore’s classic early adopter group. They were looking for datacenter SDN as part of a larger change, often driven by private cloud deployments or upgrades from 1 Gb/sec to 10 Gb/sec networks.

While we still spend a lot of our time with early adopters, it is clear to that the industry in the last year started to see an increasing interest from Moore’s early majority profile. Third party economic analyses and industry-specific reference accounts play an increasing role in the market presence of SDN products.

We think that datacenter SDN is crossing the chasm.

So What Is The Revenue Stream For Datacenter SDN?

We spend some of our time with investors who look solely at last year’s product revenue as the means to measure the market size. We spend a much larger percentage of our time with investors who are networking industry insiders and who know some of the key leading indicators that occur one to two years earlier.

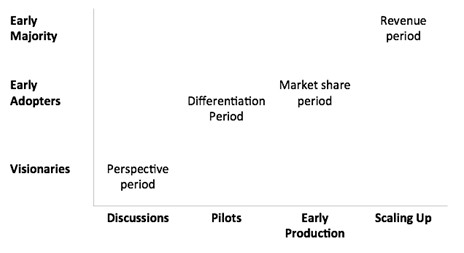

Putting Moore’s categories on one axis and budget years typical in enterprise infrastructure sales cycles on the other gives a visual that we have referenced often to investors and colleagues to set context:

To put some numbers around this, there is zero vendor product revenue in the year any organization is in discussions. Pilots in datacenter SDN can vary widely, but a reasonable planning assumption is that the early production build represents about 10X the vendor revenue as the pilot, and scaling up is 3X to 5X the early production build. These are nearly always in different budget years, so it would be very normal that a Fortune 500 organization that spends X on a pilot is expecting to spend 30X to 50X that amount two years later. Revenue turns out to be a deep lagging indicator in datacenter infrastructure in general, and datacenter SDN is no different.

From our meetings over the last six months, we see a critical mass of visionary organizations (around 3 percent of the user base) scaling up datacenter SDN deployments. Many early adopter organizations (around13 percent of the user base) are in early production or late stage pilots, and most early majority organizations (around 34 percent of the user base) with whom we meet are in discussions to figure out their 2016 pilot budgets.

We call this the “market share” period because we are waist deep in a chapter where referenceable deployments are the primary yardstick by which vendors are measured by their future customers. Early market share is being determined on a reference customer by reference customer basis. Through the course of 2015, we have seen a public customer announcement almost every month from the key incumbents and startups vying for share.

So how do we look at the revenue that the datacenter SDN market made in 2015? The vast majority is coming from the scaling of deployments by visionaries or from initial production or pilots by early adopters. Even in 2016, the majority of the revenue that can be counted by industry analysts will be coming from early adopters. This is by no means a sign of a slow market. It is simply the natural cadence of enterprise budget years, and the observation that many end user decisions will have been made in 2015 and 2016.

So,we started with the question: “What is the state of datacenter SDN?” And the answer is that it is in Gartner’s slope of enlightenment, that it is crossing Moore’s chasm, and that it is in a period where market share is being set month by month. If you follow the assumptions made in the above analysis, then 2015 will represent at most 1 percent to 3 percent of the total revenue that will occur in the datacenter SDN market over the next five years. It is an exciting time to be in datacenter networking.

Kyle Forster is a co-founder of Big Switch Networks, one of the pioneers in virtual switching and software-defined networking in the datacenter.

Very funny. Presented the same a month and half ago internally at the SDN company I work for. The ‘ilities’ are critical for the early adopters.

Moore noted that it was important to find pragmatists in pain at this stage.