Every new generation of systems architecture spawns its own set of management tools to automate the use of that technology and to deal with specific pain points in the architecture. While cloud architectures have done much to abstract the underlying compute, storage, and networking necessary to run applications, there are still substantial differences between various public and private architectures, and it seems unlikely that this will change any time soon. This is where tools such as Virtustream’s xStream come into play, which have been proven in the field among Fortune 500 companies and which made it an attractive acquisition target for EMC, which just shelled out $1.2 billion to buy Virtustream.

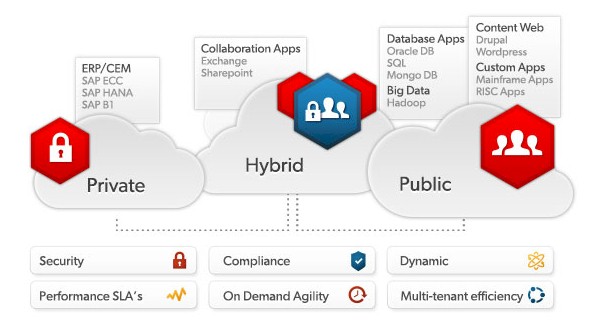

Virtustream was founded in 2009 with the idea of taking on the management of complex, I/O-intensive applications like massive SAP ERP suites on cloudy infrastructure. Such applications were not designed or tuned to run on such iron, and company founders Rodney Rogers and Kevin Reid reckoned back then that enterprises would want their applications to span different cloud architectures but have consistent management and capacity planning across those very different infrastructure clouds.

Availability Assumed, Performance Guaranteed

The insight that they had was to create a virtual unit of compute, storage, and bandwidth, called a micro virtual machine or μVM for short, that would be consistent across all types of clouds. Then they went one step further and created the xStream overlay for clouds, which is essentially a job scheduler, to be able to dynamically provision these μVMs such that companies are only charged for the actual capacity they use rather than the massive amount of overprovisioning that is done on most clouds through on-demand or reserved instances.

This μVM on the xStream platform has 200 MHz of compute, 768 MB of memory, 40 I/O operations per second of storage bandwidth, and 2 Mb/sec of network connectivity, and you can think of it as a basic unit of capacity that Virtustream came up with based on statistical analysis of tens of thousands of workloads running on many thousands of server nodes as they executed hefty applications like those from SAP. The xStream software is very tightly integrated with the VMware stack, and Rogers said on a conference call going over the deal that over 90 percent of the workloads that its customers have deployed on top of xStream are running atop VMware virtualization and orchestration software.

“What our software does is diffuse the definitional bounds of virtual machines, and ultimately allows us to run a control plane from which we perform our own resource optimization with our own resource management algorithms,” Rogers explained. “What we do is break down the cloud to its molecular components, and that allows us to very specifically eliminate resource contention and then control throughput by controlling input and output operations quite uniquely. This allows us to guarantee throughput and therefore application response times, and this is very, very unique. The infrastructure cloud space has been typified by creating commercial guarantees on the availability of infrastructure, but our approach has always been that it is all about the app, that it is all about the app’s performance on that infrastructure.” IOPS, said Rogers, is often a “throttling condition” on public clouds, and Virtustream can provide a guarantee on response time. Availability is just table stakes.

“We squeeze more juice out of a compute host than anyone else in the industry.”

The Virtustream workload orchestrator has been in use on the company’s own infrastructure cloud since 2010 and was put out as a free-standing commercial software product in 2012. The workload management and orchestration of these I/O-intensive workloads is done across each Virtustream datacenter, and across all customers, such that Virtustream can, as Rogers put it, “squeeze more juice out of a compute host than anyone else in the industry.” And that, he added, gives Virtustream among the highest gross margins in the infrastructure cloud industry. The side effect of this efficiency is that rather than billing hourly for fixed capacity, as is commonly done on the public clouds, Virtustream calculates actual consumption of the four units of capacity every five minutes. Using this methodology, Virtustream says it can cut cloud bills by 35 percent or more.

The unified billing and capacity planning across private cloud infrastructure based on VMware ESXi/vCloud and public clouds such as vCloud Air is a big seller for Virtustream, which has surpassed a $100 million run rate for its software and services. EMC has swooped in and snapped up Virtustream before others, including Wall Street, could get their hands on it, much as it did with VMware back in December 2003 when it paid $635 million for the server virtualization juggernaut.

At the time, VMware was prepping to go public, just as Virtustream has been doing since late last year, and EMC paid about six times revenue in what seemed like a pretty safe bet at the time and which has been a boon for EMC, with VMware now having in excess of $6 billion in annual sales and over 400,000 customers with something on the order of 45 million virtual machines. EMC is paying twelve times revenue for Virtustream, and that does not imply that Virtustream is going to be bigger than VMware over the long haul. It does imply that valuations are radically inflated in the middle of this decade.

In a blog post discussing the deal, Rogers said that about 60 percent of its business comes from the infrastructure cloud it has built in North America and Western Europe. The company has two of its own datacenters in the United States in Washington DC and San Francisco and another co-location facility in Las Vegas plus one of its own datacenters in London and a co-location facility in Amsterdam. Virtustream owns its own iron in these facilities. System integrators are key drivers of sales on the Virtustream’s infrastructure cloud. The remaining 40 percent of Virtustream’s revenues come from sales of its xStream software to service providers who in turn use it to build and manage their infrastructure clouds.

Virtustream raised $129.6 million in six rounds of funding, and has Intel Capital and SAP as key investors. (SAP itself uses xStream to manage its own SAP application suite.) On its infrastructure cloud, SAP applications drive about 60 percent of its sales, according to Rogers. The plan is to have xStream templates available to manage virtualized instances of Oracle’s applications by the fourth quarter. It is unclear what enterprise and service provider customers are running on top of xStream. While xStream can hook into the OpenStack cloud controller, Rogers says that by and large enterprise customers have deployed on VMware’s platform and are inclined to stick with it for running their mission critical applications.

Without putting a timeline on it, Rogers said that he believed the Virtustream business could reach $1 billion given its current growth rates – which have been 60 percent per year revenue growth – and now with its backing by EMC and, by default, VMware, which is 80 percent owned by EMC, Rogers thinks that the Virtustream business can grow even faster. How much is not clear until the EMC Federation of companies – EMC, VMware, Pivotal, RSA, and VCE – get together and see how to push this managed cloud idea.

Joe Tucci, EMC’s chairman, said on the call that he was aware that there was some overlap between VMware’s offerings and those of Virtustream, particularly with the vRealize suite of management tools compared to xStream and the vCloud Air public cloud compared to the Virtustream infrastructure cloud. He called the overlap “slight,” and added that “if you leave seams, that is where the competitors will pry in.”

EMC expects the all-cash deal to be completed in the third quarter. Virtustream will be run as an independent member of the EMC Federation, with Rogers reporting directly to Tucci.

It would not be surprising to see Virtustream being offered as a service layer on top of the vCloud Air public cloud, and over the long run, VMware could end up rebranding and reselling elements of the Virtustream stack. For now, parent EMC seems inclined to keep them separate and innovating in their own directions. That could mean, for instance, porting xStream to other clouds that are based on OpenStack or other proprietary cloud controllers. It stands to reason that there will be some integration points with Pivotal’s Cloud Foundry platform cloud, although the applications that xStream was created to support are radically different from those being developed to run on Cloud Foundry. That said, the orchestration layers of xStream might prove useful for platform clouds – particularly if xStream does have algorithms that allow it to wring more performance out of a given set of iron. It is also probably sensible for Virtustream to figure out how to integrate with Amazon Web Services, where companies can and do run large-scale, mission critical applications and they are looking for similar management capabilities.

Be the first to comment