There are times when Cisco Systems, which has a strong presence in datacenter switching, routing, and serving as well as a representative showing in storage and software, is a bellwether for IT market spending and transitions going on in the IT space. And then there are times, like now, when Cisco is a poster child for how the supply chains for chips and other components thanks to the coronavirus pandemic are constricting sales and profits.

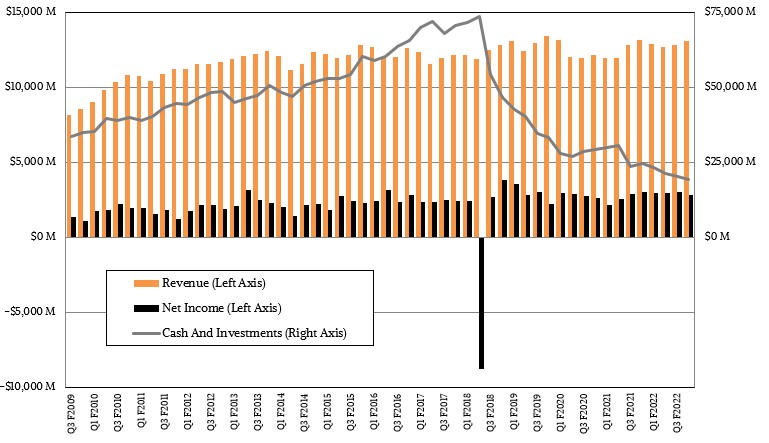

Cisco finished off its fiscal 2022 year on July 30 and has just reported its financials for the fourth quarter and or the full year. Revenues in the quarter were as flat as a pancake, at $13.1 billion and net income fell by 6 percent to $2.8 billion. For the full year, Cisco managed to boost revenues by 3 percent to $51.6 billion, and net income rose by 12 percent to $11.8 billion.

This is actually record annual revenue for Cisco, which had a record quarter a year ago, with 30 percent growth, that made for a tough compare. (All comparisons are tough, aren’t they?) As the fourth quarter ended, Cisco posted a record year for product orders, with orders up 15 percent sequentially from Q3 fiscal 2022 and up 14 percent year-on-year. Remaining performance obligations (which is not included in the product backlog, the figure of which was not supplied) was over $31 billion, and Cisco said on a call with Wall Street analysts that it expected that nearly $17 billion of that would be recognized in the fiscal 2023 year that will end next July. Cisco added that its software backlog was “north of $2 billion” but for some reason won’t give the hardware backlog.

That’s another way of saying that the supply chain boa constrictor is still squeezing, but perhaps not as tight as it has in past quarters.

“After a challenging April due to the COVID-related shutdowns in Shanghai and the impact on semiconductor and power supplies, overall supply constraints began to ease slightly at the back half of the fourth quarter and are continuing into the start of Q1,” Chuck Robbins, Cisco’s chief executive officer, explained on the call with Wall Street. “While the component supply headwinds remain, they have begun to show early signs of easing. The decisions we made and the multiple actions we have taken over the past two years are helping to improve our resiliency and will help offset cost inflation. These include adding new suppliers, leveraging alternative suppliers, redesigning hundreds of products to use alternative components with similar capability, and targeted price increases – all of which position us for the future.”

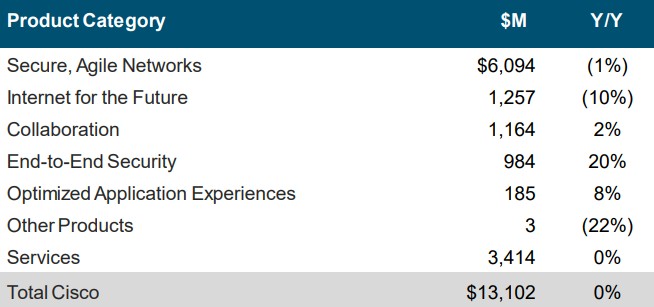

We will talk about guidance for the future in a minute, but first let’s go over what Cisco could sell in the quarter. Here’s the breakdown by product groupings:

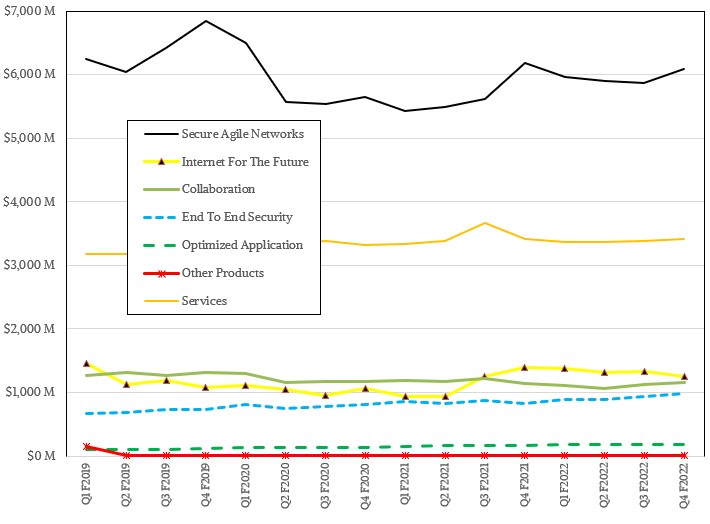

Product revenues were flat at $9.7 billion and services revenues were flat at $3.4 billion, which is how the $13.1 billion overall revenue was also flat.

The core networking business, which is called Secure, Agile Networks, was down 1 percent to $6.09 billion. Robbins said that supply chain constraints meant that datacenter switching and campus switching both declined in the quarter, but the Catalyst ASR 9000 routers and Nexus 9000 routers both saw growth, as did its Meraki wireless switching line. Access routing did well, but edge and SD-WAN routing in the enterprise declined.

And, interestingly enough, Cisco had double-digit growth in servers, but as has been the case for the past several years, it did not elaborate further on its Unified Computing System converged server-switch business. Which is a shame, because we want to know more about how that is doing specifically.

The Cisco service provider business, which is under the Internet for the Future group and which includes cable, optical, and edge products, was down 10 percent to $1.26 billion.

All of the other Cisco lines are interesting to many of us personally, but don’t have jack to do with the datacenter. We only care about campus switching inasmuch as it helps the datacenter switching and routing vendors who do both to run a multi-cylinder engine, which in theory helps smooth the business out a bit and to trickle down some technology that is mature in cheaper, less capable machines.

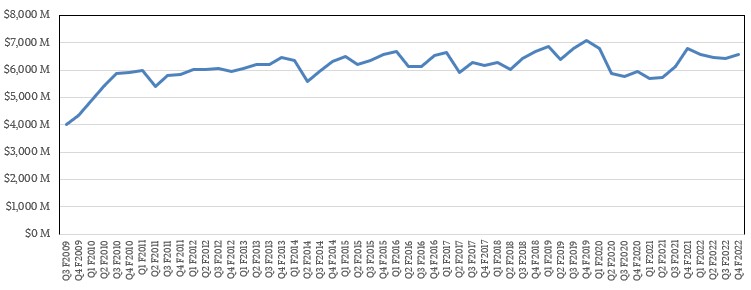

As best as we can figure from our model, the core Cisco server, switch, and routing businesses accounted for $6.59 billion in sales, down 2.9 percent year on year. Here is the trend for that since fiscal 2009:

Paul Silverstein, an analyst at investment bank Cowen, made an interesting comment to Robbins during the Q&A that bears repeating, and so does the reply from Robbins.

“From a big picture perspective, once upon a time, networking in general, and Cisco, in particular, was the canary in the coal mine,” Silverstein said. “When there was a macro downturn, you guys were the first to see it, networking was the easiest thing to push off, everyone let their networks run hotter with the enterprise carriers, et cetera, that seems to flip where networking is actually not seeing weakness that other technology product markets are seeing.”

And here is how Robbins responded:

“I think you’re right. And I’ve said this repeatedly: I think what what’s driven this is two things. Number one, the pandemic revealed the impact of not keeping your core infrastructure technology up to speed. Customers struggled, and I think it made them realize that they had a lot of technology debt that needed to be dealt with. And they don’t want to get in that position again. But the second thing is all of these megatrends that I mentioned in my opening comments. These customers are re-architecting their entire infrastructure for the first time in years to deal with hybrid cloud and to deal with, all of the mobile workers. We see IoT exploding. You see all of the climate activity is going to be a tailwind to our business, because you have to connect all these industrial systems to be able to control them. You have got to shift to 400 GE. I’ll give you a data point: 400 GE ports were up almost 700 percent year-over-year for us. We have got over 1,000 customers now that have bought 400 GE and we shipped our first 800 GE. All of these trends continue: You’ve got 5G, you’ve got WiFi-6. You’ve got this application observability, the re-architecture of applications. So I think it’s a combination of the realization of the pandemic brought on around technology debt and never letting them get to that point and then these megatrends that are going on.”

To that end, Cisco thinks as it burns down one backlog, it is going to be building up another one. Cisco has $19.3 billion in the bank, down a smidgen from last year, and $23.3 billion in deferred product revenue. So it is in good financial shape to deal with the existing backlog and build a new one and attack it. But it is not going to be easy to chew all of that backlog, at least not based on the revenue projections for Q1 F2023 and all of F2023. Cisco is only projecting revenue growth of 2 percent to 4 percent for the first quarter ending in October and 4 percent to 6 percent for the full fiscal 2023.

The boa constrictor is still going to be wrapped around the company because the supply and demand conditions in the world are not changing. Cisco can only move so fast to find alternative suppliers for power supplies and other key components, and we cannot predict what coronavirus, monkeypox, and flu might do to manufacturing operations around the globe.

Be the first to comment